Cloud Logistics Market Report Scope & Overview:

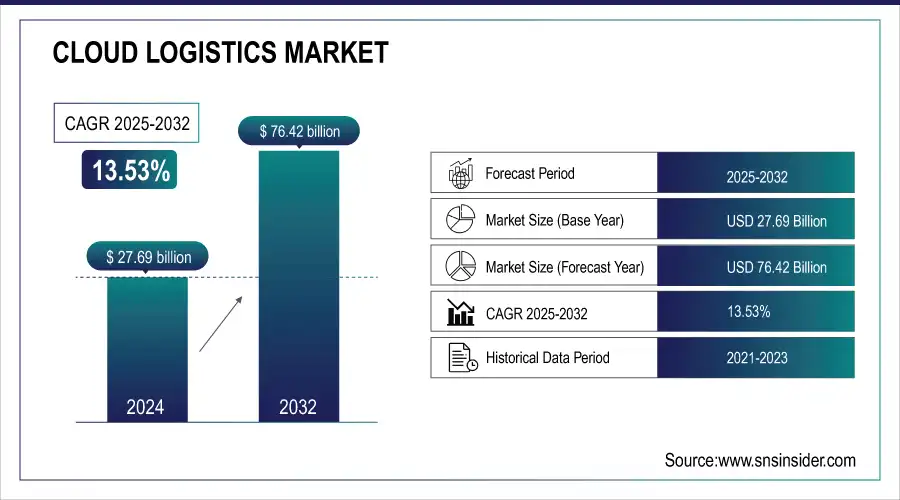

The Cloud Logistics Market Size was valued at USD 27.69 billion in 2024 and is expected to reach USD 76.42 billion by 2032 and grow at a CAGR of 13.53% over the forecast period 2025-2032.

The market is growing fast as companies more and more embrace cloud-based solutions such as TMS and WMS for improving supply chain efficiency, visibility, and scalability. The expansion is being fueled by key sectors such as e-commerce, retail, manufacturing, and healthcare, requiring faster delivery and improved performance of the operations. AI, IoT, and 5G together are making logistics intelligent with interconnected systems for real-time tracking, predictive analytics, and nimble reaction to disruptions. Similarly, AI technologies have provided dramatic efficiency gains.

To Get more information on Cloud Logistics Market - Request Free Sample Report

For instance, Walmart employed AI to drive inventory management to an entirely different level by accelerating the speed of delivery by 25%, Maersk routed using AI and experienced decreased shipping time by 20% and fuel expenses by 15%, and DHL's MySupplyChain have led to 15% more on-time deliveries and decreased shipment delays by 20%. The cloud logistics industry is emerging as a core enabler of modern supply chain management with scalable, collaborative, and responsive solutions through flexible deployment models – public, private, and hybrid clouds.

Market Size and Forecast:

-

Market Size in 2024: USD 27.69 Billion

-

Market Size by 2032: USD 76.42 Billion

-

CAGR: 13.53% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Cloud Logistics Market Trends

-

Rising demand for real-time supply chain visibility and efficiency is driving cloud logistics adoption.

-

Integration with IoT, AI, and analytics is enhancing route optimization, inventory management, and predictive maintenance.

-

Growing e-commerce and omnichannel retail operations are boosting market growth.

-

Cloud-based platforms are enabling scalable, flexible, and cost-effective logistics solutions.

-

Increasing focus on sustainability and carbon footprint reduction is shaping adoption trends.

-

Expansion of third-party logistics (3PL) and transportation management services is accelerating deployment.

-

Collaborations between logistics providers, technology vendors, and enterprises are fostering innovation and digital transformation.

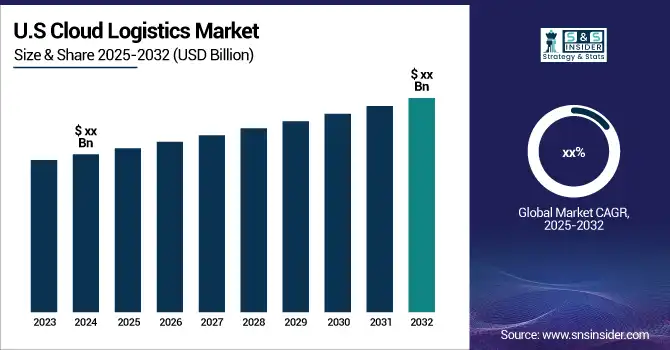

The U.S. Cloud Logistics Market size was USD 8.39 billion in 2024 and is expected to reach USD 15.94 billion by 2032, growing at a CAGR of 8.29% over the forecast period of 2025–2032.

The emergence of advanced technologies, including AI, IoT, and big data analytics in the U.S. market, is enabling organizations to improve their supply chain visibility and operational efficiency. Owing to its highly developed logistics infrastructure, presence of major cloud service providers, and high level of e-commerce penetration, the U.S is dominating the North American market. Furthermore, the rise in need for real-time shipment tracking and affordable logistics operations is further catapulting the growth of the market. The role of government initiatives that back digital transformation across industries also bolsters the U.S. dominance in driving the logistics market growth within the country.

Cloud Logistics Market Growth Drivers:

-

Growing Adoption of AI and Cloud Technologies Enhances Efficiency and Visibility in the Cloud Logistics Market Trends

The surging AI and cloud technologies are the leading driving factor of the market. Artificial Intelligence is being leveraged by companies for route optimization, predictive analytics, and inventory forecasting, and cloud platforms have brought real-time data sharing, a greater scale, and integration amongst stakeholders. Faster decisions and automating manual processes carried out in legacy systems are where cloud-based logistics systems fulfill these needs. Studies show that cloud computing in logistics has improved supply chain visibility up to 30%, enabling companies to track shipments with the turn of a key and react in near real-time to disruptions. Further, transit times are decreasing by as much as 20% through AI-assisted predictive analytics and route optimization, while cloud positionality enables scalable infrastructure capable of addressing demand surges and operational complexity. These technologies enable smooth integration among stakeholders and contribute to better coordination and data sharing along the supply chain.

Cloud Logistics Market Restraints:

-

Data Security and Privacy Concerns Pose Significant Challenges to Market Expansion

The market is a growing concern over data security and privacy. Cloud platforms store sensitive material like shipment routes, customer info, and analytics of a live supply chain, which makes them honeypots for cyber-attackers. Conservative companies have not adopted cloud logistics printing entirely due to the fear of data loss, unauthorized use, and loss of vital business information. Additionally, laws like data localization and sectoral regulations are hard to comply with for logistics providers in storing and transferring data securely. Cloud adoption may be delayed due to the time and resources that small and medium enterprises may not have to install stringent cybersecurity measures. Moreover, this restraint is further amplified by the perception of losing control over proprietary data when they migrate to third-party cloud services. These worries hold back thought about investments, complicate the pace of digital transformation, and create friction with key stakeholders.

Cloud Logistics Market Opportunities:

-

Expansion of E-Commerce Sector Creates Lucrative Opportunities for Cloud Logistics Market Growth and Scalability

The rapid expansion of the e-commerce industry presents a major opportunity for the cloud logistics market. With the growing demand for speedy and accurate deliveries, businesses must earnestly fulfill orders with more robust logistics solutions. The cloud logistics platform automates inventory tracking, warehouse management, and last-mile delivery, providing scalable systems that can serve growing e-commerce companies with speed. It also makes the need for cloud-enabled platforms stronger as another trend we are seeing is omnichannel retailing, where businesses need to harmonize logistics across online and offline channels. Cloud logistics solutions will remain in a good position to reap plenty of market opportunities in the upcoming years as online shopping continues to grow and the value of customer experience increases.

Cloud Logistics Market Challenges:

-

Integration Challenges with Legacy Systems Impede the Adoption and Efficiency of Cloud Logistics Solutions

The market is having difficulty integrating modern cloud solutions with existing legacy systems. Current software or processes for logistics and supply chain operations, in many cases, are still outdated or entirely based on manual processing that is unsuitable for cloud-based technologies. The absence of interoperability leads to data silos, inefficiencies, and increased complexity during migration. Consequently, while many organizations understand how cloud logistics market analysis can lead to long-term value, they either hold off on adoption or unwind their cloud systems into an isolated continuum, thereby shutting down their full potential. However, to overcome these integration barriers, you require coordinated efforts, investment in middleware solutions, and management change. The challenges must be dealt with before there are large-scale cloud and logistics solutions.

Cloud Logistics Market Segment Analysis

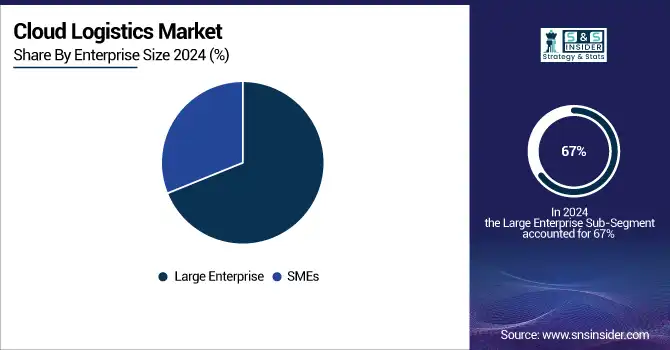

By Enterprise Size, Large enterprise segment dominated the Cloud Logistics Market, SMEs segment is expected to grow fastest.

The large enterprise segment holds a commanding 67% revenue share in 2024, by its demand for surging logistics solutions to govern enterprise global supply chains. However, leading providers including SAP introduced enhanced cloud logistics suites for large enterprises with the introduction of AI-enabled analytics, real-time visibility, and integrated multi-modal transportation management. These strong platforms allow enterprises to streamline operations, save money, and create a more robust customer experience.

The SMEs segment is experiencing the highest CAGR of 16.9%, as small and medium businesses adopt cost-effective, scalable cloud logistics platforms. Oracle launched a specialised cloud logistics solution for SMEs with simplified integration and a pay-as-you-go pricing model. This method reduces the entry barriers, allowing SME to enhance inventory management, order tracking, and last-mile delivery efficiency. SMEs have been identified extensively as the fastest-growing cloud logistics segment because of increasing digitalization and demand for agile logistics solutions.

By Type, Public cloud segment dominated the Cloud Logistics Market, Private cloud segment is expected to grow fastest.

The public cloud segment holds the largest revenue share of 43% in 2024, driven by its cost-effectiveness, scalability, and ease of deployment. Introducing programs like Azure’s Supply Chain Visibility tool, which provides real-time information about shipments and data analytics. Such innovations allow businesses to optimize their logistics operations without needing to invest large amounts upfront. Lastly, the public clouds that enable multi-tenancy are essential for supply chain partners to work together, and that is the foundation for the growing market of cloud logistics.

The private cloud segment is expected to grow at the highest CAGR of 19.7%, as organizations increasingly prioritize data security and customized logistics solutions. IBM launched its Private Cloud Logistics intended for businesses that need dedicated infrastructure but with added security. This growth parallels the surge of demand within the health and manufacturing industries that are responsible for handling sensitive data and ensuring compliance with relevant regulations.

By Industry Vertical, Retail segment dominated the Cloud Logistics Market, Healthcare segment is expected to grow fastest.

The retail segment held the largest revenue share of 29% in 2024, driven by booming e-commerce and the need for efficient inventory and delivery management. Integrating AI-powered demand forecasting and real-time shipment tracking tailored for retailers. All of these improvements make sure that fewer stockouts are encountered and faster last-mile delivery takes place. The emphasis on customer experience and speedy fulfillment in the retail sector continues to drive cloud logistics, further cementing its market-leading position.

The healthcare segment is growing at the fastest CAGR of 21.2%, propelled by increasing demand for secure, compliant, and transparent supply chain solutions. SAP launched its Healthcare Logistics Cloud to help make sure sensitive medical shipments comply with regulations and are tracked in real-time. This is a solution that can combat the logistical hurdles of healthcare, including temperature and privacy of large amounts of data. Cloud logistics in healthcare is gaining traction as the sector is characterized by its focus on patient safety and supply chain integrity.

By OS Type, Web-based segment dominated the Cloud Logistics Market, Native segment is expected to grow fastest.

The web-based segment leads with a 36% revenue share in 2024, due to its easy accessibility and seamless integration across devices. Salesforce and other companies made available better web-based, browser-accessible logistics dashboards, enabling real-time shipment tracking and analytics via the web without requiring that software be installed on premises. This flexibility allows for quick implementation and brings together supply chain partners. This web-based approach is in sync with the demand of the cloud logistics market that seeks scalable and easy-to-use platforms that will help streamline the supply chain.

The native segment is growing at the fastest CAGR of 10.9%, as logistics companies seek high-performance applications optimized for specific devices. Manhattan launched a native mobile logistics app with offline and routing capabilities. Also, it makes user experience better by processing data faster and proves to be effective even with a less connectivity from the network. This is positively impacting cloud logistics, as field workers and drivers can access relevant information at any time, improving operational efficiency and market adoption.

Cloud Logistics Market Regional Analysis

North America Cloud Logistics Market Insights

North America dominated the cloud logistics market share in 2024 with an estimated market share of approximately 42%, North America represents the largest cloud logistics market, which is supported by the dominant role of digital infrastructure, logistics networks, and the presence of major cloud service providers in the U.S. The need for enhanced visibility in the supply chain in real-time is driven by rapidly growing E-commerce and an over-efficient supply chain, and this is leading to a further boost in its adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Cloud Logistics Market Insights

Asia Pacific is the fastest-growing region with an estimated CAGR of 18.93%, driven by rapid e-commerce growth and digital adoption. The tech-advanced region, such as China, with huge manufacturing centers and thriving e-commerce supported by large local players, dominates the Asia Pacific cloud logistics market. China is the biggest cloud logistics growth market in the region due to its entire government initiatives on digital infrastructure, digitalisation, AI, and IoT integration with supply chains.

Europe Cloud Logistics Market Insights

In 2024, Europe’s market is growing steadily, driven by increasing demand for supply chain transparency and sustainability initiatives. Europe’s growth is fueled by stringent regulations, sustainability focus, and advanced industrial digitization efforts. The presence of a strong industry base, developed infrastructure, and early adoption of cloud technologies in the region, especially in manufacturing and the automotive business, has enabled Germany to dominate the region. This will expedite logistics integration into the cloud due to the nation's digital transformation and regulatory compliance importance.

Middle East & Africa and Latin America Cloud Logistics Market Insights

In 2024, the Middle East & Africa and Latin America cloud logistics markets are experiencing strong growth driven by digital infrastructure investments and rising e-commerce demand. The UAE leads the Middle East & Africa region, focusing on smart port development and logistics modernization to enhance real-time visibility and operational efficiency. Meanwhile, Brazil dominates Latin America by leveraging cloud-based solutions to tackle last-mile delivery and inventory challenges. Government initiatives and increasing awareness of cost reduction and supply chain agility fuel adoption across SMEs and large enterprises, boosting competitiveness and efficiency in both emerging markets.

Cloud Logistics Market Competitive Landscape:

Project44

Project44 plays a vital role in the Cloud Logistics Market by providing advanced visibility and predictive intelligence solutions that enhance supply chain efficiency. Its platform leverages AI and automation to offer real-time tracking, data-driven decision-making, and cost optimization for logistics providers. By focusing on transparency, agility, and resilience, Project44 empowers organizations to streamline operations, mitigate risks, and achieve end-to-end supply chain orchestration.

-

2025: Project44 Launched Decision Intelligence, transforming its Movement platform into a predictive, AI-driven system that connects, sees, acts, and automates logistics, offering proactive orchestration for global supply chains.

-

2025: Project44 Expanded platform intelligence with six new AI capabilities AI Data Quality Agents, MO (Supply Chain Assistant), plus optimization tools for automated data cleanup, cost reduction, and real-time supply chain control.

Descartes Systems Group

The Descartes Systems Group is a leading player in the Cloud Logistics Market, offering advanced transportation management, compliance, and global trade intelligence solutions. Its cloud-based platforms empower logistics providers, freight brokers, and shippers with end-to-end visibility, automation, and regulatory compliance. By leveraging AI-driven insights and connected workflows, Descartes helps businesses optimize supply chain performance, minimize risks, and improve customer experiences through efficient, data-driven logistics management.

-

2024: Descartes Systems Group Released MacroPoint FraudGuard, a new anti-fraud layer built into its MacroPoint visibility platform that helps freight brokers and logistics providers detect and prevent fraudulent tracking entries.

-

2024: Descartes Systems Group Announced that IDS, a European 4PL, adopted its cloud-based TMS and freight visibility tools streamlining workflows, reducing costs, and enhancing customer satisfaction.

Key Players:

Some of the Cloud Logistics Market Companies

-

BWISE

-

IBM Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

SAP

-

Thomson Reuters

-

Trimble

-

Uber Freight

-

The Descartes Systems Group Inc.

-

C.H. Robinson Worldwide

-

BluJay Solutions

-

Manhattan Associates

-

Infor Nexus

-

JDA Software (now Blue Yonder)

-

Kuebix

-

SAP SE Ariba

-

MercuryGate International

-

Transporeon

-

Project44

-

FourKites

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 27.69 Billion |

| Market Size by 2032 | USD 76.42 Billion |

| CAGR | CAGR of 13.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Cloud Deployment Type (Public, Private, Hybrid, Multi-Cloud) • By Operating System Type (Native, Web-based) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises [SMEs]) • By Industry Vertical (Retail, Consumer Electronics, Healthcare, Automotive, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BWISE, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP, Thomson Reuters, Trimble, Uber Freight, The Descartes Systems Group Inc., C.H. Robinson Worldwide, BluJay Solutions, Manhattan Associates, Infor Nexus, JDA Software (now Blue Yonder), Kuebix, SAP SE Ariba, MercuryGate International, Transporeon, Project44, FourKites |