Global Clinical Alarm Management Market Size & Overview:

The Clinical Alarm Management Market Size was valued at USD 2.42 billion in 2023 and is expected to reach USD 9.02 billion by 2032, and grow at a CAGR of 15.75% over the forecast period 2024-2032.

Get more information on Clinical Alarm Management Market - Request Sample Report

The clinical alarm management market is witnessing robust growth as healthcare providers strive to address patient safety concerns and mitigate alarm fatigue, a leading issue in critical care settings. Studies estimate that as many as 85-99% of clinical alarms are non-actionable, causing desensitization among healthcare professionals and increasing the risk of missed critical alerts. For instance, a study published revealed that alarm-related issues significantly contributed to adverse events, emphasizing the need for effective alarm management solutions.

Technological advancements are revolutionizing the market. For example, systems integrating artificial intelligence and machine learning can filter alarms intelligently, prioritize urgent notifications, and reduce alarm frequency by up to 50%, as demonstrated by several pilot programs in leading hospitals. Similarly, wearable devices and remote patient monitoring systems enable continuous patient surveillance. According to the American Telemedicine Association, remote monitoring has reduced hospital readmission rates by 20-30% for patients with chronic illnesses.

Hospitals are actively investing in alarm management programs to enhance efficiency. For instance, the Cleveland Clinic implemented a centralized monitoring system that cut unnecessary alarms by 30%, significantly improving response times and reducing staff burnout. Another example is a pilot program at a New York hospital that used predictive analytics to anticipate critical events, reducing alarm fatigue by 40% in intensive care units. Additionally, regulatory standards are driving market adoption. The Joint Commission requires healthcare facilities to establish and implement alarm system management policies, further incentivizing investment in advanced technologies.

The market’s growth is also fueled by increasing healthcare demands. With the global population aged 65 and older projected to double by 2050, there is a rising need for enhanced monitoring systems in critical care and long-term care settings.

Clinical Alarm Management Market Dynamics

Drivers

-

The adoption of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things has revolutionized clinical alarm management.

These technologies enable intelligent alarm filtering, prioritization, and predictive analytics, ensuring that critical alerts receive immediate attention while reducing non-actionable alarms. Smart alarm systems can also integrate with electronic health records and hospital information systems, streamlining workflows and providing context-aware insights. These innovations enhance the efficiency of alarm systems and reduce alarm fatigue among healthcare professionals, making technology a pivotal driver of market growth.

-

The growing emphasis on patient safety has led to the implementation of stringent regulatory standards by organizations such as the Joint Commission.

Hospitals and healthcare facilities are required to establish robust alarm management protocols to comply with these standards and achieve accreditation. Failure to address alarm fatigue and its associated risks can result in severe penalties or loss of certification. Consequently, healthcare providers are investing in advanced alarm management systems to meet regulatory requirements, enhance patient outcomes, and mitigate liability risks. These patient safety-focused initiatives are significantly boosting the market.

-

Rising Prevalence of Chronic Diseases and Remote Monitoring Adoption

The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses has created a higher demand for continuous patient monitoring. With the rise of telehealth and remote patient monitoring solutions, healthcare delivery is increasingly shifting to home-based care settings. This trend has amplified the need for robust alarm management systems capable of delivering reliable alerts across diverse environments. Remote systems that ensure patient safety while reducing caregiver burden are driving widespread adoption, contributing to the market's strong growth trajectory.

Restraints

-

One of the major restraints in the Clinical Alarm Management Market is the high cost associated with the implementation and integration of advanced alarm management systems.

Upgrading existing infrastructure to accommodate sophisticated technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) can be prohibitively expensive for small- and medium-sized healthcare facilities. Additionally, integrating these systems with existing electronic health records (EHRs), medical devices, and hospital information systems can pose significant technical challenges. Such integration often requires substantial time, resources, and expertise, which can delay deployment and impact operational workflows. Furthermore, healthcare providers in low- and middle-income regions may find it difficult to justify the investment in alarm management solutions due to budgetary constraints and competing priorities. These factors collectively act as a restraint, limiting the adoption of advanced alarm management systems in certain segments of the global market.

Clinical Alarm Management Market Segmentation Analysis

By Product

Nurse call systems were the leading product segment in 2023, holding 45% of the market share. Their dominance is attributed to their fundamental role in improving communication and responsiveness in healthcare environments. These systems are essential in ensuring timely patient care and emergency response in hospitals, nursing homes, and assisted living facilities. The ability to instantly alert healthcare providers to patient needs significantly enhances operational efficiency. Additionally, the integration of advanced features, such as wireless communication, real-time tracking, and seamless compatibility with electronic health records, has further boosted their demand.

Integrated communication systems are the fastest-growing product segment due to their ability to enhance overall hospital and patient communication. These systems provide seamless connectivity between various medical devices, alarms, and healthcare staff, ensuring that critical information is shared in real-time. As healthcare delivery becomes increasingly complex, integrated communication solutions are gaining traction because they improve response times, reduce alarm fatigue, and enhance patient safety. By consolidating various communication tools, such as nurse calls, alerts, and system monitoring into a unified platform, these systems streamline hospital operations and ensure that alarms are addressed efficiently.

By Type

Centralized alarm management solutions accounted for 58% of the market share in 2023. These systems are favored for their ability to consolidate alarm data from multiple devices into one platform, simplifying monitoring and response processes. Centralized solutions are particularly beneficial in large healthcare settings, such as multispecialty hospitals, where managing a high volume of alarms can otherwise overwhelm staff. Their efficiency in filtering and prioritizing alarms improves patient outcomes by ensuring critical alerts are addressed promptly, reducing alarm fatigue, and enhancing overall patient safety.

Cloud-based alarm management solutions are the fastest-growing segment by type due to their flexibility, scalability, and cost-effectiveness. These solutions allow healthcare organizations to manage alarms remotely, offering real-time monitoring and enhanced data analytics. The cloud infrastructure ensures that alarm data is accessible across different healthcare facilities and departments, facilitating better coordination and reducing downtime. Additionally, the ability to scale cloud-based solutions based on the specific needs of healthcare providers contributes to their rapid adoption, particularly in smaller healthcare centers looking for cost-effective solutions. As healthcare increasingly moves toward digital transformation, the demand for cloud-based systems is set to grow, making them a key segment in the clinical alarm management market.

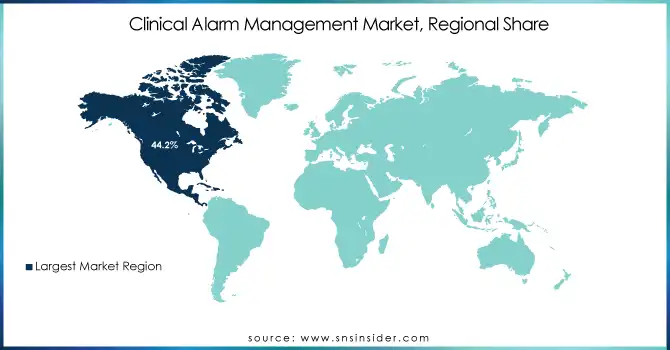

Clinical Alarm Management Market Regional Outlook

In 2023, North America held a 44.2% share of the clinical alarm management market, driven by its advanced healthcare infrastructure, high adoption of healthcare technologies, and stringent regulations focused on patient safety. The United States, in particular, stands out due to its increasing need to address alarm fatigue in hospitals, as well as the rapid adoption of advanced alarm management systems, including cloud-based solutions and integrated communication platforms. Initiatives by healthcare organizations, such as the National Patient Safety Goals by The Joint Commission, further contribute to the region’s dominance. The growing trend of telehealth and remote patient monitoring also fosters the demand for alarm management systems.

Europe is another key market for clinical alarm management, particularly in countries such as Germany, the UK, and France. With a well-established healthcare system and increasing government focus on improving healthcare safety, Europe is witnessing steady growth. The European Union's efforts to improve digital health and patient safety, along with a higher focus on integrated solutions, contribute to the market's expansion.

The Asia Pacific region is experiencing the fastest growth in the clinical alarm management market, fueled by improving healthcare infrastructure, increased healthcare spending, and a rising aging population. Countries like China and India are rapidly adopting alarm management technologies as they modernize their healthcare systems. The growing demand for patient safety and advanced healthcare solutions in this region is driving the swift adoption of cloud-based and integrated communication systems, making it a crucial market for future growth.

Need any customization research on Clinical Alarm Management Market - Enquiry Now

Key Players in Clinical Alarm Management Market

-

Koninklijke Philips N.V. (Philips Alarm Management Solutions, IntelliSpace Console, Patient Monitoring Systems, Mobile and Integrated Communication Solutions)

-

General Electric Company (GE Healthcare) (GE Healthcare Alarm Management Solutions, Patient Monitoring Systems, Carestation Anesthesia Machine, Advanced Patient Monitoring Solutions - Carescape)

-

Ascom (Ascom Unite Alarm Management, Ascom Telligence Nurse Call System, Ascom Myco Smartphone)

-

Spok, Inc. (Spok Care Connect, Spok Clinical Alarm Management Solutions, Spok Mobile Alerting System)

-

Masimo (Masimo Patient Monitoring Systems, Masimo SafetyNet)

-

Hill-Rom Services, Inc. (NaviCare Nurse Call System, NaviCare Alarm Management System, Hill-Rom Wireless Communication Solutions)

-

Vocera Communications (Vocera Alarm Management Solutions, Vocera Smartbadge, Vocera Voice and Messaging System)

-

Capsule Technologies, Inc. (Capsule Alarm Management Solutions, Capsule Patient Monitoring Solutions, Capsule Data Integration Solutions)

-

Medtronic (Medtronic Alarm Management Solutions, Medtronic Patient Monitoring Systems)

-

Drägerwerk AG & Co. KGaA (Dräger Alarm Management Solutions, Dräger Patient Monitoring Systems, Dräger Smart Alarms)

-

Baxter International, Inc. (Baxter Patient Monitoring & Alarm Solutions, Baxter Infusion Systems)

-

Stryker (Stryker Nurse Call Systems, Stryker Medical Alarm Management Solutions)

Recent Developments

In Jan 2025, AirStrip Technologies expanded its clinical decision support capabilities by acquiring DECISIO Health, a provider of advanced clinical decision support and visualization tools. This acquisition enhances AirStrip’s product portfolio, furthering its goal to improve patient outcomes and optimize clinical workflows.

In Nov 2024, GE HealthCare published data from a two-phase pilot study with Cleveland Clinic in the Journal of Clinical Anesthesia. The study showcased the effectiveness of the Portrait Mobile continuous monitoring solution, highlighting its ability to encourage timely clinical intervention and reduce alarm fatigue in post-surgical ward settings.

In Feb 2024, Philips enhanced patient care by reducing alarm noise in patient monitoring systems by up to 66%, contributing to a more peaceful environment. The recent FDA 510(k) clearance of its IntelliVue patient monitor software further supports alarm management strategies, promoting a quieter and more healing atmosphere for patients and caregivers.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.42 Billion |

| Market Size by 2032 | USD 9.02 Billion |

| CAGR | CAGR of 15.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Nurse Call Systems (Button-based systems, Integration communication systems, Other nurse call systems), Software (Connectivity Software, Clinical Decision Support tools, Other Software), Hardware/Systems (Ventilators, Patient Monitors, Respiratory monitors, Other systems), Services (Consulting & Implementation, Training & Education, Integration & Support)] • By Type [Centralized alarm management solutions, Decentralized/Distributed alarm management solutions] • By Deployment Mode [On-premise, Cloud-based, Hybrid] • By End User [Hospitals & Surgical Centers, Maternity Care Centers & Fertility Centers, Home Care Settings, Long-term & Tertiary Care Centers, Trauma and emergency care centers, Ambulatory Care Centers & OPDs, Other end users] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Koninklijke Philips N.V., General Electric Company (GE Healthcare), Ascom, Spok, Inc., Masimo, Hill-Rom Services, Inc., Vocera Communications, Capsule Technologies, Inc., Medtronic, Drägerwerk AG & Co. KGaA, Baxter International, Inc., Stryker |

| Key Drivers | • The adoption of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things has revolutionized clinical alarm management. • The growing emphasis on patient safety has led to the implementation of stringent regulatory standards by organizations such as the Joint Commission. • Rising Prevalence of Chronic Diseases and Remote Monitoring Adoption |

| Restraints | • One of the major restraints in the Clinical Alarm Management Market is the high cost associated with the implementation and integration of advanced alarm management systems. |