Virtual Reality Headset Market Report Scope & Overview:

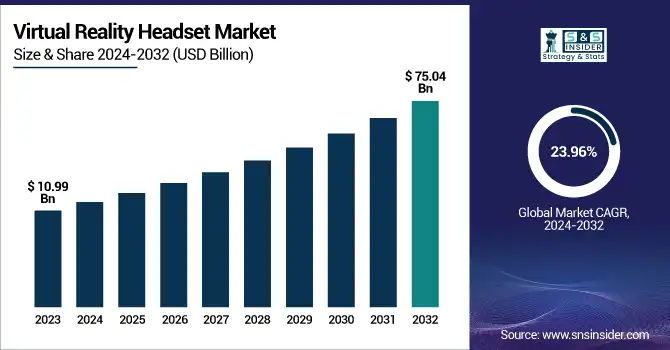

The Virtual Reality Headset Market Size was valued at USD 10.99 Billion in 2023 and is expected to reach USD 75.04 Billion by 2032 and grow at a CAGR of 23.96% over the forecast period 2024-2032.

To Get more information on Virtual Reality Headset Market- Request Free Sample Report

The Virtual Reality (VR) Headset industry is growing rapidly as consumer demand, technological advancements, and varied applications across gaming, healthcare, education, and enterprise segments continue to push market development. Technological advancements in hardware, increasing investment in immersive experiences, and expanding 5G networks that facilitate seamless VR connectivity are some of the major drivers impacting market growth. Market segment by device type market segment by product category, market segment by application, and standalone VR headsets are gaining popularity.

The U.S. Virtual Reality Headset Market was valued at USD 1.88 Billion in 2023 and is projected to reach USD 13.79 Billion by 2032, growing at a CAGR of 24.92% from 2024 to 2032. US Virtual Reality (VR) Headsets Market Overview In 2023, the US virtual reality (VR) headsets market is experiencing remarkable growth, fueled by increasing consumer demand, advancements in technology, and growing adoption by enterprises. The gaming industry still dominates, with education, healthcare, and corporate training emerging as potential high-growth areas. Next-gen VR headsets with better optics, AI features, and wireless functionality that key players such as Meta, Apple, and even HTC are investing in take the form of it. Adoption is being further fueled by the rise of the metaverse and 5G connectivity.

Virtual Reality Headset Market Dynamics

Key Drivers:

-

Rising Adoption of Immersive Gaming and Entertainment Drives Growth in the Virtual Reality Headset Market

Key Market Drivers Growth in the VR Headset Market: The sales of virtual reality headsets are primarily driven by the rise in immersive gaming experiences and interactive entertainment solutions. The focus of consumers is toward VR advancements for more realistic offerings on gaming consoles, PCs, and dedicated setups, which allow higher adoption. The demand skyrockets even more with services like streaming and virtual concerts. Further enhancements in display resolution, motion tracking, and AI-based interactions increase user engagement. This has cemented VR content as a mainstream entertainment medium with major gaming studios and entertainment companies pouring money into it. VR headsets find themselves in a pivotal space within the changing world of digital entertainment, amid this recent increase in demand.

Restraint:

-

High Costs and Affordability Issues Limit the Widespread Adoption of Virtual Reality Headsets in the Market

The cost barrier for mass adoption remains high despite the technological development of the new headsets. High-end devices are expensive, because of their advanced capabilities, including another resolution display and haptic feedback, making them less available to budget-conscious consumers. Costs are driven up further by the requirement for expensive hardware to enable high-end VR experiences. Most businesses are reluctant to invest in VR as VR comes with huge initial investment without clear ROI. Although low-cost alternatives are hitting the market, cost concerns still weigh on adoption rates, especially in developing markets, where disposable income and spend on premium tech remains low.

Opportunity:

-

Expanding Applications of Virtual Reality in Healthcare and Training Create New Growth Opportunities for the VR Headset Market

General Managers: VR in healthcare and training sectors are on high adoption, huge market potential Medical professionals also utilize VR in surgical simulations, mental health treatment, and pain management, improving patient care while reducing some of the risks involved. In a similar manner, industries like aviation, military and corporate training utilize VR for immersion-based learning environments, enhancing skill development and safety measures. The potential to replicate real-world situations without danger of physical harm renders VR a powerful educational tool. As VR’s potential is recognized by additional industries, more investments in specialized VR applications are on the rise, creating new revenue paths and widening the market beyond entertainment and gaming.

Challenge:

-

Technical Limitations and Motion Sickness Issues Hinder the User Experience in the Virtual Reality Headset Market

Nonetheless, technical limitations – including latency, motion tracking accuracy, and field-of-view constraints – remain a hindrance to widespread VR headset usage even with advancements. Latency and poor synchronization between what users are seeing and their physical movements cause motion sickness, dizziness, or discomfort for many users. Such problems will affect long-term use and as a result make VR less attractive for long periods of time. Moreover, large structure and the requirment for wired connections in a few high execution models lessen portability and convenience. These technical challenges all require ongoing innovation across both hardware and software stacks to iterate on experience to reduce bad side effects to enable broad adoption of VR.

Virtual Reality Headset Market Segments Analysis

By End-device

The high-end VR headsets segment category held the largest revenue share of 56.43%, attributed to rising demand for premium experience in gaming, enterprise applications, and professional simulations. The likes of Meta (Quest Pro), Apple (Vision Pro), and HTC (Vive XR Elite) have all released high-end headsets packed with high-res screens, eye-tracking, AI-driven interfaces and mixed reality support. These high-end devices target high-end professionals, developers, and consumers, fully interactive and a new level of realism. With the emergence of metaverses, enterprise training and high-fidelity gaming adoption, high-end VR headsets will be at the heart of revenue growth and technological evolution within the market.

During the forecast period, the low-end VR headset segment is expected to offer the highest CAGR of 25.19%, due to affordability and increasing accessibility. VR is now more accessible to mainstream users thanks to some cheaper headsets from companies like Meta (Quest 2), PICO (PICO 4), and Sony (PSVR). ↓ Standalone VR devices have become more sophisticated along with wireless and mobile VR tech, making them more attractive to casual gamers and new users. Increasing adoption of VR in education, fitness, and social applications is additionally stimulating the demand. Lower-end VR headsets are proving to be a major driver of growth in the VR market as prices decrease and content libraries grow.

By Product Type

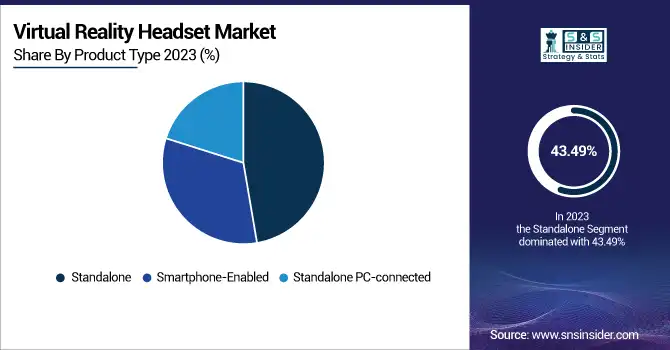

Standalone VR headset was the most prominent segment in the VR Headset Market, with a market share of 43.49% in 2023; this segment is estimated to grow with the same momentum, owing to technological innovations and increasing customer needs & preference for wireless all-in-one VR devices. Big Rift companies such as Meta (Quest 3) and HTC (Vive XR Elite) have released high-end standalone headsets with better computational power, higher resolution displays, clearer tracking, and more. Stand-alone VR as stand-alone VR continues to grow with manufacturers pouring efforts into the integration of AI, eye tracking and battery efficiency, the expectations is for sustained market growth and continued adoption.

The Smartphone-enabled VR headset segment is witness the highest compound annual growth rate (CAGR) of 24.90% during the study period, driven by affordability and increasing penetration of smartphones. Recently companies such as Samsung (Gear VR) and Google (Cardboard & Daydream View) have made inmersive experiences passable to a broader audience with the introduction of mobile VR solutions. The growth of 5G networks and VR streaming in the cloud would also help this segment expand. Organizations are investing in VR-ready devices as a result of the development and surplus of mobile-based immersive applications, and this is creating a significant growth in the Virtual Reality Headset Market.

By Application

The gaming segment accounted for the largest revenue share of 29.76% in 2023 in the Virtual Reality Headset Market, primarily due to rising demand for immersive gaming experiences. Pioneering companies like Meta (Quest 3), Sony (PlayStation VR2), and HTC (Vive XR Elite) have introduced cutting-edge headsets with high-resolution displays, better motion-tracking capabilities, and more robust haptic feedback. Adoption has also been further accelerated by the rise of cloud gaming and integration into the metaverse. Valve, Ubisoft, Epic Games and many other game developers invest in VR content, increasing the market’s potential. VR headset continue to define the future of the industry, where gaming still stands as the top the driving force.

The education segment in the Virtual Reality Headset Market is anticipated to expand at the most elevated CAGR of 16.10%. Such Emerging Adoption of VR for Interactive Learning, Virtual Field Trips, Skill-based Training, etc. Is Propelling this Growth VR platforms geared toward educational institutions include Meta's Quest for Business, Lenovo's VR Classroom 2 and Microsoft's HoloLens 2. Educational institutions are using VR to improve interactions and retention of concepts. A growing need for immersive learning experiences, particularly in medicine, engineering, and corporate training drives demand, with education being identified as a significant growth sector for VR headsets.

Regional Analysis

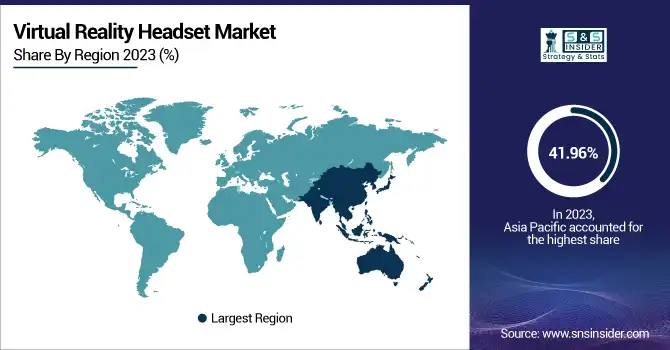

In 2023, the Asia Pacific region held the largest revenue share of 41.96% in the Virtual Reality Headset Market, which can be attributed to high consumer demand, the growth of the gaming industry in the region, and government support for digital innovation viz., through various initiatives. In tech, countries like China, Japan, and South Korea are the market leaders, with top players such as HTC, Sony, and Pico Interactive pouring dollars into VR innovation. In 2023, the Pico 4 Enterprise VR headset was released by Pico for business solutions while Sony released PlayStation VR2 for immersive gaming. With the latest breakthroughs in 5G technology and AI-backed VR systems, the hold of this industry is set to grow further, accelerating market growth.

During the forecast period, the North American market is projected to grow at the highest CAGR of 25.36%, owing to increasing investments on enterprise VR, healthcare applications, and metaverse development. Plus, profile of market-shaping product innovations from trailblazing companies like Meta, Apple, and Microsoft. In 2023, Meta debuted its Quest 3, giving it a face-lift and bringing mixed-reality capabilities, and Apple revealed its Vision Pro, changing layouts of contemporary spatial computing. Growth is further powered by the expanding use of VR in corporate training, telemedicine and defense applications. North America is an important region for VR growth, due to strong levels of R&D investment, high disposable income, and early technology adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the IoT in Smart Cities Market are:

-

Carl Zeiss AG – (ZEISS VR One Plus)

-

Facebook Technologies, LLC (Oculus) – (Oculus Rift, Oculus Quest 2)

-

Google LLC (Alphabet Inc.) – (Google Cardboard, Google Daydream View)

-

HTC Corporation – (HTC Vive Pro 2, HTC Vive XR Elite)

-

LG Electronics Inc. – (LG 360 VR)

-

Microsoft Corporation – (HoloLens 2, Windows Mixed Reality Headsets)

-

Razer Inc. – (Razer OSVR)

-

FOVE, Inc. – (FOVE 0)

-

Valve Corporation – (Valve Index)

-

HP Inc. – (HP Reverb G2)

-

Merge Labs Inc. – (Merge VR Headset, Merge AR/VR Cube)

-

Meta Platforms Inc. – (Meta Quest 3, Meta Quest Pro)

-

Samsung Electronics Co. Ltd. – (Samsung Gear VR, Samsung Odyssey+)

-

Sony Interactive Entertainment LLC (Sony Group Corporation) – (PlayStation VR, PlayStation VR2)

Recent Trends

-

March 2023- ZEISS VR One Plus received an update with improved lens technology.

-

October 2023 - Meta Quest 3 launched with enhanced pass through and higher resolution.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.99 Billion |

| Market Size by 2032 | US$ 75.04Billion |

| CAGR | CAGR of 23.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-device - (Low-end device, Mid-range device, High-end device) • By Product Type - (Standalone, Smartphone-enabled, Standalone PC-connected) • By Application - (Gaming, Healthcare, Media & Entertainment, Manufacturing, Retail, Education, Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carl Zeiss AG, Facebook Technologies, LLC (Oculus), Google LLC (Alphabet Inc.), HTC Corporation, LG Electronics Inc., Microsoft Corporation, Razer Inc., FOVE, Inc., Valve Corporation, HP Inc., Merge Labs Inc., Meta Platforms Inc., Samsung Electronics Co. Ltd., and Sony Interactive Entertainment LLC (Sony Group Corporation). |