Thin Wall Packaging Market Report Scope & Oveview:

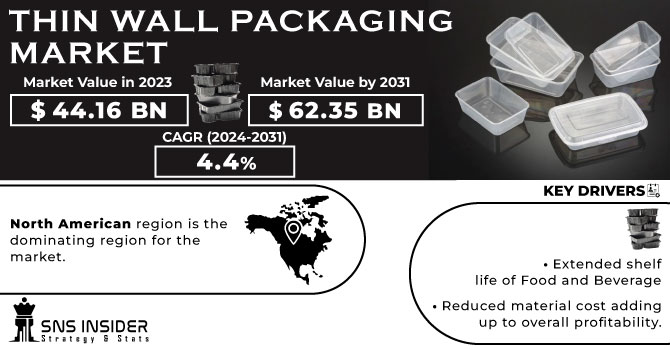

The Thin Wall Packaging Market size was USD 44.16 billion in 2023 and is expected to Reach USD 62.35 billion by 2031 and grow at a CAGR of 4.4 % over the forecast period of 2024-2031.

Due to the severe need for minimising packaging weight in line with strict food safety and consumer protection regulations, there is expected to be strong demand from the Thin Wall Packaging Market over the forecast period. Demand in the market is set to grow further over the coming years, driven by long term growth and sustainability goals for entities within the packaging sector that usually include recycling and adoption of bio based raw materials.

Get More Information on Thin Wall Packaging Market - Request Sample Report

Its wide range of uses include production of high clarity transparent thin wall packaging for Frozen, chilled and Ambient Food; dairy products, household chemicals or paints. Demand growth over the forecast period will be significantly influenced by nonpackaging applications such as personal care, pails and household products including containers for detergents, pods, cotton buds and wipes. Consumer preferences for good packaging products can be attributed to this. The attractiveness of products allows the brands to differentiate their product in a fastmoving consumer goods sector, thereby increasing visibility and brand appeal for consumers.

The packaging industry is heavily dependent on the optimisation of the production process, which has an impact on the marginal profit generated in the trade. Thin-walled packaging achieves optimum performance as it offers high properties resulting in a cost-effective production process.

The increased stacking capacity during storage which results from reduced weight is another important factor to guide demand on the thin wall packaging market. This results in a direct reduction of floor space consumption during storage and transport, which leads to the development of possibilities for reducing storage costs. Lower risk of breakage/loss during transit, improved environmental performance and recyclability will also impact demand for the product over the forecast period.

MARKET DYNAMICS

KEY DRIVERS:

-

Extended shelf life of Food and Beverage

The effective barrier properties of thin-walled packaging can extend the shelf life of food, reduce food waste, and improve product quality.

-

Reduced material cost adding up to overall profitability.

RESTRAIN:

-

The rising cost of raw materials

The cost of raw materials used in thin-walled packaging, such as plastic and aluminum, has increased in recent years. This is due to a number of factors, including growing demand for these materials and volatility in global commodity markets. Rising raw material costs can make thin-walled packaging more expensive and lead to lower demand

OPPORTUNITY:

-

Increasing demand for pre-packaged food and beverages

Global demand for prepackaged foods and beverages is growing rapidly. This is due to a number of factors, including an increasing number of working women, increasing popularity of convenience foods, and rising disposable incomes of consumers. The growing demand for prepackaged foods and beverages will create opportunities for thin-wall packaging manufacturers.

-

Rising disposable incomes in developing countries.

CHALLENGES:

-

Stringent government regulations

Governments around the world are increasingly imposing stricter regulations on the use of plastics and other materials in food packaging. This is due to concerns about the environmental impact of these materials. These regulations can complicate the operations of thin-wall packaging manufacturers and lead to increased costs.

IMPACT OF RUSSIAN UKRAINE WAR

The war disrupted supply chains for raw materials and components used in thin-walled packaging, such as plastics, metals and electronics. This has pushed up the prices of these materials and components, putting pressure on the margins of thin-wall packaging manufacturers. The price of polyethylene terephthalate (PET), a plastic commonly used in thin-walled packaging, has increased by more than 30% since the start of the war. The war also disrupted the transportation of goods, further delaying the delivery of raw materials and components to thin-walled packaging manufacturers. This has resulted in production delays and shortages of thin-walled packaging products.

Due to these factors, the growth rate of thin wall packaging market is expected to slow down in the coming years. Here are some concrete examples of war's impact on the thin-wall packaging market. The price of aluminum, another material commonly used in thin-walled packaging, also increased by more than 20%. The war also disrupted the production of electronic components used in thin-walled packaging, such as sensors and valves.

This causes delays in the delivery of these components, affecting the production of thin-walled packaging products.

IMPACT OF ONGOING RECESSION

The economic downturn is expected to negatively impact the thin-wall packaging market, with demand falling by 2-3% in 2023.

The drop in demand is due to a number of factors such as, Reduced consumer spending, rising unemployment, Tighten the credit market.

The impact of the recession will vary by region. The developed country market is expected to be affected more than the developing country market. The thin-wall packaging market is expected to recover in 2024, but it may take several years for the market to return to pre-recession levels. Several packaging manufacturers have announced layoffs or factory closures. Others have reduced production capacity or switched to more profitable products. Demand for thin-walled packaging materials, such as plastic and aluminum, has decreased. The prices of these materials have also fallen, but this has not been enough to make up for the drop in demand.

Overall, the ongoing economic downturn is having a negative impact on the thin-wall packaging market.

KEY MARKET SEGMENTS

By Material

-

Polypropylene

-

PET

-

PVC

-

PE

-

PS

By Product Type

-

Tubs

-

Trays

-

Cups

-

Jars

-

Pots

-

Clamshells

-

Lids

By Production Process

-

Thermoforming

-

Injection Molding

By Application

-

Food & Beverages

-

Electronics

-

Cosmetics

-

Others

REGIONAL ANALYSIS

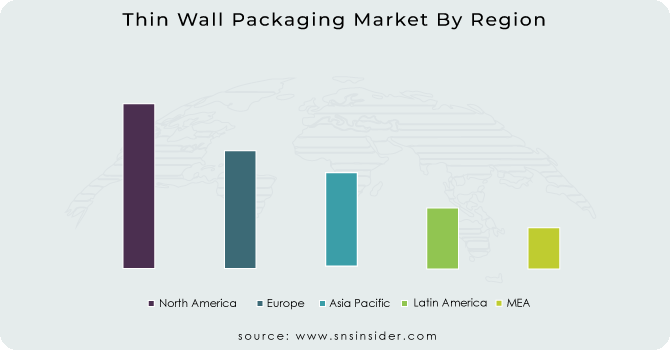

North American region is the dominating region for the market. Due to the consumption of packaged foods, it is creating more need for the thin wall packaging. Also, use of thin wall containers by various end use industries is adding to the growth of the overall market in this region.

Due to growing environmental concerns and stringent rules and regulations against packaging waste European region is the second largest market for thin wall packaging. In this region, there is increased use of thin wall containers for home use. Germany is the largest market in this region followed by UK which is the fastest growing market.

Asia Pacific region is the fastest growing region over the forecast period. The reason for this is the increased industrialization, growing e commerce and rise in disposable income.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Thin Wall Packaging market are Amcor Limited, RPC Group PLC, Double H Plastics, Greiner Packaging International GmBH, Berry Global Inc, Reynolds Group Holdings, Silgan Holdings, Mold-Tek Packaging, EVCO Plastics, LykaPack and other players.

Amcor Limited-Company Financial Analysis

RECENT DEVELOPMENT

-

March 2023, Sumitomo SHIIN DEMAG has been expanding its portfolio of Packaging Injection Molding Machines and unveiling three new packaging ranges for Fastcycles.

-

In the single injection moulding procedure step, ENGEL, ALTPLA Group, Brink and IPB Printing have jointly produced thin walled containers made up of PET and rPET.

| Report Attributes | Details |

| Market Size in 2023 | US$ 44.16 Bn |

| Market Size by 2031 | US$ 62.35 Bn |

| CAGR | CAGR of 4.4 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polypropylene, PET, PVC, PE, PS) • By Product Type (Tubs, Trays, Cups, Jars, Pots, Clamshells, Lids) • By Production Process (Thermoforming, Injection Molding) • By Application (Food & Beverages, Electronics, Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Limited, RPC Group PLC, Double H Plastics, Greiner Packaging International GmBH, Berry Global Inc, Reynolds Group Holdings, Silgan Holdings, Mold-Tek Packaging, EVCO Plastics, LykaPack |

| Key Drivers | • Extended shelf life of Food and Beverage • Reduced material cost adding up to overall profitability. |

| Market Restraints | • The rising cost of raw materials |