Hospital Information System Market Report Scope & Overview:

Get more information on Hospital Information System Market - Request Sample Report

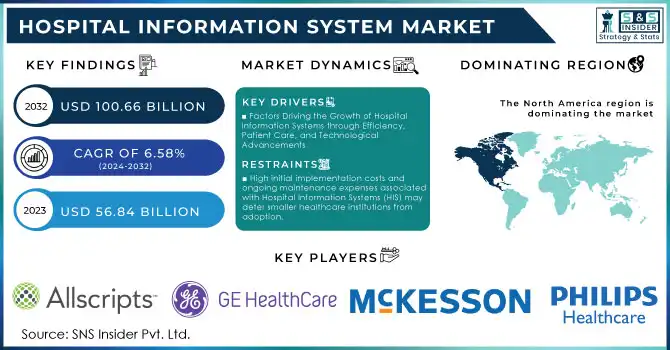

The Hospital Information System Market Size was valued at USD 56.84 billion in 2023 and is projected to reach USD 100.66 billion by 2032, with a CAGR of 6.58% over the forecast period 2024-2032.

The Hospital Information System (HIS) market is experiencing significant growth, driven by the rapid shift towards digitized healthcare solutions, the increasing adoption of electronic health records (EHR), and supportive government policies aimed at improving healthcare delivery. HIS is an integrated software platform that manages a wide range of hospital operations, including patient management, billing, clinical data, and resource scheduling. As hospitals and healthcare institutions continue to embrace these solutions, HIS has become essential in optimizing workflows, reducing administrative burdens, and enhancing the quality of care delivered.

The market is being propelled by several key factors, including the rising demand for operational efficiency in healthcare. With the global healthcare industry under pressure to reduce costs and improve patient outcomes, HIS provides hospitals with tools to streamline processes and enhance clinical decision-making. According to the U.S. Department of Health and Human Services, the adoption of EHRs in hospitals reached 96% in 2022, highlighting the widespread acceptance of digital solutions in managing patient data and enhancing service delivery. Furthermore, advancements in technologies like cloud computing, artificial intelligence (AI), and machine learning are significantly enhancing the capabilities of HIS, enabling real-time data analysis, predictive analytics, and personalized treatment plans. These technological advancements are increasingly integrated into HIS, improving not only the efficiency of healthcare operations but also the accuracy of diagnoses and patient care. According to a study published in BMC Health Services Research, AI-driven HIS systems are expected to improve healthcare efficiency by streamlining administrative processes and reducing medical errors.

Government regulations are also accelerating HIS adoption. Policies like the Health Information Technology for Economic and Clinical Health (HITECH) Act in the U.S. and the European Union's General Data Protection Regulation (GDPR) emphasize the need for secure, interoperable healthcare IT systems. For instance, recent updates to federal health IT strategies aim to enhance interoperability and transparency, which are essential for integrating hospital information systems across different healthcare providers. Additionally, the shift towards patient-centered care, supported by the pandemic’s push for telehealth and remote monitoring, has further increased demand for integrated systems that ensure seamless data sharing between healthcare providers and patients.

Overall, the hospital information system market is poised for robust growth, driven by technological innovations, regulatory support, and the increasing demand for more efficient and cost-effective healthcare solutions. As healthcare systems continue to digitize, HIS plays a pivotal role in transforming healthcare delivery, enhancing both patient care and operational efficiencies globally.

Hospital Information System Market Dynamics

Drivers

-

Factors Driving the Growth of Hospital Information Systems through Efficiency, Patient Care, and Technological Advancements

One of the primary factors is the increasing demand for enhanced operational efficiency in hospitals. HIS solutions streamline administrative, clinical, and financial processes, helping healthcare institutions reduce costs and improve service delivery. With the rising pressure to deliver high-quality care while managing operational costs, hospitals are increasingly adopting HIS to integrate patient data, automate workflows, and optimize resource management.

Another crucial driver is the growing emphasis on patient-centered care and improving patient outcomes. HIS systems enable better coordination of care, access to real-time patient information, and effective decision-making, which leads to improved diagnosis, treatment, and patient satisfaction. Furthermore, the increasing prevalence of chronic diseases and aging populations worldwide have amplified the need for efficient healthcare delivery systems.

Additionally, government initiatives promoting the digitization of healthcare and the adoption of electronic health records (EHR) are accelerating the HIS market. Programs aimed at improving healthcare quality, reducing errors, and promoting data interoperability are encouraging healthcare providers to adopt integrated systems.

The rising trend of healthcare IT outsourcing also supports the HIS market growth, as hospitals seek cost-effective ways to implement and maintain advanced information systems. The advancement of cloud-based solutions and the integration of artificial intelligence (AI) and machine learning further enhance the capabilities of HIS, driving market expansion. As a result, these factors collectively fuel the adoption and growth of hospital information systems across the global healthcare industry.

Restraints

-

High initial implementation costs and ongoing maintenance expenses associated with Hospital Information Systems (HIS) may deter smaller healthcare institutions from adoption.

-

Data security and privacy concerns, particularly with the integration of cloud-based solutions and electronic health records (EHR), pose significant challenges for HIS implementation.

Key Segmentation

By Component

In 2023, the software segment emerged as the dominant component in the Hospitals Information Systems (HIS) market, capturing the largest share. Software solutions form the backbone of HIS, encompassing a wide range of functionalities such as Electronic Health Records (EHR), Clinical Decision Support Systems (CDSS), and billing systems. Hospitals rely heavily on these systems to streamline administrative tasks, improve patient care, and ensure compliance with healthcare regulations. The growing need for digital transformation and efficient management of healthcare data has significantly contributed to the dominance of this segment, accounting for over 55.0% of the market in 2023. The increasing adoption of advanced analytics, cloud-based solutions, and artificial intelligence (AI) within HIS further boosts the growth of this segment.

The services segment, particularly system integration, consulting, and maintenance services, is the fastest-growing segment within HIS. This growth is driven by the rising complexity of healthcare IT infrastructure and the need for expert guidance to implement and manage sophisticated HIS solutions. Services are increasingly being outsourced by hospitals to specialized vendors, facilitating smoother deployment and operational continuity. This segment is expected to grow at a compounded annual growth rate (CAGR) of 14.0% from 2024 to 2032.

By Application

In 2023, Clinical Information Systems (CIS) was the largest and most dominant application segment, comprising over 30.0% of the HIS market share. CIS includes systems such as Electronic Medical Records (EMR), Patient Management Systems, and Clinical Decision Support Systems. These systems are essential in improving patient care by ensuring accurate patient data, facilitating seamless communication between healthcare providers, and enhancing clinical workflow. The growing adoption of EMRs and the push for more efficient patient care models are key reasons behind this segment's dominance.

The Electronic Medical Record (EMR) segment is the fastest-growing within HIS applications. The global push for digitalization in healthcare, driven by government mandates, financial incentives, and the growing demand for improved patient care, has led to an increased implementation of EMR solutions. With the ability to streamline patient data management and enhance clinical workflows, EMRs are expected to witness rapid growth, with a CAGR of around 12% over the next few years.

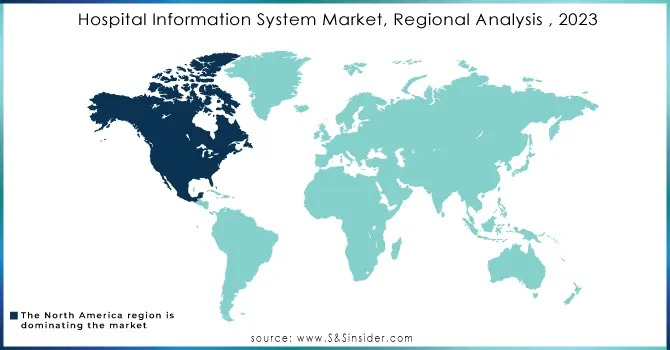

Hospital Information System Market Regional Overview

North America dominated the HIS market, accounting for the largest share in 2023, with the U.S. leading the region. The region's dominance is primarily due to the rapid adoption of advanced healthcare IT solutions, robust healthcare infrastructure, and government-driven initiatives such as the Affordable Care Act, which incentivizes hospitals to adopt electronic health records (EHR) and other HIS solutions. The presence of major HIS vendors and continuous innovation in software and services further contribute to the region's market strength. North America is expected to maintain its leadership due to ongoing digital transformation efforts and high healthcare expenditure.

Europe is the second-largest market for HIS, with significant growth fueled by healthcare digitization programs in countries like Germany, the UK, and France. European healthcare systems are increasingly focusing on improving patient outcomes and streamlining hospital operations, which is driving the adoption of HIS solutions, particularly in clinical and administrative information systems.

The Asia Pacific region is witnessing the fastest growth, driven by the rapid expansion of healthcare infrastructure, especially in countries like China, India, and Japan. The increasing demand for affordable and efficient healthcare solutions, combined with a rising number of hospital network expansions, is driving HIS adoption. Governments in this region are also heavily investing in healthcare digitization, which is expected to accelerate market growth further.

Need any customization research on Hospital Information System Market - Enquiry Now

Key Players

-

McKesson Corporation - McKesson Radiology, McKesson Enterprise Imaging, McKesson EHR, McKesson Pharmacy Management

-

Cerner Corporation - Cerner Millennium, Cerner PowerChart, Cerner EHR, Cerner Population Health Management

-

Carestream Health - Carestream Health Radiology Information System (RIS), Carestream PACS, Carestream Health Enterprise Imaging Solutions

-

Allscripts Healthcare, LLC - Allscripts Sunrise, Allscripts TouchWorks EHR, Allscripts CareInMotion, Allscripts MyChart

-

Merge Healthcare Inc. (IBM) - Merge RIS, Merge PACS, Merge EHR, Merge Cardiovascular

-

NextGen Healthcare - NextGen EHR, NextGen Practice Management, NextGen Population Health Management

-

GE Healthcare - Centricity RIS, Centricity PACS, Centricity Enterprise

-

Siemens Healthineers - Syngo, Siemens Healthineers RIS, Siemens Healthineers PACS, Siemens Healthineers EHR solutions

-

Dedalus SpA - Dedalus Healthcare Information Systems, Dedalus Clinical Information System, Dedalus Hospital Information System (HIS)

-

General Electric Company - GE Centricity HIS, GE Centricity EMR, GE Centricity PACS

-

Comarch SA - Comarch Hospital Information System, Comarch Electronic Health Records (EHR)

-

Wipro Limited - Wipro Healthcare Information Systems, Wipro HealthCloud

-

Epic Systems Corporation - EpicCare EMR, Epic Radiant (Radiology Information System), EpicCare Ambulatory, Epic MyChart (Patient Portal)

-

NXGN Management, LLC - NextGen EHR, NextGen Practice Management

-

Philips Healthcare - Philips IntelliSpace PACS, Philips IntelliSpace Enterprise Edition

-

Computer Programs and Systems Inc. - CPSS Allscripts EHR, CPSS Healthcare Information Management, CPSS Enterprise Solutions

-

OpenEMR - OpenEMR (Open-source Electronic Medical Records System)

-

Agfa-Gevaert N.V. - Agfa HealthCare Enterprise Imaging, Agfa HealthCare PACS, Agfa HealthCare RIS, Agfa HealthCare EHR Solutions

-

Medidata Solutions Inc. - Medidata Clinical Cloud, Medidata Rave EDC (Electronic Data Capture)

-

Eclipsys - Eclipsys Sunrise EHR, Eclipsys Sunrise Acute Care

-

Medical Information Technology Inc. - MEDITECH HIS, MEDITECH EHR

-

Napier Healthcare Solutions Pte. Ltd. - Napier HIS, Napier EMR

-

Greenway Health, LLC - Greenway PrimeSUITE EHR, Greenway Intergy EHR

-

Neusoft Medical Systems Co., Ltd. - Neusoft HIS Solutions, Neusoft Radiology Solutions, Neusoft PACS

Recent Development

In November 2024, Oklahoma introduced a new Health Information Exchange (HIE) designed to improve communication between healthcare providers and enhance patient care. This initiative is supported by USD 21 million in funding, which will be allocated to establish electronic health record (EHR) connections across the state. The HIE aims to facilitate seamless data sharing among healthcare professionals, ultimately leading to more efficient and coordinated care for patients.

In June 2023, Qatar Biobank (QBB), established to support medical research, was successfully integrated with Oracle Cerner's electronic health record (EHR) system. This EHR system is utilized as the clinical information system (CIS) at Hamad Medical Corporation (HMC), enhancing data accessibility and streamlining research efforts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 56.84 Billion |

| Market Size by 2032 | US$ 100.66 Billion |

| CAGR | CAGR of 6.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Hardware, Services) • By Application (Clinical Information Systems, Administrative Information Systems, Electronic Medical Records, Laboratory Information Systems, Radiology Information systems, Pharmacy Information Systems, Others) • By Delivery Mode (Web-based, On-premise, Cloud-based) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | McKesson Corporation, Cerner Corporation, Carestream Health, Allscripts Healthcare, LLC, Merge Healthcare Inc. (IBM), NextGen Healthcare, GE Healthcare, Siemens Healthineers, Dedalus SpA, General Electric Company, Comarch SA, Wipro Limited, Epic Systems Corporation, NXGN Management, LLC, Philips Healthcare, Computer Programs and Systems Inc., OpenEMR, Agfa-Gevaert N.V., Medidata Solutions Inc., Eclipsys, Medical Information Technology Inc., Napier Healthcare Solutions Pte. Ltd., Greenway Health, LLC, Neusoft Medical Systems Co., Ltd. |

| Key Drivers | •Factors Driving the Growth of Hospital Information Systems through Efficiency, Patient Care, and Technological Advancements |

| Restraints | • High initial implementation costs and ongoing maintenance expenses associated with Hospital Information Systems (HIS) may deter smaller healthcare institutions from adoption. • Data security and privacy concerns, particularly with the integration of cloud-based solutions and electronic health records (EHR), pose significant challenges for HIS implementation. |