Quality Management Software Market Size & Overview:

Get more information on Quality Management Software Market - Request Free Sample Report

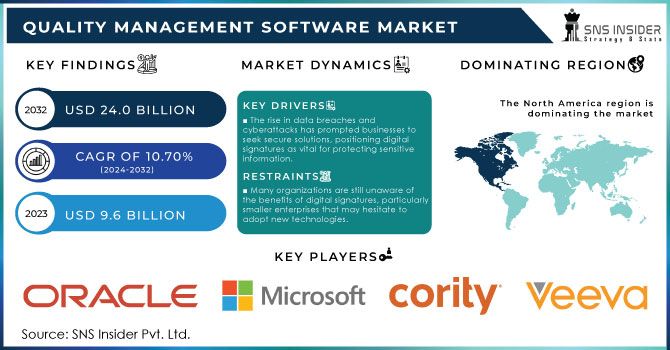

Quality Management Software (QMS) Market was valued at USD 9.6 billion in 2023 and is expected to reach USD 24.0 billion by 2032, growing at a CAGR of 10.70% from 2024-2032.

The quality management software (QMS) market is rapidly advancing and is driven by technological innovations and stricter regulatory requirements across industries. QMS solutions optimize operations, ensure compliance, and enhance the quality of products and services. Key growth factors include the rising need for companies to meet standards like ISO 9001 and the increasing demand for workflow automation and risk management tools. Industries such as manufacturing, healthcare, and automotive are adopting QMS software to improve efficiency, achieve compliance, and manage risks more effectively. The shift toward cloud-based QMS solutions is also a major contributor, as businesses are drawn to their scalability, flexibility, and lower upfront costs compared to traditional on-premise systems.

A significant trend shaping the market is the integration of emerging technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into QMS tools. AI-driven analytics enable predictive maintenance, early defect detection, and real-time quality monitoring, while IoT enhances quality control by facilitating real-time data collection from connected devices. For instance, According to the study it estimates that 75% of large enterprises will use AI-enabled QMS tools by 2026 to automate quality management processes, such as predictive analytics and real-time defect tracking. The pharmaceutical and biotech sectors have shown increased demand for QMS solutions, underscoring the need for quality assurance and regulatory compliance in medical product production and distribution. These industries rely on QMS to ensure product traceability, adhere to stringent regulatory guidelines, and reduce risks in drug development and supply chain management.

The emphasis on sustainability and environmental compliance also drives QMS adoption, as companies face growing pressure to implement eco-friendly practices while maintaining product quality. Additionally, mobile QMS solutions are gaining traction, enabling users to manage quality processes via mobile devices and allowing real-time quality management from remote locations. These trends demonstrate how companies are increasingly investing in QMS to adapt to evolving business and regulatory environments.

Market Dynamics

Drivers

-

Demand for automating quality processes to reduce manual errors and improve efficiency.

-

Shift towards scalable and flexible cloud-based QMS platforms due to lower costs and easier implementation.

-

Growing need for mobile-friendly QMS to enable real-time access to quality data from remote locations.

The growing demand for mobile-friendly Quality Management Software (QMS) reflects the need for real-time access to quality data as businesses embrace flexible and remote work setups. Mobile QMS enables quality teams to oversee, review, and approve processes from any location, making it essential for industries like manufacturing, healthcare, and logistics, where fast decisions and quick issue resolution are critical to maintaining product quality and regulatory compliance. By using mobile QMS, users can access important data—such as audits, inspections, non-conformance reports, and corrective actions—via smartphones or tablets, accelerating quality management by removing the dependency on desktop systems. These mobile solutions also allow teams to capture and submit data directly from the field, whether on the factory floor, in a warehouse, or at a remote site, enhancing data accuracy and timeliness.

Cloud-based QMS integration further boosts mobile functionality by providing seamless synchronization across devices, enabling better collaboration among remote teams. As companies increasingly adopt hybrid or remote work models, mobile QMS becomes crucial for sustaining operational efficiency and upholding quality standards.

Here’s a comparison table showcasing the benefits of mobile-friendly QMS:

|

Feature |

Traditional QMS |

Mobile-Friendly QMS |

|---|---|---|

|

Accessibility |

Limited to desktop |

Accessible via mobile |

|

Data entry |

Manual, location-dependent |

Real-time, on-the-go |

|

Decision-making |

Delayed due to lack of access |

Instant with real-time data |

|

Collaboration |

Limited to office settings |

Remote collaboration |

Restraints

-

The increasing reliance on cloud-based QMS raises concerns about data privacy, breaches, and compliance with stringent data protection regulations.

-

Employees and organizations may resist adopting new technologies, preferring familiar manual or legacy systems.

-

Standard QMS solutions may not fully meet industry-specific requirements, leading to dissatisfaction or the need for costly customization.

Standard Quality Management Software (QMS) solutions usually offer general features that aim to meet various industry needs. However, sectors like pharmaceuticals, aerospace, and healthcare often have specific regulatory requirements, processes, and quality control demands that standard QMS platforms may not fully address. This gap can lead to dissatisfaction among users, as the software may lack vital functionalities crucial for their operations. For instance, pharmaceutical companies typically need robust traceability and compliance tracking features that are often missing from basic QMS offerings.

Consequently, businesses often find themselves needing to invest in costly customizations to tailor the QMS to their specific workflows, significantly extending both implementation time and costs. According to a report, nearly 39% of QMS users in specialized industries view the need for considerable customization as a major challenge during implementation. These additional costs can be particularly challenging for small and mid-sized enterprises that have limited budgets for software adjustments. Moreover, the ongoing maintenance and updates for these customizations can become burdensome, negatively affecting the overall return on investment (ROI) for QMS solutions. This highlights the urgent need for more adaptable, industry-specific QMS options that can cater to unique operational demands without extensive modifications.

Resistance to adopting new technologies, like Quality Management Software (QMS), is a common challenge for organizations. Many employees have become accustomed to manual processes or legacy systems they've relied on for years, resulting in a natural reluctance to change. This comfort with familiar methods can make them hesitant to learn new software that might disrupt their established workflows.

A report reveals that 70% of digital transformations fail, largely because of resistance from employees. Furthermore, only 16% of employees believe that their company's digital initiatives will remain sustainable over time. In the context of QMS, this resistance can impede successful implementation and effective use of the software. Employees may worry that new systems will complicate their tasks or doubt their ability to adapt to new processes, leading to decreased morale and productivity. Furthermore, inadequate training and support during the transition to a new QMS can intensify these concerns. A report from TechPro Research highlights that 69% of employees cited insufficient training as a major factor in resisting new technology. Consequently, organizations may struggle to fully harness the benefits of QMS solutions, negatively affecting their quality management processes and overall operational efficiency. To foster a culture of innovation and ensure successful technology adoption, it is vital to address these challenges with comprehensive training and support.

Segment Analysis

By Solution

The complaint-handling segment captured the largest revenue share, surpassing 17.6% in 2023, and is anticipated to experience a notable CAGR of 11.6% during the forecast period. Efficient complaint management allows organizations to meet customer expectations. Traditional tools and processes for handling complaints enable businesses to resolve customer issues effectively, supporting long-term success. However, changing consumer behavior and preferences, along with a growing demand for personalized solutions, are prompting organizations to focus more on customer satisfaction to boost engagement. Consequently, a strong complaint management system can adeptly handle unique and complex customer inquiries, resolve issues, and deliver a satisfying experience.

By Deployment

The on-premise segment dominated the market and represented over largest 53.1% revenue share, in 2023, as demand for on-premise software grows with many businesses transitioning from manual to automated systems. On-premise deployment of Quality Management Software (QMS) allows for tailored customization to meet specific business requirements. Organizations that prioritize data protection often choose on-premise QMS to reduce risks associated with the loss of sensitive information and critical data. Consequently, end-users are increasingly opting for on-premise quality management software due to its enhanced data security.

The cloud segment is expected to achieve the highest CAGR of 11.8% during the forecast period. The rapid adoption of cloud-based QMS is driven by features such as flexibility and mobility. Additionally, cloud deployment removes the necessity for end-users to invest in dedicated hardware, resulting in significant cost savings. Cloud-based QMS can be accessed through a web browser, with all system upgrades managed by the vendor, facilitating easy data access from any location. These benefits are increasing market demand for cloud-based quality management software, which also provides inherent scalability, allowing organizations to adjust resources based on their needs.

By Enterprise Size

The large enterprises segment held the largest revenue share, accounting 61.2% in 2023. Large organizations require integrated resources to manage their business activities on a single platform, and Quality Management Software (QMS) solutions allow them to maintain control over procedures while supporting enterprise-wide deployment. Cost-effectiveness plays a crucial role in driving the adoption of QMS solutions among large enterprises, with many vendors providing dedicated software suites tailored to meet their specific needs.

The small and medium enterprise (SME) segment is projected to experience the highest CAGR of over 11.7% during the forecast period. QMS solutions help SMEs lower the overall costs of their finished products by streamlining processes. The demand for QMS solutions in SMEs is generally high, as these organizations focus on cost efficiency. SMEs often look for robust quality management software to scale their operations and ensure regulatory compliance.

By End- Use

The manufacturing and heavy industry segment held the largest market share at 19.7% in 2023. The rise of smart manufacturing and the integration of Information and Communication Technology (ICT) into manufacturing processes are expected to influence the sector significantly in the coming years. Technologies such as industrial robotics, data analytics, 3D printing, and machine learning will propel growth in this segment. Additionally, growing awareness among manufacturers of the advantages of Quality Management Software (QMS) in reducing downtimes and asset failure rates is likely to further boost the segment throughout the forecast period.

The healthcare segment is projected to grow at the highest CAGR of over 13.7% during the forecast period. Recent significant changes in the healthcare industry have led pharmaceutical companies to focus on enhancing their internal efficiency to maintain competitiveness. QMS solutions support these companies in improving the quality and availability of medicines by implementing effective monitoring controls. In the healthcare sector, QMS solutions enhance overall system quality by prioritizing product excellence. They also empower pharmaceutical companies to develop high-quality products, manage supplier relationships, support data integrity, and ensure regulatory compliance. As pharmaceutical companies expand globally, the adoption of standardized QMS procedures is increasingly becoming a priority.

Regional Analysis

North America dominated the market and captured the largest market share, surpassing 41.3% in 2023, driven by strong demand for compliance-based products and services from medical and hospital associations in the region. Quality Management Software (QMS) is widely used in various healthcare programs and organizations throughout the U.S., including home care agencies, nursing homes, and ambulatory care providers. Moreover, the introduction of new products by many quality management software providers is further fueling market demand in this segment.

In Europe, the quality management software market was valued at USD 2.64 billion in 2023. Factors such as the growing number of enterprises, increased investments in digital transformation efforts like Industry 4.0, and the rising adoption of process automation tools—including artificial intelligence and machine learning—are expected to drive the growth of quality management software. These innovations are designed to automate processes, minimize variations, and improve quality and safety throughout the region.

Need any customization research on Quality Management Software Market - Enquiry Now

Key Players

The major key players are

-

SAP - (SAP Quality Management, SAP Integrated Business Planning)

-

Oracle - (Oracle Quality Management Cloud, Oracle Manufacturing Cloud)

-

Siemens - (Siemens Teamcenter Quality, Siemens Opcenter Quality)

-

IBM - (IBM Watson Quality, IBM Maximo Asset Management)

-

Medidata Solutions - (Medidata Quality Management, Medidata Rave)

-

MasterControl - (MasterControl Quality Management System, MasterControl Document Control)

-

ETQ - (ETQ Reliance, ETQ Quality Management)

-

Sparta Systems - (TrackWise, Quality Management System)

-

Intelex - (Intelex Quality Management Software, Intelex Document Control)

-

Gensuite - (Gensuite QMS, Gensuite Audit Management)

-

SOPHIA - (SOPHIA Quality Management, SOPHIA Compliance Management)

-

Qualio - (Qualio Quality Management System, Qualio Document Management)

-

Arena Solutions - (Arena PLM, Arena Quality Management)

-

Plex - (Plex Manufacturing Cloud, Plex Quality Management)

-

ProShop - (ProShop ERP, ProShop Quality Management)

-

QAD - (QAD Cloud ERP, QAD Quality Management)

-

SQC - (SQC Quality Control Software, SQC Compliance Solutions)

-

Veeva Systems - (Veeva Vault Quality, Veeva Vault QMS)

-

iSixSigma - (iSixSigma Quality Management Software, iSixSigma Training Services)

-

Qualityze - (Qualityze QMS, Qualityze CAPA Management)

Recent Developments

In April 2023, Greenlight Guru, a provider of cloud-based software solutions for MedTech companies, announced the launch of its Export API. This new feature allows customers to export data from the QMS platform to third-party software, including CRM, ERP, and business intelligence solutions, thereby enhancing user efficiency.

In April 2023, Qualityze, a quality management software provider, introduced Qualityze EQMS, a cloud-based solution tailored for the telecommunications industry. Built on Salesforce, Inc.’s cloud platform, this software helps telecommunications companies meet various quality objectives with improved security, reliability, and flexibility.

| Report Attributes | Details |

| Market Size in 2023 | USD 9.6 billion |

| Market Size by 2032 | USD 24.0 billion |

| CAGR | CAGR of 10.70 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Document Control, Non-conformances/Corrective & Preventative, Complaint Handling, Employee Training, Quality Inspections (PPAP & FAI), Audit Management, Supplier Quality Management, Calibration Management, Change Management, Mobile Incidents and Event Reporting) • By Enterprise size (Small and Medium Enterprise (SME), Large Enterprise) • By Deployment (Cloud, On-premise) • By End-Use (IT & Telecom, Life Sciences, Transportation & Logistics, Consumer Goods & Retail, Food & Beverage, Defense & Aerospace, Manufacturing & Heavy Industry, Utilities, Government, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

SAP, Oracle, Siemens, IBM, Medidata Solutions, Master Control, ETQ, Sparta Systems, Intelex, Gensuite and others |

| Key Drivers | •Demand for automating quality processes to reduce manual errors and improve efficiency •Shift towards scalable and flexible cloud-based QMS platforms due to lower costs and easier implementation •Growing need for mobile-friendly QMS to enable real-time access to quality data from remote locations. |

| Market Restraints | •The increasing reliance on cloud-based QMS raises concerns about data privacy, breaches, and compliance with stringent data protection regulations. •Employees and organizations may resist adopting new technologies, preferring familiar manual or legacy systems. •Standard QMS solutions may not fully meet industry-specific requirements, leading to dissatisfaction or the need for costly customization. |