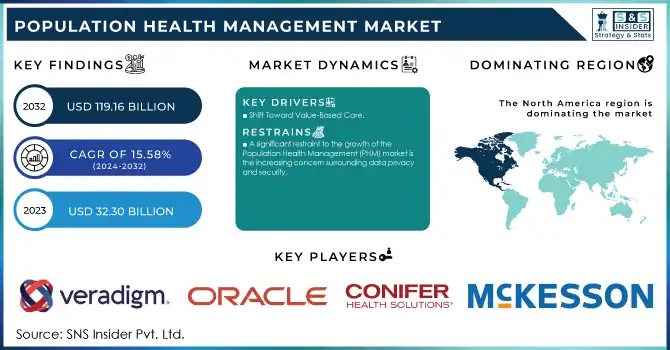

Population Health Management Market Size & Trends:

The Population Health Management Market was valued at USD 32.30 billion in 2023 and is expected to reach USD 119.16 billion by 2032 with a growing CAGR of 15.58% over the forecast period of 2024-2032.

Get more information on Population Health Management Market - Request Sample Report

The Population Health Management (PHM) Market is rapidly expanding as healthcare systems adopt value-based care models to improve outcomes and control costs. PHM leverages advanced data integration, analytics, and coordinated care to manage patient populations effectively, focusing on preventive healthcare, chronic disease management, and enhanced patient engagement.

Chronic diseases are a significant driver of PHM adoption. According to the CDC report, 6 in 10 adults in the U.S. have at least one chronic disease, while 4 in 10 have two or more, accounting for 90% of the nation's annual healthcare expenditures. For instance, PHM initiatives have been pivotal in reducing hospital readmission rates among diabetic patients by enabling early intervention and continuous monitoring through connected care systems. Programs such as California's CalAIM Population Health Management Initiative exemplify government-led efforts to integrate PHM frameworks into statewide healthcare systems, targeting Medicaid beneficiaries.

The global push toward value-based care further accelerates the PHM market. For example, the U.S. Centers for Medicare & Medicaid Services reported a 21% reduction in avoidable hospital admissions in accountable care organizations employing PHM tools. Similarly, value-based European programs, such as the National Health Service's Integrated Care Systems, enhance healthcare quality while managing costs through comprehensive PHM strategies.

Technological advancements also play a crucial role. Tools like artificial intelligence and machine learning enhance predictive analytics, allowing healthcare providers to identify high-risk individuals proactively. Telehealth platforms and wearable devices have enabled remote monitoring for over 30 million patients globally in 2023, ensuring continuous care for chronic disease patients and elderly populations. For instance, Mayo Clinic's PHM initiatives utilize advanced analytics to predict patient readmission risks, reducing them by 17% over three years.

The increased focus on preventive healthcare has also driven PHM adoption. Employers investing in wellness programs report an average USD 3 return on every USD 1 spent by reducing absenteeism and improving employee health.

Market Dynamics

Drivers

-

Shift Toward Value-Based Care

The transition from fee-for-service to value-based care models is one of the key drivers of the Population Health Management Market. In this model, healthcare providers are rewarded based on patient outcomes rather than the volume of services provided. This change aligns with the broader goals of reducing healthcare costs while enhancing quality. Population Health Management tools enable healthcare providers to identify high-risk patients, prevent unnecessary hospitalizations, and coordinate care more efficiently. This approach not only improves patient satisfaction but also reduces the financial burden on healthcare systems. As a result, more providers are adopting Population Health Management systems to ensure that they meet performance-based incentives tied to outcomes, further promoting the widespread adoption of Population Health Management strategies. This shift is expected to accelerate the growth of the market as more healthcare organizations embrace the need for cost-effective and results-driven care models.

-

Rising Chronic Disease Prevalence

The growing prevalence of chronic diseases is another major driver for the Population Health Management market. Conditions such as diabetes, hypertension, and cardiovascular diseases are increasingly common, leading to rising healthcare costs and the need for more effective management strategies. According to various studies, these chronic diseases account for a significant portion of global healthcare spending. Population Health Management systems offer a comprehensive solution by aggregating patient data, identifying at-risk individuals, and facilitating personalized care plans. By focusing on continuous monitoring and early intervention, Population Health Management reduces hospital admissions, readmissions, and emergency room visits, ultimately improving long-term patient outcomes. As the global population continues to age and the incidence of chronic diseases rises, the demand for Population Health Management solutions to manage these conditions effectively will grow, driving market expansion.

-

Technological Advancements and Data Integration

Technological innovations in healthcare, such as artificial intelligence, machine learning, and telemedicine, are key factors propelling the Population Health Management market. These technologies enable more accurate data analysis, predictive modeling, and personalized care delivery. AI and ML algorithms help healthcare providers identify high-risk patients and predict future health events, allowing for proactive care interventions. Telemedicine and remote monitoring solutions are increasingly important for managing chronic diseases, as they allow healthcare providers to track patients' conditions in real-time, even from a distance. Additionally, integrating electronic health records and health information exchanges ensures seamless data sharing across various healthcare platforms. The ability to gather, analyze, and act upon large sets of data enhances care coordination, improves patient outcomes, and contributes to the rapid adoption of Population Health Management solutions, driving market growth.

Restraints

-

A significant restraint to the growth of the Population Health Management (PHM) market is the increasing concern surrounding data privacy and security.

Since PHM systems collect, store, and analyze large volumes of sensitive patient information, healthcare organizations face challenges in protecting this data from breaches or unauthorized access. Regulatory frameworks like the Health Insurance Portability and Accountability Act in the U.S. and the General Data Protection Regulation in Europe impose strict data handling and security requirements. However, the complexity of data sharing among various platforms and third-party vendors amplifies the risk of security breaches, leading to hesitancy among healthcare providers. These concerns can slow the adoption of PHM solutions, particularly in regions with strict data privacy regulations, thereby limiting the market's overall growth.

Population Health Management Market Segmentation Outlook

By Product & Service

In 2023, the software segment held the largest share of the Population Health Management (PHM) market, accounting for approximately 52% of the total market revenue. This dominance is attributed to the increasing adoption of advanced analytics, electronic health records, and population data management tools that enable healthcare providers to monitor and manage patient populations effectively. Software solutions are critical for integrating and analyzing large volumes of data, ensuring seamless care coordination, and supporting decision-making processes. The growing need for value-based care models and the adoption of predictive analytics further bolstered the demand for PHM software, making it a pivotal component of healthcare ecosystems.

The services segment is anticipated to be the fastest growth over the forecast period. This growth is driven by the increasing need for consulting, implementation, training, and ongoing support services as healthcare organizations transition to advanced PHM systems. The rising demand for tailored service solutions to address specific organizational needs and optimize PHM implementation is a significant growth driver. Healthcare providers are also leveraging third-party services to ensure compliance with regulatory requirements and to enhance system efficiency, fueling the rapid expansion of this segment.

By Mode of Delivery

In 2023, cloud-based solutions dominated the PHM market with an estimated 80% share. Their dominance is due to their cost-effectiveness, scalability, and ease of implementation compared to traditional on-premise systems. Cloud-based platforms enable seamless data integration, real-time access to patient information, and enhanced interoperability between systems, all of which are critical for effective population health management. Additionally, the ongoing shift toward digital transformation in healthcare, coupled with the rising preference for remote access solutions, significantly contributed to the widespread adoption of cloud-based PHM solutions.

The cloud-based delivery model is also projected to be the fastest-growing segment during the forecast period. The growth is fueled by the increasing need for flexible and secure data management solutions, particularly in the wake of the COVID-19 pandemic, which underscored the importance of remote and scalable healthcare technologies. The ability of cloud platforms to integrate with telemedicine services and support data sharing across multiple stakeholders further drives their adoption. Additionally, advancements in cloud security and the reduced upfront investment requirements make this segment highly appealing to healthcare organizations.

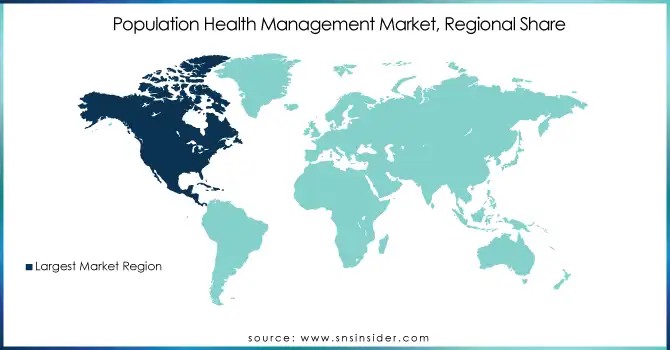

Regional Analysis

In 2023, North America emerged as the dominant region in the Population Health Management market, capturing a significant market share of approximately 47%. This dominance is driven by the region’s well-established healthcare infrastructure, widespread adoption of value-based care models, and the presence of leading market players offering advanced PHM solutions. The United States, in particular, has been a key contributor, with initiatives like the Affordable Care Act and accountable care organizations promoting the adoption of PHM practices. Moreover, the increasing prevalence of chronic diseases and rising healthcare expenditure have further fueled demand for PHM systems in the region.

Asia-Pacific is projected to be the fastest-growing region during the forecast period. Factors such as rapid healthcare digitization, increasing government investments in healthcare IT infrastructure, and the rising burden of chronic diseases contribute to this growth. Countries like China, India, and Japan are at the forefront, driven by expanding healthcare systems and increasing awareness about the benefits of population health management. The growing penetration of cloud-based solutions and telemedicine in these regions further enhances the adoption of PHM technologies.

Need any customization research on Population Health Management Market - Enquiry Now

Key Population Health Management Comapanies and Products

-

Veradigm LLC – Veradigm Connect, Veradigm Insights

-

Oracle – Oracle Health Management, Oracle Cloud Healthcare Analytics

-

Conifer Health Solutions, LLC – ConiferConnect, Value-Based Care Solutions

-

eClinicalWorks – Healow Insights, eClinicalWorks Population Health Analytics

-

Enli Health Intelligence (Cedar Gate Technologies) – Enli CareManager, Cedar Gate Analytics

-

McKesson Corporation – McKesson Health Solutions, InterQual Care Intelligence

-

Medecision – Aerial Population Health Management Platform

-

Optum, Inc. – Optum One, OptumIQ Analytics

-

Koninklijke Philips N.V. – Philips Wellcentive, IntelliSpace Population Health

-

Athenahealth, Inc. – AthenaHealth Population Health, AthenaClinicals

-

Welltok (Virgin Pulse) – CaféWell, Virgin Pulse Health Solutions

-

Epic Systems Corporation – Epic Healthy Planet, Care Everywhere

-

NextGen Healthcare – NextGen Population Health Solutions

-

Medical Information Technology, Inc. (MEDITECH) – Expanse Population Health

-

Kareo, Inc. – Kareo Analytics

Recent Development

In Jan 2025, HealthEC and VirtualHealth partnered to create Elligint Health, combining VirtualHealth’s award-winning HELIOS medical management platform with HealthEC’s advanced population health analytics. This collaboration aims to deliver integrated, precision-driven solutions that streamline complexity, enable actionable insights, and support healthcare organizations in excelling under value-based care models.

In Jan 2025, Cedar Gate Technologies, a prominent provider of value-based care technology and services, is recognized as the innovation leader in the Frost Radar U.S. Population Health Management 2024 report. Among the 50 technology vendors evaluated, Cedar Gate achieved the highest ranking on the Innovation Index, highlighting its leadership in advancing PHM solutions.

In Nov 2024, i2i Population Health, a leader in population health solutions, partnered with CureMD, a renowned cloud-based Electronic Health Record (EHR) and Practice Management solutions provider. This strategic collaboration focuses on enhancing care management and driving improved health outcomes nationwide

| Report Attributes | Details |

| Market Size in 2023 | USD 32.30 Billion |

| Market Size by 2032 | USD 119.16 Billion |

| CAGR | CAGR of 15.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service [Software, Services] • By Mode of Delivery [On-premise, Cloud-based] • By End User [Healthcare Providers, Healthcare Payers, Other End Users] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Veradigm LLC, Oracle, Conifer Health Solutions, LLC, eClinicalWorks, Enli Health Intelligence (Cedar Gate Technologies), McKesson Corporation, Medecision, Optum, Inc., Koninklijke Philips N.V., Athenahealth, Inc., Welltok (Virgin Pulse), Epic Systems Corporation, NextGen Healthcare, Medical Information Technology, Inc. (MEDITECH), Kareo, Inc. |

| Key Drivers | • Shift Toward Value-Based Care • Rising Chronic Disease Prevalence • Technological Advancements and Data Integration |

| Restraints | • A significant restraint to the growth of the Population Health Management (PHM) market is the increasing concern surrounding data privacy and security. |