Cloud Native Security Service Market Report Scope & Overview:

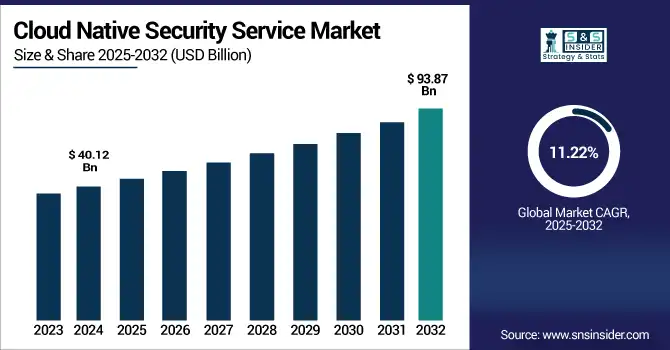

The Cloud Native Security Service Market size was valued at USD 40.12 billion in 2024 and is expected to reach USD 93.87 billion by 2032, expanding at a CAGR of 11.22% over the forecast period of 2025-2032.

To Get more information on Cloud Native Security Service Market- Request Free Sample Report

The Cloud Native Security Service Market is growing quickly due to the quick rise of containers, microservices, and serverless architectures. Security needs to be a part of these environments and built into DevSecOps processes. Cloud-native tools, including CNAPP, CSPM, CWPP, and CIEM, can help find misconfigurations, manage identities, and keep workloads safe while they are moving. Demand is rising due to security dangers and regulatory regulations related to the cloud, which are becoming more complicated. Organizations are adopting automation, zero-trust architecture, and policy-as-code to increase visibility and adherence to requirements. The market in North America is out front, and the fastest growth is being reported in the Asia Pacific. Future trends involve AI-based threat detection and agentless, multi-cloud security.

According to research, over 55% of cloud-native workloads lack agent-based security due to performance concerns, while misconfigurations in CI/CD pipelines cause 25–30% of breaches. AI-powered CNAPPs are reducing false positives by up to 70% compared to traditional rule-based tools.

The U.S Cloud Native Security Service Market size reached USD 10.44 billion in 2024 and is expected to reach USD 22.63 billion in 2032 at a CAGR of 10.16% from 2025 to 2032.

The U.S. market is leading with the early adoption of cloud, widespread availability of cloud native giants such as AWS, Microsoft Azure, Google Cloud, and clarity of DevSecOps culture. Increasing demand for strong cloud-native security models is driven by strict regulatory requirements, such as HIPAA, SOX, and CCPA. Increasing cyberattacks against container and cloud environments, widespread Kubernetes adoption, and a growing emphasis on zero-trust architecture are also driving it. Massive investment in AI-powered threat detection and real-time monitoring solutions also helps maintain the U.S. hegemony and innovation in this maturing field.

Market Dynamics:

Drivers:

-

Rising Integration of DevSecOps and Zero Trust Models Across Enterprise Environments Drives Market Expansion

The increasing adoption of DevSecOps and zero trust architectures is one of the major drivers of the cloud-native security market. Businesses are baking security into the software development lifecycle, boosting risk mitigation, and compliance on the fly. Systems based on principles of zero trust and continual security, along with least privilege, also harmonize particularly well in containerized environments and those built on the microservices model. Current cloud native security service market trends also show that we are headed toward more and more automated policy enforcement, native K8S (Kubernetes) controls, and security-as-code, especially in some of the most regulated industries including finance and health care.

According to research, around 74% of cloud-native organizations have integrated security into their CI/CD pipelines, enabling early vulnerability detection. Zero Trust adoption has reduced lateral threat movement by 67%, while DevSecOps in regulated sectors has boosted secure deployment frequency by 34% without compromising compliance.

Restraints:

-

Lack of Skilled Professionals and Complexity of Implementation Restrict the Widespread Deployment of Advanced Security Architectures

Despite increasing demand, the market is significantly hindered by a lack of skilled cybersecurity professionals and the difficulty of implementing and managing cloud-native security solutions. Advanced frameworks, such as CNAPP, CSPM, and CIEM need specialized skill sets in security and DevOps. Most corporations, especially SMBs, find it difficult to establish policies, real-time monitoring of threats, and adherence to compliance across hybrid or multi-cloud environments.

Opportunities:

-

Growing Emphasis on Agentless and AI-Powered Security Solutions Creates New Avenues for Scalable and Lightweight Deployments

Increasing adoption of agentless security solutions and AI-based threat detection is providing tremendous growth opportunities. Agentless architecture provides a low-overhead, faster time to value, and broader compatibility across multi-cloud environments, thus an ideal solution to server monitoring for modern DevOps teams. AI and ML models enhance anomaly detection, prioritize risks, and deter false positives, facilitating early incident identification. Recent directions include smart CNAPPs that can learn and adjust to application behavior dynamically, and without dependence on deep integration in the infrastructure.

Challenges:

-

Increased Risk of Misconfiguration and Visibility Gaps Across Distributed Environments Presents a Persistent Operational Challenge

One of the most important challenges in this market is the market misconfiguration risk and issues of end-to-end visibility in cloud-native environments. Its complexity and distributed nature make it difficult to ensure the same security controls are implemented across microservices, APIs, containers, and serverless functions that are growing at an unprecedented rate. Over the years, misconfigurations have been one of the top three reasons for data breaches in public cloud environments. Without unified dashboards, organizations struggle to track user permissions, network flows, and policy drift.

Segmentation Analysis:

By Component

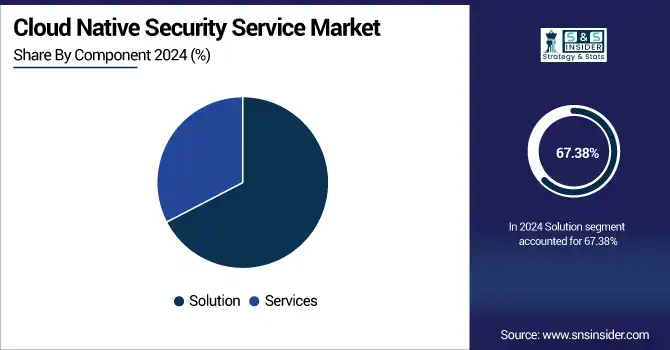

The Solution segment held a dominant 67.38% of revenue share in 2024, driven by strong demand for integrated cloud-native security platforms. The FortiCNAPP solution by major vendor Fortinet advanced with lifecycle protection, AWS Marketplace expansion. CrowdStrike also announced Falcon Cloud Security, a new CNAPP that combines code-to-cloud visibility and AI-powered threat remediation in a single offering. These innovations are driven by an increase in cyber threats, regulatory compliance and demand for consolidated security. Due to the organizations making the shift from manual to automated protection, the Solution segment continues to be the most prominent in the Cloud Native Security Service Market.

The Services segment is projected to grow at a 12% CAGR, fueled by increasing demand for managed cloud-native security offerings. Vendors, such as Sysdig integrated AI-driven Sage into their CNAPP to streamline threat analysis, while security service providers ramp up expert-led vulnerability assessments and compliance operations in hybrid-cloud environments. This surge is driven by digital transformation and the rising sophistication of cyber threats. In the Cloud Native Security Service Market, Services play a critical role by offering scalable, managed, and customized security solutions to enterprises lacking in-house expertise.

By Deployment

The Private Cloud segment led with a 50.38% share in 2024, driven by the enterprises' need to adhere to data sovereignty constraints, regulatory mandates, and/or legislation, and protect sensitive workloads. For instance, HPE beefed up its GreenLake private cloud services to provide cloud-native security for hybrid. Likewise, Check Point has introduced SASE based on India to comply with local regulatory requirements. This trend is fuelled by rising cyber threats and the increase in tight legislation on data residency.

The Hybrid Cloud segment is expanding rapidly, with a 12.07% CAGR, supported by growing demand for flexible and secure hybrid architectures. Hybrid defenses boosted with AI-infused CNAPP tools from market players including Sysdig and CrowdStrike that span across on-prem and cloud for consolidated visibility. This cloud native security service market growth is fueled by the demands of digital transformation strategies that need to scale security while balancing compliance and cost. One Segment that Allows Flexibility and End-End Protection Across Environments is the Hybrid Deployment Model.

By Enterprise Size

Large Enterprises dominated with a 60.39% revenue share in 2024, driven by the need for robust, scalable defenses. Cloud native security service market companies including Fortinet and CrowdStrike tailor solutions such as FortiCNAPP and Falcon Cloud Security specifically for large-scale deployments. These platforms support extensive regulatory compliance, high-volume data protection, and AI-driven threat detection, aligning with enterprise needs. The sector is growing fast as large enterprises increasingly migrate to cloud-native architectures, making this segment central to the evolution of the Cloud Native Security Service Market.

The SMEs segment is forecasted to grow at an 11.79% CAGR, driven by affordable, managed cloud-native security services. Startups including Harness and Traceable launched new CNAPP solutions specifically for modern cloud-native applications. Companies are adopting scalable, subscription-based security tools that reduce complexity and require minimal expertise. The growth is enabled by the increasing capability of vendors to deliver enterprise-grade solutions tailored for SME budgets and operational agility.

By End-Use

The BFSI sector led with a 21.47% revenue share in 2024, driven by stringent data protection regulations. Market leaders including Zscaler, in partnership with Vectra AI, enhanced AI-based threat detection to secure financial cloud environments. Additionally, solutions including CrowdStrike Falcon Cloud Security offer prioritized risk intelligence and runtime protection tailored for finance. This dominance is fueled by the financial sector’s need for real‑time monitoring, threat resilience, and compliance.

The Retail & E‑commerce segment is growing at a 13.57% CAGR, driven by rapid growth in digital sales and omnichannel platforms. Vendors are expanding offerings, such as Fortinet's CNAPP and AI-based detection, to secure e‑commerce infrastructures. Similarly, cloud-native SASE launches, such as Check Point’s India-based instance support regional compliance in digital retail markets. Growth is also driven by rising retail cyberattacks and regulatory compliance.

Regional Analysis:

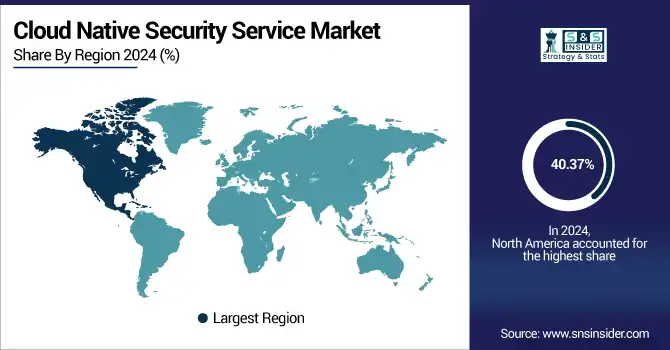

North America held the largest Cloud Native Security Service Market share in 2024, accounting for 40.37% of global revenue. This dominance is fueled by early adoption of cloud technologies, a mature cybersecurity ecosystem, and a strong presence of cloud-native security vendors such as Palo Alto Networks, IBM, Fortinet, and Cisco. Robust digital transformation strategies and high enterprise cloud spending further strengthen the region’s leadership. The United States leads the regional market due to its advanced IT infrastructure, significant investments in AI and cybersecurity technologies, and the presence of top cloud service providers including AWS, Microsoft Azure, and Google Cloud.

Europe represents a significant share in the market, driven by strict data protection regulations, such as GDPR, growing awareness of cybersecurity risks, and adoption of hybrid/multi-cloud infrastructures. Enterprises are increasingly implementing cloud-native security tools to meet compliance needs and improve operational resilience amidst rising cyberattacks and geopolitical uncertainties. Germany dominates the European market owing to its strong industrial base, leadership in Industry 4.0, and proactive digitalization initiatives. Enterprises in sectors including manufacturing and finance have rapidly embraced secure cloud-native platforms.

Asia Pacific is the fastest-growing region with a CAGR of 30.72%, driven by rapid digital transformation, increasing adoption of cloud services, and government support for cybersecurity infrastructure. The region is witnessing a surge in demand from BFSI, telecom, and e-commerce sectors that are vulnerable to rising cyber threats. China is the leading country in the region, backed by its massive digital economy, investments in cloud-native innovation, and strong government support for data security initiatives, especially across manufacturing and public sector digital platforms.

The Middle East & Africa and Latin America regions are witnessing steady growth in the Cloud Native Security Service Market, driven by increasing cloud adoption across sectors including BFSI, energy, telecom, and government. Countries including the UAE and Brazil are leading due to rapid digital transformation, proactive cybersecurity strategies, and rising regulatory focus on data privacy and infrastructure modernization.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major key players of the Cloud Native Security Service Market are Amazon Web Services, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Zscaler, Inc., IBM Corporation, Broadcom, Inc., Trellix, Proofpoint, Inc., and others.

Key Developments:

-

In June 2024, Zscaler expanded its partnership with Vectra AI to integrate AI-powered threat detection into its ZIA and ZPA services. Additionally, Zscaler announced the acquisition of Red Canary to enhance its managed threat detection capabilities.

-

In May 2024, Cisco acquired Isovalent, a leading cloud-native network security provider and primary contributor to Cilium. The acquisition strengthens Cisco’s Kubernetes-native security capabilities and enhances its position in the cloud-native observability and security ecosystem.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 40.12 Billion |

| Market Size by 2032 | USD 93.87 Billion |

| CAGR | CAGR of 11.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (solution, services) •By Deployment (Private, Hybrid, Public) •By Enterprise Size (Large_Enterprises, SMEs) •By End Use (BFSI, Retail Ecommerce, IT Telecom, Healthcare, Manufacturing, Government, Aerospace Défense, Energy Utilities, Transportation Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Zscaler, Inc., IBM Corporation, Broadcom, Inc., Trellix, Proofpoint, Inc. |