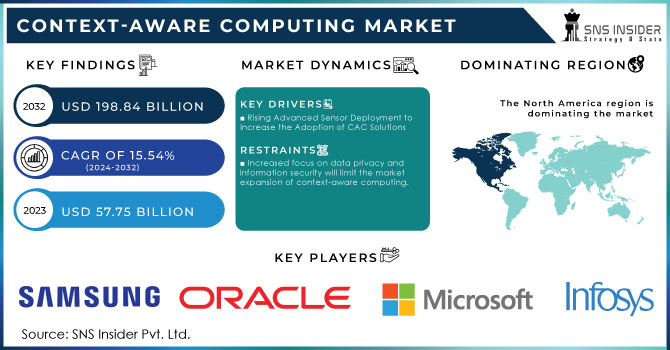

Context-Aware Computing Market Size & Overview:

Get more information on Context-Aware Computing Market - Request Free Sample Report

The Context-Aware Computing Market size was USD 57.2 Billion in 2023 and is expected to Reach USD 206.3 Billion by 2032 and grow at a CAGR of 15.3% over the forecast period of 2024-2032.

The demand for emerging context-aware computing solutions is rising due to the fast development of smart technologies and the growing focus of governments to implement intelligent systems in numerous industries. According to the U.S. Department of Commerce 2023 Report, the governmental sector invested almost $1.8 billion in intelligent infrastructure and computing technologies, which include CAC innovations. In the case of the EU Digital Decade initiative, it is possible to speak about the more than €10 billion that are currently provided to enhance context-aware systems in a wide range of sectors, including healthcare, transportation, and public safety, as a part of the aim to achieve the respective goals. This governmental support is conditional on the ability to improve the processing of real-time data that targets the needs of the emerging Internet-of-things projects. The same trend can be observed in the field of intelligent transportation and automation which also demand sophisticated CAC solutions.

The demand for CAC will increase with the growth of connected devices, such as tablets, PCs, adaptive phones, smart wearables, shopping assistant tools, etc. This technology will change the way businesses operate by providing them with valuable contextual data involving the behavior and needs of their customers. Thus, they will produce the products and services most demanded by customers to achieve high satisfaction and loyalty rates. Moreover, they will always be aware of their customers’ behavior to make timely and advantageous decisions. As a result, the demand for context-aware computing will facilitate the broader adoption of this technology by multiple businesses.

Context-Aware Computing Market Dynamics

Drivers

-

The growing integration of connected devices across various sectors increases the demand for context-aware computing.

-

Improved algorithms and capabilities in AI/ML enable more effective data analysis, enhancing the personalization of user experiences.

-

The shift to cloud-based services facilitates real-time data processing, making context-aware applications more accessible and scalable.

-

Enhanced patient care and improved customer experiences through context-aware solutions are driving adoption in these critical sectors.

-

Rising advanced sensor deployment to increase the adoption of CAC solutions.

Due to the growth and integration of sophisticated sensors in connected products including laptops, smart wearables, smartphones, and other smart products, the demand for CAC solutions is fast rising. Numerous connected gadgets come with a variety of high-tech sensors, such as GPS, accelerometers, magnetometers, light sensors, and microphones, which enhance user experience and offer context-aware features. Contextual data can now be gathered by solution developers using mobile-based sensors. The demand for these computing services is anticipated to increase as the number of connected devices with sensors increases. As electronics device manufacturers use this kind of computing solutions for emergency warnings, location tracking, and other uses, the demand for advanced sensors will increase across several industries.

Restraints:

-

The significant investment required for technology and infrastructure can deter smaller organizations from adopting these systems.

-

Increased focus on data privacy and information security will limit the market expansion of context-aware computing.

-

The challenges in integrating context-aware solutions with existing systems can slow down their deployment in various industries.

Increased focus on data privacy and information security is a very significant restraint of the context-aware computing market. Various organizations have access to a great amount of contextual data about users and the circumstances in which services or products are used. This data includes personal information and other sensitive data. With regulatory bodies on the rise, this data is getting more and more scrutiny regarding the way it is handled. Laws, such as the General Data Protection Regulation in Europe, impose strict limitations and guidelines on the acquisition, storage, and use of data, requiring organizations to invest heavily in ensuring its privacy. This has made quite a few companies and organizations worried about potential legal troubles and associated penalties and has pushed them away from investing in CAC solutions.

Consumers who produce the data seem to be more interested in the way their information is used and are more suspicious of it. These factors combined drive down the investment in CAC and slow down the expansion of the market. Although it is very promising, this technology is restrained by various factors, and a great number of them are centered around the newest and most important of them all, cybersecurity. The utmost importance of the protection of sensitive data and personal information in modern society is the most significant hurdle in adopting CAC.

Context-Aware Computing Market Segment analysis

By Component

In 2023, the solutions segment held a commanding 58% share of the context-aware computing market, largely attributed to the rising adoption of sophisticated software platforms and intelligent systems that integrate CAC capabilities. The U.S. Census Bureau noted in its 2023 report that around 45% of medium and large enterprises in the U.S. had adopted context-aware computing solutions, primarily to enhance customer experience, streamline operations, and support decision-making through real-time data analytics. Furthermore, solutions like AI-driven personalization engines, which enable businesses to provide tailored services based on user contexts, have seen widespread uptake, particularly in the retail and healthcare sectors. These sectors have increased investments in CAC platforms to enhance patient outcomes through smart healthcare systems and improve customer engagement through personalized marketing campaigns.

The dominance of the solutions segment is further backed by governmental support for digital transformation initiatives. For example, the Government of Japan’s Society 5.0 initiative allocated $2 billion for research and development (R&D) in advanced computing technologies, of which CAC plays an important role. This has resulted in the accelerated deployment of context-aware software in the fields of e-commerce and healthcare, as well as advanced industrial automation. The solutions segment will likely continue to lead, given the ongoing advancements in artificial intelligence and machine learning, which are foundational to the context-aware computing paradigm.

By End User

In 2023, the consumer electronics segment accounted for the highest share of about 28% in the context-aware computing market. This was largely due to the increasing incorporation of CAC technologies into smartphones, wearables, connected devices, and home automation systems. For example, according to the International Telecommunication Union, in 2023, smartphone shipments reached more than 1.38 billion units, many of which are equipped with advanced sensors and tools for context-aware operations. Today, such devices use contextual information, such as location, time, user preferences, and environmental data, to provide a more personalized and efficient service. Thus, smartphones and wearables exploit CAC for health or sleep tracking, virtual assistants, as well as for seamless connectivity with smart home automation systems based on the Internet of Things.

Governments also contribute to the development of smart consumer electronics through investments and implementations of the corresponding infrastructures. For instance, the Made in China 2025 policy proposed by the Chinese authorities touts the necessity of smart devices, including contextually aware consumer electronics. As a result, the policy has boosted the production of such devices in China, as well as their adoption by both domestic and international customers. This substantial push from both the government and industry has enabled the consumer electronics segment to dominate the market.

Regional Analysis

In 2023, North America dominated the context-aware computing market with a 34% share. This dominance of the market is driven by significantly advanced technologies within the U.S. and Canada and digital transformation across several sectors. According to the report by NIST, the U.S. government invested over $2.5 billion to support innovations by the year 2023 in AI, ML, and IoT; which are the underlying technologies for context-aware computing. Thus, many institutions within the U.S. and Canada have adopted the solutions across sectors such as healthcare, retail, and automotive. The U.S. Bureau of Labor Statistics reported a 12% growth in IT jobs around the same year, indicating an increase in the region’s digital economy where context-aware computing is integral in business operations and customer engagement. The presence of the major market players, such as Google LLC, Cisco Systems, Inc., Intel Corporation, Microsoft Corporation, Port Shift Ltd., Amazon.Com, Inc., AT&T, inc., among others, is expected to increase product demand. The players use context-aware computing in their products keeping customers returning for more as they prove to be efficient in their work.

The Asia-Pacific will exhibit the highest growth rate. Additionally, the demand due to technological advancement is evidence of a rapidly digitalizing market landscape. The demand for context-aware computing systems has increased due to technology shift. The high level of adoption of connected gadgets, AR-VR smart tools, sensors and IoT-based devices to provide an improved experience for customers has had a mixed influence on the deployment of technologies. The Asia-Pacific market growth is projected to be due to the rise in number of organizations with these solutions. Many players in the industry are focusing on product development and launching strategies to enhance their product lines and customer experience.

Need any customization research on Context-Aware Computing Market - Enquiry Now

Key Players

-

IBM Corporation (Watson IoT Platform, IBM Cloud Pak for Data)

-

Microsoft Corporation (Azure AI, Microsoft Cortana)

-

Google LLC (Google Assistant, Google Cloud AI)

-

Apple Inc. (Siri, Core ML)

-

Amazon Web Services (AWS) (Amazon Lex, AWS IoT)

-

Intel Corporation (Intel Movidius, Intel RealSense)

-

Qualcomm Technologies, Inc. (Snapdragon Neural Processing Engine, Qualcomm AI Engine)

-

Cisco Systems, Inc. (Cisco DNA Center, Cisco Edge Intelligence)

-

Samsung Electronics Co., Ltd. (Bixby, SmartThings)

-

Hewlett Packard Enterprise (HPE) (HPE Edgeline, HPE GreenLake)

-

Oracle Corporation (Oracle Adaptive Intelligence, Oracle IoT Cloud)

-

SAP SE (SAP Leonardo, SAP Conversational AI)

-

Siemens AG (MindSphere, Siemens Desigo CC)

-

Sony Corporation (Xperia Intelligence Engine, Aibo)

-

NVIDIA Corporation (NVIDIA Jetson, NVIDIA DeepStream SDK)

-

ARM Holdings (ARM Cortex-A, ARM Neural Networks SDK)

-

Honeywell International Inc. (Honeywell Forge, Honeywell Sentience)

-

Hitachi, Ltd. (Hitachi Lumada, Pentaho)

-

Schneider Electric (EcoStruxure, Aveva Edge)

-

Fujitsu Limited (Fujitsu Human Centric AI Zinrai, Fujitsu IoT Solutions) and others.

Latest News in the Context-Aware Computing Market

-

May 2024, PROG Holdings, Inc. extended its collaboration with Infosys Forge to enhance banks’ client experiences through AI solution and optimize operational efficiency with intellectual automation. The purpose of the tie-up was to exploit Infosys’ digital capabilities and modern technologies to upgrade skills and boost quicker readiness to the market.

-

February 2024, Wipro Limited unveiled its Enterprise AI-Ready Platform, which aimed to enable businesses to construct tailor-made and comprehensive AI environments. The benefit of this tool is described as the possibility for companies to build flexible business-specific AI-based ecosystems.

-

February 2024, the U.S. Department of Defence declared its plans to allocate $500 million on the implementation of context-aware computing in military environments. The money would be spent on investments in the improvement of the real-time situational awareness of the solutions in combat and logistics.

| Report Attributes | Details |

| Market Size in 2023 | USD 57.2 Billion |

| Market Size by 2032 | USD 206.3 Billion |

| CAGR | CAGR of 15.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vendor (Mobile Network Operator, Device Manufacturer, Online, Web, and Social Networking Vendors) • By Component (Solution, Services) • By End-Use (BFSI, Consumer Electronics, Media and Entertainment, Automotive, Healthcare, Telecommunication, Logistics and Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

IBM Corporation, Microsoft Corporation, Google LLC, Apple Inc., Amazon Web Services (AWS), Intel Corporation, Qualcomm Technologies, Inc., Cisco Systems, Inc., Samsung Electronics Co., Ltd., Hewlett Packard Enterprise (HPE), Oracle Corporation, SAP SE, Siemens AG, Sony Corporation, NVIDIA Corporation, ARM Holdings |

| Key Drivers |

•The growing integration of connected devices across various sectors increases the demand for context-aware computing. |

| Market Opportunities | •The significant investment required for technology and infrastructure can deter smaller organizations from adopting these systems. •Increased focus on data privacy and information security will limit the market expansion of context-aware computing. •The challenges in integrating context-aware solutions with existing systems can slow down their deployment in various industries. |