Master Data Management Market Report Scope & Overview:

The Master Data Management Market size was valued at USD 19.10 Billion in 2025 and is projected to reach USD 72.79 Billion by 2032, growing at a CAGR of 18.21% during 2026–2033.

The Master Data Management Market is experiencing strong growth, driven by rising enterprise data volumes and increasing demand for data accuracy and consistency. Growing digital transformation, cloud adoption, and regulatory compliance needs are accelerating MDM deployment. Advancements in analytics, automation, and AI-enabled data governance are enhancing operational efficiency across industries.

Master Data Management Market Size and Forecast:

-

Market Size in 2025: USD 19.10 Billion

-

Market Size by 2032: USD 72.79 Billion

-

CAGR: 18.21% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Master Data Management Market - Request Free Sample Report

Key Master Data Management Market Trends:

-

Growing enterprise focus on creating a single source of truth is accelerating adoption of MDM platforms.

-

Rising cloud migration is increasing demand for scalable and flexible cloud-based MDM solutions.

-

Integration of AI and machine learning is improving data quality, matching, and governance automation.

-

Increasing regulatory compliance requirements are strengthening enterprise data governance initiatives.

-

Expansion of omnichannel business models is driving demand for customer and product master data.

-

Growing adoption of MDM-as-a-service models is improving implementation speed and cost efficiency.

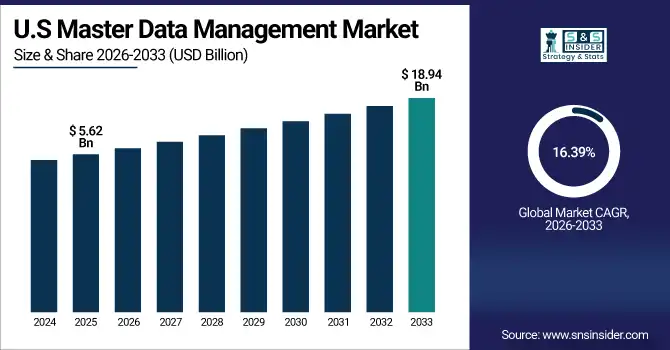

U.S. Master Data Management Market Insights:

The U.S. Master Data Management Market size was USD 5.62 billion in 2025 and is expected to reach USD 18.94 billion by 2033, growing at a CAGR of 16.39% over the forecast period of 2026–2033. According to a study, nearly 65% of U.S. enterprises report data inconsistencies across multiple systems. This cause, fragmented data environments, effects increased adoption of MDM solutions to improve data accuracy, governance, and enterprise decision-making efficiency.

Master Data Management Market Drivers

-

Rising Need for Enterprise-Wide Data Consistency Boosts Master Data Management Market Growth

The growing need for consistent, accurate, and unified enterprise data is a primary driver of the Master Data Management Market. As organizations operate across multiple digital platforms, data silos increase operational inefficiencies. This cause, fragmented data systems, effects rising adoption of MDM solutions to establish a single source of truth. MDM platforms enable improved data quality, governance, and cross-departmental alignment, supporting better analytics and decision-making. Increasing reliance on data-driven strategies across BFSI, retail, healthcare, and manufacturing continue to accelerate market expansion.

In April 2025, a U.S.-based retail enterprise deployed an enterprise MDM platform, reducing duplicate customer records by 38% and improving cross-channel data visibility.

Master Data Management Market Restraints:

-

High Implementation Complexity and Integration Challenges Limit Market Expansion

Despite strong demand, implementation complexity remains a key restraint for the Master Data Management Market. This cause, heterogeneous IT environments and legacy systems, effects longer deployment timelines and higher integration costs. Many organizations struggle to align MDM platforms with existing ERP, CRM, and analytics tools. Data migration, governance alignment, and change management further increase complexity. These challenges slow adoption among small and mid-sized enterprises, despite long-term efficiency gains, slightly restraining overall market penetration.

In 2024, an enterprise IT survey found that 41% of organizations delayed MDM deployment due to integration challenges with legacy infrastructure.

Master Data Management Market Opportunities:

-

Cloud-Based and AI-Enabled MDM Platforms Create New Market Growth Opportunities

The shift toward cloud computing and AI-enabled data management presents significant growth opportunities for the Master Data Management Market. This cause, increasing demand for scalability and automation, effects rapid adoption of cloud-based MDM platforms. AI-driven data matching, cleansing, and governance improve accuracy while reducing manual effort. Cloud deployment lowers infrastructure costs and accelerates implementation. As enterprises modernize data architectures, vendors offering intelligent, cloud-native MDM solutions gain strong competitive advantages, driving long-term market growth.

In June 2025, a global software provider launched an AI-powered cloud MDM platform, enabling enterprises to improve data accuracy by over 30% within the first deployment year.

Master Data Management Market Segmentation Analysis

By Deployment Model, Cloud-Based Solutions Lead Market While On-Premises Registers Fastest Growth

The cloud-based segment dominated the Master Data Management Market with the largest revenue share of 58% in 2025E. This cause, rising demand for scalability, lower infrastructure costs, and faster implementation, effects strong enterprise adoption of cloud MDM platforms. Cloud solutions enable centralized data governance, real-time access, and seamless integration across distributed business units. Product innovations such as AI-driven data quality tools and subscription-based pricing further enhance adoption. Cloud deployment supports agile business models, reinforcing its leadership position across global enterprises.

The on-premises segment is growing at the fastest CAGR of 18.86% during the forecast period. This cause, heightened data security requirements and regulatory compliance needs, effects increased adoption among BFSI, government, and healthcare organizations. On-premises MDM solutions offer greater control over sensitive data, customization flexibility, and internal governance. Vendors are enhancing on-premises offerings with hybrid integrations and advanced security modules, strengthening demand and supporting sustained growth within the Master Data Management Market.

By Component, Solutions Lead Market While Services Register Fastest Growth

Based on the Component, the Solutions (Software) segment dominated the Master Data Management Market with 63% revenue share in 2025E. This cause, increasing demand for automated data governance, data quality management, and master data consolidation, effects widespread adoption of MDM software platforms. Enterprises rely on MDM solutions to ensure consistency across customer, product, and supplier data. Continuous product development in AI-based matching, metadata management, and real-time synchronization reinforces the segment’s dominance across industries.

The Services segment is growing at the highest CAGR of 20.12% during the forecast period. This cause, rising complexity of MDM deployments, effects increased demand for consulting, system integration, and ongoing support services. Organizations seek expert assistance for implementation, customization, and governance alignment. Service providers offering end-to-end MDM lifecycle management are gaining traction, accelerating market growth and strengthening long-term customer relationships.

By Data Domain, Customer Master Data Leads Market While Finance / Reference Data Grows Fastest

The Customer Master Data segment accounted for the largest revenue share of 32% in 2025E. This cause, growing focus on customer experience, personalization, and omnichannel engagement, effects high adoption of customer-centric MDM solutions. Enterprises utilize customer master data to unify records across marketing, sales, and service platforms. Enhanced analytics, improved compliance, and better decision-making reinforce the segment’s leadership in the Master Data Management Market.

The Finance / Reference Data segment is growing at the fastest CAGR of 20.63% during the forecast period. This cause, increasing regulatory compliance and financial reporting requirements, effects rising adoption of standardized financial data management solutions. Accurate reference data ensures consistency across accounting, risk management, and reporting systems. Financial institutions increasingly deploy advanced MDM platforms to reduce errors, enhance transparency, and improve audit readiness.

By End User, IT & Telecom Leads Market While Retail & E-commerce Registers Fastest Growth

The IT & Telecom segment dominated the Master Data Management Market with 29% revenue share in 2025E. This cause, massive data volumes and complex network ecosystems, effects strong reliance on MDM solutions for data accuracy and operational efficiency. Telecom operators use MDM platforms to manage customer, product, and service data across multiple systems. Continuous digital transformation initiatives sustain the segment’s leadership.

The Retail & E-commerce segment is growing at the highest CAGR of 21.19% during the forecast period. This cause, increasing omnichannel retail strategies and personalized shopping experiences, effects rising demand for unified customer and product data. MDM solutions enable retailers to synchronize data across online and offline platforms, improving inventory management and customer engagement, driving rapid market expansion.

Master Data Management Market Regional Insights

North America Dominates the Master Data Management Market in 2025E

In 2025E, North America commands an estimated 42% share of the Master Data Management Market, driven by strong enterprise digital transformation initiatives and high adoption of data governance frameworks. The region benefits from early implementation of cloud computing, AI-driven analytics, and regulatory compliance requirements across BFSI, healthcare, retail, and IT sectors. Growing reliance on centralized data platforms to improve decision-making and operational efficiency further accelerates adoption, positioning North America as the leading region in the global Master Data Management Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

The United States is the dominating country in North America, supported by its mature enterprise software ecosystem and strong presence of global MDM solution providers. U.S. organizations increasingly deploy MDM platforms to manage complex customer, product, and financial data across large-scale IT environments. Continuous investments in cloud-native architectures, AI-enabled data quality solutions, and compliance-driven data governance strengthen the country’s leadership and drive sustained regional growth.

Asia Pacific Is the Fastest-Growing Region in the Master Data Management Market in 2025E

Asia Pacific is projected to grow at the fastest pace, with an estimated CAGR of 20.63% in 2025E, fueled by rapid digitalization, expanding enterprise IT infrastructure, and increasing adoption of cloud-based data management solutions. Rising data volumes from e-commerce, telecom, and financial services are driving demand for unified and accurate master data platforms. Government-led digital transformation initiatives across emerging economies further accelerate market expansion in the region.

China dominates the Asia Pacific Master Data Management Market due to large-scale enterprise digitization and rapid expansion of e-commerce, banking, and telecom industries. Enterprises increasingly adopt MDM solutions to manage customer and transaction data efficiently. India is also emerging as a strong contributor, driven by cloud adoption and digital governance initiatives. Together, these countries support strong regional momentum through enterprise modernization and data-driven business strategies.

Europe Master Data Management Market Insights, 2025

Europe held a significant share of the Master Data Management Market in 2025, supported by strict data protection regulations, growing cloud adoption, and increasing emphasis on data quality and governance. Enterprises across manufacturing, automotive, healthcare, and financial services are adopting MDM platforms to ensure regulatory compliance and operational efficiency. The region’s focus on digital transformation and enterprise data standardization continues to support steady market growth.

Germany leads Europe’s Master Data Management Market due to its strong industrial base and advanced enterprise IT infrastructure. Organizations increasingly deploy MDM solutions to unify product, supplier, and customer data across complex supply chains. The country’s emphasis on Industry 4.0, data transparency, and regulatory compliance reinforces its dominance within the European market.

Middle East & Africa and Latin America Master Data Management Market Insights, 2025

In 2025, the Middle East & Africa and Latin America regions experienced steady growth in the Master Data Management Market, driven by expanding digital infrastructure and rising enterprise data complexity. In the Middle East & Africa, the UAE leads adoption through smart government initiatives and enterprise digitalization programs. In Latin America, Brazil dominates the market, supported by growing investments in cloud computing, banking digitization, and enterprise analytics. Both regions represent emerging growth opportunities as organizations prioritize centralized data governance and operational efficiency.

Competitive Landscape for the Master Data Management Market

Informatica

Informatica is a global leader in enterprise data management, offering comprehensive Master Data Management solutions through its Intelligent Data Management Cloud (IDMC). The company specializes in data integration, data quality, governance, and metadata management, enabling organizations to establish a trusted single source of truth across customer, product, supplier, and financial data. Informatica serves a broad range of industries, including BFSI, healthcare, retail, and manufacturing. Its role in the Master Data Management Market is critical, as it delivers scalable, cloud-native, and AI-driven MDM platforms that support complex enterprise data ecosystems and regulatory compliance requirements.

-

In March 2025, Informatica enhanced its cloud MDM capabilities by introducing AI-powered data matching and automated governance features within its IDMC platform, improving enterprise data accuracy and operational efficiency.

IBM

IBM is a prominent provider of enterprise Master Data Management solutions, leveraging its expertise in AI, hybrid cloud, and analytics. Through IBM InfoSphere MDM and related data governance tools, the company enables organizations to manage, govern, and synchronize master data across complex IT environments. IBM’s solutions are widely adopted across regulated industries such as banking, healthcare, and government. Its role in the Master Data Management Market is significant, offering robust, scalable platforms that support secure data management, advanced analytics, and seamless integration with enterprise systems.

-

In February 2025, IBM expanded its hybrid cloud MDM offerings by integrating advanced AI-driven data quality and governance tools, enhancing data accuracy for large-scale enterprise deployments.

SAP SE

SAP SE is a leading enterprise software provider offering Master Data Management solutions integrated within its SAP Master Data Governance (MDG) platform. The company focuses on enabling centralized data governance, consistency, and compliance across SAP and non-SAP environments. SAP serves global enterprises across manufacturing, retail, energy, and logistics sectors. Its role in the Master Data Management Market is vital, as it supports end-to-end business process integration by ensuring high-quality master data across ERP, supply chain, and financial systems.

-

In January 2025, SAP introduced enhanced automation features within SAP MDG, enabling faster master data validation and governance workflows for large enterprises.

Oracle Corporation

Oracle Corporation is a key player in the Master Data Management Market, providing MDM capabilities through Oracle Enterprise Data Management and Oracle Cloud Infrastructure. The company emphasizes scalable, cloud-native solutions that integrate seamlessly with Oracle ERP, CX, and analytics platforms. Oracle’s MDM offerings support customer, product, and financial data governance across global enterprises. Its role in the market is essential, delivering high-performance, secure, and compliant data management solutions tailored for complex enterprise environments.

-

In April 2025, Oracle upgraded its cloud-based MDM platform with enhanced AI-driven data harmonization and governance capabilities, supporting faster enterprise-wide data standardization.

Master Data Management Market Key Players:

-

Informatica

-

IBM

-

SAP SE

-

Oracle Corporation

-

TIBCO Software Inc.

-

Talend S.A.

-

Stibo Systems

-

Profisee Group, Inc.

-

Reltio Inc.

-

Ataccama Corporation

-

SAS Institute Inc.

-

Teradata Corporation

-

Magnitude Software, Inc.

-

EnterWorks (Winshuttle, LLC)

-

Riversand Technologies, Inc. (Syndigo)

-

Contentserv Group AG

-

Semarchy

-

Cloudera, Inc.

-

Microsoft

-

Qlik

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 19.10 Billion |

| Market Size by 2032 | US$ 72.79 Billion |

| CAGR | CAGR of 18.21 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment Model (On premises, Cloud based) • By Data Domain (Customer Master Data, Product Master Data, Supplier / Vendor Data, Finance / Reference Data, Asset & Location Data) • By End User / Industry Vertical (IT & Telecom, Banking, Financial Services & Insurance (BFSI), Healthcare, Retail & E commerce, Manufacturing, Media & Entertainment / Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Informatica, IBM, SAP SE, Oracle Corporation, TIBCO Software Inc., Talend S.A., Stibo Systems, Profisee Group, Inc., Reltio Inc., Ataccama Corporation, SAS Institute Inc., Teradata Corporation, Magnitude Software, Inc., EnterWorks (Winshuttle, LLC), Riversand Technologies, Inc. (Syndigo), Contentserv Group AG, Semarchy, Cloudera, Inc., Microsoft, Qlik |