R&D in GCC Market Report Scope & Overview:

Get More Information on R&D in GCC Market - Request Sample Report

The R&D in GCC Market Size was valued at USD 11.17 billion in 2023 and is expected to reach USD 49.38 billion by 2032 with a growing CAGR of 16.34% over the forecast period of 2024-2032.

R&D in the Global Capability Center market has emerged as a huge force for companies trying to leverage global talent resources and expertise. GCCs encompass a wide array of functions such as R&D, IT, business process outsourcing, and engineering solution services usually located within large corporate structures. These centers play a huge role in providing companies with access to specialized skills, facilitating cost reductions, and enhancing operational efficiencies so that companies can remain competitive in the global market.

The distinction that makes R&D in GCCs is the emphasis on innovation and high-tech projects as key objectives. Through collaborating with the local ecosystems, research institutions, startups, and industry partners, the GCCs act as catalysts for innovation in a way that may further lead to innovation in new products and services. Therefore, it is not only beneficial for the company to produce more innovations but also to form it as an industry leader. Moreover, GCCs are important tools for conducting market research that can help promote the organizational understanding of variations in market dynamics as well as consumers' preferences. In these creative surroundings, the GCCs are also able to produce prototypes that can be used in determining the feasibility and workability of new products.

The R&D in GCC market is growing at an impressive pace due to mounting demand for both innovation and operational efficiency in almost all parts of the economy. India positioned itself as an attractive destination for GCCs, backed by initiatives from government agencies in the form of Special Economic Zones that enjoy tax breaks. Tamil Nadu recently became the first state in India to announce GCC-specific subsidies.

On the other hand, according to reports, by the year 2023, the R&D in GCC market in that region had grown in a manner that added up to as high as 50,000 new jobs within three years alone, in the State of Tamil Nadu. The growth trajectory points to the continued globalization of businesses and the increasing need for the advancement of technology. In this scenario, where firms are expected to continue competing in an increasingly dynamic market environment, the investment in R&D-focused GCCs would still be strategic. These centers do not only serve to fuel sustainable growth and innovation but are also more importantly shaping the future face of global business operations. As organizations utilize the capacities of GCCs, they are always well prepared to face the intricacies of modern product development and meet every demand that is defined in an ever-evolving marketplace which will propel the growth of the R&D in GCC market.

R&D in GCC Market Dynamics

Drivers

-

Driving Innovation and Efficiency Through Global Capability Centers in Today's Market

The Global Capability Center market propelling with the rapid growth, and the trends are being driven by various factors. One key reason for this trend is investment in R&D by multinational companies to remain innovative and competitive. ZS Associates and Torry Harris, among others, are setting up GCCs to add operational efficiency and further service excellence. India is also emerging as a prominent GCC hub, provided with a vast pool of skilled talent, a favorable regulatory environment, and cost-effective operational benefits. The increase in digital technologies and increasing demand for agile business solutions led organizations to make use of GCCs for enhanced R&D capabilities. Additionally, GCCs enable firms to accelerate product development cycles and respond rapidly to market demands that are considerably important in today's fast business landscape. As companies are trying to be more efficient and reduce time-to-market while increasing innovation, the use of GCCs is bound to increase and firms are going to splurge on advanced technologies as well as talent acquisition. More importantly, this impending focus on sustainability and corporate social responsibility is forcing organizations to set up GCCs, where profitability besides being enhanced also socially contributes. This integrative approach to R&D in GCCs makes them a progressively important component of the global business ecosystem.

Restraints

-

Navigating Challenges in Global Capability Centers – Regulatory Hurdles and Talent Acquisition in R&D

Regulatory complexity can become an obstacle in locating GCCs in various regions due to factors of compliance with local laws and international standards. Talent shortages in specific high-tech domains can also constrain the operational effectiveness of GCCs. Economic and political uncertainty may also deter investment in GCCs, as companies exercise caution while expanding their operations in uncertain environments. These restraints require strategic solutions in terms of addressing the regulatory as well as talent acquisition challenges for full exploitation of the benefits of GCCs in R&D.

R&D in GCC Market Segmentation Overview

By Industry

Information technology and software development represented the market leader in 2023, accounting for approximately 50.36%. This is due to the growing dependence on digital solutions within many types of businesses, spurred by the ever-increasing transition into a wholly digital system. Digital transformation has thus led to a significant investment of capital in software development, cloud computing, and cybersecurity by business entities to gain greater operational efficiency and customer engagement.

The Pharmaceutical and Biotechnology segment is the fastest growing segment with the highest growth rate during the forecast period 2024-2032. This is mostly attributed to trends in advancements of biopharmaceuticals, growing emphasis on personalized medicine, and increasing investment in R&D activities. The increasing interest in developing vaccines and new drug therapies amidst continued challenges in the health sector, such as those arising in the aftermath of the COVID-19 pandemic, has driven demand for biopharmaceuticals to unprecedented levels.

By Technology

At the R&D level, in 2023, AI and ML technologies held a market share of around 52.3%. Their dominance in the R&D in GCC market is mainly because of enhanced patient care, smooth operations, and data-driven decision-making. These algorithms are increasingly being used for applications in diagnostics, predictive analytics, and personalized treatment plans- which is a really valuable support to healthcare providers. Increased AI integration in applications including applications such as radiology and genomics has significantly improved accuracy and efficiency, thus assuring it of a leadership spot in the market.

Cloud Computing is anticipated to be the fastest-growing technology segment over the forecast period 2024-2032. This growth rate can be attributed to the increased demand by healthcare organizations for scalable storage and data management capabilities. Access to and sharing of patient information are increasingly important as healthcare systems migrate toward electronic health records (EHR) and telemedicine. The flexibility and cost-effectiveness of cloud solutions coupled with enhanced security measures in place for data have provided an opening for this segment to grow at a very high pace during the next few years.

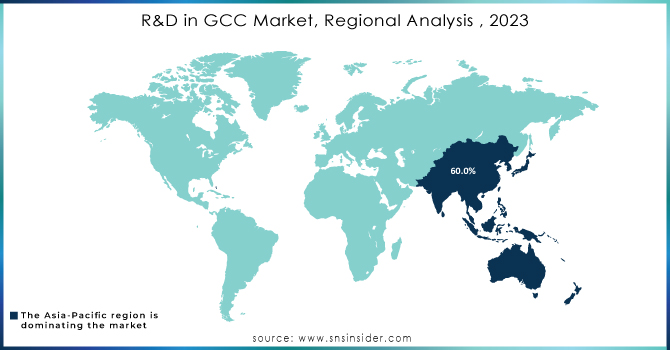

R&D in GCC Market Regional Analysis

Asia-Pacific emerged as the most prominent hub in 2023, accounting for approximately 60.0% of the R&D GCC market. The cradle of such success rests in India with a vast pool of talent, is cost-effective, and now offers leadership in IT and software development. India has been likened to being the "GCC capital of the world." Multi-nationals increasingly rely on India for software engineering, data analytics, and digital transformation initiatives. China contributes more to the region, especially in manufacturing and electronics. The Asia-Pacific region is expected to expand at a CAGR of % from 2024 to 2032.

North America is robustly led by the U.S., which continues to make large investments in AI, ML, and cloud computing, hence driving innovation. The setting up of GCCs in North America is led by companies across industries such as IT, pharmaceutical, and automotive to maintain business competitiveness and enhance productivity. There is a growing trend of collaboration with offshore GCCs, especially those of India, in addition to concerted domestic efforts, as GCCs are hubs for advanced R&D initiatives. The region is expected to expand at a CAGR of % from 2024 through 2032, driven by sustained demand towards technological adoption and innovation-driven sectors.

Need Any Customization Research On R&D in GCC Market - Inquiry Now

Key Players in the R&D in GCC Market

-

Accenture

-

IBM

-

Tata Consultancy Services (TCS)

-

Wipro

-

Cognizant

-

Saudi Aramco

-

Qatar Petroleum

-

Emirates National Oil Company (ENOC)

-

Siemens

-

Microsoft

-

Huawei

-

Riyadh Techno Valley

-

Dubai Silicon Oasis Authority (DSOA)

-

Gulf Organization for Research and Development (GORD)

-

Frost & Sullivan

Recent Developments

-

In Sept 2024, ZF Lifetec inaugurated a new Global Capability Center (GCC) in Hyderabad, backed by a €5 million investment aimed at advancing passive safety technology. This facility is designed to enhance road safety not only in India but also on a global scale. It will initially employ approximately 220 professionals, with plans for future expansion. The initiative has received support from the Telangana government, highlighting the region's commitment to fostering innovation in safety technologies.

-

In July 2024, Tamil Nadu positioned itself as a hub for Global Capability Centers (GCC), with pharmaceutical giant AstraZeneca spearheading the initiative. In addition to AstraZeneca, major players such as Pfizer and Roche have established their centers in the state, further enhancing its appeal as a key destination for R&D activities in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.17 billion |

| Market Size by 2032 | US$ 49.38 billion |

| CAGR | CAGR of 16.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Industry (Information Technology (IT) and Software Development, Pharmaceutical and Biotechnology, Manufacturing and Engineering, Consumer Electronics, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, IBM, Tata Consultancy Services (TCS), Wipro, Cognizant, Saudi Aramco, Qatar Petroleum, Emirates National Oil Company (ENOC), Siemens, Microsoft, Huawei, Riyadh Techno Valley, Dubai Silicon Oasis Authority (DSOA), Gulf Organization for Research and Development (GORD), Frost & Sullivan |

| Key Drivers | • Driving Innovation and Efficiency Through Global Capability Centers in Today's Market |

| Restraints | • Navigating Challenges in Global Capability Centers – Regulatory Hurdles and Talent Acquisition in R&D • Inadequate reimbursement policies |