Packaging Foams Market Report Scope:

To Get More Information on Packaging Foams Market - Request Sample Report

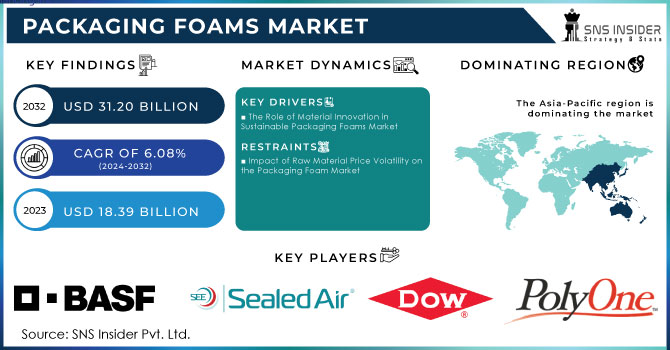

The Packaging Foams Market size was valued at USD 18.39 billion in 2023 and is expected to grow to USD 31.20 billion by 2032 and grow at a CAGR of 6.08 % over the forecast period of 2024-2032.

The packaging foam market is witnessing significant growth, largely driven by the rise of online shopping and the increasing need for effective packaging solutions that ensure product safety during shipping. As e-commerce continues to flourish, the demand for packaging foams that provide adequate cushioning and protection has surged, making these materials indispensable in the logistics of the industry. According to a recent report, the online shopping sector in Europe is experiencing substantial returns growth, spurred by fierce competition and innovation. This dynamic landscape has intensified the demand for advanced packaging solutions. Sustainability has emerged as a crucial factor in the packaging foam market. Companies are increasingly focusing on innovations in bio-based and recyclable foams to reduce their carbon footprints and enhance environmental responsibility. The shift towards sustainable packaging is no longer just a trend; it has become a commercial imperative as businesses strive to meet consumer expectations and comply with regulatory requirements. For instance, Huhtamaki North America recently launched fiber-based egg cartons made from 100% recycled materials, showcasing the industry's commitment to sustainability.

Regulatory measures are also shaping the market, highlighted by Washington State's ban on EPS foam clamshell containers and similar products, underscoring the growing regulations surrounding plastic usage and waste. This evolving regulatory landscape has prompted companies to explore alternatives to traditional petroleum-based foams, leveraging recycled plastics and organic materials.The increasing interest in sustainable packaging aligns with global efforts to combat plastic pollution and reduce waste. As manufacturers adapt to changing consumer preferences and regulatory demands, innovations in packaging foams are expected to drive market growth, establishing the industry as a critical component of the overall packaging landscape. With projections indicating significant growth in the global market, manufacturers are likely to enhance their product offerings to meet evolving consumer and regulatory needs. The convergence of e-commerce expansion and sustainability initiatives will undoubtedly shape the future trajectory of the packaging foam market, reflecting its versatility and customization options across various applications and industries, including industrial goods, consumer electronics, and automotive components.

The packaging foam market is currently undergoing substantial growth, fueled primarily by the rapid expansion of e-commerce, increasing consumer demand for product protection during shipping, and a growing focus on sustainability. With e-commerce transactions surging globally, the need for effective cushioning materials like packaging foam has become essential to ensure that products are safely delivered to customers. This has made packaging foam a critical component of logistics and supply chains, especially in industries where product safety is paramount.

The Rise of Sustainable Packaging

Sustainability is emerging as a key factor shaping the packaging foam market, with businesses and consumers becoming more conscious of environmental impact. Companies are increasingly investing in innovations such as bio-based and recyclable foams to help reduce their carbon footprints. This rise reflects the broader market shift towards eco-friendly packaging solutions, driven in part by regulatory pressures, particularly in the U.S. and Europe. Governments and organizations are rolling out plastic reduction initiatives in response to growing concerns about plastic pollution.

In the U.S., for instance, the Biden-Harris administration, as outlined in a 2024 White House fact sheet, introduced ambitious measures to combat plastic pollution, including a mandate for federal agencies to reduce the use of single-use plastics in operations by 2025. This regulatory framework is expected to stimulate further innovation in sustainable packaging, encouraging companies to explore alternative materials such as recycled content foams and biodegradable products. These developments are not just about meeting regulatory requirements but also responding to evolving consumer expectations for greener, more sustainable products.

Market Segmentation and Industry Applications

The packaging foam market serves a diverse range of industries, with e-commerce, automotive, and consumer electronics leading the demand. E-commerce has been a particularly strong driver of packaging foam demand, largely due to the need for lightweight, protective, and customizable packaging solutions. As online shopping grows, so does the need for effective packaging that can ensure product safety, especially given the rise in returns. In Europe, for example, e-commerce returns have grown significantly, with nearly 30% of products ordered online being returned. This has increased the demand for cost-effective, durable packaging materials, including foam.

In the automotive industry, packaging foam is used to protect various components during shipping and handling. As the electric vehicle (EV) market expands, so too does the demand for advanced packaging solutions that provide not just cushioning but also insulation and vibration control. Similarly, the consumer electronics industry relies heavily on high-performance packaging foams to safeguard sensitive products from shocks and other damage during transit.

Regulatory Impact and Future Outlook

The regulatory landscape is also reshaping the packaging foam market, particularly with legislation aimed at reducing plastic usage. In 2024, for instance, Washington State enacted a ban on expanded polystyrene (EPS) foam clamshell containers, pushing companies to develop more sustainable alternatives. Similar regulations are expected to proliferate in other states and regions, driving innovation in foam packaging materials. In response, manufacturers are turning to sustainable alternatives like plant-based polyurethane foam and polylactic acid (PLA) foam, which align with global efforts to reduce waste and enhance sustainability. By 2030, sustainable packaging foams are expected to represent 25% of the total market, highlighting the ongoing shift toward environmentally friendly packaging solutions.

Looking ahead, the packaging foam market is poised for further growth as companies expand their product portfolios to meet the increasing demand for sustainable and high-performance foam materials. Leading industry players such as Huhtamaki, Sealed Air Corporation, and Dow Chemical are at the forefront of developing plant-based and recyclable foam products, setting the stage for continued market expansion. As sustainability and e-commerce continue to drive the market, packaging foams will remain integral to a wide range of industries, making this sector vital for future growth and innovation.

Market Dynamics

Drivers

- The Role of Material Innovation in Sustainable Packaging Foams Market

Innovation in material development is a significant driver of growth in the packaging foam market, as advancements in technology and materials science pave the way for eco-friendly alternatives. The emergence of bio-based and recyclable foams has transformed the landscape of packaging solutions, enabling companies to move away from traditional petroleum-based materials without sacrificing performance or protective qualities. These innovative foams are derived from renewable resources, such as plant materials, which not only lessen dependence on fossil fuels but also promote a circular economy through their recyclability or compostability. For instance, materials like mycelium, sourced from mushrooms, are gaining traction for their biodegradable properties, providing a sustainable option for various packaging applications. As a result, businesses are increasingly integrating these advanced materials into their packaging strategies, responding to consumer demands for sustainable practices while maintaining product integrity . Moreover, the continued investment in research and development fosters a competitive environment, encouraging manufacturers to innovate and improve the performance of these sustainable foams . With regulations tightening around single-use plastics and growing public awareness about environmental issues, the demand for innovative packaging solutions is expected to rise. Companies that adopt these advanced materials can not only enhance their brand reputation but also align with sustainability goals, making them more appealing to environmentally conscious consumers . Consequently, the ongoing evolution of material science is crucial for the packaging foam market, positioning it for sustained growth as businesses strive to implement greener packaging solutions.

Restraints

- Impact of Raw Material Price Volatility on the Packaging Foam Market

The packaging foam market is significantly impacted by raw material price volatility, particularly concerning petroleum-based products. Fluctuations in crude oil prices can lead to unpredictable costs for the raw materials used in manufacturing various types of foams. As a result, manufacturers often face challenges in maintaining profitability, which can directly affect their pricing strategies. When raw material costs rise, manufacturers may be compelled to pass these increased expenses onto consumers, leading to higher prices for packaging foam products. This situation creates a ripple effect throughout the supply chain, as businesses dependent on packaging foams for logistics and product protection may also experience budget constraints. Furthermore, this volatility complicates long-term planning and investment for foam manufacturers, as they must navigate unpredictable market conditions. According to recent market analyses, the global market for volatile stocks, including those of companies involved in raw material supply, indicates a strong correlation between economic factors and price fluctuations. This uncertainty can hinder growth opportunities within the packaging foam sector, prompting businesses to explore alternative materials that may offer more stable pricing and lower risk, thereby influencing overall market dynamics.

Segment Analysis

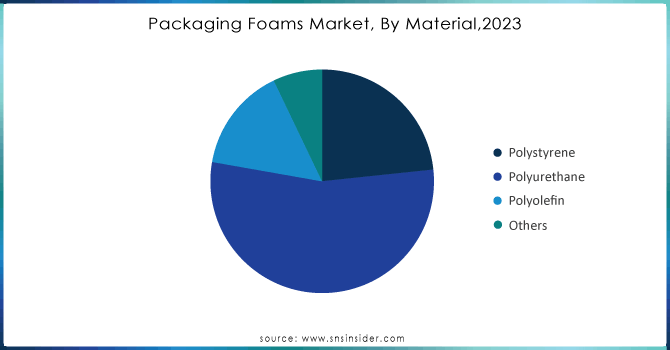

By Material

The packaging foam market is diverse, with polyurethane (PU) leading the segment, capturing around 55% of the market share in 2023. This dominance is due to PU's exceptional cushioning and insulation properties, making it a favored choice in various industries. Its ability to be produced in different densities and firmness levels allows for customization based on specific applications. PU foams are lightweight, reducing shipping costs, and offer excellent shock absorption to protect fragile items during transit, especially in consumer electronics, automotive parts, and pharmaceuticals. Recent innovations include Sealed Air Corporation's eco-friendly PackTech line, while companies like BASF are investing in bio-based PU alternatives to meet sustainability goals. Regionally, North America and Europe are witnessing significant growth, fueled by advancements in manufacturing technologies and a strong focus on eco-friendly solutions. In Germany, investments in sustainable packaging are aligned with EU regulations, while China and India are experiencing rapid growth in e-commerce, driving demand for packaging foams. As the push for sustainable packaging intensifies, the market is likely to see increased competition and innovation across all segments, prompting manufacturers to explore new formulations and production techniques to meet evolving consumer needs.

Do You Need any Customization Research on Packaging Foams Market - Inquire Now

By Type

The packaging foam market is diverse, with flexible foams leading the segment, capturing an impressive 70% market share in 2023. This dominance is due to their unique characteristics, making them ideal for various applications across multiple industries. Flexible foams, often composed of polyurethane, polyethylene, or other polymers, are soft and adaptable, providing excellent cushioning and protection during storage and transportation. Their lightweight nature helps reduce shipping costs, making them economically viable for manufacturers. These foams are particularly effective in sectors such as consumer electronics, automotive, and furniture, where safeguarding delicate items from impact is essential. For instance, they are frequently used to package electronics like smartphones and laptops, ensuring secure transit. Recent innovations in flexible foams demonstrate the industry's commitment to sustainability. Pregis has launched an eco-friendly line made from recycled materials, while Sealed Air Corporation introduced AirCap™, a high-performance packaging solution utilizing flexible foam materials. BASF is developing bio-based flexible foam formulations, and Dow Chemical has unveiled new foams tailored for the e-commerce sector, emphasizing lightweight protection for rapid delivery needs. In summary, the flexible foam segment is poised for continued growth, driven by innovation and sustainability as e-commerce and logistics expand.

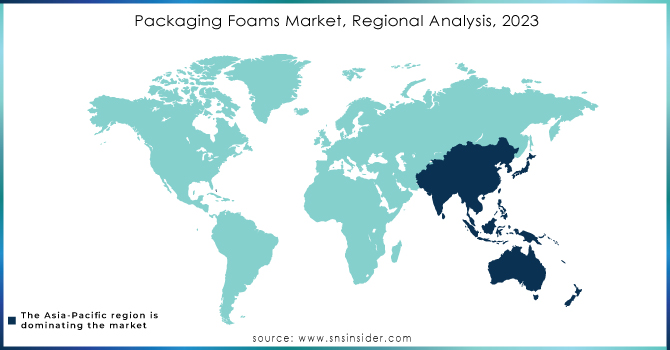

Regional Analysis

The Asia-Pacific region is a significant player in the packaging foam market, holding approximately 26% market share in 2023, driven by rapid industrialization, the rise of e-commerce, and growing consumer demand for innovative packaging solutions. Countries like China, India, and Japan are experiencing robust growth in manufacturing and retail, particularly fueled by the e-commerce boom, which necessitates effective packaging materials to ensure product safety during transit. The expanding middle class in these nations further propels demand for consumer electronics and automotive parts, requiring durable packaging options. In response to this rising demand, companies in the region are innovating their product offerings. Sealed Air Corporation has expanded its operations in China with new flexible foam packaging solutions tailored for e-commerce, while Pregis has introduced an eco-friendly line of flexible foams made from recycled materials. Additionally, BASF is investing in bio-based flexible foams, and Dow Chemical has launched lightweight packaging solutions to meet rapid delivery needs. Government initiatives in countries like India and China promote sustainability, driving manufacturers toward eco-friendly practices. With advancements in manufacturing technology, regions like Vietnam and Thailand are emerging as manufacturing hubs, further strengthening the Asia-Pacific's position in the global packaging foam market.

North America is rapidly becoming the fastest-growing region in the packaging foam market, fueled by technological advancements, a booming e-commerce sector, and increasing demand for sustainable packaging solutions. In 2023, the region captured a significant market share, driven by innovation and environmental responsibility. The U.S. and Canada lead this growth, with e-commerce driving demand for protective packaging, while industries such as automotive and consumer electronics contribute to the need for high-performance materials like foam. Companies like Sealed Air Corporation and Pregis have launched eco-friendly foam products, catering to environmentally conscious consumers. BASF and Dow Chemical are also advancing sustainable packaging by introducing bio-based and lightweight foam solutions. North America’s focus on sustainability is further reinforced by government regulations and consumer preferences, encouraging manufacturers to reduce their carbon footprint through bio-based materials. Additionally, the U.S. and Canada are investing in advanced manufacturing technologies, particularly in states like Michigan and Texas, which are becoming key hubs. This commitment to innovation and sustainability positions North America as a leader in the global packaging foam market. As e-commerce continues to grow, the region’s focus on eco-friendly practices and advanced packaging materials is expected to drive market expansion, meeting evolving consumer demands for sustainable solutions.

Key Players

Some of the Major Players in Packaging Foam Market who provide product and offering:

-

Sealed Air Corporation (Bubble Wrap, Foam-in-Place)

-

BASF SE (Elastoflex, Styrofoam)

-

DOW Chemical Company (Ethafoam, Styrofoam)

-

Polyone Corporation (Versaflex, FlexiFoam)

-

Rogers Corporation (BISCO Silicones, PORON Urethane)

-

Pregis Corporation (AirShock, Foam Packaging)

-

FP International (FP Green Foam, Eco-Foam)

-

Airlite Plastics Company (Airlite Foam, Airlite Pads)

-

UFP Technologies, Inc. (Custom Foam Packaging, BioFoam)

-

Sonoco Products Company (Sonopost, Sonocore)

-

International Paper Company (Foam and Fiber Packaging)

-

Foster Corporation (Foster Foam, Custom Foam Solutions)

-

Morrison Container Handling Solutions (Foam Inserts, Custom Foam Packaging)

-

EPE Foam Manufacturer (EPE Foam, Custom Foam Solutions)

-

Armacell International S.A. (Armaflex, Apocel)

-

Avery Dennison Corporation (Avery Foam, Packaging Solutions)

-

Bertelson Packaging (Polyurethane Foam, EPS Products)

-

Innovative Packaging (Custom Foam Inserts, Cushioning Solutions)

-

SABIC (SABIC HDPE, SABIC PS)

-

Platinum Packaging Group (Eco-Friendly Foam, Custom Foam Solutions)

-

Others

Recent Developments

-

In March 2024, Seawise Innovative Packaging introduced Styrofoam, a new type of packaging meant to substitute the commonly used EPS foam. The new packaging is created as a cost-effective option for businesses looking to decrease the use of plastics in their supply chain.

-

In May 2024, Apple announced its collaboration with RISE (Research Institutes of Sweden) to develop a new bio-based foam material for packaging, derived from responsibly sourced wood pulp. This cellulose-based foam aims to combat plastic pollution by offering excellent compression resistance, a uniform pore structure, and compatibility with existing paper packaging recycling streams, thereby reducing reliance on fossil fuels and simplifying the recycling process.

-

On March 19, 2024, Cruz Foam was recognized as one of the Most Innovative Companies for its efforts in creating bio-based alternative packaging tailored for the growing e-commerce market. Collaborating with Atlantic Packaging and sustainable food brands like Verve Coffee and Real Good Fish, Cruz Foam aims to replace petroleum-based packaging with an innovative solution made from 70% upcycled food waste, addressing the environmental impact of traditional packaging materials in the $6.3 trillion e-commerce industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.39 Billion |

| Market Size by 2032 | USD 31.20 Billion |

| CAGR | CAGR of 6.08%From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polystyrene, Polyurethane, Polyolefin, and Others) • By Type (Flexible and Rigid) • By End-Use Industry (Automotive, Electrical & Electronics, Building & Construction, Medical, Food & Beverage, Military & Defense, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sealed Air Corporation, BASF SE, DOW Chemical Company, Polyone Corporation, Rogers Corporation, Pregis Corporation, FP International, Airlite Plastics Company, UFP Technologies, Inc., Sonoco Products Company, International Paper Company, Foster Corporation, Morrison Container Handling Solutions, EPE Foam Manufacturer, Armacell International S.A., Avery Dennison Corporation, Bertelson Packaging, Innovative Packaging, SABIC, and Platinum Packaging Group. & Others |

| Key Drivers | • The Role of Material Innovation in Sustainable Packaging Foams Market |

| RESTRAINTS | • Impact of Raw Material Price Volatility on the Packaging Foam Market |