Cement Market Report Scope & Overview:

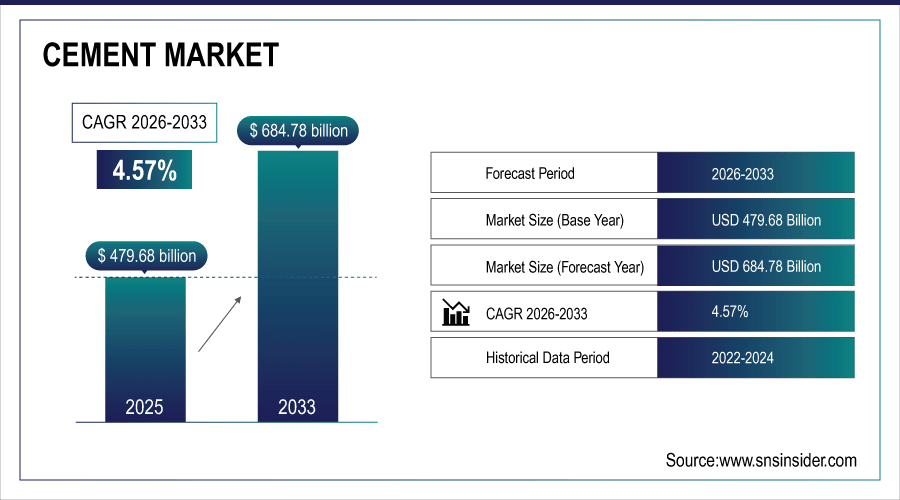

The Cement Market was valued at USD 479.68 billion in 2025E and is projected to reach USD 684.78 billion by 2033, growing at a CAGR of 4.57% during the forecast period 2026–2033.

The cement market comprises ordinary Portland cement, clinker-based cement types such as blended cements and oil well cements and other products including white cements. Residential and commercial construction is estimated to lead the market in 2025, trailed by infrastructure development. Construction firms, property developers and government contracts still represent the majority of end users. Market expansion is anticipated to continue through 2033 due to greater urbanization, infrastructure improvements, and construction activity across the globe.

Ordinary Portland Cement contributed 45% in 2025, driven by high demand in residential and commercial construction projects for building foundations, walls, and general construction purposes.

To Get More Information On Cement Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 479.68 Billion

-

Market Size by 2033: USD 684.78 Billion

-

CAGR: 4.57% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cement Market Trends:

-

The world consumed more than 3.2 billion tons of cement in 2025, indicative of steady construction and infrastructure growth worldwide.

-

Residential construction comprised 42% of the overall cement demand, indicating urban housing requirements.

-

Infrastructure spending contributed 28% to consumption, fueled by government investment in roads, bridges and railways.

-

Blended cements accounted for up to 25% of all cement consumption, signalling a move towards sustainable and green building materials.

-

Sales from online and distributor channels accounted for 15% of new sales driven by increased digital procurement in cement.

U.S. Cement Market Insights:

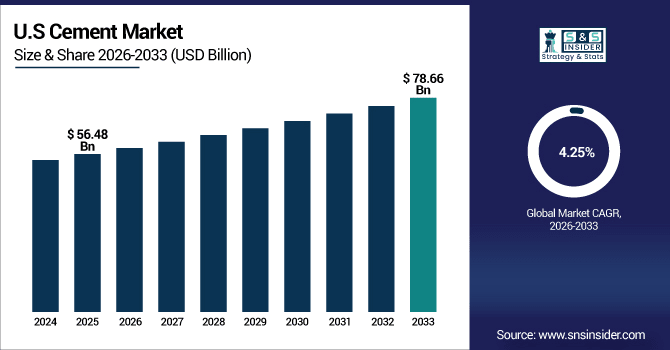

The U.S. Cement Market was valued at USD 56.48 billion in 2025E, expected to reach USD 78.66 billion by 2033 at a CAGR of 4.25%. Growth is attributed to growing residential and non-residential construction, infrastructure development and increased penetration of environmentally sustainable cement solutions supported by government initiatives and urbanization.

Cement Market Growth Drivers:

-

Rapid Urbanization and Expanding Infrastructure Investments Drive Cement Demand Across Residential, Commercial, and Public Projects.

The cement market growth is driven by rapid urbanization and rising infrastructure investments. In 2025, total global consumption of cement tallied more than 32 billion tons, residential consumers using some 1.34 billion tons and commercial projects some.98 billion tons. Infrastructure uses made up 0.9 billion tons or 28% of the total. Blended cements and sustainable types had 25% total adoption, online and distributor sales accounted for 15% of overall market penetration.

Blended cement adoption reached 25%, supported by rising sustainability and eco-friendly construction initiatives.

Cement Market Restraints:

-

Volatile Raw Material Prices and Energy Costs Hinder Consistent Cement Production and Profit Margins Globally.

Increasing raw material and energy prices are still constraining the development of the cement market. Price fluctuations of limestone and clay led to 27% of global cement producers dwelling on production growth, while 18% had some inflated costs due to rising energy prices which occurred in 2025. This financial pressure prevents constant production and selling, hampering market development in the face of growing interest in projects for residential, non-residential and industrial construction all over the world.

Cement Market Opportunities:

-

Growing Adoption of Sustainable and Green Cement Solutions Opens New Opportunities in Eco-Friendly Construction Projects.

Eco-friendly construction is opening doors to the development of sustainable/green cement systems. By 2025, worldwide blended and low-carbon cement production exceeded 800 million tons, with white and specialized cements of 120 million tons utilized for green building. 15% of new builds were treated with a green cement solution. Market gains will be amplified as governments and builders adopt sustainable building practices through 2033.

Specialty cements, including white cement, contributed 8% of the market, driven by demand in energy-efficient and high-performance construction applications.

Cement Market Segmentation Analysis:

-

By Product Type, Ordinary Portland Cement held the largest market share of 45.32% in 2025, while Blended Cement is expected to grow at the fastest CAGR of 5.12%.

-

By Application, Residential Construction contributed the highest market share of 42.56% in 2025, while Infrastructure is forecasted to expand at the fastest CAGR of 5.68%.

-

By End User, Construction Companies / Contractors held the largest share of 48.39% in 2025, while Government Projects are anticipated to grow at the fastest CAGR of 5.42%.

-

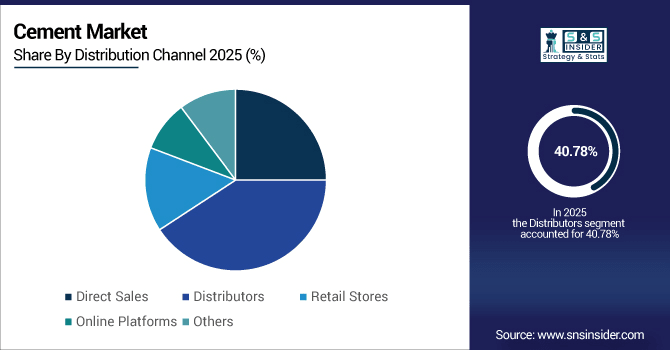

By Distribution Channel, Distributors accounted for the dominant share of 40.78% in 2025, while Online Platforms are projected to grow at the fastest CAGR of 6.05%.

By Distribution Channel, Distributors Dominate While Online Platforms Grow Fast:

Dealers handled more than 1.32 billion tons of cement in 2025, providing comprehensive coverage to contractors, retailers and small construction companies. 490 million tons at online platforms highlighting digital ordering, direct to site delivery and better supply chain performance. Online purchase of such products will cross 900 million tonnes by 2033 as small and medium sized businesses shift to e-commerce platforms due to ease in convenience, competitive pricing and organized logistics for both urban and semi-urban construction projects.

By Product Type, Ordinary Portland Cement Leads While Blended Cement Expands Rapidly:

Normal Portland Cement dominated the world market in 2025, with over 1.48 billion tons produced annually to meet basic construction needs in housing and commercial development. Production of blended cement reached 790 million tons as low-carbon and sustainable materials gained in popularity. The worldwide market for blended cements is projected to exceed 1.25 billion tons by 2033 on rising green building trends and strict environmental regulations along with increasing demand in infrastructure projects for durable materials that have lower impact on the environment.

By Application, Residential Construction Dominates While Infrastructure Grows Fast:

In 2025, urban housing and commercial buildings lead by both residential constructions have consumed more than 1.34 billion tons of cement. Government funding and public-private partnerships underwrote the use of 910 million tons for infrastructure projects, such as highways, bridges and airports. Demand for specialized types of cement will receive a major fillip, with urbanization in the developing world and growing investment in transport and energy infrastructure driving demand to more than 1.42 billion tonnes by 2033.

By End User, Construction Companies Lead While Government Projects Expand Rapidly:

Construction firms bought some 1.57 billion tons of cement in 2025, mostly for houses and businesses to bloom. Public-funded infrastructure projects used 730 million tons, and that is expected to grow to 1.18 billion by 2033 as urbanization and national resource development programs catch on. Industrial consumers are also ramping up borrowing for high-strength cement to build factories, warehouses, and energy-efficient buildings, leading to diversified demand across sectors.

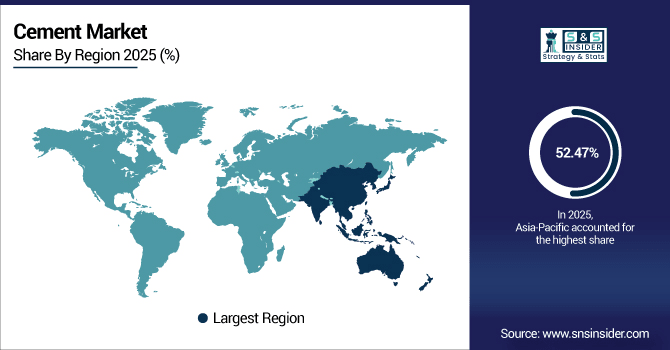

Cement Market Regional Analysis:

Asia-Pacific Cement Market Insights:

The cement market in the Asia Pacific region accounted for 52.47% of world consumption in 2025, and more than 1.68 billion tons of the material were utilized throughout China, India, Japan and Australia. Residential building swallowed up 780 million tons, commercial projects 520 million tons and infrastructure projects 380 million tons. The remaining 1.2 billion and 450 million tons were provided by distributors and online platforms. Urbanization, infrastructure expansion and increased use of sustainable cement products drive market growth through 2033.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Cement Market Insights:

In 2025, more than 1.05 billion tons of cement were used in China, about 480 million for residential construction and another 350 million for commercial projects. Infrastructure projects, like highways and bridges, represented 220 million tons. This generated strong market expansion, with distributors and online channels accounting for 750 million tons and 180 million tons of product supply.

North America Cement Market Insights:

In 2025, North America sucked down more than 640 million tons of cement with 280 million toward residential projects and 190 million for commercial ones. A further 120 million tonnes was used to build infrastructure, such as roads, bridges and railway links, while government and industrial projects accounted for 50 million tonnes. Distributors brought in 420 million tons, and online platforms processed 95 million tons. Strong growth is forecast through 2033 on increasing urbanization and sustainability building programs.

U.S. Cement Market Insights:

The United States consumed more than 460 million tons of cement in 2025, with 180 million tons devoted to residential construction and 130 million tons on commercial projects. Infrastructure projects represented 95 million tons, government initiatives 35 million tons, and distributors and online platforms processed 360 million and 100 million tons, respectively, enabling the strong volume growth.

Europe Cement Market Insights:

In 2025, Europe demand for cement was over 580 Mt with Germany, the UK and France being the leading consumers. Residential building accounted for 240 million tons, commercial projects used 190 million tons and infrastructure projects 120 million tons. Mills received 400 million tons through distributors and 95 million tons online. Healthy advances will be promoted by urban renewal, infrastructure improvement, and the use of environmentally friendly and blended cement products throughout much of Europe through 2033.

Germany Cement Market Insights:

In 2025, more than 180 million tonnes of cement were used in Germany, 75 million tonnes in residential construction, and another 55 million for commercial purposes. Infrastructure projects used 35 million tons, the agency said. Rising demand for green and blended cement, in addition to urbanization and industrialisation will further push market growth until 2033.

Middle East and Africa Cement Market Insights:

Middle East & Africa Cement Market is projected to develop at a CAGR of 5.78% between 2020 and 2033, with infrastructure projects and government-backed construction initiatives representing the fastest-growing segments driving regional demand. The area of 28 cities consumed more than 210 million tons of cement in 2025, including more than 85 million for residential building, over 65 million for commercial projects and another nearly 60 million in infrastructure supported by urbanization and government-led construction.

Latin America Cement Market Insights:

In 2025, Latin America used over 130 million tons of cement and the leading producers were Brazil, Mexico, and Argentina. Residential construction consumed 55 million tons, followed by commercial projects at 40 million tons and infrastructure ventures at 35 million tons. Urbanisation, governmental infrastructure investment, and the acceptance of sustainable cement solutions, will fuel healthy expansion over 2019-2023.

Cement Market Competitive Landscape:

In 2025, CNBM leads the global cement market with a production capacity of 530 million tons annually. The company has over 200 subsidiaries and approximately 200,000 employees. CNBM focuses on cement, ready-mixed concrete, and fiberglass. It has a large domestic and international footprint. With its large distribution network and innovative production processes, the business also supplies infrastructure projects and commercial construction all over the world.

-

In April 2025, CNBM commenced operations at a state-of-the-art new cement plant in Ethiopia, supporting regional infrastructure development.

Anhui Conch Cement produced over 400 million tons of cement in 2025, making it one of China’s largest manufacturers. The organisation has over 160 affiliates and extended its business in Southeast Asia, Cambodia, Indonesia, Laos and Myanmar. Anhui Conch contributes to residential, commercial and infrastructure projects employing the most ultra-modern production technology such as highly automated production lines and reduced energy consumption low heat cement technology making it a leader in both domestic and foreign markets in terms of production capacity, fast growth rates and profitability.

-

In March 2025, Anhui Conch Cement received a next-generation CK Mill for advanced cement grinding from Kawasaki, enhancing production efficiency.

Holcim operates in 45+ countries, producing over 300 million tons of cement annually as of 2025. The company targets sustainable construction with low-carbon and blended cement products as well. Holcim’s efficient, reliable products and services help professionals build everything from housing and skyscrapers to bridges and infrastructure. Growth Projects and Environmentally Friendly Range are accelerating penetration and the adoption of sustainable construction practices on a global scale.

-

In June 2025, Holcim expanded its product portfolio by acquiring Langley Concrete Group Inc., enhancing its precast concrete and ready-mix cement offerings in Canada.

Cement Market Key Players:

Some of the Cement Market Companies are:

-

China National Building Material (CNBM)

-

Anhui Conch Cement

-

Holcim Group

-

Heidelberg Materials

-

UltraTech Cement

-

Cemex

-

CRH plc

-

Dangote Cement

-

Taiwan Cement

-

China Resources Cement

-

Votorantim Cimentos

-

BBMG Corporation

-

Buzzi Unicem

-

InterCement

-

Lafarge

-

Italcementi

-

Asia Cement

-

Taiheiyo Cement

-

Jidong Development Group

-

Shanshui Cement

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 479.68 Billion |

| Market Size by 2033 | USD 684.78 Billion |

| CAGR | CAGR of 4.57% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Ordinary Portland Cement, Blended Cement, White Cement, Oil Well Cement, Others) • By Application (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure, Others) • By End User (Construction Companies, Real Estate Developers, Government Projects, Industrial Users, Others) • By Distribution Channel (Direct Sales, Distributors, Retail Stores, Online Platforms, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | China National Building Material (CNBM), Anhui Conch Cement, Heidelberg Materials, UltraTech Cement, Cemex, CRH plc, Dangote Cement, Taiwan Cement, China Resources Cement, Votorantim Cimentos, BBMG Corporation, Buzzi Unicem, InterCement, Lafarge, Italcementi, Asia Cement, Taiheiyo Cement, Jidong Development Group, Shanshui Cement, Birla Corporation |