Graphic Film Market Report Scope & Overview:

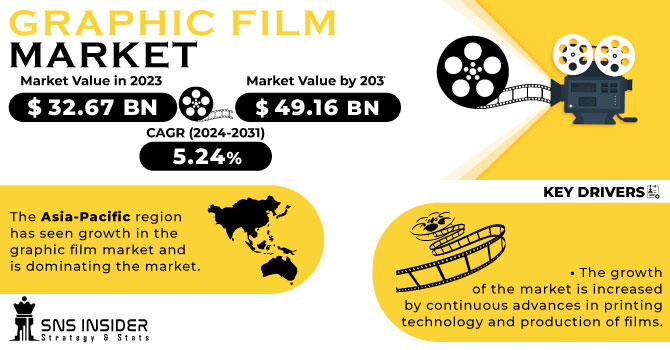

The Graphic Film Market size was USD 32.67 billion in 2023 and is expected to Reach USD 49.16 billion by 2031 and grow at a CAGR of 5.24 % over the forecast period of 2024-2031.

The global graphic film market is a dynamic and growing industry, playing a pivotal role in industries ranging from advertising and automotive to retail and architecture. Graphic film, prized for its adaptability and visual impact, serves as a versatile medium for a wide range of applications, including eye-catching signage, eye-catching vehicle wraps, advertising displays charismatic and transformative interior decoration. The growth trajectory of this market is driven by a combination of factors, underpinned by the growing demand for compelling branding and communication solutions in various industries. As businesses are engaged in the constant battle for consumer attention, graphic film provides an artistic and resonant channel to convey messages, establish brand identity, and nurture lasting impression.

Get More Information on Graphic Film Market - Request Sample Report

The technology sector is fundamental in the growth of this market, with advances in printing and film production techniques essential to its story. Digital printing has revolutionized the personalization of graphic films, allowing intricate designs and vivid colors to flourish on these films. At the same time, innovations in adhesive technology have redefined application dynamics, making membranes easier to install and extending service life.

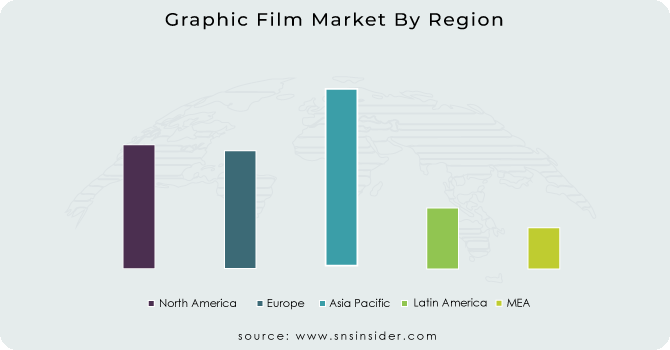

By region, the market landscape has distinct characteristics. The Asia-Pacific region is emerging as a dominant market. The growth is driven by rapid urbanization, rising consumer spending and the explosive growth of the advertising industry.

North America reflects a second largest but growing graphic film market. Characterized by efficient production capacity and vibrant advertising sectors, countries such as the United States and Canada are emblematic of this phenomenon. Their vibrant economies and vibrant creative industries foster market synergies across industries.

Across the Atlantic, Europe presents a landscape rich in tradition and innovation. Countries like Germany, known for their automotive prowess, use graphic film to amplify the vehicle's aesthetic and marketing appeal. The UK, distinguished by its creative sectors, drives the growing market, integrating graphic films into media and architectural projects. Scandinavia's enthusiasm for sustainability is evident in their interest in eco-friendly graphic film alternatives that align with the region's environmental awareness.

Despite its appeal and potential, the graphic film market is grappling with many challenges. Changing environmental regulations are driving the trend towards sustainable alternatives, catalyzing innovation in compostable and recyclable graphic films. In addition, market participants must skillfully navigate the dynamic consumer preferences and changing technology landscape to maintain their competitive edge.

MARKET DYNAMICS

KEY DRIVERS:

-

The growth of the market is increased by continuous advances in printing technology and production of films.

Digital printing allows for complex designs, high-resolution graphics, and customizability, catering to diverse customer preferences and requirements. In addition, advances in adhesive technology have improved ease of installation and durability, expanding the range of surface applications.

-

Growth in automotive industry.

Graphic films are used in car wraps, graphics and labels which is highly beneficial for the automobile industry.

RESTRAIN:

-

The development and implementation of new technologies costs is higher which can hinder the market

Small businesses can find it difficult to invest in research and development, which limits their ability to keep up with industry trends.

OPPORTUNITY:

-

The rise of e-commerce has led to an increased demand for graphic films

Graphic films can play an important role in creating attractive and memorable packaging designs that enhance the customer's unboxing experience.

-

The growing category of environmentally conscious consumers and businesses can be targeted by the creation of biodegradable or recyclable graphic films.

CHALLENGES:

-

For manufacturers, it is still a challenge to balance costs with quality and innovation

Maintaining competitive pricing while investing in research, development, and sustainable practices can strain profit margins

IMPACT OF RUSSIAN UKRAINE WAR

Russia and Ukraine are major producers of graphic films, and the war has disrupted exports from both countries. This led to a shortage of graphic films in the global market, driving up prices. The war created a need for graphic films for use in packaging and other applications. This increases demand for graphic films and puts upward pressure on prices. The war also has created uncertainty in the graphic films market, making it difficult for businesses to plan for the future. This has led to some businesses delaying or cancelling orders for graphic films, which is further disrupting the market and driving up prices. The price of PET film, a type of graphic film used in packaging, has increased by 30% ar. Since the beginning of the war prices have risen by 20% for BOPP, a further type of graphics film that is included in packaging. In 2023, war in Ukraine is estimated to have a 2.5% impact on the worldwide graphic film market.

IMPACT OF ONGOING RECESSION

The ongoing economic downturn is expected to have a negative impact on the graphic film market. The economic downturn is expected to lead to lower demand for graphic films as businesses and consumers cut back on spending. In addition, the economic downturn is expected to increase the price of graphic film due to increased raw material and energy costs. In 2023, due to the recession, global demand for graphic film is expected to fall by 2.5%. Businesses and consumers are cutting spending, leading to lower demand for graphic films. This is especially true for non-essential applications, such as advertising and packaging. Due to the increased cost of materials and energy, graphics film prices are projected to rise by 5% in 2023. Raw material and energy costs are rising, leading to higher prices for graphic film. This makes it more expensive to use graphic film for companies, which could lead to a further drop in demand.

KEY MARKET SEGMENTS

By Polymer

-

PP

-

PVC

-

PE

By Film Type

-

Transparent

-

Opaque

-

Translucent

-

Reflective

By Printing Technology

-

Digital

-

Rotogravure

By End Use

-

Promotional & Advertisement

-

Industrial

-

Automotive

REGIONAL ANALYSIS

The Asia-Pacific region has seen growth in the graphic film market and is dominating the market. This growth can be attributed to a number of factors, including rapid urbanization, growing consumer spending, and a growing advertising industry. Countries like China, Japan, Korea and India have become the main players in this market.

The North American graphic film market is mature and established. It is driven by factors such as advanced manufacturing capabilities, a strong advertising and media industry, and a developed retail sector.

Europe also has a growing graphic film market, with varying demand across different countries. The European market is driven by factors such as a strong manufacturing base, robust retail industry, and a focus on sustainability.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Graphic Film market are 3M Company, KPMF Limited, Constantia Flexibles, Arlon Graphics LLC, Aura Graphics Limited, Drytac Corporation, The Griff Network, Charter NEX, Avery Dennison Corporation, Innovia Films and other players.

Constantia Flexibles-Company Financial Analysis

RECENT DEVELOPMENT

-

A new communication campaign is announced by Innovia Films, the world leader in polypropylene film production, that highlights its commitment to producing sustainable and recycled material for use on consumer packaging, labels and graphics films.

-

In Europe, ProAmpac is introducing a new PE recyclable film packaging.

| Report Attributes | Details |

| Market Size in 2023 | US$ 32.67 Bn |

| Market Size by 2031 | US$ 49.16 Bn |

| CAGR | CAGR of 5.24 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Polymer (PP, PVC, PE) • By Film Type (Transparent, Opaque, Translucent, Reflective) • By Printing Technology (Digital, Rotogravure) • By End Use (Promotional & Advertisement, Industrial, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | 3M Company, KPMF Limited, Constantia Flexibles, Arlon Graphics LLC, Aura Graphics Limited, Drytac Corporation, The Griff Network, Charter NEX, Avery Dennison Corporation, Innovia Films |

| Key Drivers | • The growth of the market is increased by continuous advances in printing technology and production of films. • Growth in automotive industry. |

| Market Challenges | • For manufacturers, it is still a challenge to balance costs with quality and innovation |