Geospatial Solutions Market Report Scope & Overview:

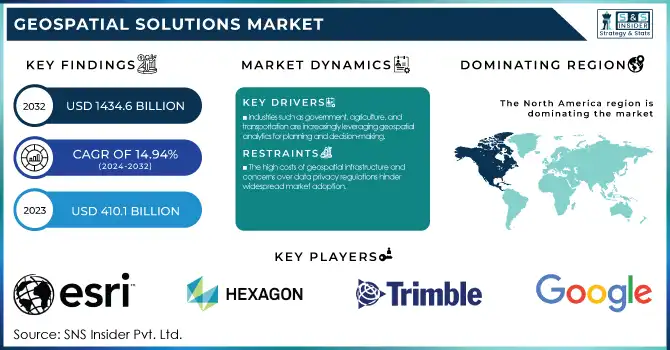

The Geospatial Solutions Market was valued at USD 410.1 Billion in 2023 and is expected to reach USD 1434.6 Billion by 2032, growing at a CAGR of 14.94% from 2024-2032. The Geospatial Solutions Market is experiencing rapid growth, fueled by rising adoption across multiple industries. Government, agriculture, and transportation sectors are at the forefront of geospatial analytics, utilizing location-based insights for enhanced planning and operations. Regional geospatial data infrastructure is expanding, with North America and Europe focusing on smart city projects, while Asia-Pacific accelerates adoption due to urbanization. Furthermore, cloud-based geospatial solutions are gaining momentum worldwide, as businesses embrace scalable, real-time mapping and analytics for smarter decision-making.

To Get more information on Geospatial Solutions Market - Request Free Sample Report

Geospatial Solutions Market Dynamics

Drivers

-

Industries such as government, agriculture, and transportation are increasingly leveraging geospatial analytics for planning and decision-making.

The booming demand for real-time location-based insights is a pivotal factor responsible for driving the Geospatial Solutions Market. Geospatial analytics is used by various industries including government services, agriculture, transportation, and urban planning to make important decisions, develop infrastructure, and assess risk. This factor further boosts the growth of smart city, disaster management, and environmental monitoring sectors, thus driving the market growth. Moreover, several developments in artificial intelligence, the Internet of Things, and cloud computing capabilities complement the geospatial data processing sphere, allowing huge datasets to be processed in a scalable, and more centralized manner. 5G network expansion is also aided by quick data transfer, increasing geospatial solution efficiency and performance. All these aspects cumulatively lead to increasing usage of geospatial technologies across the globe.

Restraints

-

The high costs of geospatial infrastructure and concerns over data privacy regulations hinder widespread market adoption.

However, the Geospatial Solutions Market is expected to face several challenges, high implementation costs, and data privacy concerns being some of them, which can hinder market growth. Advanced geospatial infrastructure needs large expenditure on software, hardware, and expertise which makes it a challenge for many small and medium enterprises to adapt. In addition, large-scale collection, storage, and analysis of geospatial data create privacy and security risks—particularly concerning government and defense applications. This is in addition to compliance with regional data protection such as GDPR and CCPA. This may slow the pace of the large-scale adoption of geospatial solutions, especially in developing geographies where financial and technical resources are constrained.

Opportunities

-

AI and cloud computing enhance geospatial analytics, enabling real-time data processing and predictive insights for various applications.

There are plenty of growth opportunities with the infusion of AI and cloud computing into geospatial solutions. Analytical tools ideally offer great potential and with AI-powered analytics, processing spatial data and providing predictive insights for urban planning, logistics, and disaster management becomes easier. The market for cloud-based geospatial solutions is on the rise as it gives us scalability, cost savings, and real-time data access. Companies are using these technologies to streamline processes, make better business decisions, and improve customer experiences. Moreover, new market opportunities are being created by the increasing use of geospatial data such as with autonomous vehicles, drones, and IoT devices. By proving the value of geospatial solutions, sectors around the world will likely jump on faster when it comes to digital transformation.

Challenges

-

Inconsistencies in geospatial data and lack of standardization create challenges in integration and decision-making across industries.

However, the major challenge in the Geospatial Solutions Market is getting the data correctly and getting the correct interoperability of the data between various platforms. There are multiple sources of geospatial data, like satellites, sensors, UAVs, etc. Closing Line: Noticeable Errors in spatial data or mapping also impact decision-making and lowers the creditability of geospatial applications. Finally, the fact that most companies work on legacy, software, and hardware ecosystems makes the integration of geospatial data problematic. Efforts continue to define standards to solve this wrong, but the absence of common protocols to utilize the data in the geospatial solution will never be able to be adopted completely by all industries.

Geospatial Solutions Market Segment Analysis

By Technology

In 2023, the GIS/Spatial analytics segment dominated the market and accounted for significant revenue share in 2023. Driven by due to the growing need for data-driven decision fostering across industries. In the backdrop of efficient resource management, urban planning, and disaster response gaining priority, GIS solutions come to our rescue. The addition of AI and machine learning takes spatial analytics to the next level, enabling deeper insights and predictive capabilities.

The fastest CAGR for 3D scanning in the forecast period of 2024 to 2032 With its increasing applications in construction, manufacturing, and heritage preservation, the market is witnessing growth. The need for accurate and rich spatial data for modeling and simulation drives the use of 3D scanning in these industries. On construction sites, 3D scanning improves the accuracy of project planning and monitoring, which lowers errors and costs.

By Component

In 2023, the software segment dominated the market and accounted for 45% of revenue share. The growing demand for advanced technology to manage and analyze huge amounts of spatial data is a growing factor to drive the market. Advancements in cloud-based platforms and the integration of AI and machine learning into geospatial software only add more capability and easier access. Real-time data analysis and decision-making through geospatial software are crucial for industries ranging from urban planning and agricultural sciences to environmental monitoring.

From 2024 to 2032, services are anticipated to experience the fastest CAGR during the forecast period. It can be attributed to increasing dependence on specialized expertise for data collection, analysis, and integration. With the increasing adoption of geospatial technologies by organizations, the demand for consulting, implementation, and maintenance services to ensure optimal utilization of these tools is also growing.

By Application

In 2023, the surveying & mapping segment dominated the market and accounted for a significant revenue share. Their importance for the infrastructure industry, land management, and urban planning drives the market. The never-ending growth in the construction of housing projects and industries requires maps which creates the necessity of such maps. Moreover, the development of technology like drones and LiDAR allows surveying and mapping tasks to be performed with greater accuracy and speed.

The land management segment is anticipated to witness the fastest growth rate in the forecast period. Rising demand for land use planning, property management, and sustainable development to meet the needs of an expanding population is boosting the growth of the market. These geospatial technology solutions are being adopted by governments and private organizations to monitor land use, evaluate property lines, and better manage the use of natural resources.

By End-Use

In 2023, the utility segment dominated the market and accounted for a significant revenue share. These technologies are critical for infrastructure management, asset tracking, and service delivery, which fuels market growth. Utilities use geospatial tools for efficient network operations, real-time asset monitoring, and fast response to outages or maintenance requirements. The combination of GIS with smart grid technologies optimizes utilities that have an electric, water, and/or gas distribution network.

The defense & intelligence segment is expected to register the fastest CAGR during the forecast period. Increasing dependence on these technologies for surveillance, reconnaissance, and mission planning is anticipated to drive the market. Geospatial solutions are extremely important in this regard for military forces as they offer valuable insights regarding the local terrain, troop movements, and potential threats, all of which enable better decision-making in terms of military operations. The Incorporation of satellite Imagery, UAVs, and real-time data analysis improves the accuracy and efficiency of the defense plans.

Regional Landscape

In 2023, North America dominated the market, accounting for 34% of the total revenue share. This market is mainly driven by advancing technology adoption and demand from the main end-use industries such as defense, transportation, and urban planning. Promising initiatives by the governments to emerge technologies, such as smart city projects, environmental monitoring programs, etc. also create a positive impact on the growth of the market in the region due to better infrastructure systems. Additionally, having leading geospatial technology companies, along with the presence of R&D investment, enhances innovation and market growth.

Asia Pacific is expected to register the fastest CAGR during the forecast period. Driving the market are the country's business large-scale infrastructure extensions, urbanization, and intelligent town initiatives. Geospatial technology use continues to grow as economies in the region continue to invest in transportation, utilities, and environmental monitoring, among other sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Esri – ArcGIS

-

Hexagon AB – GeoMedia

-

Trimble Inc. – Trimble Business Center

-

Google – Google Earth Engine

-

TomTom – TomTom Maps API

-

HERE Technologies – HERE Location Services

-

Maxar Technologies – SecureWatch

-

Autodesk – AutoCAD Map 3D

-

Bentley Systems – OpenCities Map

-

SAP SE – SAP HANA Spatial

-

Oracle Corporation – Oracle Spatial and Graph

-

Microsoft – Azure Maps

-

IBM Corporation – IBM Environmental Intelligence Suite

-

Harris Geospatial (L3Harris) – ENVI

-

Mapbox – Mapbox Studio

Recent Developments

-

In August 2024, Trimble Inc. forecasted lower-than-expected quarterly revenue due to weak demand in its mobility and agriculture sectors amid a volatile economy.

-

In October 2024, Nvidia expanded its Earth-2 project, combining geospatial AI with physics simulations, gaining adoption by weather and climate authorities.

-

In November 2024, Niantic announced the development of a "Large Geospatial Model" utilizing data from Pokémon Go players to create detailed 3D maps.

-

In December 2024, World Labs, co-founded by AI pioneer Fei-Fei Li, raised $230 million to advance its large-scale geospatial AI models.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 410.1 Billion |

|

Market Size by 2032 |

USD 1434.6 Billion |

|

CAGR |

CAGR of 14.94% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Technology (GIS/Geospatial Analytics, Remote Sensing, GPS, 3D Scanning) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Esri, Hexagon AB, Trimble Inc., Google, TomTom, HERE Technologies, Maxar Technologies, Autodesk, Bentley Systems, SAP SE, Oracle Corporation, Microsoft, IBM Corporation, Harris Geospatial (L3Harris), Mapbox |