Enterprise A2P SMS Market Size & Overview:

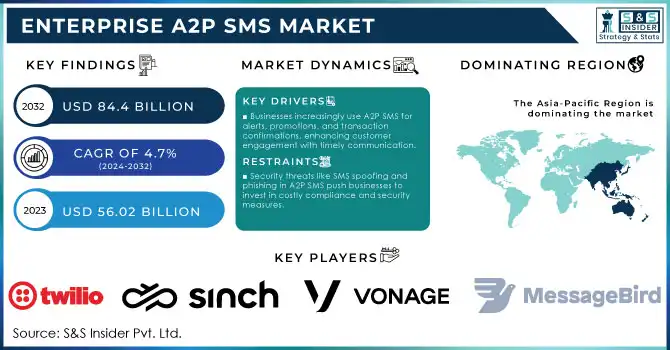

Enterprise A2P SMS Market Size was valued at USD 58.63 Billion in 2024 and is expected to reach USD 84.4 Billion by 2032, growing at a CAGR of 4.66% over the forecast period 2025-2032.

The increasing number of smartphone and internet users is positively affecting the popularity of OTT messaging platforms (for example WhatsApp, Facebook Messenger, and iMessage, etc.,) that come with rich communication options (such as images, videos, and stickers etc.) thus enhancing customer engagement. For several sectors, OTT messaging also empowers user identification, enabling functionalities such as order confirmation and delivery notifications. RedBus, for example, uses WhatsApp to send tickets as well as send information related to cancellations, refunds, real-time bus location, etc. As a result, this trend is proving to be a vehicle to allow for A2P messaging opportunities across sectors.

Get more information on Enterprise A2P SMS Market - Request Sample Report

Market Size and Forecast:

-

Enterprise A2P SMS Market Size in 2024: USD 2.27 Billion

-

Enterprise A2P SMS Market Size by 2032: USD 3.11 Billion

-

CAGR: 3.99% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Enterprise A2P SMS Market Trends

-

Rising demand for low-cost chipless RFID solutions to enable affordable high-volume tagging.

-

Growing integration of RFID with smart packaging for real-time tracking and consumer engagement.

-

Advancements in printed electronics are improving the cost-efficiency and scalability of RFID tags.

-

Increasing focus on sustainable and eco-friendly materials to meet green regulations.

-

Expanding adoption in retail and apparel to enhance inventory accuracy and reduce shrinkage.

-

Accelerated use of RFID in healthcare for asset tracking and patient safety compliance.

Enterprise A2P SMS Market Growth Drivers

-

Businesses increasingly use A2P SMS to connect with customers through alerts, promotions, and transaction confirmations. This direct communication boosts customer engagement, especially for time-sensitive information.

-

With the expansion of e-commerce and mobile marketing, companies rely on A2P SMS for order confirmations, delivery notifications, and security alerts, enhancing customer satisfaction in these high-growth sectors.

-

The adoption of AI and chatbots in A2P SMS enables businesses to offer personalized, automated customer support, providing better customer interaction and operational efficiency.

The growing adoption of Application-to-Person (A2P) SMS messaging is changing the way enterprises engage customers in several industries, especially in those industries where real-time communication is key. Businesses are using the A2P SMS to send alerts, reminders promotions, and transactional notifications to consumers. Thanks to SMS open rates of 98% vs 20% for email, A2P SMS is a highly effective channel for instant communication and engagement, especially for time-sensitive messages, such as appointment reminders and security alerts. For instance, in the banking sector, SMS is widely used for two-factor authentication (2FA) and fraud alerts, providing customers with enhanced security and convenience. With the increasing number of cyber threats, most financial institutions are adopting SMS-based notifications to employ additional security protocols. In addition, A2P SMS is widely used by retail and e-commerce industries for order confirmation, delivery updates, and customized advertisement offers. As an example, reports state that above 60% of customers like to get promotions on SMS than any other digital channel proving the effectiveness of SMS in driving customer engagement.

The convenience and high engagement rate of SMS have made it an essential channel for companies looking to enhance customer satisfaction and loyalty. Given the real-time customer engagement enterprises are looking for, this will continue to remain a staple for communicating, further aided by the fact that consumers increasingly prefer communicating over SMS to other digital messaging platforms.

Enterprise A2P SMS Market Restraints

-

Messaging apps like WhatsApp and Facebook Messenger offer similar functionality, drawing businesses away from A2P SMS as they shift towards more interactive and multimedia-friendly options.

-

Security threats, including SMS spoofing and phishing, pose risks in A2P SMS, prompting businesses to invest heavily in compliance and security measures, which can be costly.

-

Regulations designed to prevent spam and protect consumer data impact A2P SMS usage by restricting the number of messages businesses can send, adding compliance costs and limiting reach.

Security has been one of the most significant restraints in the Enterprise A2P SMS market for both service providers and end-users. A2P (service messages from applications to us) SMS, is a highly used service by organizations for sensitive communication such as OTPs (One-time passwords), bank alerts, promotional messages, etc., and is subject to various security risks, such as phishing, SMS spoofing, and malware. Such security threats can cause data breaches, financial fraud, and the threat of unauthorized access to user data, rendering SMS an untrusted channel of communication. To prevent this all businesses utilizing A2P SMS thus need to focus on advanced security features such as encryption and user validation protocols to stop security risks and comply with privacy laws. Additionally, the increasing prevalence of phishing and smishing (SMS phishing) scams has necessitated greater security measures, as companies have little to gain and a lot to lose if their networks are breached. Not only do these new security requirements increase operational costs, but they also make it difficult to seamlessly integrate A2P SMS with other business platforms.

Enterprise A2P SMS Market Segment Analysis

By Deployment

In 2023, the Enterprise A2P SMS Market was dominated by the cloud segment, which accounted for about 68% of revenue share. Cloud adoption is primarily driven by organizations looking for scalable, cheaper solutions that can support high-volume messaging. This approach frees organizations from expensive on-premises hardware investment while managing messaging services on cloud-centric infrastructure. Cloud providers (which are also the beneficiaries of government incentives for digital transformation), on the whole offer stringent security and compliance standards in comparison. The U.S. government, for example, is giving incentives in the form of tax benefits to businesses that embrace cloud technologies under Section 179 to facilitate their digital transition objectives. This is particularly appealing for enterprises with variable demand for messaging services, making such deployments increasingly attractive in the Cloud.

By Application

The customer relationship management (CRM) services held 39% of the revenue share in 2023, leading the market. CRM plays a vital role in improving customer engagement and satisfaction through personalized and timely communication, hence the demand. Various government reports highlight the importance of customer engagement in digital business models. As an example, a 2023 study carried out by the U.S. Department of Commerce stated that 74% of customers preferred text communicating with businesses over other channels due to convenience and dependability. In addition, the promotion and marketing part of A2P SMS is also anticipated to grow phenomenally as an increasing number of enterprises are adopting SMS as a channel for targeted marketing. Responsible marketing is encouraged by governments worldwide, and frameworks such as GDPR, which governs interaction with customers in the EU, require consent-based messaging, ensuring a safe and user-friendly atmosphere for promotional SMS to thrive.

By End-User

The BFSI (Banking, Financial Services, and Insurance) sector held a 28% revenue share in the Enterprise A2P SMS Market in 2023. This growth is driven by the BFSI sector seeking to establish safe and immediate communication channels for OTPs (One-Time Passwords), transaction alerts, and account notifications. BFSI communications are heavily regulated by government bodies. The Reserve Bank of India, for example, makes it compulsory that all banks have an SMS alert system for each transaction so that customers are constantly updated in real-time and string exposing frauds minimal. These regulatory mandates therefore help entrench the BFSI sector's dependence on A2P SMS as a communication channel.

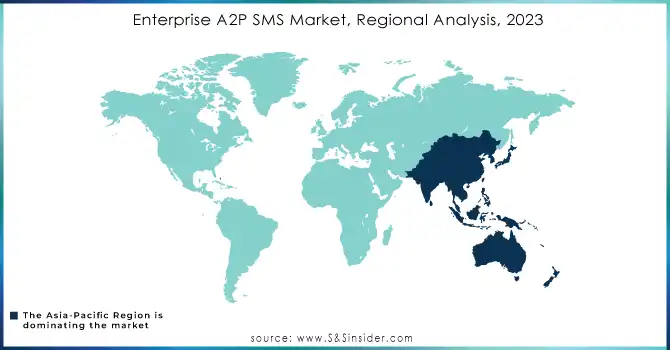

Enterprise A2P SMS Market Regional Analysis

Asia Pacific Enterprise A2P SMS Market Insights

In 2023, the Asia-Pacific region led the Enterprise A2P SMS Market and held the largest regional market share. Fueled by accelerated digitalization, mobile growth, and favorable government initiatives for increased digital connectivity and services pan-sector, this leadership is evident. Enormous smartphone penetration in countries such as China, India, and Japan utilize A2P SMS extensively for customer engagement, promotion, and authentication. With $8 billion estimated to be raised from Government-led programs like India’s Digital India and Make in India initiatives, emphasizing the requisite of digital communication and transaction frameworks, A2P SMS becomes the primary business communication tool with a significant market share. As businesses nowadays have started using A2P messages to connect with their customers across all sectors, both urban and rural, SMS usage for enterprise purposes has increased significantly as per the recent data from India most recently by the Telecom Regulatory Authority of India. Likewise, China’s MIIT (Ministry of Industry and Information Technology) stated the number of mobile subscribers exceeded 1.6 billion in 2023, providing enterprises a vast user base for A2P messaging applications.

North America Enterprise A2P SMS Market Insights

North America is projected to grow significantly in the Enterprise A2P SMS Market during the forecast period, supported by a large base of mobile users and a well-established regulatory framework ensuring secure communication. Rising demand for digital advertising, and increased adoption of sophisticated technologies like the Internet of Things (IoT). A2P SMS is utilized by the region's fast-growing startups and small companies to create recognition and manage their client base. The region accounted for a significant portion of the global revenue share due to high adoption rates across sectors such as healthcare and BFSI.

Latin America (LATAM) Enterprise A2P SMS Market Insights

The LATAM Enterprise A2P SMS Market is gradually expanding in 2025, supported by the region’s emerging automotive, construction, and industrial manufacturing sectors. Countries like Brazil and Mexico are witnessing increasing adoption of advanced powder coating systems to improve product quality, reduce operational costs, and comply with environmental standards. Local distributors and service providers are partnering with global technology companies to access state-of-the-art coating equipment and technical support. Government initiatives promoting industrial modernization and export competitiveness are further contributing to market growth across the region.

Middle East & Africa (MEA) Enterprise A2P SMS Market Insights

The MEA Enterprise A2P SMS Market is gaining traction in 2025, driven by industrial diversification and rising demand for high-quality and durable coating solutions. Countries including the UAE, Saudi Arabia, and South Africa are deploying advanced powder coating systems in automotive, construction, and heavy machinery sectors. Expansion of industrial hubs, adoption of modern manufacturing practices, and the presence of international equipment providers are encouraging investments in advanced powder coating infrastructure. Additionally, initiatives to adhere to global quality and environmental standards are propelling the regional market growth.

Need any customization research on Enterprise A2P SMS Market - Enquiry Now

Enterprise A2P SMS Market Competitive Landscape

Xtrutech Ltd

Xtrutech Ltd is a leading provider of extrusion and material handling equipment, specializing in solutions that enhance manufacturing efficiency and product quality across industries such as plastics, chemicals, and food processing. The company focuses on delivering innovative extruder lines, cooling systems, and integrated automation solutions to optimize production processes.

-

In June 2024, Xtrutech Ltd launched the XTDC2, a drum cooler with interchangeable configurations. Designed for seamless integration, it can be paired with Xtrutech’s XTS24 twin-screw extruder to enhance the efficiency of extruder lines.

Hillenbrand Inc. (Coperion GmbH)

Hillenbrand Inc., through its subsidiary Coperion GmbH, is a global provider of bulk material handling, processing, and Enterprise A2P SMS. The company offers advanced extrusion, feeding, and weighing technologies for industries including plastics, chemicals, and food, aiming to improve operational efficiency and product consistency.

-

In May 2023, Hillenbrand Inc. (Coperion GmbH) acquired Schenck Process FPM to integrate advanced technologies into its equipment. This strategic acquisition is expected to strengthen the company’s product portfolio and expand its footprint in the Enterprise A2P SMS market.

Enterprise A2P SMS Market Key Players

Key Service Providers/Manufacturers:

-

Twilio Inc. (Twilio SMS API, Twilio Flex)

-

Sinch AB (Sinch SMS API, Sinch Verification)

-

Infobip Ltd. (Infobip SMS, Infobip Conversations)

-

Tata Communications (SMS Services, Mobility Platform)

-

Vonage (Vonage Messaging API, Vonage Contact Center)

-

MessageBird (MessageBird SMS API, Flow Builder)

-

CM.com (CM.com Messaging API, Mobile Service Cloud)

-

OpenMarket Inc. (Mobile Engagement Platform, Global SMS)

-

Monty Mobile (Bulk SMS, A2P Messaging Solutions)

-

Route Mobile Limited (Route Mobile A2P SMS, Route OTP)

Key Users of A2P SMS Services

-

Amazon

-

Uber

-

Airbnb

-

Walmart

-

Bank of America

-

HSBC

-

McDonald's

-

Netflix

-

Delta Airlines

-

Starbucks

| Report Attributes | Details |

| Market Size in 2024 | USD 58.63 Billion |

| Market Size by 2032 | USD 139.15 Billion |

| CAGR | CAGR of 4.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Pushed Content Services, Customer Relationship Management Services, Promotion and Marketing, Interactive Services, Others) • By Deployment (Cloud, On-premises) • By End User (BFSI, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles |

Twilio Inc., Sinch AB, Infobip Ltd., Tata Communications, Vonage, MessageBird, CM.com, OpenMarket Inc., Monty Mobile, Route Mobile Limited. |