Event Apps Market Report Scope & Overview:

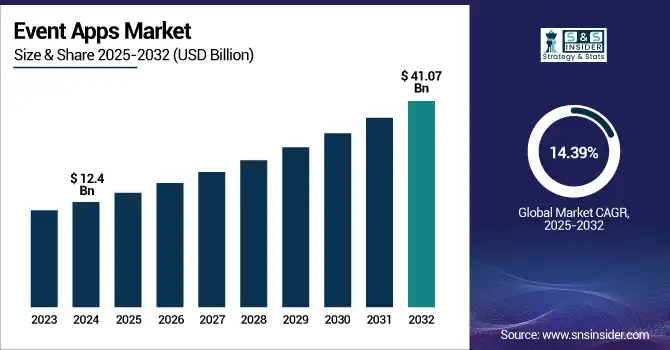

The Event Apps Market was valued at USD 12.4 billion in 2024 and is expected to reach USD 41.07 billion by 2032, growing at a CAGR of 14.39% from 2025-2032.

To Get more information on Event Apps Market - Request Free Sample Report

The expansion of the Event Apps Market is being fueled by the growing need for digital solutions for event management, improved attendee interaction, and individualized experiences. The popularity of hybrid and virtual events, mobile technology growth, and artificial intelligence is also driving the growth of the market. Furthermore, the expanding requirement of businesses for streamlined event planning and analytics software is further fueling the usage of event apps across the world.

According to ON24, AI-driven content hubs experienced visitors increase by 110%, webinars that were promoted by AI experienced visitor traffic increase by 109%, CTA interaction increased by 68%, and demo requests increased 4 times, proving the strength of AI in event activity and conversion.

Based on studies, 83% of event planners are leveraging event apps for better planning, while 82% of sports viewers interact with one another through their mobile phones while watching events, highlighting the increasing importance of event apps in delivering face-to-face and real-time engaging experiences.

U.S. Event Apps Market was valued at USD 3.45 billion in 2024 and is expected to reach USD 9.86 billion by 2032, growing at a CAGR of 14.05% from 2025-2032.

The U.S. Event Apps Market is expanding with expanding digital event management software adoption, improved virtual and hybrid events, and real-time engagement functionality needs. Improvements in mobile technology, artificial intelligence, and personalized experiences also influence the market growth across industries and sectors.

Based on studies, in 2022, there were 7,426 American companies specializing in trade show and conference planning with the highest being in California (932), followed by Florida (468) and New York (429).

Event Apps Market Dynamics

Drivers

-

Widespread smartphone penetration and internet access are significantly accelerating the adoption and use of event apps globally

Greater use of smartphones and broadband connectivity has transformed event planning and experience delivery. Today's audience participants anticipate real-time updates, effortless navigation, and interactive digital offerings such as mobile event apps. Organizers benefit from improved communication, data-driven insights, and streamlined attendee management. With mobile usage increasing across the world, particularly in developing markets, demand for mobile-centric event solutions keeps on growing. Also, cloud platforms have greater scalability and accessibility, and hence mobile-driven experiences form a vital part of current event strategies in sectors.

According to research, 78% of the businesses utilizing a mobile event app have seen their return on investment (ROI) improve. Furthermore, 67.2% of event management platforms with mobile event apps have lead scanning as a prominent feature, and 67.5% of the attendees find mobile event apps an integral component of the event.

Restraints

-

Data privacy concerns and cybersecurity risks are limiting the full-scale adoption of event apps among cautious organizations and users

Event apps collect an enormous amount of sensitive data, such as personal information, location information, and behavioral data, which pose serious privacy concerns. Organizations, especially those dealing in highly regulated industries, face tremendous pressure to comply with data protection regulations like GDPR and CCPA. Fear of data breaches, unauthorized access, and misuse of attendee data causes apprehension, especially for large events. Besides, the lack of standardized security practices among providers contributes to the fear. With changing cyber threats, companies are hesitant to adopt until they are satisfied with strong cybersecurity practices, holding back market growth.

Opportunities

-

Increased demand for virtual and hybrid events is opening up new application opportunities for event apps in various industries

The transition to hybrid and virtual formats, prompted by the pandemic, opened immense possibilities for event app innovations. Businesses now realize the value of engaging remote participants with features like live streaming, virtual networking, and on-demand content. Event apps are the essential infrastructure for enabling these to occur with efficiency. This trend has created a broader customer base beyond traditional event planners to include corporations, schools, and non-profits. In addition, the capability of measuring digital interaction in real time creates new models of revenue by way of sponsorship and sponsored content. With hybrid formats emerging as the new trend, event apps have much to gain from this shift in event strategy and production.

According to research, 93% of event organizers plan to invest in virtual events in the future, and 95.5% believe virtual events will be a part of their strategy moving forward. Additionally, 38.8% of respondents think hybrid events will be the most popular in the next year.

Challenges

-

Fragmented ecosystem and lack of integration with existing enterprise tools reduce operational efficiency and user adoption

Most event apps fail to integrate seamlessly with larger enterprise ecosystems like CRM systems, marketing automation software, or internal comms systems. This fragmentation restricts data synchronization, adds manual labor, and dilutes the full potential of event technology. Organizations then end up handling numerous systems, and this causes inefficiencies as well as a negative user experience for planners and attendees. Also, the lack of industry-standard APIs does not make interoperability easier and costly. Until greater integration, firms will not be inclined to incorporate event apps into business processes. Such fragmentation remains one significant barrier to large-scale industry-wide adoption.

Event Apps Market Segment Analysis

By Type

Enterprise Event Apps segment led the Event Apps Market with a maximum revenue share of nearly 28% in 2024 as large-scale organizations are looking more for customized, secure, and scalable platforms to organize conferences, internal meetings, and client events. Enterprises prioritize analytics, integration with internal systems, and heightened attendee engagement and hence prefer customized enterprise-grade solutions. Their large budgets and drive for digital transformation largely helped this segment lead by revenue.

Hybrid Apps segment is expected to grow at the fastest CAGR of nearly 16.47% in 2025–2032, as a result of increasing demand for seamless, cost-effective solutions across various platforms. As event planners contact both Android and iOS users without needing different codebases to accommodate, hybrid applications have the advantage of rapid deployment, easy updates, and reduced development costs. The flexibility and growing performance of hybrid technologies are giving rise to this rapid market expansion.

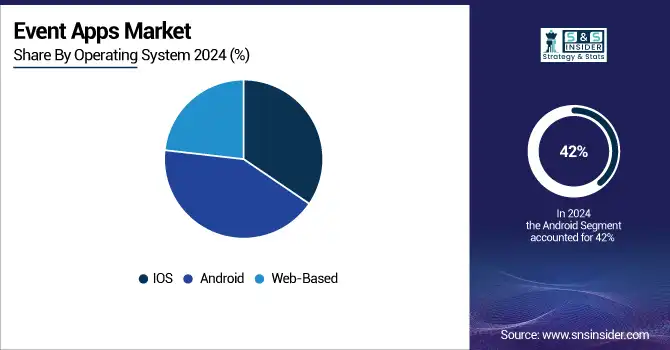

By Operating System

Android segment accounted for the maximum revenue share of approximately 42% in 2024 within the Event Apps Market as a result of its large base of users worldwide, especially across developing countries. The low-cost, open-source characteristic and the cheap price tag of Android devices made them very popular with event visitors. Furthermore, the need for compatibility with Android comes high in developers' list so that the audience becomes extensive, resulting in high app usability and availability, cementing the number one spot in event apps for Android.

Web-based segment is expected to expand at the fastest CAGR of nearly 15.75% during the forecast period from 2025–2032 owing to its availability on all devices without any download requirement. With growing hybrid and virtual events, web-based apps facilitate speedy deployment, instantaneous updates, and wider reach, particularly among the install-hesitant users. Being less costly to develop and maintain, they are a good option for planners who want the maximum accessibility and interaction.

By End User

Event Planners and Organizers segment dominated the Event Apps Market with the highest revenue share of about 38% in 2024 as a result of their inherent reliance on event technology to streamline operations, monitor attendees, and optimize instant interaction. Such experts specifically invest in event-specific tools to organize complex logistics and ensure seamless event delivery. Their very position within the events ecosystem organically makes them the key users and drivers of total market revenue.

Corporates segment is expected to grow at the fastest CAGR of approximately 15.95% between 2025–2032, driven by the growing adoption of internal events, town halls, product launches, and client-conference events. Event apps are being utilized by corporates to promote employee engagement, brand experience, and operational efficiency. Digital-first communication planning and work-from-anywhere culture adoption is also encouraging corporates to adopt scalable event technology solutions to achieve better connectivity and influence.

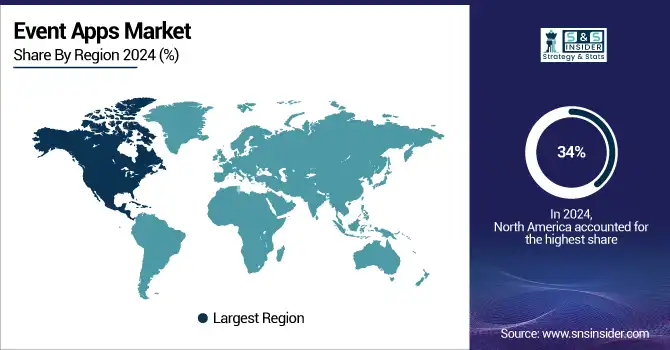

Regional Analysis

North America dominated the Event Apps Market with the highest revenue share of approximately 34% during 2024 due to its advanced digital ecosystem, high smartphone penetration, and early uptake of event technologies. High density in the area of tech firms, regular corporate activities, and mature event management business fuel consistent demand. In addition, investment in AI, analytics, and personalization features in event apps continues to fuel revenue generation across public and private sectors.

The U.S. led the Event Apps Market trend based on frequent corporate events, robust digital uptake, and infrastructure supporting data-driven, real-time event management.

Asia Pacific is anticipated to expand at the fastest CAGR of around 16.51% during the forecast period of 2025–2032, driven by growing digitalization, growing internet penetration, and growth in the middle class going to more organized events. India, China, and Southeast Asia are observing a rise in corporate events, conferences, and cultural events. Regional players are also providing economic solutions, making event apps inexpensive and fuelling adoption among varied segments of users

China dominated the Event Apps Market due to rapid urbanization, booming tech ecosystem, and rising demand for digital solutions across large-scale conferences, expos, and corporate events.

Europe has a strong presence in the Event Apps Market because of its well-developed event industry, high digital technology adoption, and growing need for sustainable, hybrid event solutions in corporate, cultural, and academic sectors, especially in Western European nations.

Germany dominated the Event Apps Market due to its robust economy, high demand for business and industrial events, and strong adoption of digital solutions for event management and attendee engagement.

Middle East & Africa and Latin America are witnessing growth in the Event Apps Market because of growing digital transformation, heightened mobile usage, and mounting interest in organizing international conferences and exhibitions, propelling demand for effective, technology-facilitated event management solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Whova, Cvent Inc., Evenium, Eventbase Technology Inc., Livestorm Inc., Meeting Application, ON24, Inc., SpotMe, WebEx Events, Yapp Inc., LiveTiles, CadmiumCD, Splash, Hubilo, Aventri, Bizzabo, Freeman, DoubleDutch, Hopin, Swapcard, Attendify, Eventbrite.

Recent Developments:

-

In June 2024, Cvent introduced key updates to its Attendee Hub, including features like live captions, self-service branded apps, and SMS verification for webinars. New functionalities enhance attendee engagement with bulk media uploads, contact sharing, and agenda improvements.

-

In March 2024, over 1,480 companies, including General Electric, Amazon Web Services, and Salesforce, adopted Webex Events for webinars and webcasts, marking a significant milestone in the platform's widespread adoption across industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.4 Billion |

| Market Size by 2032 | USD 41.07 Billion |

| CAGR | CAGR of 14.39% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Enterprise Event Apps, Hybrid Apps, Meeting Apps, Conference Apps, Trade Show Apps, Festival Apps, Sports Event Apps) • By Operating System (iOS, Android, Web-based) • By End User (Event Organizers and Planners, Corporates, Government, Education) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Whova, Cvent Inc., Evenium, Eventbase Technology Inc., Livestorm Inc., Meeting Application, ON24, Inc., SpotMe, WebEx Events, Yapp Inc., LiveTiles, CadmiumCD, Splash, Hubilo, Aventri, Bizzabo, Freeman, DoubleDutch, Hopin, Swapcard, Attendify, Eventbrite. |