Chemical Distribution Market Report Scope & Overview:

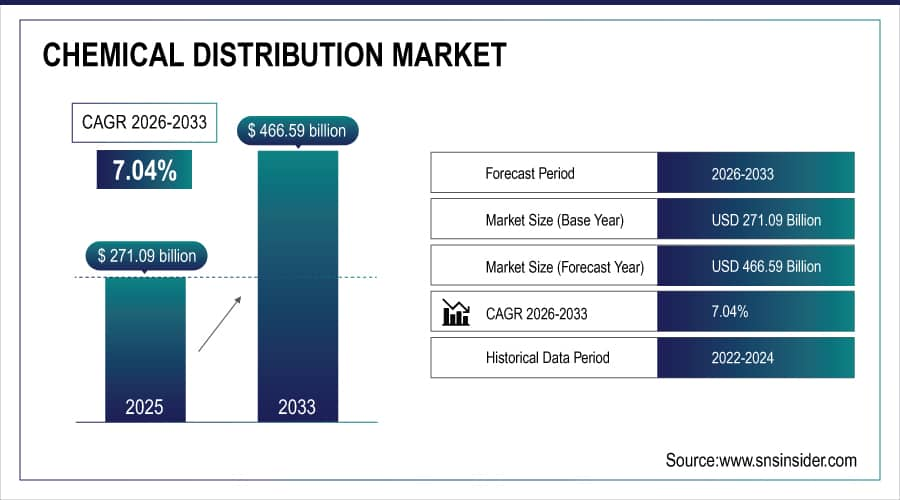

The Chemical Distribution Market Size is valued at USD 271.09 Billion in 2025E and is expected to reach USD 466.59 Billion by 2033 and grow at a CAGR of 7.04% over the forecast period 2026-2033.

The Chemical Distribution Market analysis, due to strong and growing demand from a wide array of end-use industries such as agriculture, construction, automotive, electronics, pharmaceuticals, and manufacturing especially in emerging economies undergoing industrialization and urbanization.

According to study, automotive, construction, and electronics industries together account for over 40% of distributor revenue, reflecting strong cross-industry demand for both commodity and specialty chemicals.

To Get More Information On Chemical Distribution Market - Request Free Sample Report

Chemical Distribution Market Size and Forecast:

-

Market Size in 2025: USD 271.09 Billion

-

Market Size by 2033: USD 466.59 Billion

-

CAGR: 7.04% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Chemical Distribution Market Trends:

-

Specialty chemical distribution grows quickly due to higher margins and value-added services.

-

Manufacturers increasingly outsource logistics, storage, and compliance to specialized distribution partners.

-

Asia-Pacific leads demand with rapid industrialization and expanding manufacturing capacities.

-

Digital supply chain platforms improve forecasting accuracy and reduce operational inefficiencies significantly.

-

Sustainability initiatives boost demand for eco-friendly chemicals and safer distribution practices.

-

Industry consolidation accelerates as major distributors acquire regional players for market expansion.

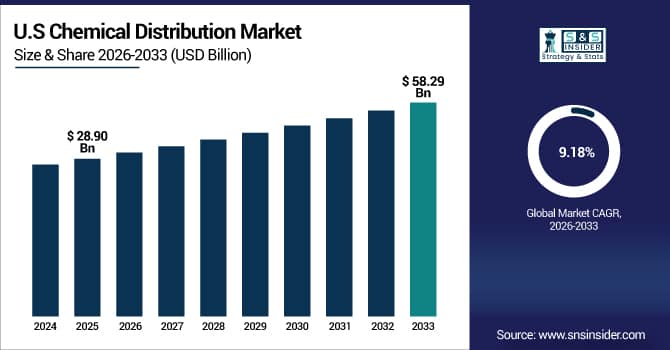

The U.S. Chemical Distribution Market size is USD 28.90 Billion in 2025E and is expected to reach USD 58.29 Billion by 2033, growing at a CAGR of 9.18% over the forecast period of 2026-2033,

The U.S. chemical distribution market is growing rapidly due to rising demand for specialty chemicals, advanced supply chain solutions, and strict regulatory compliance. Expansion in industrial manufacturing, construction, and healthcare sectors, along with adoption of digital logistics platforms and third-party distribution services, drives efficient delivery and market growth nationwide.

Chemical Distribution Market Growth Drivers:

-

Rapid Industrial Growth and Rising Demand Across End-Use Sectors

A major driver of the chemical distribution market growth is the expanding demand for chemicals across industries such as agriculture, pharmaceuticals, automotive, construction, electronics, and manufacturing. As industrial production rises especially in rapidly developing regions manufacturers increasingly rely on distributors to manage complex supply chains, regulatory compliance, storage, blending, packaging, and just-in-time delivery of chemical products. Distributors provide crucial technical expertise, logistical support, and value-added services that help companies streamline procurement and focus on core operations. This trend is strengthened by the growth of specialty chemicals, customized formulations, and stringent safety standards, all of which significantly boost the role and demand for chemical distribution services.

Chemical distributors help companies cut procurement and logistics costs by 12–18% through value-added services such as blending, packaging, and inventory management.

Chemical Distribution Market Restraints:

-

High regulatory compliance costs and hazardous material handling challenges restrain market expansion.

A major restraint is the stringent regulatory environment governing chemical handling, transportation, storage, and disposal, which places significant pressure on distributors. Compliance with safety standards, environmental regulations, hazardous material protocols, and international trade rules requires substantial investment in documentation, trained personnel, advanced infrastructure, and monitoring technologies. Smaller distributors often struggle to meet these requirements due to limited financial and operational capacity. Additionally, variations in regulations across countries create complex cross-border logistics and increase overall operational costs. These challenges slow market growth and restrict entry for new or mid-scale distributors.

Chemical Distribution Market Opportunities:

-

Growth of Specialty Chemicals and Expansion in Emerging Markets

A major opportunity lies in the rising demand for high-value specialty chemicals and rapid industrialization across emerging economies such as Asia-Pacific, Latin America, and the Middle East. Specialty chemicals including agrochemicals, construction additives, pharmaceuticals, personal care ingredients, and electronic chemicals require technical expertise and tailored distribution solutions, creating strong opportunities for advanced distributors. Emerging regions are witnessing booming manufacturing activities, rising urbanization, and growing adoption of modern industrial processes, all of which increase the need for reliable chemical supply chains. Additionally, partnerships between distributors and local suppliers help expand product portfolios, enhance service capabilities, and unlock long-term growth potential.

Asia-Pacific, Latin America, and the Middle East collectively account for over 50% of industrial capacity expansion in the past decade.

Chemical Distribution Market Segmentation Analysis:

-

By Product: In 2025, Commodity Chemicals led the market with a share of 61.45%, while Specialty Chemicals is the fastest-growing segment with a CAGR of 8.90%.

-

By Packaging Type: In 2025, Bulk Containers led the market with a share of 39.60%, while Intermediate Bulk Containers (IBCs) is the fastest-growing segment with a CAGR of 9.10%.

-

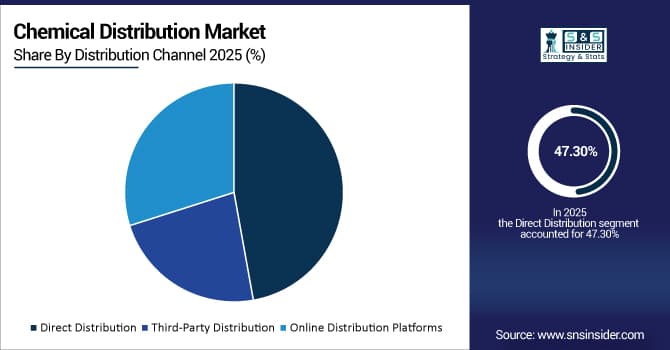

By Distribution Channel: In 2025, Direct Distribution led the market with a share of 47.30%, while Online Distribution Platforms is the fastest-growing segment with a CAGR of 9.35%.

-

By End Use: In 2025, Industrial Manufacturing led the market with a share of 26.48%, while Pharmaceuticals is the fastest-growing segment with a CAGR of 9.40%.

By Product, Commodity Chemicals Lead Market and Specialty Chemicals Fastest Growth

In 2025, Commodity chemicals dominate the market, as these bulk, low-cost chemicals are essential across multiple industries including manufacturing, construction, and consumer goods. Their widespread use, consistent demand, and large-volume transactions ensure stable market share.

Meanwhile, Specialty chemicals are the fastest-growing segment, driven by rising demand for high-value, application-specific chemicals such as agrochemicals, construction additives, pharmaceuticals, and electronic chemicals. These require technical expertise, customized distribution, and value-added services, accelerating growth for advanced distributors .

By Packaging Type, Bulk Containers Leads Market and Intermediate Bulk Containers (IBCs) Fastest Growth

In 2025, Bulk containers dominate the market, due to their cost-efficiency, suitability for large-scale industrial consumption, and ease of transport for commodity chemicals. Industries with high-volume needs prefer bulk shipments to reduce logistics costs.

Meanwhile, Intermediate Bulk Containers (IBCs) are the fastest-growing segment, as they provide flexibility, safe handling, and easy storage for specialty chemicals. Increasing demand in mid-sized industrial users and chemical manufacturers is driving rapid adoption of IBC packaging solutions.

By Distribution Channel, Direct Distribution Lead Market and Online Distribution Platforms Fastest Growth

In 2025, Direct distribution dominates the market, with manufacturers supplying chemicals directly to end-users for better control, quality assurance, and stronger customer relationships. Large industrial consumers prefer direct sourcing for reliability and cost efficiency.

Meanwhile, Online distribution platforms are the fastest-growing segment, fueled by digital transformation in procurement, increasing e-commerce adoption, and convenience in sourcing specialty and niche chemicals. Smaller businesses and distributors increasingly rely on online channels for timely orders and market access.

By End Use, Industrial Manufacturing Leads Market and Pharmaceuticals Fastest Growth

In 2025, Industrial manufacturing dominates the market, as chemical consumption is highest in processing, formulation, and production operations across sectors like automotive, construction, and textiles. Consistent demand ensures stable revenue for distributors.

Meanwhile, Pharmaceuticals and specialty sectors are the fastest-growing segment, driven by rising healthcare requirements, research, and formulation of high-value chemicals. Regulatory demand and innovation in specialty chemical applications are accelerating distribution growth in these high-margin end-use industries.

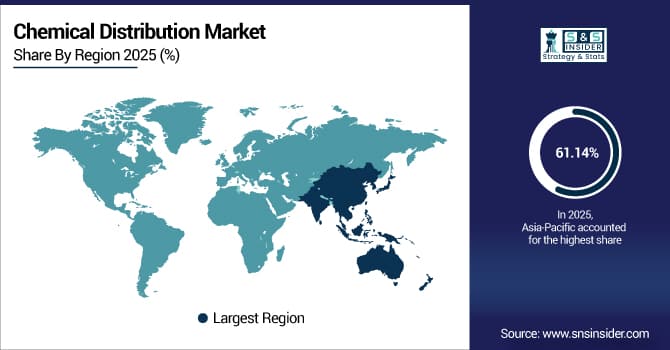

Chemical Distribution Market Regional Analysis:

Asia-Pacific Chemical Distribution Market Insights:

The Asia-Pacific dominated the Chemical Distribution Market in 2025E, with over 61.14% revenue share, due to rapid industrialization, growing manufacturing sectors, and increasing demand for specialty and commodity chemicals. Expansion in industries such as automotive, construction, pharmaceuticals, and consumer goods drives high-volume chemical consumption. The region benefits from well-established supply chains, efficient logistics networks, and increasing adoption of advanced distribution technologies. Rising urbanization, infrastructure development, and investments in industrial hubs further strengthen market dominance, positioning Asia Pacific as the leading contributor to the chemical distribution industry.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China and India Chemical Distribution Market Insights

China and India drive strong chemical distribution growth due to rapid industrialization, expanding manufacturing sectors, and rising demand for specialty and commodity chemicals. Efficient logistics networks, urbanization, and infrastructure development further strengthen market expansion in both countries.

North America Chemical Distribution Market Insights:

The North America region is expected to have the fastest-growing CAGR 9.23%, in the forecasted period 2026-2033, driven by increasing demand for specialty chemicals, regulatory compliance, and technological advancements in logistics and supply chain management. Companies focus on safety, quality control, and efficient delivery mechanisms. Strong growth in industrial manufacturing, construction, and healthcare sectors, combined with strategic partnerships between chemical producers and distributors, fuels rapid market expansion. Increasing adoption of digital platforms, warehouse automation, and third-party distribution services accelerates efficiency, making North America the fastest-growing region in the chemical distribution market.

U.S and Canada Chemical Distribution Market Insights

The U.S. and Canada experience fast chemical distribution growth fueled by increasing demand for specialty chemicals, advanced supply chain solutions, and regulatory compliance. Industrial manufacturing, construction, and healthcare sectors drive adoption, while digital platforms and third-party distribution services enhance efficiency and market expansion.

Europe Chemical Distribution Market Insights

Europe maintains steady growth in the chemical distribution market, supported by stringent environmental and safety regulations, growing industrial output, and increasing demand from automotive, pharmaceuticals, construction, and consumer goods sectors. Distributors prioritize compliance, safe transportation, and efficient supply chain management to meet regional standards. Investments in digital supply chain solutions, logistics infrastructure, and warehouse automation enhance operational efficiency. The region also focuses on sustainable distribution practices and integration of advanced technologies. Consistent industrial development and adoption of specialty chemicals across manufacturing and energy sectors drive long-term market stability in Europe.

Germany and U.K. Chemical Distribution Market Insights

Germany and the U.K. maintain steady market growth, supported by stringent safety and environmental regulations, high industrial activity, and strong demand from automotive, pharmaceutical, and consumer goods sectors.

Latin America (LATAM) and Middle East & Africa (MEA) Chemical Distribution Market Insights

Latin America and the Middle East are gradually expanding in the chemical distribution market. Brazil and Mexico in Latin America lead industrial growth, supported by urbanization, construction, and manufacturing demand. In the Middle East, countries like Saudi Arabia and the UAE invest heavily in petrochemical industries and industrial infrastructure. Both regions focus on improving logistics, supply chain efficiency, and safety standards. Increasing industrialization, rising chemical demand in construction and automotive sectors, and government-backed industrial initiatives drive market growth. Partnerships between local distributors and chemical producers further accelerate adoption and enhance regional market potential.

Chemical Distribution Market Competitive Landscape:

Brenntag is a chemical distributor offering a broad portfolio of industrial and specialty chemicals across diverse sectors including pharmaceuticals, food, coatings, and personal care. The company provides value-added services such as formulation support, logistics, and regulatory compliance assistance. With a strong network, advanced supply chain management, and customer-focused solutions, Brenntag ensures timely delivery, operational efficiency, and product expertise. Its emphasis on innovation, sustainability, and tailored distribution strategies makes Brenntag a key player in the chemical distribution market.

-

In June 2024, Brenntag Opened a new “EDGE‑certified” green‑warehouse in Northern India to support sustainable distribution, improve logistics, storage efficiency and reduce environmental footprint.

Univar Solutions delivers a wide range of specialty and commodity chemicals, serving industries like coatings, personal care, pharmaceuticals, and food. The company combines sourcing, formulation expertise, and advanced logistics to provide reliable, cost-effective distribution solutions. Univar emphasizes regulatory compliance, technical support, and sustainable practices. Through strong partnerships with suppliers and customers, it ensures efficient supply chain operations and value-added services. Univar’s focus on innovation, market reach, and integrated chemical solutions positions it as a leading chemical distributor.

-

In September 2024, Univar Solutions Merged with Nexeo Solutions creating one of North America’s largest chemical‑distribution entities. The merger combined logistics networks and product portfolios, enhancing supply‑chain scale and reach.

Barentz International specializes in the distribution of specialty chemicals and ingredients for pharmaceuticals, food, personal care, and industrial applications. The company offers technical support, formulation services, and supply chain optimization to meet complex customer requirements. Barentz emphasizes sustainability, quality assurance, and regulatory compliance across its operations. By leveraging local market expertise and a collaborative approach with suppliers and clients, Barentz strengthens its position in the chemical distribution market, providing tailored, reliable, and value-added chemical solutions to a diverse set of industries.

-

In March 2024, Barentz International announced a strategic distribution agreement with Evonik Industries to supply its AvailOm Omega‑3 Lysine complex in Canada starting March 10, 2024.

Chemical Distribution Market Key Players:

-

Brenntag

-

Univar Solutions

-

Helm AG

-

Nagase & Co

-

IMCD

-

Azelis Group

-

Biesterfeld

-

Barentz International

-

ICC Chemical

-

Omya

-

Jebsen & Jessen

-

Sinochem Plastics

-

Nexeo Solutions

-

Kraton Corporation

-

Westlake Chemical

-

Mitsubishi Corporation (Chemical Division)

-

DKSH Group

-

Elementis PLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 271.09 Billion |

| Market Size by 2033 | USD 466.59 Billion |

| CAGR | CAGR of 7.04% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Specialty Chemicals, Commodity Chemicals) •By Packaging Type (Bulk Containers, Drums & Barrels, Intermediate Bulk Containers (IBCs), Flexible Packaging, Others) •By Distribution Channel (Direct Distribution, Third-Party Distribution, Online Distribution Platforms) •By End Use (Automotive & Transport, Agriculture, Construction, Consumer Goods, Industrial Manufacturing, Textiles, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Brenntag, Univar Solutions, Tricon Energy, Helm AG, Nagase & Co., IMCD, Azelis Group, Biesterfeld, Barentz International, Stockmeier Chemie, ICC Chemical, Omya, Jebsen & Jessen, Sinochem Plastics, Nexeo Solutions, Kraton Corporation, Westlake Chemical, Mitsubishi Corporation (Chemical Division), DKSH Group, and Elementis PLC |