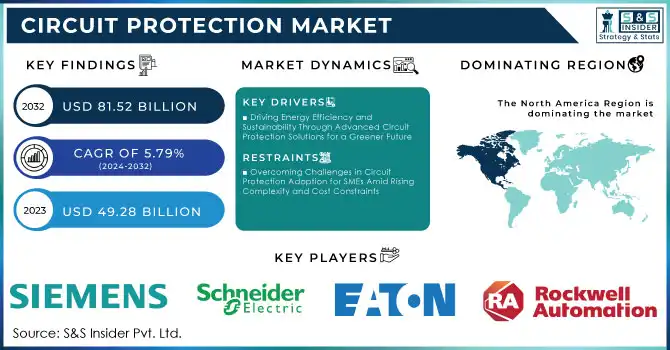

Circuit Protection Market Size & Growth Trends:

The Circuit Protection Market Size was valued at USD 49.28 Billion in 2023 and is expected to reach USD 81.52 Billion by 2032 and grow at a CAGR of 5.79% over the forecast period 2024-2032.

The Circuit Protection Market is growing due to increasing demands to safeguard electronic devices and electrical systems from overloads, short circuits, and power surges causing damage. This circuit protection market has a high demand for reliable and efficient solutions mainly due to the alarming rate of proliferation of consumer electronics, automotive advancements, and industrial automation. In addition, the growth of electric vehicles and connected cars in the automotive sector is also expanding the circuit protection market, as these vehicles need advanced systems to protect sensitive electronics.

To Get More Information on Circuit Protection Market - Request Sample Report

In addition, on the industrial end, it is taking up automation and IoT-based technologies highly dependent upon complex sensitive electrical components, further augmenting demand for circuit protection. In addition, the increasing awareness of safety regulations and standards in different industries forces manufacturers to integrate circuit protection elements into their products to meet compliance and increase the reliability of their products. As more renewable energy-based power generation is being installed in various locations such as solar and wind power, circuit protection solutions are becoming increasingly critical in ensuring electrical systems remain free from voltage fluctuations and power irregularities; thus, its market is also growing.

Circuit Protection Market Dynamics

KEY DRIVERS:

-

Driving Energy Efficiency and Sustainability Through Advanced Circuit Protection Solutions for a Greener Future

With industries across the globe looking to cut energy consumption as well as decrease their ability to damage the environment, the demand for circuit protection devices that increase the efficiency of the system is on the rise. This is particularly true for power distribution networks and renewable energy systems, where an efficient management of energy is indeed what maximizes performance while minimizing losses. Circuit protection solutions, which include fuses, circuit breakers, and surge protectors, are in themselves mechanisms that are meant to mitigate waste energy and guarantee seamless system functionality for electricity. With governments as well as regulatory bodies putting across some stringent energy efficiency standards, industries are being pushed to embrace a high level of advanced circuit protection technology to satisfy such standards and thereby bolster the total reliability of their systems.

-

Enhancing Reliability in Complex Systems Through Advanced Circuit Protection Solutions for Critical Industries

The reason that contributes to the growth of this market is the increased complexity of modern electrical and electronic systems, mainly in telecommunications, data centers, and healthcare. The use of sensitive electronics in mission-critical applications creates a higher requirement for protection from electrical faults, surges, and power fluctuations. Examples include Data centers: Servers and networking equipment must always be operational, and any electrical disturbance can cause expensive downtime or even loss of data. For this reason, devices for circuit protection are very important for maintaining safety and stability in these systems. Health sector: Since constant power supply to life-saving medical equipment and other equipment is held paramount, the sector relies on circuit protection that does not allow failures or malfunctions. The demand for the advancement of circuit protection technologies has increased with the dependence of industries on complex and interrelated systems.

RESTRAIN:

-

Overcoming Challenges in Circuit Protection Adoption for SMEs Amid Rising Complexity and Cost Constraints

The high cost of advanced circuit protection devices proves expensive for SMEs and industries with sensitive costs. Advanced circuit protector devices are expensive due to complicated technology, excellent material quality, significant investments in R&D, high adherence to tough certification standards, and customization. Protection devices range from USD 50 to USD 500, while advanced circuit breakers may go up to USD 100 to USD 1,000 or even higher. This means it will not be possible for some businesses to adopt the most advanced technology and instead look for cheaper alternatives that possibly may not offer enough protection and thus limit growth in the market. Another restraining feature is the complexity of modern electronics, as they have advanced to the point that they are very complex and, therefore require more sophisticated and precise circuit protection solutions. Complexity can be a challenging feature for manufacturers, especially in the design, integration, and scalability aspects. Furthermore, product updating is required on constant development to keep up with new developments in safety standards and technological advancements that further burden manufacturers.

Circuit Protection Market - Key Segmentation

BY PRODUCT

The circuit breaker segment dominated the global circuit protection market in 2023 with a revenue share of 22.67%, based on its wide usage among various industries and sectors. A circuit breaker is crucial for preventing an electrical overload and short circuits; therefore, it is always included in power distribution networks, residential buildings, industrial environments, and other infrastructure projects. Another reason for such huge demand for circuit breakers is because of their 'resetting ability after tripping'. Circuit breakers can be reset and reused after a fault while fuses need replacement.

The HD Pro (High-Demand Professional) segment will experience faster growth with a CAGR of 6.6% as such applications are more specialized for high-performance environments like heavy industry, data centers, and advanced manufacturing sectors. Fast-paced digitization and interconnectivity of industries make demands for stronger circuit protection solutions that can withstand heavy power loads and greater operational reliability.

BY CHANNEL

The power generation application dominated the global circuit protection market in 2023, accounting for 21% of revenue. This is primarily due to the increasing demand for reliable infrastructure in power generation. Gaining prominence in global energy consumption, particularly from the increased use of renewable sources like solar and wind, has heightened the need for effective circuit protection. The important role that circuit protection plays in the operation of electrical systems be it conventional or renewable source power generation facilities is ensuring a safe operating environment.

The HVAC segment is projected to grow faster at a CAGR of 6.75% on account of rising demand for energy-efficient HVAC systems in all residential, commercial, and industrial sectors. In the area of buildings becoming smarter and energy-conscious, HVAC systems, for example, are becoming integrated with other advanced technologies that require advanced circuit protection to prevent electrical components from overloads, short circuits, and surges.

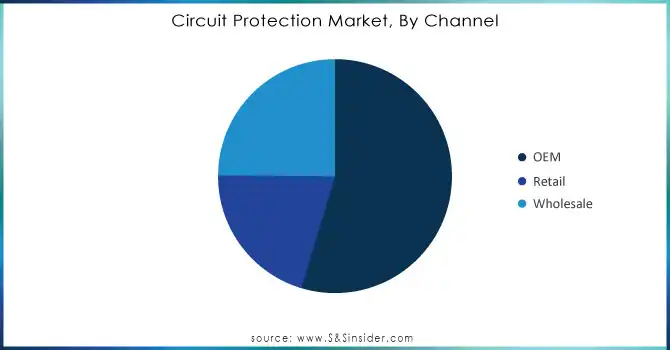

BY CHANNEL

OEMs were the dominant force in the global circuit protection market in 2023 and held a share of more than 54%. The only reason for this is that many industries depend on OEMs to develop integrated circuit protection solutions targeted toward specific applications. OEMs manufacture and design equipment wherein circuit protection devices are embedded. That, therefore, ensures safety while performance is optimized.

The wholesale segment is expected to grow at a high CAGR of 6.25%. Growth will be enabled by increased circuit protection needs from construction, telecommunications, and renewable energy industries, along with increased complexity in electrical systems. Wholesalers act as a linkage in the distribution of circuit protection products and thus offer easy access to multiple solutions from various manufacturers.

Do You Need any Customization Research on Circuit Protection Market - Inquire Now

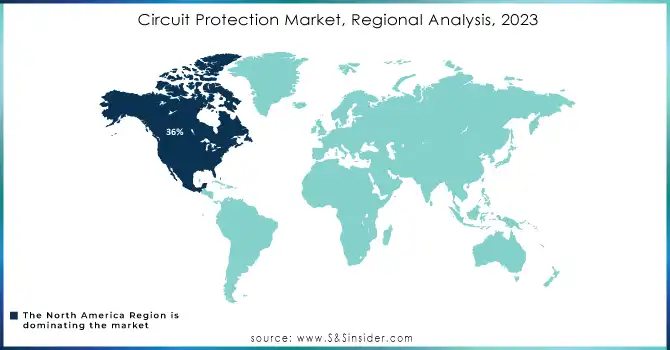

Circuit Protection Market Regional Analysis

North America dominated the circuit protection market with a revenue share of 36% in 2023, due to advanced infrastructures, a robust industrial base, and substantive investment in technology and energy. High numbers of key players and manufacturers within the U.S. and Canada further enhanced the growth of the market as these companies innovate and develop better products. In addition, strict safety measures and regulations in North America require top-notch circuit protection solutions in a widening range of industries from automotive to aerospace and renewable energy. The tendency toward smart grid technologies as well as electric vehicle adoption leads to the growing demand for more sophisticated circuit protection devices in this region and reinforces North America's lead in the market.

The Asia Pacific region is expected to be the fastest-growing region, with an estimated CAGR of 6.25 % for the forecast period. This is largely because the Asia Pacific region witnesses relatively rapid industrialization and urbanization coupled with rising energy demands in China, India, and Southeast Asia. Booming manufacturing, especially the electronics and automotive markets in Asia, requires potent circuit protection solutions to ensure safe and efficient electrical systems. The government initiatives undertaken in favor of renewable energy and smart infrastructure enhance the demand for circuit protection devices. The Asia Pacific circuit protection market will witness an enormous growth rate, thereby ensuring that new opportunities attract not only local players but also international players to take advantage of the new opportunities arising from the same.

Key Players in the Circuit Protection Market are:

-

Schneider Electric (Miniature Circuit Breakers, Residual Current Devices)

-

Eaton Corporation (Circuit Breakers, Fuse Holders)

-

ABB (Molded Case Circuit Breakers, Surge Protective Devices)

-

Siemens (Circuit Breakers, Surge Arresters)

-

General Electric (GE) (Air Circuit Breakers, Ground Fault Circuit Interrupters)

-

Rockwell Automation (Overload Relays, Circuit Protectors)

-

Bel Fuse Inc. (Polyfuse Resettable Fuses, Circuit Protection Modules)

-

Littelfuse (Glass Fuse, Semiconductor Fuses)

-

Mersen (Fuse Holders, High-Speed Fuses)

-

TE Connectivity (Circuit Protection Fuses, Circuit Breakers)

-

Amphenol (Circuit Breakers, Fuses)

-

NTE Electronics (Fuses, Circuit Breakers)

-

Farnell (Thermal Circuit Breakers, Glass Fuses)

-

Cooper Bussmann (Buss Fuses, Circuit Protection Devices)

-

Panasonic (Resettable Fuses, Circuit Breakers)

-

Honeywell (Circuit Breakers, Surge Protectors)

-

Littelfuse (Automotive Fuses, Surface Mount Fuses)

-

Vishay Intertechnology (TVS Diodes, Circuit Protection Devices)

-

NXP Semiconductors (ESD Protection Devices, Overvoltage Protection)

-

Wurth Elektronik (Polymeric PTC Fuses, Circuit Breakers)

RECENT TRENDS:

-

In March 2024, Siemens launched one of the world's most innovative circuit protection devices, featuring ultra-fast, multifunctional, and parametrizable capabilities. This device operates up to 1,000 times faster than traditional solutions, ensuring wear-free switching and offering multiple adjustable functions.

-

In July 2024, Toshiba Electronic Devices & Storage Corporation has unveiled the TCKE9 Series, a new lineup of eight compact, high-voltage electronic fuses (eFuse ICs) designed to enhance the protection of power supply lines.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 49.28 Billion |

| Market Size by 2032 | USD 81.52 Billion |

| CAGR | CAGR of 5.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Circuit Breaker, Fuse, HD Pro, Inrush Current Limiter, Mobile Power Protection, Overvoltage Protection, PTC Devices, GFCI) • By Application (Agriculture, Automotive, Commercial & Residential Building, Household Appliances, HVAC, Power Generation, Recreational Vehicle (RV), Telecom, Others) • By Channel (OEM, Retail, Wholesale) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Eaton Corporation, ABB, Siemens, General Electric (GE), Rockwell Automation, Bel Fuse Inc., Littelfuse, Mersen, TE Connectivity, Amphenol, NTE Electronics, Farnell, Cooper Bussmann, Panasonic, Honeywell, Vishay Intertechnology, NXP Semiconductors, Wurth Elektronik. |

| Key Drivers | • Driving Energy Efficiency and Sustainability Through Advanced Circuit Protection Solutions for a Greener Future. • Enhancing Reliability in Complex Systems Through Advanced Circuit Protection Solutions for Critical Industries. |

| Restraints | • Overcoming Challenges in Circuit Protection Adoption for SMEs Amid Rising Complexity and Cost Constraints. |