Surge Protection Devices Market Size & Trends:

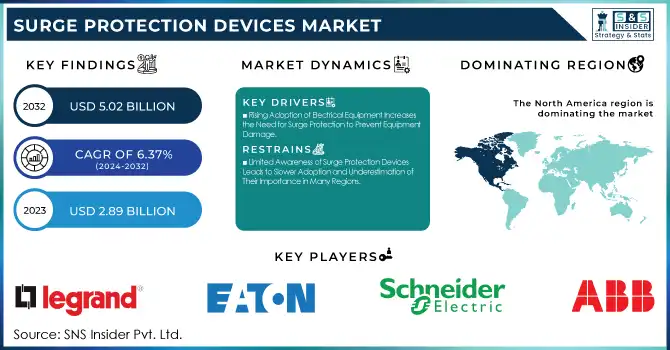

The Surge Protection Devices Market was valued at USD 3.07 billion in 2024 and is expected to reach USD 5.04 billion by 2032, growing at a CAGR of 6.37% from 2025-2032.

To get more information on Surge Protection Devices Market - Request Free Sample Report

The Surge Protection Devices (SPD) market is rapidly growing due to increased reliance on electronics and rising voltage surge incidents. Adoption of smart homes, data centers, renewable energy systems, and electric vehicle charging infrastructure drives demand for reliable surge protection. Innovations, such as Raycap’s ProTec PV Box and IoT-enabled SPDs, provide real-time monitoring and plug-and-play installation. Rising renewable energy deployment, technological advancements, and the need for energy-efficient, compact, and cost-effective solutions present significant growth opportunities. SPDs are essential for safeguarding sensitive equipment across residential, commercial, and industrial sectors, ensuring market expansion in the coming years.

Market Size and Forecast

-

Market Size in 2024: USD 3.07 Billion

-

Market Size by 2032: USD 5.04 Billion

-

CAGR: 6.37% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Surge Protection Devices Market Trends

-

Rising demand for reliable electrical infrastructure and protection against voltage surges is driving the surge protection devices (SPD) market.

-

Growing adoption across residential, commercial, and industrial sectors is boosting market growth.

-

Increasing deployment in renewable energy systems, data centers, and smart grids is expanding applications.

-

Integration with IoT and smart building technologies is enhancing monitoring and predictive maintenance capabilities.

-

Regulatory standards and safety compliance requirements are shaping market adoption trends.

-

Advancements in modular, compact, and high-capacity SPDs are improving efficiency and reliability.

-

Collaborations between manufacturers, distributors, and infrastructure developers are accelerating innovation and market penetration.

Surge Protection Devices Market Growth Drivers:

-

Rising Adoption of Electrical Equipment Increases the Need for Surge Protection to Prevent Equipment Damage.

The global rise in the adoption of electrical appliances, industrial machinery, and consumer electronics is creating a growing need for surge protection. As more households and businesses rely on advanced technologies and electrical devices, the risk of electrical surges—caused by factors like lightning, grid instability, or power fluctuations—becomes a significant concern. This risk can lead to costly equipment damage or downtime, making surge protection devices crucial in safeguarding sensitive electronics. Furthermore, industries such as manufacturing, healthcare, and IT are increasingly dependent on complex machinery and systems that require constant protection against voltage spikes. This surge in demand for electrical and electronic equipment, coupled with the necessity to prevent damage, ensures that surge protection systems remain a vital component in modern electrical infrastructure across multiple sectors.

-

Rapid Urbanization and Infrastructure Growth Drive Increased Demand for Reliable Surge Protection Devices in Electrical Systems.

The worldwide trend of rapid urbanization and growing infrastructure projects is placing greater emphasis on the need for reliable and stable electrical systems. As cities expand and modernize, new residential, commercial, and industrial buildings require robust electrical grids to support the increasing demand for power. Surge protection devices are essential in these developments to protect critical electrical systems and ensure the safety and longevity of equipment. With power surges becoming a common risk in large-scale urban areas, the demand for SPDs will continue to rise, as they are key to preventing damage to sensitive equipment. Furthermore, as infrastructure projects grow in scale and complexity, the need for enhanced electrical reliability and protection systems, including SPDs, becomes crucial in maintaining seamless operations across various sectors such as construction, transport, and public utilities.

Surge Protection Devices Market Restraints:

-

Limited Awareness of Surge Protection Devices Leads to Slower Adoption and Underestimation of Their Importance in Many Regions.

In some regions, the lack of awareness regarding the importance of surge protection devices contributes to their slower adoption. Many individuals and businesses are unaware of the potential damage that power surges can cause to sensitive electronic equipment, leading to underestimation of the need for protective devices. This lack of understanding often results in delayed or missed investments in surge protection, particularly in areas where electrical infrastructure is not well-developed. Additionally, smaller businesses or residential areas with limited budgets may prioritize other expenses over surge protection, unaware of the long-term cost savings and prevention of equipment damage that SPDs provide. This knowledge gap can significantly limit the market penetration of SPDs, particularly in developing regions or industries that are still in the early stages of adopting modern electrical safety measures.

Surge Protection Devices Market Segment Analysis

By Product, Hard Wired SPDs dominated in 2023 with 42% revenue, Plug-In SPDs growing fastest at 7.71% CAGR.

In 2024, the Hard Wired Surge Protection Devices segment dominated the Surge Protection Devices Market with the highest revenue share of approximately 42%. This dominance can be attributed to their widespread use in commercial and industrial settings, where larger-scale, permanent surge protection solutions are required. Hard-wired SPDs provide robust protection for entire electrical systems, safeguarding sensitive equipment from voltage spikes and power surges, which is crucial for industries relying on uninterrupted power supply.

The Plug-In Surge Protection Devices segment is projected to grow at the fastest CAGR of 7.71% from 2025 to 2032. This growth is driven by increasing demand from residential and small commercial sectors, where ease of installation and affordability are key factors. Plug-in devices offer a simple, cost-effective solution for protecting individual appliances and electronics, making them ideal for consumers looking for immediate, hassle-free protection without the need for complex wiring or installation.

By End Use, Industrial segment led in 2023 with 43% revenue, Commercial segment growing fastest at 8.13% CAGR

In 2024, the Industrial segment led the Surge Protection Devices Market with the highest revenue share of around 43%. This dominance is largely due to the critical need for surge protection in industrial operations, where sensitive machinery and large-scale equipment are highly susceptible to power surges. Industries such as manufacturing, oil and gas, and energy rely on continuous, stable electrical systems, making robust surge protection essential to prevent costly downtime and equipment damage.

The Commercial segment is expected to grow at the fastest CAGR of 8.13% from 2025 to 2032. This growth is fueled by the increasing reliance on electronic devices, automated systems, and IT infrastructure in commercial settings, which necessitate effective surge protection to maintain operational efficiency. As businesses continue to expand their technological capabilities and digitalize their operations, the demand for plug-and-play, easy-to-install surge protection solutions is rising, driving rapid growth in this segment.

By Type, Type 2 SPDs dominated in 2023 with 45% revenue, Type 1 SPDs growing fastest at 7.84% CAGR

In 2024, the Type 2 segment dominated the Surge Protection Devices Market with the highest revenue share of approximately 45%. This can be attributed to Type 2 SPDs' widespread use in protecting electrical systems from smaller, transient power surges that commonly occur in residential, commercial, and industrial settings. Their ability to offer reliable protection after a Type 1 SPD, combined with cost-effectiveness and ease of installation, makes them highly sought after for safeguarding equipment and ensuring the stability of electrical grids.

The Type 1 segment is expected to grow at the fastest CAGR of 7.84% from 2025 to 2032. This growth is driven by increasing awareness of the need for comprehensive surge protection at the point of entry in electrical systems, especially in areas prone to high lightning activity. Type 1 SPDs are critical for preventing large-scale surges caused by external factors, and their adoption is gaining momentum as industries and residential buildings prioritize advanced protection against severe electrical spikes.

Surge Protection Devices Market Regional Analysis

North America Surge Protection Devices Market Insights

In 2024, North America led the Surge Protection Devices Market with the highest revenue share of approximately 39%. This dominance can be attributed to the region’s well-established infrastructure, growing reliance on advanced electrical systems, and stringent regulatory standards that drive the need for reliable surge protection. The increasing adoption of smart grids, coupled with high demand for surge protection in commercial and industrial sectors, further solidifies North America's position as a key market for SPDs.

Asia Pacific Surge Protection Devices Market Insights

The Asia Pacific segment is projected to grow at the fastest CAGR of 8.10% from 2025 to 2032. This growth is driven by rapid urbanization, expanding industrial sectors, and increasing power infrastructure development across countries like China, India, and Southeast Asia. As the region modernizes its electrical systems and integrates more electronic devices, the demand for surge protection devices is expected to surge, fueled by both residential and commercial applications in emerging economies.

Europe Surge Protection Devices Market Insights

In Europe, the Surge Protection Devices (SPD) market is expanding due to rising adoption of smart homes, renewable energy systems, and industrial automation. Increasing deployment of solar PV, EV charging infrastructure, and IoT-enabled devices is driving demand for reliable voltage surge protection. Technological advancements, stringent electrical safety regulations, and focus on energy efficiency are further boosting market growth, making SPDs essential across residential, commercial, and industrial sectors in the region.

Middle East & Africa and Latin America Surge Protection Devices Market Insights

In the Middle East & Africa and Latin America, the Surge Protection Devices (SPD) market is witnessing growth due to rising industrialization, urbanization, and adoption of renewable energy systems. Increasing use of smart homes, data centers, and electric vehicle infrastructure is fueling demand for reliable surge protection. Government regulations, focus on energy efficiency, and growing awareness of electrical safety are further driving market expansion across residential, commercial, and industrial applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

Surge Protection Devices Market Competitive Landscape:

DEHN SE

DEHN SE, founded in 1910 and headquartered in Germany, is a global leader in lightning protection, surge protection, and safety solutions for electrical and electronic systems. The company designs and manufactures high-quality devices and systems that safeguard infrastructure, industrial installations, and critical equipment. DEHN focuses on innovation in power quality, grounding, and lightning protection technologies, providing customized solutions to meet the growing safety and reliability needs of industrial, commercial, and utility sectors worldwide.

-

2024: DEHN will expand its presence in the U.S. by acquiring parts of ABB’s surge protection business, including the Current Technology and Joslyn brands. This acquisition strengthens DEHN's position in power quality, grounding, lightning protection, and surge protection, facilitating tailored solutions for U.S. customers through its new Mooresville headquarters.

Littelfuse, Inc.

Littelfuse, founded in 1927 and headquartered in Chicago, Illinois, is a leading global manufacturer of circuit protection, power control, and sensing technologies. The company delivers innovative solutions to safeguard electronics, automotive, industrial, and aerospace applications. Littelfuse emphasizes high-reliability and performance under extreme conditions, providing components such as fuses, TVS diodes, and surge protection devices to protect critical systems and ensure safety, efficiency, and operational continuity across diverse industries.

-

August 2024: Littelfuse introduced the SMBLCE-HR/HRA, SMCLCE-HR/HRA, and SMDLCE-HR/HRA High-Reliability Low Capacitance TVS Diode Series. These diodes are designed to protect avionics equipment from lightning and overvoltage threats, offering advanced, high-reliability protection for the aviation industry.

Key Players:

Some of the major key players in Surge Protection Devices Market along with their product:

-

ABB Ltd (Switzerland) - (Electrical Equipment and Automation Solutions)

-

General Electric Company (United States) - (Energy Solutions and Electrical Components)

-

Schneider Electric (France) - (Energy Management and Automation Products)

-

Eaton Corporation plc (Ireland) - (Power Management Solutions)

-

Legrand (France) - (Electrical and Digital Infrastructure Solutions)

-

Emerson Electric Co. (United States) - (Automation and Control Solutions)

-

Siemens (Germany) - (Industrial Automation and Digitalization Products)

-

CG Power and Industrial Solutions Limited (India) - (Electrical Equipment and Solutions)

-

Littelfuse, Inc. (United States) - (Circuit Protection and Sensing Solutions)

-

Bourns, Inc. (United States) - (Electronic Components and Sensors)

-

Belkin (United States) - (Consumer Electronics Accessories)

-

Havells India (India) - (Electrical and Lighting Products)

-

Hubbell (United States) - (Electrical and Lighting Solutions)

-

Infineon Technologies (Germany) - (Semiconductors and System Solutions)

-

Leviton Manufacturing (United States) - (Electrical Wiring Devices and Solutions)

-

Maxivolt (United States) - (Voltage Regulation and Power Supply Solutions)

-

Mersen (France) - (Electrical Protection and Thermal Management Solutions)

-

Philips (Netherlands) - (Lighting Solutions and Electronics)

-

Phoenix Contact (Germany) - (Connectivity and Automation Solutions)

-

Raycap (Greece) - (Surge Protection and Connectivity Solutions)

-

Rockwell Automation (United States) - (Industrial Automation and Information Solutions)

List of suppliers that provide raw materials and components for surge protection devices:

-

Littelfuse, Inc.

-

Mersen

-

Schneider Electric

-

TE Connectivity

-

Eaton Corporation plc

-

AVX Corporation

-

Vishay Intertechnology

-

Bourns, Inc.

-

STMicroelectronics

-

Infineon Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.07 Billion |

| Market Size by 2032 | USD 5.04 Billion |

| CAGR | CAGR of 6.37% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Hard Wired Surge Protection Devices, Plug In Surge Protection Devices, Line Cord Surge Protectors, Power Control Devices) • By Power Range (Below 100 Ka, 100 Ka To 500 Ka, 500 Ka To 1000 Ka, Above 1000 Ka) • By Type (Type 1, Type 2, Type 3, Type 4) • By End Use (Residential, Industrial, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd, General Electric Company, Schneider Electric, Eaton Corporation plc, Legrand, Emerson Electric Co., Siemens, CG Power and Industrial Solutions Limited, Littelfuse, Inc., Bourns, Inc., Belkin, Havells India, Hubbell, Infineon Technologies, Leviton Manufacturing, Maxivolt, Mersen, Philips, Phoenix Contact, Raycap, Rockwell Automation |