CNC Router Machine Market Report Scope & Overview:

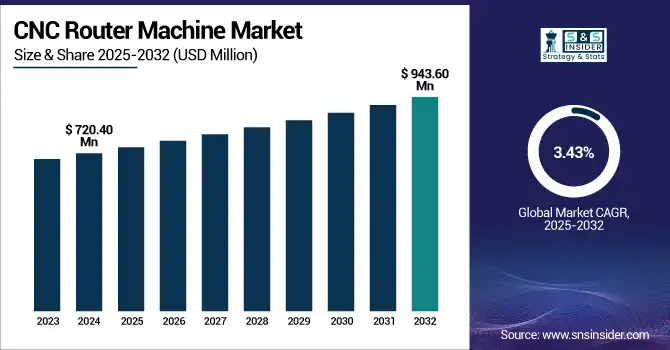

The CNC Router Machine Market size was valued at USD 720.40 million in 2024 and is expected to reach USD 943.60 million by 2032, growing at a CAGR of 3.43% over the forecast period of 2025-2032.

To Get more information on CNC Router Machine Market - Request Free Sample Report

The CNC router machines market growth is driven by the rising demand for automation, precision, and customization across industries such as automotive, aerospace, furniture, and electronics. CNC router machines are an important part of the CNC machinery market, and are becoming more and more preferred by industrial sectors and artisanal markets due to their ability to provide a well-finished and intricate output, particularly with Wood CNC Machines and Wood CNC Router Machines. As technology advances, machines continue to become more capable, with 5-axis routing, hybrid additive-subtractive systems, and AI-driven automation allowing manufacturers to create sophisticated, high-credibility, high-quality components effectively. IoT-based technologies enable real-time monitoring and predictive maintenance, leading to Industry 4.0 approaches and smart manufacturing. Meanwhile, smaller, more affordable CNC routers are bringing precision manufacturing tools to small-scale and hobbyist markets.

Emerging trends in the CNC router market highlight a shift toward sustainability and environmental responsibility. With minimal impact on the environment and in line with worldwide initiatives, manufacturers are designing energy-efficient routers and using recyclable materials. Rising consumer demand for personalized goods provides enormous possibilities because CNC routers can manufacture customized designs to serve niche markets and consumer wants. Advanced software programs such as computer-aided design (CAD) or computer-aided manufacturing (CAM) simplify programming and increase accuracy, making CNC routers easier for many more people to use.

In March 2025: Masterwood unveiled the MVD 900 vertical CNC machine at LIGNA 2025. Compact yet high-performing, it features a 6-position motorized tool changer, robust drilling head, and energy-saving technology, designed for space-constrained workshops while offering precise woodworking capabilities.

In February 2025, China continues to struggle with developing high-end CNC machine tools, relying on imports from companies like Siemens and Fanuc. Despite efforts to reduce dependency, challenges in technology, expertise, and competition persist, limiting its progress in the high-precision manufacturing sector.

CNC Router Machine Market Dynamics

Drivers

-

Technological advancements in CNC routers enhance precision, efficiency, and customization, reducing downtime and boosting productivity.

Technological advancements in CNC router machines have significantly enhanced their capabilities, making them indispensable in modern manufacturing. Multi-axis systems facilitate complex geometries and designs, increasing precision and versatility. Advanced software interfaces enable smooth interaction between design and machine, reducing friction in the operation. Additionally, Industry 4.0 Technologies like the Internet of Things (IoT) allow real-time tracking and analytics, which results in better operational efficiency as well as predictive maintenance. Together, these innovations enable greater productivity and efficiency with less downtime, as well as the ability to satisfy the increasing demand for high-end customization or sophisticated components across a range of industries.

In November 2024, ENCY Software introduced digital twin capabilities in its CAD/CAM system through the Machine Maker platform. This allows manufacturers to create virtual replicas of CNC machines, simulating processes to identify issues early. The integration enhances simulation accuracy, improves workflow, and optimizes resource use, supporting the shift to real-time monitoring and data-driven decisions in manufacturing.

Restraint

-

The shortage of skilled labor in CNC router operations leads to higher costs and delays, prompting companies to invest in automation and training.

The shortage of skilled labor in CNC router machine operations is a significant challenge impacting manufacturing sectors globally. CNC routers are not that difficult to operate, but knowing how to maintain and operate these machines just right takes specialized knowledge on programming, machine settings, as well as troubleshooting. Yet, for industries, there is a real shortage of qualified technicians: as the workforce gets older, youngsters show little interest, and training programs are not very plentiful. Their deficit raises operational costs, production delays, and downgrades competitiveness. In response, companies are automating, providing apprenticeship opportunities, and working with educational institutions to create customized training programs. These initiatives focus on addressing the skills gap and creating a sustainable pipeline of skilled CNC machinists.

In September 2024: a report by the National Skill Development Corporation highlighted a substantial shortfall in skilled labor in India, with a demand for 103 million skilled workers but only 74 million available to meet that need.

CNC Router Machine Market Segmentation Analysis

By Type

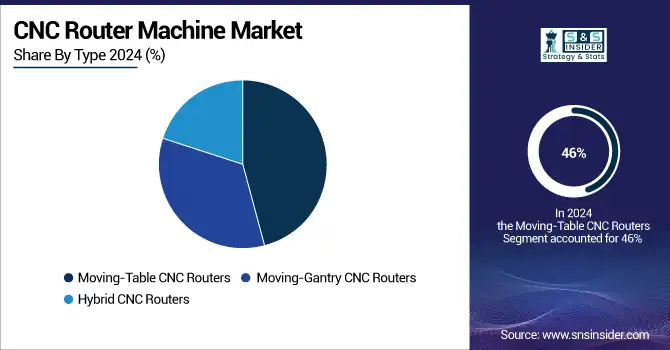

The Moving-Table CNC Routers segment dominated the market and accounted for 46% of the CNC router machine market share. This design uses a moving table instead of a moving gantry, enabling efficient and precise handling of large, heavy materials. This type is perfect for industries like woodworking, metalworking, and aerospace, but may have huge workpieces that should be processed with high precision. The design aids in greater load distribution, keeps stress on the machine, and provides high cutting efficiency, particularly making it suitable for industrial work.

The Hybrid CNC Routers segment is expected to be the fastest-growing segment in the market. This type of router incorporates the best of the moving-gantry and moving-table designs to deliver high flexibility, speed, and accuracy. Hybrid machines release a new versatility that goes beyond the traditional scope of metal and material capabilities of a CNC router. With industries seeking more sophisticated solutions for complex machining processes, hybrid routers are gaining traction as they can process a range of materials and accommodate larger workpieces at a higher level of precision, facilitating segment growth.

By Application

Metalworking dominated the CNC router machine market, with a significant market share of 39.8% in 2024. The dominance here is mainly because of the large consumption of CNC routers in industries like aerospace, automotive, and manufacturing, in which precision is the need of the hour. These industries demand precision metal machining for cutting, engraving, and milling of metals like aluminum, steel, and titanium. The incredible precision, dependability, and pace of CNC routers make them an absolute must-have in the metalworking industries that require complicated and highly detailed processes. This increase in the industry will thus lead to an increasing demand for the use of CNC routers in metalworking applications.

Woodworking is the fastest-growing segment in the CNC router machine market. As the need for precision and automation is increasing in the woodworking industry, CNC routers are gaining popularity. These machines provide better precision, speed, and efficiency, suitable for preparing, trimming, and milling hardwood products with complex layouts. This, in turn, has driven growth in demand for custom furniture, architectural components, and wood applications. Woodworking automation also translates into fewer costs incurred by manpower and more speed in production, ultimately propelling the need for CNC routers in this industry in the foreseeable future.

CNC Router Machine Market Regional Outlook

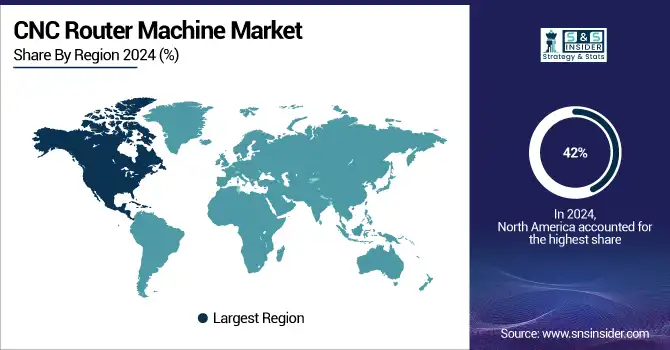

North America dominated the CNC Router Machine market with a 42% market share in 2024. CNC technology has become an integral part of the US manufacturing industry, and thus, the region will be highly relevant. The demand for advanced CNC router machines is mainly driven by industries such as automotive, aerospace, and furniture. Moreover, favorable technologies and automation in this region are also accelerating the growth of CNC routers. North America plays host to the most dominant market due to the presence of major players in the manufacturing and technology sectors.

The U.S. CNC router machine market is projected to grow from USD 217.85 million in 2024 to USD 275.95 million in 2032, with a CAGR of 3.00%. The rise is attributed to higher levels of automation in industries like manufacturing, construction, and woodworking. The U.S. will continue to be the North America leading country through increased acceptance of the market across regions in precision machining and customisation of various end-factories,

Asia-Pacific is the fastest-growing region in the CNC router machine market, driven by rapid industrialization and expanding manufacturing sectors. Most of this growth is courtesy of nations such as China, Japan, and India. In particular, blue-chip China is the largest manufacturing nation in the world and a major contributor to the demand for automation and precision machine tools. The demand for CNC router machines in the automotive, electronics, and textile industries is booming across the region. Increasing need for high-end manufacturing technologies is one of the key factors that is driving the market growth in the region quickly.

China holds a dominant position in the CNC router machine market, thanks to its technological advancements and significant presence in manufacturing. The country has historically been a pioneer of industrial automation, and high infrastructure and industrial output continues to create demand for CNC routers there. CNC technology further expands in different industries such as woodworking, metalworking, automotive, and will empower China, which take in CNC technology rapidly and nigh of markets have declare, to be the additional CNC market–leader.

Europe holds a significant share of the CNC Router Machine market, with leading countries like Germany, Italy, and the UK at the forefront. Strong industrial base in automotive, aerospace, and precision engineering sectors, which need high-performance CNC routers for manufacturing, augurs well for the market in this region. Using only the latest technology for CNC routers, European manufacturers ensure that their CNC router machines meet the highest standards. Moreover, the European CNC router machine market trends of automation and customization adoption in the industries in Europe maintain the stronghold of Europe in the global landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in CNC Router Machine Market are:

CNC router machine companies are Shoda, AXYZ Automation Group, ART, Thermwood Corporation, Exel CNC Ltd, MultiCam Inc., Anderson Group, ShopSabre, The SHODA Company, and Tommotek.

Recent Development

-

In April 2024: MultiCam participated in the ISA International Sign Expo in Orlando, where they showcased the Apex3R CNC Router and the Kongsberg C24 digital cutting system. The demonstration emphasized the machines' adaptability in cutting a wide range of materials, such as plastic, aluminum, wood, and high-density foam.

-

In October 2024: MultiCam marked its 35th anniversary with a special event at its Dallas facility. The celebration featured the 'Me and my MultiCam' campaign and an Oktoberfest-themed party, highlighting the company’s long-standing legacy and strong customer relationships.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 720.40 Million |

| Market Size by 2032 | USD 943.60 Million |

| CAGR | CAGR of 3.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Moving-Gantry CNC Routers, Moving-Table CNC Routers, Hybrid CNC Routers) • By Application (Woodworking, Metalworking, Plastic Fabrication, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Shoda, AXYZ Automation Group, ART, Thermwood Corporation, Exel CNC Ltd, MultiCam Inc., Anderson Group, ShopSabre, The SHODA Company, Tommotek. |