Digital Audio Workstation Market Report Scope & Overview:

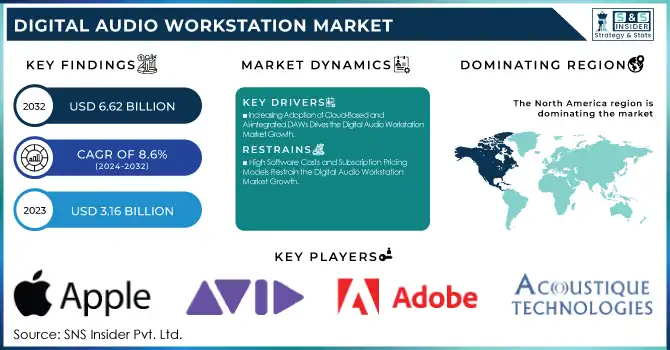

The Digital Audio Workstation Market Size was valued at USD 3.16 Billion in 2023 and is expected to reach USD 6.62 Billion by 2032 and grow at a CAGR of 8.6% over the forecast period 2024-2032. The Market analysis can include details like the division of professional and hobbyist users, including adoption rates in software versus hardware solutions, as well as DAW licenses and subscription pricing trends. Music production trends, especially AI-driven composition tools and cloud-based DAWs, are also important here. Furthermore, statistical data on device compatibility, including the spread of users across Windows, macOS, and mobile platforms, as well as industry-specific adoption rates in music production, broadcasting, game development, and education, help illustrate key market dynamics.

Get more information on Digital Audio Workstation Market - Request Sample Report

Digital Audio Workstation Market Dynamics

Key Drivers:

-

Increasing Adoption of Cloud-Based and AI-integrated DAWs Drives the Digital Audio Workstation Market Growth

The growing integration of cloud-based and AI-powered digital audio workstations (DAWs) is significantly driving market expansion. Cloud-based DAWs, musicians, producers, and audio engineers can collaborate from anywhere, access projects from various devices, and minimize hardware dependence. AI-driven tools also optimize workflow efficiency through features such as automated mastering, intelligent sound design, and real-time audio enhancements. These advancements are available for professionals and hobbyists alike, thereby expanding the use of DAWs across industries in music production, gaming, broadcasting, and education. The DAW market is gaining pace as the demand for affordable, scalable, and AI-infused audio solutions increases.

Restraint:

-

High Software Costs and Subscription Pricing Models Restrain the Digital Audio Workstation Market Growth

Despite the increasing popularity of DAWs, high pricing remains a major barrier for independent artists, small studios, and emerging musicians. Many premium DAWs have one-time licensing fees or monthly/annual subscriptions, which puts them out of reach for a budget-conscious user. Costs related to essential plugins, virtual instruments, and sound libraries add further costs. Free DAWs with limited features somewhat mitigate the problem, but professionals need more advanced software with greater capabilities. With increased competition, pricing models have to adapt to reach a wider consumer base without sacrificing profitability.

Opportunity:

-

Rising Popularity of Mobile and Cross-Platform DAWs Creates Growth Opportunities in the Digital Audio Workstation Market

The increasing adoption of mobile and cross-platform DAWs is opening new avenues for market growth. Modern musicians and producers seek flexibility, leading to a surge in demand for iOS and Android-compatible DAWs. These applications offer mobile music production solutions that do not necessarily need high-end computers. Furthermore, cloud synchronization and seamless cross-platform compatibility allow users to begin projects on mobile devices and finalize them on desktops, enhancing workflow efficiency. With the development of mobile processing power and 5G connectivity, mobile DAWs will attract hobbyists and professionals alike. This trend offers a huge opportunity for software developers to increase their user base.

Challenge

-

Compatibility Issues Between DAWs and Third-Party Plugins Pose a Challenge in the Digital Audio Workstation Market

One of the major challenges in the DAW market is compatibility between software and third-party plugins. Most producers rely on virtual instruments, effects plugins, and sound libraries to thicken up the sounds of their productions. However, these generate different issues, such as plugin formats that are either VST, AU, or AAX, and software versions that might become unstable, crash, or work partially. Moreover, OS updates might make a few plugins become non-operable or result in expensive upgrades. Inconsistencies plague users and interrupt workflows, especially for professional use with complex projects. Seamless integration and backward compatibility are always challenges for DAW developers.

Digital Audio Workstation Market Segments Analysis

By Operating System

The Windows segment of the Digital Audio Workstation market accounted for the largest share of revenue in 2023, holding 27%. The reasons behind this are the vast popularity of Windows-based PCs in the audio engineers, producers, and musicians' community. Because of the available hardware and relatively low prices, Windows has always been a preferable platform for professional studios and home producers. That has helped boost the DAW market quite remarkably.

The MAC segment in the Digital Audio Workstation (DAW) market is projected to experience the fastest CAGR of 10.26% during the forecast period. This can be attributed to the fact that the MacBook Pro M2 as well as Apple's Logic Pro are meant to stimulate creative professionals' desire. Increased demand for high-performance, AI-driven audio production tools adds to macOS growth in the market with the constant flow of new product offerings such as Ableton Live for Mac.

By End Use

The Professional Audio Engineers and Mixers segment dominated the Digital Audio Workstation Market with the largest share of revenue, accounting for 37% in 2023. This is mainly boosted by the strong demand for superior quality, powerful DAWs for professional use in mixing and mastering. Main companies such as Avid Technology with Pro Tools and Steinberg with Cubase have continued serving this market using highly advanced and specialized tools aimed at precision in the control of sound. Since audio professionals need powerfully performing computers, DAWs designed with heavy audio functionality are also assisting the growth in this segment within the DAW market.

The Music Studios segment is expected to witness the Fastest CAGR of 10.40% during the forecasted period. This growth, by increasing demands made on state-of-the-art DAWs in professional music studios where creativity and precision are critical, is driven. Companies like Apple with Logic Pro and PreSonus with Studio One continuously release new features on hardware-software seamless integration. As music studios shift to more cloud-based solutions and AI-powered tools, these innovations offer further expansion in the DAW market and attract more studios to cater to the emerging needs of production capabilities.

By Deployment

The On-premise segment of the Digital Audio Workstation Market dominated in 2023 with the largest share of revenue, accounting for 64%. This is because of the demand for professional, high-performance systems in music studios and broadcasting stations where high-quality audio processing is of paramount importance. The top players are Avid Technology with Pro Tools HDX and Steinberg with Cubase Pro, who are innovating on-premise software that can be integrated with professional hardware, allowing customizable studio setups. The market's backbone still comprises on-premise solutions due to their higher control and performance for high-demand audio production.

The Cloud segment in the Digital Audio Workstation Market is set to grow at the Fastest CAGR of 9.25% during the forecasted period. This growth is driven by the increasing demand for collaborative, remote music production and the rise of cloud-based DAWs like BandLab and Soundtrap. Companies like PreSonus have introduced cloud solutions, integrating their software with cloud storage for easy access and sharing. Cloud-based DAWs enable scalable, cost-effective solutions for both amateurs and professionals, revolutionizing workflows and supporting the transition to more flexible, cloud-first production environments.

By Component

The Software segment dominated the Digital Audio Workstation Market in 2023, accounting for 58% of the total revenue. This is because there is a demand for more professional and feature-rich DAWs for music production, mixing, and editing. Companies such as Avid Technology with Pro Tools, Ableton with Live, and Steinberg with Cubase continue to hold the top with new software releases that give their users the full force of the tools for audio editing, mixing, and mastering. The software segment continues to be a key revenue generator in the DAW market, with more musicians and audio engineers moving towards software-based production, providing unmatched versatility and performance.

The Services segment in the Digital Audio Workstation Market is expected to grow at the Fastest CAGR of 9.43% during the forecasted period. This growth is driven by the growing demand for cloud-based DAW services and subscription-based models. Companies such as BandLab Technologies with BandLab, and PreSonus with Studio One Cloud have launched services that support remote collaboration, online storage, and access to software tools. The market is transforming toward cloud services and AI-based music production, opening opportunities for service providers to offer scalable and flexible solutions for professionals and hobbyists alike.

Regional Analysis

In 2023, the North American region dominated the Digital Audio Workstation Market, holding a significant market share of 32%. This dominance can be attributed to the presence of key industry players like Avid Technology, PreSonus, and Apple, who have strong product offerings and a loyal customer base in the region.

Additionally, the increasing demand for professional-grade audio production tools in sectors like music production, broadcasting, and film production has driven this market share. A well-established region of music studios and the rising trend of independent music production are further fueling the market dominance. Innovations such as Pro Tools and Logic Pro have ensured North America's leadership in the DAW market.

The Asia Pacific region emerged as the fastest-growing market in 2023 for Digital Audio Workstations, with an estimated CAGR of 10.81%. This rapid growth is driven by rising technological adoption in countries such as India, China, and Japan, both in the increasing music production as well as in the gaming industry. The large number of accessible DAW solutions and the boom of cloud-based platforms such as BandLab and Soundtrap is fueling expansion in the region. Moreover, the rise in independent music creators and local content production in Asia further contributes to the robust growth in this region.

Need any customization research on Digital Audio Workstation Market - Enquiry Now

Key Players

Some of the major players in the Digital Audio Workstation Market are:

-

Yamaha Corporation (Cubase, Nuendo)

-

Ableton (Ableton Live, Ableton Push)

-

Bitwig GmbH (Bitwig Studio, Bitwig Grid)

-

BandLab Technologies (Cakewalk by BandLab, BandLab Online DAW)

-

Dirac Research AB (Dirac Live, Dirac Virtuo)

-

PreSonus Audio Electronics, Inc. (Studio One, Notion)

-

Apple Inc. (Logic Pro, GarageBand)

-

Adobe (Adobe Audition, Adobe Premiere Pro Audio Editing)

-

Avid Technology Inc. (Pro Tools, Sibelius)

-

MA Lighting (grandMA3, dot2 OnPC)

-

Steinberg Media Technologies GmbH (Cubase, WaveLab)

-

Native Instruments GmbH (Komplete, Maschine)

-

Renoise (Renoise, Redux)

-

Harrison Consoles (Mixbus, AVA Plugins)

-

MAGIX Software GmbH (Samplitude, Sound Forge)

Recent Trends

-

In November 2024, MusicRadar published an article titled "Best laptop for music production 2025: Portable computers for musicians, producers and DJs," highlighting top laptops suitable for music production. The article emphasized a preference for Apple machines in modern recording studios, recommending the Apple MacBook Pro M4 as the ultimate music-making machine.

-

In February 2025, Adobe unveiled Project Music GenAI Control, a prototype tool designed to generate musical compositions using simple text prompts. This development aimed to simplify the music creation process, making it more accessible to a broader audience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.36 Billion |

| Market Size by 2032 | US$ 6.62 Billion |

| CAGR | CAGR of 8.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Operating System (MAC, Windows, Android, Others) • By End Use (Professional Audio Engineers and Mixers, Electronic Musicians, Music Studios, Music Schools, Broadcasting and Media Companies, Game Developers, Others) • By Deployment (On-premise, Cloud) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Yamaha Corporation, Ableton, Bitwig GmbH (Germany), BandLab Technologies (Singapore), Dirac Research AB (Sweden), PreSonus Audio Electronics, Inc., Apple INC., Adobe, Avid Technology Inc., MA Lighting, Steinberg Media Technologies GmbH, Native Instruments GmbH, Renoise, Harrison Consoles, MAGIX Software GmbH. |