Clustering Software Market Report Scope & Overview:

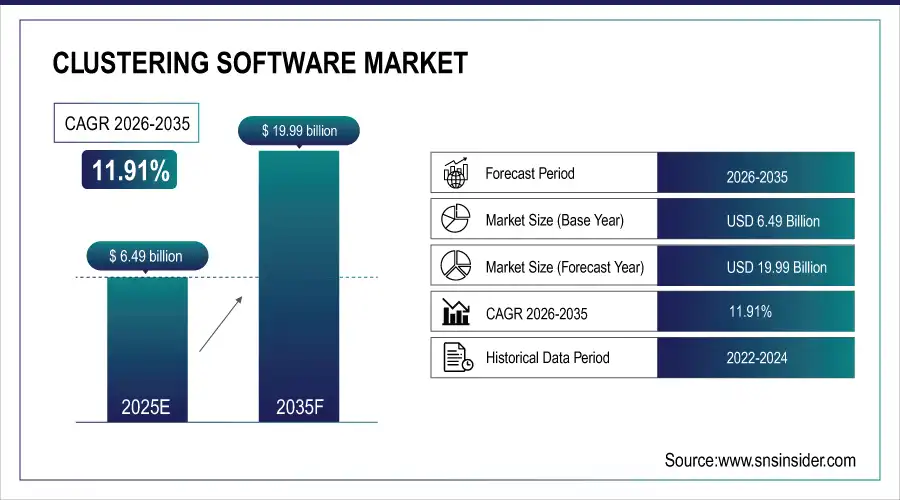

The Clustering Software Market size was valued at USD 6.49 billion in 2025 and is expected to reach USD 19.99 billion by 2035, growing at a CAGR of 11.91% during 2026-2035.

The clustering software market growth is driven by the rising use of data analytics, AI, and machine learning in various sectors. Companies are using clustering software to bolster decision-making, identify trends, and improve data segmentation. The clustering software market trends indicate that more inclination towards self-service analytics, a growing preference for cloud deployment, and Integration with big data platforms. BFSI, healthcare, and IT and telecommunications sectors are at the forefront of adoption. The demand for huge amounts of data, advanced tools for business intelligence, and automation is driving growth. Based on Clustering Software Market analysis, it indicates that the market is expected to grow tentatively over the next decade, owing to technological developments and digital transformation projects. The second highlights sustained, robust demand, especially for companies that deploy solutions that take advantage of AI.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 6.49 Billion

-

Market Size by 2035 USD 19.99 Billion

-

CAGR of 11.91% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get more information On Clustering Software Market - Request Free Sample Report

Clustering Software Market Trends:

-

Increasing integration of AI and machine learning in clustering software for automated insights and pattern discovery.

-

Rising adoption of unsupervised learning and clustering algorithms across industries like healthcare, finance, and retail.

-

Growing emphasis on data mining and predictive analytics to support digital transformation initiatives.

-

Expansion of customer segmentation and targeted marketing to enhance personalization and engagement.

-

Increasing availability of large-scale digital customer data, driving demand for scalable and efficient clustering solutions.

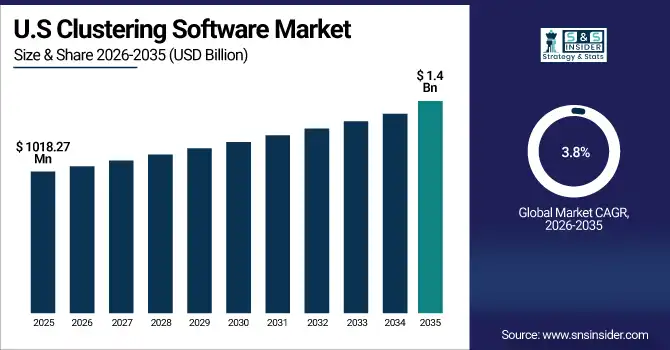

The U.S. Clustering Software Market is expected to be worth around USD 1018.27 Million in 2025, growing at a CAGR of 3.8% during the forecast period and reaching the value of USD 1.4 Billion in 2035. Growth is attributed to the adoption of AI and machine learning technologies, increasing demand for data analytics, and the demand in the market for efficient customer segmentation. These factors are likely to help in maintaining consistent growth for the market in the following years.

Clustering Software Market Growth Drivers:

-

Rising AI/ML Integration Drives Clustering Software Demand by Enabling Automated Insights and Pattern Discovery.

Artificial intelligence (AI) and machine learning (ML) are one of key factors driving the clustering software market to witness extensive adoption in recent times. Unsupervised learning is one of the important tasks in the field of machine learning, and clustering algorithms are one of the main topics of unsupervised learning. These technologies are being used by industries including healthcare, finance, and retail to better understand data and make smart decisions. With the data volumes increasing rapidly, effective analytical software becomes a necessity for clustering to hold everything all together with efficiency and scalability. Such evolving demand is paving the growth of the market as enterprises are now prioritizing data mining & predictive analytics in their digital transformation agendas.

Clustering Software Market Restraints:

-

High Technical Complexity Limits Adoption Due to the Need for Skilled Professionals and Accurate Model Selection.

Although clustering software is indeed helpful, it can be difficult to apply and interpret, especially for enterprise success teams without trained data science individuals. But the different clustering algorithms can give us different results, and finding the right one over a concrete dataset is always a challenge. The analytics, to be useful and actionable, often require in-depth analysis expertise; this is not accessible to SMEs (Small and Medium Enterprises) due to limited testing resources. Furthermore, if proper parameters are not set for clustering or if the quality of the data is not up to the mark, it can produce inappropriate clustering results and lead to wrong insights. This can inhibit adoption, particularly for organizations with limited experience with advanced analytics or who cannot support ongoing maintenance and recalibration.

Clustering Software Market Opportunities:

-

Growing Need for Customer Segmentation Fuels Clustering Software Use in Targeted Marketing and Personalization.

With more companies seeking to provide personalized experiences, the need for customer segmentation tools has never been greater. With clustering software, organizations can divide customers into groups with similar behavior, demographics, or preferences, allowing them to gain valuable insights into their customer base, eventually enhancing marketing efforts, product development, and customer service. It becomes crucial in areas such as e-commerce, retail, and digital services, where the impact of personalized engagement affects revenue and loyalty directly. Moreover, the transition towards digital-first models has created abundant customer data, ideal circumstances for clustering use cases. This is an enormous growth opportunity for vendors to deliver scalable, easy-to-use solutions designed for marketers and customer analytics.

Clustering Software Market Segment Analysis:

By Type

Self-Service Clustering segment dominated the clustering software market and accounted for 44% of revenue share in 2025. As grew the most with easier UI, fewer requirements for IT team intervention, and rapid self-service analytic adoption of large enterprises. With an attempt to give non-technical users the ability to do self-service frameworks, the segment is expected to continue growing consistently due to the requirements of speed of decision making and flexibility in data exploration tools for business intelligence solutions. The hybrid clustering segment is expected to register the fastest CAGR during the forecast period, as it offers a flexible solution that allows integrated on-premise cybersecurity with cloud scalability. Hybrid models are quickly being adopted by organizations looking for compromise between the demands of handling sensitive data and the need to continue to drive high-performance computing forward. The growth of this segment in the time to come will be considerably driven by continuous trends towards digital transformation and cloud integration.

By Deployment

The on-premises segment dominated the market and accounted for 69% of the clustering software market share in 2025, due to greater control over data, due to security compliance, and legacy infrastructure in large enterprises. It continues to be the choice for sectors with stringent data governance mandates. Although growth remains where it is, we could see a bit of a taper as businesses continue the move to scalable, more cost-effective cloud solutions as they chase digital agility. Cloud segment is expected to register the fastest CAGR during the forecast period, due to increasing needs for scalability, remote access, and affordability. The cluster approach is fast to deploy and integrates easily with AI/ML platforms making it popular with SMEs and digitally native firms that are increasingly turning toward cloud-based clustering. The segment will continue to grow well in the future as the adoption of cloud by different sectors continues to grow.

By Enterprise Size

The larger enterprises segment dominated the clustering software market and accounted for a significant revenue share in 2025, because they have a huge volume of data to process and an advanced analytics infrastructure and resources to invest in such complex clustering solutions. Their push towards enhancing customer insights, operations, and predictive analytics keeps them in demand. We expect the segment to continue growing steadily as large enterprises continue to drive digital transformation and data-driven strategies. The SME segment is expected to grow at the fastest CAGR owing to the increasing availability of low-cost cloud-based clustering tools and growing awareness about the advantages of data analytics. SMEs are spending billions on intelligent software for improving the targeting of customers and the efficiency of operations, as competition becomes more brutal. Government Digital Initiatives & Flexible Subscription Models Will Continue to Enable Rapid Adoption in This Segment

By End-Use

The Retail segment dominated the clustering software market and accounted for the largest market share in 2025, owing to high consumer demand for customer segmentation, personalized marketing, and inventory optimization. Clustering software is used by retail businesses to build loyalty programs, optimize operations, and gain insights into purchasing behavior. With the growing e-commerce, along the omnichannel strategies, the segment is anticipated to perform exceedingly well, backed by data-backed decision-making and a dynamically competitive market. Healthcare & Life Sciences is forecast to be the fastest growing vertical, as it provides actionable insights for patient segmentation, discovering disease patterns, and drug discovery across the globe. Clustering software is used for genomic research, personalized medicine and clinical data analysis. The growing use of AI-assisted diagnostics and the increased emphasis on precision health care will drive rapid growth in this segment.

Clustering Software Market Regional Analysis:

North America Clustering Software Market Insights

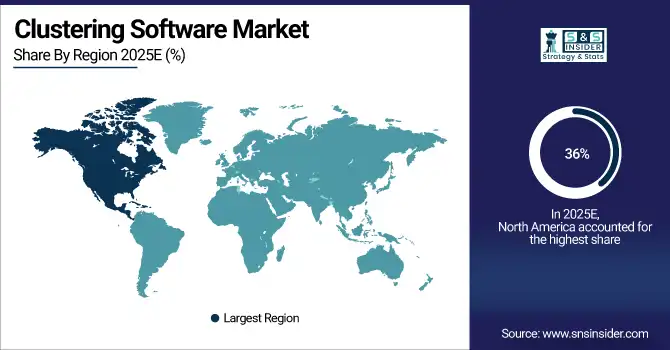

North America dominated the clustering software market and accounted for 36% of revenue share in 2025, due to the presence of key clustering software vendors and early technology adoption across industries, including retail and e-commerce, media and entertainment, and government and defense in North America. Sustained investments in advanced analytics, cloud infrastructure, and data security will foster regional growth, particularly across the BFSI, healthcare, and retail verticals.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Clustering Software Market Insights

The Asia Pacific is expected to register the fastest CAGR during the forecast period, due to the rapid digital transformation, increasing IT infrastructure, such as telecommunications, and growing penetration of AI-driven analytics across several emerging economies like India and China. The future growth in the region will be mostly reinforced on account of the government initiatives in favor of digitalization, coupled with the growing trend of SMEs towards cost-efficient clustering solutions. The Asia Pacific Clustering software market was led by China, due to large scale digital transformation, robust government support for AI initiatives, and quick enterprise big data analytics adoption. Smart Technology Adoption Continues: Demand for cloud infrastructure will support strong headline growth for the country in the years ahead.

Europe Clustering Software Market Insights

The growth of the market in Europe is primarily supplemented by the rising demand for data-driven decision making, sound regulatory frameworks supporting data security, and increasing adoption of artificial intelligence across industries. The market will exhibit consistent growth driven by digital advances and government initiatives throughout sectors. The European clustering software market was dominated by Germany owing to its strong IT infrastructure, as well as a good industrial base, and manufacturing analytics leadership in the country. The clustering software market in Germany will remain positive driven by sustained focus on Industry 4.0, AI integration, and smart factory initiatives.

Latin America (LATAM) and Middle East & Africa (MEA) Clustering Software Market Insights

In 2025, the Latin America (LATAM) and Middle East & Africa (MEA) clustering software markets are witnessing steady growth, driven by increasing adoption of AI/ML-based analytics and data-driven decision-making. Rising demand for customer segmentation, predictive analytics, and personalized marketing, coupled with expanding digital infrastructure, cloud adoption, and e-commerce growth, is creating significant opportunities for software providers across these regions.

Clustering Software Market Key Players:

The major clustering software market companies

-

Microsoft Corporation

-

IBM Corporation

-

Amazon Web Services (AWS)

-

Google LLC

-

Oracle Corporation

-

SAS Institute Inc.

-

SAP SE

-

Cloudera Inc.

-

Databricks Inc.

-

HPE (Hewlett Packard Enterprise)

Competitive Landscape for Clustering Software Market:

SAS Institute Inc. is a global leader in advanced analytics and data management solutions, offering robust clustering software for customer segmentation, predictive modeling, and pattern discovery. Its AI- and ML-powered platforms help enterprises across healthcare, finance, retail, and other sectors derive actionable insights, optimize decision-making, and enhance personalized marketing strategies.

-

In May 2025, at SAS Innovate 2025, SAS introduced significant enhancements to its Viya platform, including AI agents, improved digital twin simulations, and the hybrid use of quantum AI for complex manufacturing tasks. These advancements aim to bolster responsible AI deployment and decision intelligence across industries.

SAP SE is a leading enterprise software provider offering advanced clustering and analytics solutions for customer segmentation, predictive insights, and data-driven decision-making. Its platforms enable businesses across retail, finance, and healthcare to analyze large datasets, optimize operations, personalize marketing, and improve overall efficiency through AI- and ML-powered clustering capabilities.

-

In March 2025, SAP announced the integration of a Knowledge Graph Engine into SAP HANA Cloud, enabling sophisticated data modeling and querying using RDF and SPARQL. This enhancement facilitates advanced analytics and decision-making capabilities within the platform.

| Report Attributes | Details |

| Market Size in 2025 | USD 6.49 Billion |

| Market Size by 2035 | USD 19.99 Billion |

| CAGR | CAGR of 11.91% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Self-Service Clustering, Managed Clustering, Hybrid Clustering) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Microsoft Corporation, IBM Corporation, Amazon Web Services (AWS), Google LLC, Oracle Corporation, SAS Institute Inc., SAP SE, Cloudera Inc., Databricks Inc., HPE (Hewlett Packard Enterprise and others in report |