Cloud-based Contact Center Market Report Scope & Overview:

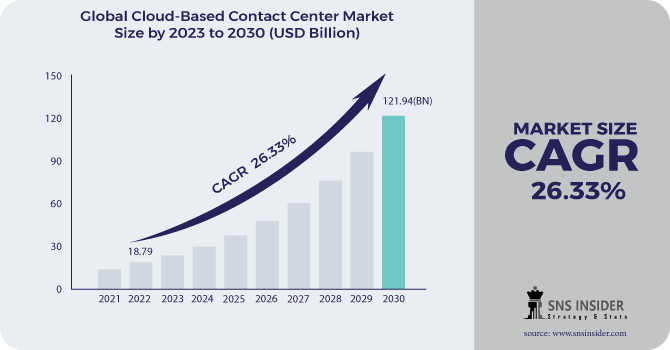

Cloud-based Contact Center Market was valued at USD 31.96 billion in 2025E and is expected to reach USD 182.14 billion by 2033, growing at a CAGR of 24.30% from 2026-2033.

Get more information about Cloud-Based Contact Center Market - Request Sample Report

The growth of the Cloud-based Contact Center Market is driven by increasing demand for seamless customer experiences, scalability, and cost-efficient solutions. Rising adoption of AI, analytics, and automation enhances operational efficiency and service quality. Businesses are shifting to cloud platforms to support remote work, omnichannel communication, and digital transformation initiatives, while reducing infrastructure costs, ensuring flexibility, and enabling real-time insights, collectively fueling robust market expansion globally.

Cloud-based Contact Center Market Size and Forecast

-

Market Size in 2025E: USD 31.96 Billion

-

Market Size by 2033: USD 182.14 Billion

-

CAGR: 24.30% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cloud-based Contact Center Market Trends

-

Rising demand for scalable and flexible customer service operations is driving the cloud-based contact center market.

-

Growing adoption of remote and hybrid work models is boosting cloud contact center deployments.

-

Expansion of AI-powered tools such as chatbots, speech analytics, and intelligent routing is enhancing customer experience.

-

Increasing integration with CRM, omnichannel communication, and workforce management systems is shaping market growth.

-

Focus on cost optimization, faster deployment, and business continuity is accelerating cloud adoption.

-

Advancements in cloud security, reliability, and compliance capabilities are strengthening enterprise confidence.

-

Partnerships between cloud service providers, contact center vendors, and enterprises are accelerating innovation and global market expansion.

Cloud-based Contact Center Market Growth Drivers:

-

Rising demand for enhanced customer experience and omnichannel communication solutions is fueling cloud-based contact center adoption globally.

Cloud-based contact centers enable businesses to efficiently manage interactions across multiple channels, including voice, email, chat, and social media. Organizations increasingly prioritize seamless customer experiences to boost satisfaction and retention. The scalability and flexibility of cloud solutions allow quick adaptation to changing market demands without heavy infrastructure investment. AI-driven features such as chatbots, sentiment analysis, and predictive analytics further improve operational efficiency. Growing digital transformation initiatives across industries are driving adoption, making cloud-based contact centers an essential solution for improving responsiveness, service quality, and overall customer engagement in competitive markets.

Cloud-based Contact Center Market Restraints:

-

High dependency on reliable internet connectivity and potential system downtimes pose significant challenges for enterprises.

Cloud-based contact center operations rely entirely on uninterrupted internet connectivity to function effectively. Network outages, latency issues, or bandwidth limitations can disrupt communication with customers, impacting service quality and satisfaction. Downtime or slow system performance can also result in loss of revenue and operational inefficiency. Enterprises in regions with unreliable network infrastructure may find cloud-based deployment impractical. Additionally, migration from legacy systems to cloud platforms requires careful planning and technical expertise. These technological dependencies and potential operational disruptions act as major restraints, slowing adoption and limiting the market’s full potential across global enterprises.

Cloud-based Contact Center Market Opportunities:

-

Integration of AI, analytics, and automation technologies offers significant growth prospects for cloud-based contact centers.

Cloud-based platforms increasingly leverage artificial intelligence, machine learning, and advanced analytics to enhance operational efficiency. Features like predictive routing, chatbots, sentiment analysis, and real-time dashboards improve agent productivity and customer satisfaction. Organizations can gain valuable insights into customer behavior and operational trends, enabling informed decision-making. Automation reduces human error, accelerates response times, and minimizes operational costs. As businesses adopt digital transformation strategies, the opportunity to implement AI-driven contact center solutions becomes more prominent. Continuous innovation in AI and analytics integration presents a major avenue for market expansion across industries globally.

Cloud-based Contact Center Market Segment Analysis

By Component, Solutions segment dominated the cloud-based contact center market

In the cloud-based contact center market, the component segment is primarily divided into solutions and services, with solutions dominating at approximately 69% of revenue share in 2025. This dominance is driven by the demand for advanced features that enhance operational efficiency and customer experience, including CRM software, AI tools, and multi-channel communication platforms. Recent developments, such as Five9's AI-powered solution and Genesys's automation enhancements, exemplify this trend. While services like implementation and support are crucial, organizations increasingly prioritize robust solutions to improve customer interactions.

By Deployment, Hosted deployment dominated the cloud-based contact center market

In the cloud-based contact center market, the deployment segment consists of hosted and on-premises solutions, with hosted deployment capturing around 65% of revenue in 2025. This preference highlights the appeal of flexible, scalable solutions delivered as Software as a Service (SaaS), allowing organizations to access advanced features without significant hardware investments. Hosted solutions facilitate quick adaptation to market changes and enhance operational efficiency. Notable product developments include Five9's AI-enhanced hosted platform and Genesys Cloud CX, which leverages AI and machine learning for improved customer engagement.

.png)

Need any customization research on Cloud-Based Contact Center Market - Enquiry Now

Cloud-Based Contact Center Market Regional Analysis

North America Cloud-based Contact Center Market Insights

North America dominates the cloud-based contact center market, capturing 47% of the total revenue in 2025. This significant share is driven by the region's advanced technological infrastructure, high adoption rates of cloud solutions, and a strong emphasis on enhancing customer experience. Major players in the industry, such as Five9, Genesys, and Cisco, are headquartered in North America, contributing to the innovation and development of cutting-edge solutions. Recently, Five9 launched its latest AI-powered cloud contact center platform, which integrates advanced machine learning capabilities to improve customer engagement and operational efficiency.

Asia Pacific Cloud-based Contact Center Market Insights

The Asia Pacific region is the second fastest-growing market for cloud-based contact centers in 2025, fueled by rapid digital transformation and a rising demand for enhanced customer service. Countries like India, China, and Australia are at the forefront, as businesses seek to leverage cloud solutions for improved operational efficiency. Notable developments include Tata Consultancy Services launching an AI-driven cloud contact center solution to enhance customer experiences, and NEC Corporation introducing advanced cloud services in Japan that integrate AI for optimized interactions. Additionally, favorable government policies and investments in IT infrastructure support this trend. As organizations embrace flexible, scalable solutions, the Asia Pacific market is poised for sustained growth, driven by technological advancements and a focus on customer-centric strategies.

Europe Cloud-based Contact Center Market Insights

The Europe Cloud-based Contact Center Market is expanding due to growing adoption of digital transformation initiatives and demand for enhanced customer experience across industries. Enterprises are leveraging cloud platforms to enable omnichannel communication, improve operational efficiency, and support remote workforce management. Rising integration of AI, analytics, and automation solutions further drives efficiency and personalization. Regulatory compliance and data security measures are shaping deployment strategies, contributing to steady market growth across European countries.

Middle East & Africa and Latin America Cloud-based Contact Center Market Insights

The Middle East & Africa and Latin America Cloud-based Contact Center Market is witnessing growth driven by increasing digitalization, rising adoption of remote work, and the need for cost-effective, scalable customer service solutions. Enterprises in these regions are integrating AI, analytics, and omnichannel communication platforms to enhance customer experience. Improving internet infrastructure and supportive government initiatives further encourage cloud deployment, enabling businesses to streamline operations and expand service capabilities across diverse markets.

Cloud-based Contact Center Market Competitive Landscape:

Genesys Telecommunications Laboratories, Inc.

Genesys is a global leader in cloud-based customer experience and contact center solutions. Its Genesys Cloud platform integrates AI, workforce engagement, and omnichannel support to optimize customer interactions and operational efficiency. The company emphasizes generative AI, analytics, and cloud scalability to help enterprises enhance service quality, agent productivity, and customer satisfaction. Genesys continues to drive innovation in AI-powered CX solutions across diverse industries worldwide.

RingCentral, Inc.

RingCentral is a global provider of cloud-based communications and collaboration solutions, including messaging, voice, video, and contact center services. Its RingCX cloud contact center platform leverages AI-powered analytics and workforce management tools to optimize agent performance and customer experience. RingCentral focuses on seamless integration, scalability, and AI innovation, enabling enterprises to streamline operations, boost engagement, and deliver high-quality, data-driven interactions across multiple channels.

-

2025: Expanded RingCX cloud contact center by acquiring CommunityWFM, integrating AI-powered workforce management and analytics.

-

2023: Genesys Cloud CX grew revenue over 50% YoY, surpassing US $1.2 B in ARR, expanding AI-powered Workforce Engagement and Experience solutions.

Aircall SAS

Aircall is a cloud-based call center and business phone system provider that focuses on intelligent voice solutions for customer support and sales teams. Its platform unifies voice, text, collaboration, and AI-powered analytics, enabling businesses to improve agent efficiency, customer engagement, and operational insights. Aircall emphasizes AI virtual assistants and intelligent workspace tools to enhance communication workflows, streamline call management, and integrate with CRM and helpdesk systems globally.

-

2025: Launched AI Voice Agent, an always-on virtual assistant to manage inbound calls and enhance customer engagement in cloud contact centers.

-

2024: Unveiled Aircall Workspace, an intelligent hub unifying voice, text, sentiment analysis, and agent collaboration across cloud contact channels.

Key Players in Cloud-Based Contact Center Market

Some of the list of companies along with their products related to the cloud-based contact center market:

-

Genesys Telecommunications Laboratories, Inc. (Genesys Cloud)

-

Ameyo (Ameyo Contact Center Software)

-

Aircall SAS (Aircall)

-

RingCentral, Inc. (RingCentral Contact Center)

-

Amazon Web Services, Inc. (Amazon Connect)

-

Metaswitch Networks Ltd. (Metaswitch Cloud Contact Center)

-

Vocalcom Group (Vocalcom Cloud Contact Center)

-

Cisco (Cisco Webex Contact Center)

-

Five9, Inc. (Five9 Cloud Contact Center)

-

Oracle Corporation (Oracle Cloud Contact Center)

-

Exotel Techcom Pvt. Ltd. (Exotel Cloud Telephony)

-

TCN, Inc. (TCN Cloud Contact Center)

-

Avaya(Avaya OneCloud)

-

NICE Ltd. (NICE inContact)

-

Tata Consultancy Services Limited (TCS Contact Center Solutions)

-

3CLogic Software, Inc. (3CLogic Cloud Contact Center)

-

Aspect Software, Inc. (Aspect Cloud)

-

Talkdesk, Inc. (Talkdesk Cloud Contact Center)

-

Worldline (Worldline Cloud Contact Center)

-

8x8, Inc. (8x8 Contact Center)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 23.27 Billion |

| Market Size by 2033 | USD 164.79 Billion |

| CAGR | CAGR of 24.30 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions and Services) • By Deployment (Hosted and On-premise) • By organization size (Small and Medium-sized Enterprises and Large Enterprises) • By Industry (BFSI, Telecommunications, IT and ITeS, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Genesys Telecommunications Laboratories, Inc., Ameyo, Aircall SAS, RingCentral, Inc., Amazon Web Services, Inc., Metaswitch Networks Ltd., Vocalcom Group, Cisco Systems, Inc., Five9, Inc., Oracle Corporation, Exotel Techcom Pvt. Ltd., TCN, Inc., Avaya Inc., NICE Ltd., Tata Consultancy Services Limited, 3CLogic Software, Inc., Aspect Software, Inc., Talkdesk, Inc., Worldline, and 8x8, Inc. |