Cloud Gaming Market Report Scope & Overview:

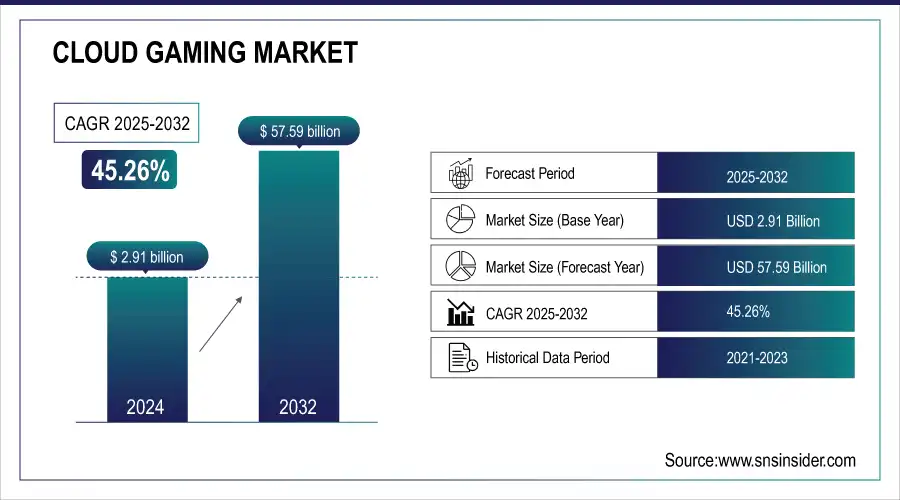

The Cloud Gaming Market was valued at USD 2.91 billion in 2024 and is expected to reach USD 57.59 billion by 2032, growing at a CAGR of 45.26% from 2025-2032.

Get more information on Cloud Gaming Market - Request Sample Report

The cloud gaming market is experiencing rapid growth, driven by high-speed internet access, 5G rollout, and shifting consumer preferences. By eliminating the need for powerful local hardware, it enables gaming on smartphones, tablets, and low-end PCs, broadening accessibility. Subscription-based models and cross-device compatibility have further fueled adoption, reflecting trends seen in music and video streaming. Major tech companies are integrating cloud gaming into their ecosystems, enhancing user convenience and reach. While latency, data security, and internet reliability remain challenges, ongoing technological advancements and rising demand for flexible gaming solutions position cloud gaming as a transformative force in the gaming industry.

Market Size and Forecast

-

Cloud Gaming Market Size in 2024: USD 2.91 Billion

-

Cloud Gaming Market Size by 2032: USD 57.59 Billion

-

CAGR: 45.26% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Cloud Gaming Market Trends

-

Rising demand for on-demand, device-agnostic gaming experiences is fueling cloud gaming adoption.

-

Expanding internet penetration and rollout of high-speed 5G networks are enhancing accessibility and performance.

-

Growing shift toward subscription-based gaming models is boosting market growth.

-

Integration with AI, AR, and VR technologies is creating immersive gaming experiences.

-

Reduction in hardware dependency is attracting casual and cost-sensitive gamers.

-

Increasing investments from tech giants, gaming studios, and telecom providers are accelerating innovation.

-

Cross-platform compatibility and social gaming trends are widening user engagement and market scope.

Cloud Gaming Market Growth Drivers:

-

Affordable subscription plans offering access to extensive game libraries attract a diverse range of consumers.

Affordable subscription plans are one of the biggest drivers, improving access to a wide swath of consumers. In contrast with the legacy set-ups, which require significant capital investment in consoles or high-performance PCs, cloud gaming represents an affordable option. Subscription-based pricing gives users access to huge libraries of games without the high costs of Erforderlich hardware or individual game purchases. It has made gaming accessible to everyone, allowing casual players, budget-sensitive consumers, and consumers in developing countries to game with no financial barriers. These kinds of subscription models often have tiers – one that allows users to choose based on their needs and budget. Often, basic tiers will give you access to a standard library of games, while premium levels will provide higher res, extra features like exclusive items, and multiplayer. This flexibility increases the appeal of cloud gaming services to both casual gamers and hardcore fans alike.

Furthermore, the trend you see in other entertainment spaces where consumers are starting to prefer access over ownership — music, video, etc. — is also apparent when it comes to sports subscriptions. This model keeps users coming back for more and coming back to the same or related products to keep filling in their game libraries and backgrounds with the latest content, updates, or features. While cloud gaming providers are still improving their services and expanding their game libraries, it seems that low-cost monthly subscriptions will endure as a significant market growth engine. These plans are helping to reach out to a large number of preposterous groups and regions by reducing barriers to entry and offering maximum value.

-

The deployment of 5G networks enables low-latency, high-speed streaming, enhancing the performance and accessibility of cloud gaming services.

-

Cloud gaming's ability to run on various devices, including smartphones, tablets, and low-end PCs, broadens its user base.

Cloud Gaming Market Restraints:

-

Compared to traditional platforms, some cloud gaming services offer fewer game options, reducing their appeal to hardcore gamers.

Cloud gaming services often face challenges in offering a game library as extensive as traditional gaming platforms, which can limit their appeal, particularly to hardcore gamers. Traditional platforms like consoles and gaming PCs boast vast libraries encompassing diverse genres, exclusive titles, and backward compatibility with older games. These platforms benefit from well-established ecosystems and long-standing partnerships with game developers, enabling them to provide a comprehensive selection of games. In comparison, cloud gaming platforms may fall short due to factors such as licensing restrictions, technical hurdles, and cost constraints. Game developers often require specific agreements to make their titles available on cloud platforms, a process that can be both time-intensive and expensive. Additionally, the technical demands of streaming games—such as optimizing them for cloud infrastructure—can restrict the inclusion of certain titles, particularly older or niche games not designed for cloud compatibility.

This limitation in game variety can be a significant deterrent for hardcore gamers, who value access to an extensive range of titles, including exclusive and high-performance options. These gamers are more likely to notice gaps in cloud gaming libraries, which may lead them to favor traditional platforms or subscribe to multiple services to meet their gaming preferences. To overcome this challenge, cloud gaming providers are actively working to expand their offerings through strategic partnerships and exclusive content agreements. However, until these efforts fully take shape, the perception of limited game options may continue to hinder the widespread adoption of cloud gaming among dedicated gaming enthusiasts.

-

Cloud gaming demands consistent high-speed internet, which is not universally available, especially in rural and developing areas.

-

The reliance on cloud infrastructure raises risks of data breaches and security vulnerabilities, deterring some users.

Cloud Gaming Market Segment Analysis

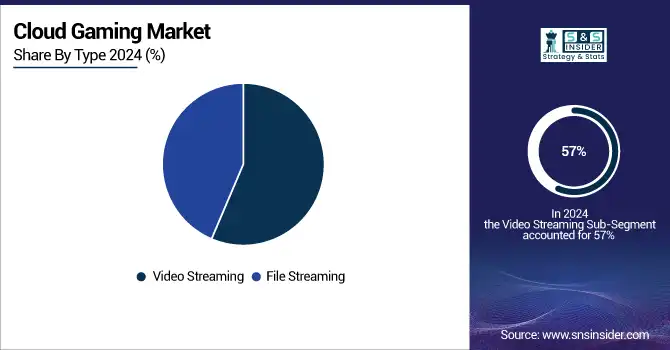

By Type, Video streaming dominates the cloud gaming market. File streaming is expected to grow fastest.

In 2024, the video streaming segment dominated the market and held the highest market share of around 57%. High-performance computing will likely continue to dominate the segment because it allows gamers to play any game without concern about hardware requirements. Since gaming graphics are processed in the cloud and not on local devices, gamers need a high-speed, stable internet connection to run the games. This, in turn, is anticipated to contribute to the segment's dominance in the forecast period.

The file streaming segment is expected to witness the fastest CAGR during the forecast period from 2025 to 2032. This particular segment growth is due to the economic benefits it offers game developers. Streaming files allow gamers to commence the game once a set percentage of the files are downloaded. Hence, increased adoption of file streaming by game developers and gamers is expected to positively contribute to the growth of the segment.

By Device, Gaming consoles dominate the cloud gaming market. Smartphones are expected to grow fastest.

In 2024, the gaming consoles segment dominated the market and held the largest share of the market with over 49%. The segment accounted for a large market share due to factors such as increased disposable income, and some game titles are available for only specific consoles. The racing title Forza Horizon is only on Microsoft Xbox consoles, drawing in potential new users to buy Xbox consoles just to play the game. So, along with the fact that modern consoles can output at 4K resolutions let alone 120-hertz, it is predicted that lifestyle gamers will turn to get the most out of the gaming experience.

The smartphone segment is expected to grow at the fastest growing CAGR during the forecast period from 2025 to 2032. The reason for this growth is the increasing number of freemium games that incorporate optional in-app purchases and subscriptions. Likewise, players engaged that belong to the cloud gaming market also focused on mobile gaming as a result of extensive demand penetration of smartphones in the world. Moreover, features such as enabled 5G and Wi-Fi 6 on contemporary handhelds are expected to meet the technical threshold for cloud gaming and positively aid the vertical.

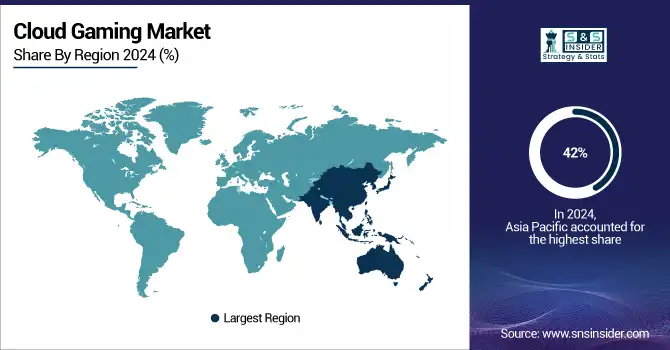

Regional Analysis

Asia Pacific Cloud Gaming Market Insights

The Asia Pacific region accounted for more than 42% of the market share in the year 2023, owing to distinct demographics and a huge gaming population. China and India, two of the largest nations on Earth, not only have billion-strong populations, but they also have massive gamer communities. Complementing it is the high penetration of low-cost high-speed internet and also the high percentage of smartphone users that make it hard for this region to be overtaken.

Need any customization research/data on Cloud Gaming Market - Enquiry Now

North America Cloud Gaming Market Insights

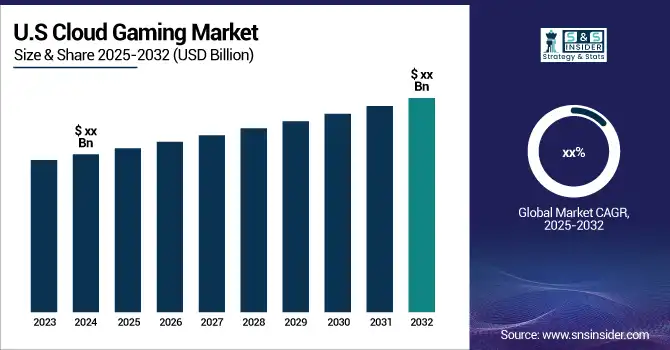

The North American segment is expected to grow at the fastest CAGR over the forecast period. The growth is driven by the leaders of cloud gaming such as NVIDIA Corporation, Microsoft Corporation, and Intel Corporation. Strong tech innovations and widespread availability of 5G and high-speed internet in the region are also key factors driving the region's speedy market growth.

Europe Cloud Gaming Market Insights

Europe is emerging as a significant region in the cloud gaming market, driven by strong broadband infrastructure, widespread 5G deployment, and a growing gaming community. Increasing demand for cross-platform access and subscription-based gaming models is accelerating adoption. European telecom operators and tech companies are collaborating with cloud gaming providers, enhancing accessibility. Supportive digitalization initiatives further strengthen Europe’s role as a key growth hub for the global cloud gaming industry.

Middle East & Africa and Latin America Cloud Gaming Market Insights

The Middle East & Africa and Latin America are witnessing rising potential in the cloud gaming market, fueled by improving internet infrastructure, expanding 5G networks, and growing smartphone penetration. Increasing interest in affordable, subscription-based gaming models attracts a younger demographic. Partnerships between telecom operators and cloud gaming providers are enhancing availability, while ongoing digitalization initiatives position these regions as emerging markets with strong growth prospects in the global gaming ecosystem.

Cloud Gaming Market Competitive Landscape:

NVIDIA Corporation

NVIDIA Corporation plays a pivotal role in the cloud gaming market with its GeForce NOW platform, offering high-performance streaming across devices. Leveraging its advanced GPU technology, NVIDIA enables gamers to access AAA titles without expensive hardware investments. Its continuous innovation in graphics, AI, and cloud infrastructure strengthens market adoption. Strategic partnerships and global expansion further solidify NVIDIA’s leadership in the evolving cloud gaming ecosystem.

-

2025 – NVIDIA is introducing the Blackwell architecture to GeForce NOW, delivering RTX 5080-class cloud performance 5K at 120 fps streaming and expanding the game library with Install-to-Play support for over 4,500 titles.

-

2024 – NVIDIA Corporation announced expansion of GeForce NOW to Apple Vision Pro, Meta Quest 3, and other VR/MR devices, plus a new RTX-powered data center in India.

Sony Interactive Entertainment

Sony Interactive Entertainment is a key player in the cloud gaming market, primarily through PlayStation Now and PlayStation Plus Premium services. By integrating cloud streaming with its PlayStation ecosystem, Sony enables seamless access to PS4 and PS5 titles without downloads. Continuous enhancements to PlayStation Portal and expansion of streaming services reinforce Sony’s strategy to deliver premium, device-flexible gaming experiences and strengthen its competitive position in cloud gaming.

-

2025 – Sony Interactive Entertainment Released a system software update for PlayStation Portal in April, enhancing the Cloud Game Streaming Beta with user-experience improvements for PlayStation Plus Premium members streaming via the remote device.

-

2024 – Sony Interactive Entertainment Began rolling out PS5 Cloud Streaming for PlayStation Plus Premium members, enabling access to supported PS5 games directly from their consoles without downloading.

-

2024 – Sony Interactive Entertainment Released a June system update for PlayStation Portal that adds support for 5GHz public Wi-Fi, improving remote connectivity for cloud game streaming.

-

2023 – Sony Interactive Entertainment Launched PS5 Cloud Streaming this October—Premium members could stream supported PS5 titles in select regions without local download, unlocking access to top games.

Microsoft Corporation

Microsoft Corporation is a leading force in the cloud gaming market with its Xbox Cloud Gaming service, integrated into Xbox Game Pass Ultimate. By enabling seamless streaming of console-quality games across smartphones, PCs, and smart TVs, Microsoft is broadening accessibility and engagement. Strategic partnerships, continuous infrastructure upgrades, and integration within its vast Xbox ecosystem strengthen Microsoft’s position as a dominant innovator in cloud gaming.

-

2025 – Microsoft Corporation announced that Xbox Cloud Gaming (Beta) has broadened device support to include web browsers, TVs, Meta Quest, Fire TV, Samsung TVs, and more expanding streaming reach.

-

2023 – Microsoft Corporation Research teams developed a novel synchronization technology for cloud gaming that keeps audio and video streams precisely aligned even across multiple devices and network conditions.

Amazon Web Services

Amazon Web Services (AWS) plays a vital role in cloud gaming through its Amazon Luna platform and powerful cloud infrastructure. Leveraging AWS’s scalable data centers, Luna provides low-latency game streaming across devices, supported by flexible subscription models. AWS also empowers developers with cloud-native gaming tools like GameLift, driving innovation and accessibility. Its dual role as both platform provider and enabler strengthens its footprint in the global cloud gaming ecosystem.

-

2025 – AWS unveiled Amazon GameLift Streams, enabling browser-based cloud game streaming at 1080p/60fps across devices—providing developers a seamless way to stream without requiring downloads or installs.

-

2025 – Jackbox Games announced a spring beta launch for a smart TV cloud streaming service, using AWS GameLift Streams to deliver ad-supported free games and eventual subscription-based catalogs.

Key Players

The major key players along with their products are

-

NVIDIA Corporation - GeForce NOW

-

Microsoft Corporation - Xbox Cloud Gaming

-

Sony Interactive Entertainment - PlayStation Now

-

Google LLC - Google Stadia

-

Amazon Web Services - Amazon Luna

-

Tencent Holdings - START

-

Ubisoft Entertainment - Ubisoft+ Cloud Gaming

-

Electronic Arts - EA Play

-

Intel Corporation - Intel Server GPU for Cloud Gaming

-

Parsec Cloud - Parsec for Teams

-

Shadow (Blade Group) - Shadow PC

-

Blacknut - Blacknut Cloud Gaming

-

Vortex - Vortex Cloud Gaming

-

Rainway Inc. – Rainway

-

Ubitus Inc. – Ubitus Cloud Gaming

-

Paperspace (DigitalOcean) – Paperspace Gaming Cloud

-

LiquidSky Software Inc. – LiquidSky

-

Boosteroid – Boosteroid Cloud Gaming

-

Antstream Arcade – Antstream

-

Gamestream – Gamestream Cloud Gaming

-

NetEase – NetEase Cloud Gaming

| Report Attributes | Details |

|---|---|

|

Market Size in 2024 |

USD 2.91 Billion |

|

Market Size by 2032 |

USD 57.59 Billion |

|

CAGR |

CAGR of 45.26% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (File Streaming, Video Streaming) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

NVIDIA Corporation, Microsoft Corporation, Sony Interactive Entertainment, Google LLC, Amazon Web Services, Tencent Holdings, Ubisoft Entertainment, Electronic Arts, Intel Corporation, Parsec Cloud, Shadow (Blade Group), Blacknut, Vortex, Rainway Inc., Ubitus Inc., Paperspace (DigitalOcean), LiquidSky Software Inc., Boosteroid, Antstream Arcade, Gamestream, NetEase |