Healthcare Cyber Security Market Report Scope & Overview:

Get more information on Healthcare Cyber Security Market - Request Sample Report

The Healthcare Cyber Security Market size was valued at USD 17.10 Billion in 2023 and is expected to reach USD 80.60 Billion by 2032 and grow at a CAGR of 18.8% over the forecast period 2024-2032.

The healthcare industry is witnessing a high demand for effective solutions against cybersecurity threats. The major aspect that has been clearly analysed here has been the increasing incidents of cybercrimes targeting health care providers. Patient’s data was compromised in 45% of the total breaches in 2022 according to the Department of Human and Health Services (HHS) wherein 40 million people were affected. In terms of compromised patient records, this means that there was an almost 30% increase from those of 2021. Furthermore, the Federal Bureau of Investigation (FBI’s) report on ransomware attacks in 2023 revealed that cybercriminals have grown more advanced with a 67% increase in attacks on the healthcare sector. These attacks interfere with patient care and also cause significant financial losses since it takes over USD 9.3 million as an average cost for a breach involving healthcare data. As such, increased attack rates, escalating demand for securing information, as well as high expense of violations are forcing medical organizations across America to focus more on investing in security systems. Also, the high adoption rates of AI in healthcare in developed nations is playing a major role in improving the overall demand landscape for healthcare cyber security market. For instance, 90% of nursing tasks will be done by artificial intelligence by 2030 which will ultimately force the need for healthcare cyber security solutions.

Moreover, government regulations are similarly serving a very imperative function. Health Insurance Portability and Accountability Act (HIPAA) is crucial as it requires strong data security measures while the Department of Justice (DOJ) goes after criminals in the healthcare cyber fraud sector. Thus, such combinations are pushing the healthcare cyber security market to its next stage of substantial growth. Having this in mind, US health care industry due to some factors coming together has been witnessing an upswing regarding demanding strong cybersecurity solutions. The main one among them is the disturbing growth of cyber-attacks on health care providers.

MARKET DYNAMICS:

Market Dynamics:

Drivers:

-

The regulatory bodies across the globe have started applying even tighter rules regarding the protection of data like HIPAA in the US and GDPR regulation in EU.

-

The use of invasive and wearable medical low-power devices in healthcare palate the Internet of things (IoT). Moreover, the use of clouds for storage is now being practices with EHRs, although it remains common.

-

The rising technological advancements and the increased in the use of IT solutions particularly for outpatient services among healthcare workers.

The enhancement of technology has led to the simplification of healthcare personnel's procedures for outpatient care through an increase in IT solutions. Electronic health records allow secure access to patient data, enabling drug management and virtual medical appointments. Telehealth services enable virtual appointments, enhancing accessibility for patients residing at a distance or facing mobility constraints. However, this compromising factor presents the healthcare cybersecurity market at risk because, as time passes, the dependency on technology increases. Proper implementations of cybersecurity are essential because reported major breaches doubled from 2018 and 2022 with 93% in rate. The need for enhancing the security arrangements is believed by the healthcare facilities to be on the rise following the deployment of the IT solutions.

Restrains:

-

Many health professionals are unaware about cyber threats such as scam that may occur due to human errors leading to cyber-attacks or leaking data.

A lack of cybersecurity training is evident as less than a third of the health workers claiming to have had any training at all, but a significant number of them also seem to have little knowledge concerning the existence of cyber threats in the first place. This leads to a rather risky position when it comes to financial operations. The employees for instance when conducted through phishing, they can be made to release certain key information or click some certain links which can effectively launch a cyber-attack or release sensitive information.

Such lack of preparation boosts the healthcare cyber security market. Since patient data is often under attack, the necessity for formidable protection is without doubt. For instance, in May 2024 when a hospital chain largely failed the test on a vulnerability that had become apparent. Cyber criminals we’re able to breach the system through a phishing email, violating the patients’ records and thereby placing the lives of thousands at risk due to the treatments that were made to be delayed. This incident supports the very much needed cybersecurity education in healthcare organizations.

KEY MARKET SEGMENTS:

On The Basis of Component

-

Solutions

-

Antivirus and Antimalware

-

Identity and Access Management Solutions

-

Encryption and Data Loss Protection Solutions

-

Other solutions

-

-

Services

-

Consulting

-

Managed Security Services

-

Others Services

-

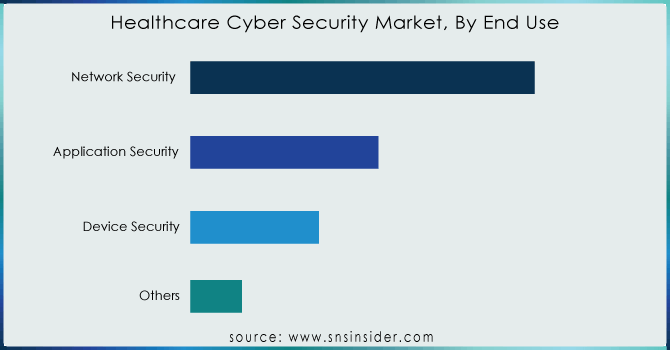

On The Basis of Security Type

-

Network Security

-

Application Security

-

Device Security

-

Others

Network Security held around 60% share in 2023, is indeed the largest segment and it gives rise to firewalls, intrusion detection/prevention systems (IDS/IPS) and data loss prevention (DLP) among others. Such tools keep off unauthorized admission, malicious code infestation as well as these tools help in keeping away hackers from accessing healthcare data.

Application Security accounted for 25% of share, this segment looks at how to protect healthcare applications that hold and process sensitive patient information. It contains products such as web application firewall, source code scanners, or API security that do not allow attackers take advantage of weak points in healthcare apps. According to SNS Insider study Device Security held around 15% share in 2023. With connected medical devices like pacemakers and insulin pumps on the rise, securing them becomes very important. This section also covers end point security software, device authentication protocols and encryption keys which secure these gadgets from any form of manipulation and access by unauthorized parties.

Get more information on Healthcare Cyber Security Market - Enquiry Now

On The Basis of Deployment

-

On-premises

-

Cloud-based

In 2023 on-premises solutions were dominant approximately holding around 65% share for the healthcare organizations that wanted total control of their security systems. This was attractive to institutions with strict regulatory demands or fears of cloud privacy invasion. Recently, the use of cloud-based solutions which is expected to reach 35% by 2032 is growing due to the advantages of scalability, cost savings, and ease in implementation particularly for small practices. Furthermore, initial fears are being addressed through improved cloud protection protocols and expanding faith in reputable cloud service providers. Thus, a mixture of on-premises and cloud-based solutions is formed by this situation where some companies match them with their specific safety needs and infrastructure capabilities.

On The Basis of End-use

-

Pharma & Chemicals

-

Medical Devices

-

Health Insurance

-

Hospitals

-

Others

Hospitals are one of the major platforms for cyberattacks, accounted for approximately 35% of the market share due to their vast stores of electronic health records (EHRs) and dependence on interlinked medical devices. For Pharma & Chemicals segment which held 20% share in 2023, industrial espionage is a known threat that steals intellectual property and research data.

Manufacturers of medical devices is growing segment which held 15% share in 2023 and is expected to be the fastest segment over the forecast period, have difficulties in securing connected devices from vulnerabilities capable to disrupt patient care or compromise safety. Health insurance companies accounted for approximately 10% share regard the protection of sensitive financial information and prevention of fraudulent claims as key.

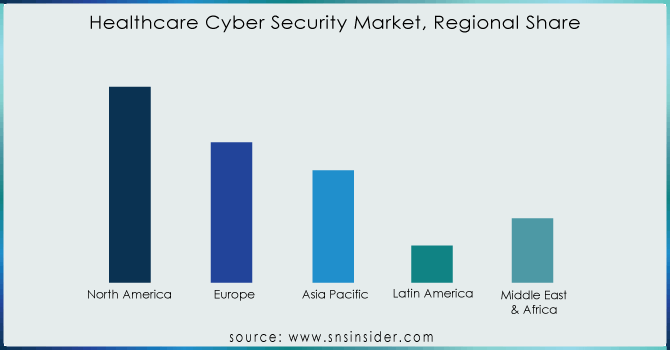

REGIONAL ANALYSIS:

The North American healthcare cybersecurity was a market leader globally with over 40% market share in 2023. Many top healthcare cybersecurity companies are based in the United States which is a powerhouse in North America, making the U.S. marketplace highly competitive and full of opportunities. These companies provide cutting edge solutions for an extensive healthcare infrastructure including hospitals, clinics and pharmaceutical giants. Secondly, North America has a high level of consciousness about cyber threats. At least one cyber-attack has been experienced by 75% of healthcare organizations in the region. Increased awareness of this has prompted more investment into cybersecurity solutions, thus driving market growth. Furthermore, stringent government regulations exist in North America concerning patient data privacy (HIPAA) that require strong cybersecurity measures. These regulations mixed with a rapidly changing threat landscape repeat the position of North America as the leading healthcare cybersecurity market.

Asia-Pacific’s healthcare sector is undergoing a transition to an interconnected system with an increased usage of EHRs, telehealth & telemedicine and internet connected medical devices. The digitalization process however not only improves patients’ care but also increases the chances for cyber-criminals to sneak into an organization’s systems. In Asia, it is shocking that as high as 75% of its people do not have basic knowledge on how to stay safe online therefore making them vulnerable to social engineering tactics and phishing attacks. This loophole is further increased since at least some underdeveloped countries within APAC still lack the required network infrastructure capable of protecting their systems from sophisticated cyber-attacks. But the scenario is not completely vulnerable, a recent study stated there has been an increase in the number of cyberattacks up to 80% further causing a boom in health care security cognizance. Solutions such as Identity and Access Management (IAM) would be mainly used by governments and healthcare providers to enhance safety for access to patient’s sensitive data.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The major key players are Northrop Grumma Corporation, Palo Alto Networks, Inc., Sensato investors, Symantec Corporation, Cisco Systems, Inc., FireEye, Inc., IBM Corporation, Kaspersky Lab, Lockheed Martin Corporation, MACAFEE, INC. & Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.10 Billion |

| Market Size by 2032 | USD 80.60 Billion |

| CAGR | CAGR 18.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Solution and services) • by Security Type (Network Security, Application Security, Device Security, and Others) • by Deployment (On-premises and Cloud-based) • by End-use (Pharma & Chemicals, Medical Devices, Health Insurance, Hospitals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Northrop Grumma Corporation, Palo Alto Networks, Inc., sensato investors, Symantec Corporation, Cisco Systems, Inc., FireEye, Inc., IBM Corporation, Kaspersky Lab, Lockheed Martin Corporation, and MACAFEE, INC. |

| Key Drivers |

|

| Market Restraints |

|