HDPE Pipes Market Report Scope & Overview:

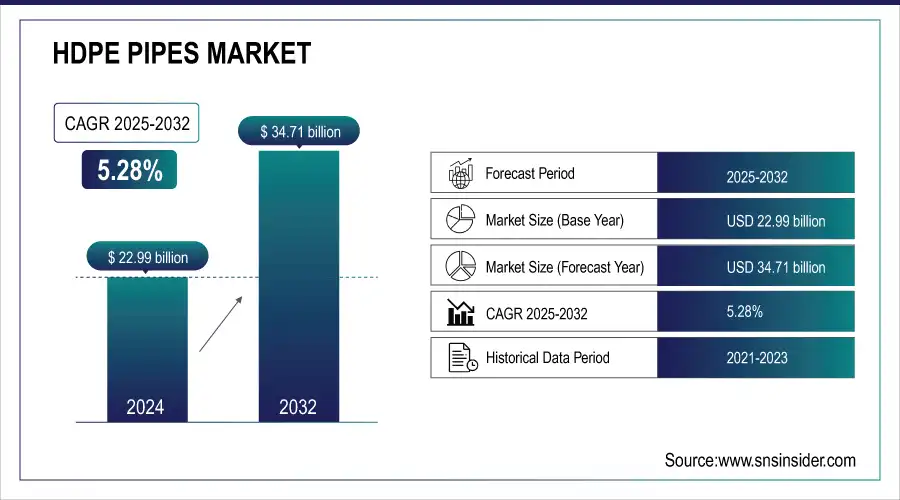

The HDPE Pipes Market Size was estimated at USD 22.99 billion in 2025E and is expected to arrive at USD 34.71 billion by 2033 with a growing CAGR of 5.28% over the forecast period 2024-2033.

The HDPE Pipes Market is witnessing a shift towards high-performance and sustainable piping solutions, driven by advancements in polymer technology and increased capacity utilization rates across key regions. Production volumes have surged in Asia-Pacific, while North America maintains high-capacity utilization rates. Technological integration in HDPE manufacturing, including AI-driven quality control and automation, is enhancing efficiency and reducing downtime. Additionally, export-import dynamics indicate a rising demand for premium-grade HDPE pipes, particularly in Europe and the Middle East, reflecting a shift toward durable, corrosion-resistant materials for infrastructure projects.

Market Size and Forecast:

-

HDPE Pipes Market Size in 2025E: USD 22.99 Billion

-

HDPE Pipes Market Size by 2033: USD 34.71 Billion

-

CAGR: 5.28% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on HDPE Pipes Market - Request Free Sample Report

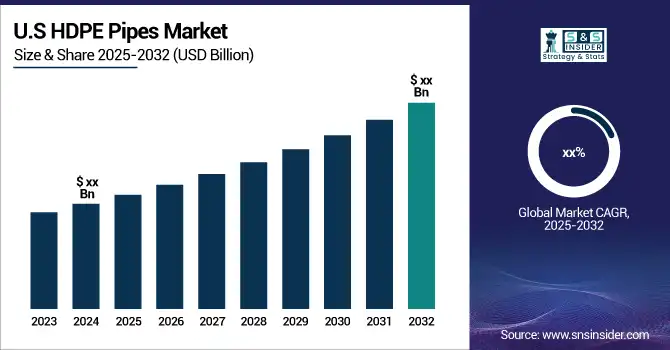

The U.S. HDPE Pipes market size was valued at an estimated USD 8.65 billion in 2025 and is projected to reach USD 13.10 billion by 2033, growing at a CAGR of 4.29% over the forecast period 2026–2033. Market growth is driven by increasing investments in water and wastewater infrastructure, rising demand for durable and corrosion-resistant piping systems, and expanding applications in oil & gas, agriculture, and industrial sectors. Growing adoption of HDPE pipes for irrigation, stormwater management, and gas distribution, along with their advantages such as flexibility, long service life, and low maintenance requirements, is accelerating market expansion. Additionally, government initiatives for infrastructure modernization, urban development projects, and continuous advancements in pipe manufacturing technologies further support the steady growth outlook of the U.S. HDPE pipes market during the forecast period.

Key HDPE Pipes Market Trends

-

Rising adoption of HDPE pipes in water supply, sewage, and irrigation systems due to durability and corrosion resistance.

-

Growth of PE 100 grade pipes for high-strength and long-life applications across sectors.

-

Expansion of HDPE usage in the oil & gas sector for high-pressure and long-distance pipelines.

-

Technological advancements in extrusion and 3D printing improving pipe strength and cost efficiency.

-

Increasing focus on sustainable practices, including recycling and eco-friendly coatings.

-

Replacement of aging infrastructure in developed regions driving HDPE pipe demand.

-

Growing adoption in agriculture for flexible, chemical-resistant irrigation systems.

-

Expansion of e-commerce and direct-to-consumer channels for pipe distribution globally.

HDPE Pipes Market Growth Drivers

-

The HDPE pipes market is growing rapidly due to increasing infrastructure investments, rising demand for sustainable piping solutions, and advancements in manufacturing technologies.

The HDPE pipes market is witnessing significant growth, driven by increasing investments in infrastructure development across water supply, sewage, and irrigation systems. Global governments and private sectors alike are increasingly focused on improving water management and sanitation facilities, which is further driving demand for durable piping solutions with a corrosion-resistant coating. The growth of smart cities and industrial zones has increased the demand for well-designed water distribution networks. This growth is also attributed to the modernisation in agriculture with the adoption of advanced irrigation techniques and increasing application of HDPE pipes for their versatility and durability. According to market analysis, there is a growing demand for eco-friendly and recyclable materials within the environment that is conducive to environmental regulations and urbanization planning. The adoption of pipe is further driven by improvements in pipe manufacturing and jointing technologies, which are improving the performance of products. Urbanization in the Asia-Pacific, Latin America, and Africa regions is very rapid, and the consequent demand for HDPE pipes is anticipated to rise due to the expansion of infrastructure facilities, which is a crucial growth factor likely to boost growth in this market.

HDPE Pipes Market Restraints

-

HDPE pipes have a higher initial cost due to expensive raw materials, specialized installation, and advanced manufacturing processes.

HDPE pipes have a higher initial investment cost compared to traditional piping materials such as PVC, steel, or concrete. The high initiation cost limits the usage of these pipes in some applications, but it is compensatory due to the low maintenance requirements and long-term production. In the early stages, costs are associated with acquiring materials like fusion welding equipment and skilled labor for proper installation. Although HDPE pipes provide advantages in terms of long-term durability, corrosion resistance, and low maintenance, the initial investment can be a hurdle for cost-sensitive projects, especially in developing countries. And extensive infrastructure development might require major capital investment, and these alternatives might seem more appealing. But, with higher initial costs come better lifecycle values that save replacement and maintenance costs down the road. With increasing awareness around specific long-term benefits and technological advancements, which drive down the prices, HDPE pipes are expected to be increasingly adopted across various applications.

HDPE Pipes Market Opportunities

-

Advancements in HDPE pipe extrusion, jointing, and multi-layer technology enhance durability, leak resistance, and application versatility.

Technological advancements in HDPE pipe manufacturing have significantly improved performance, durability, and application versatility. Advancements in pipe extrusion technology have improved accuracy, consistent wall thickness, and superior mechanical characteristics, providing longer service life and greater resistance to external pressures. Butt fusion and electrofusion welding are examples of advanced jointing methods that provide seamless and leak-proof connections, leading to lower maintenance costs and improved system reliability. In addition, the improvement of multilayered HDPE pipes provides greater strength, thermal resistance, and chemical compatibility, which make them suitable for possible new applications such as oil and gas, water distribution, and sewage systems. In addition, equipped with the help of automation and real-time monitoring, manufacturing processes have been also optimized, which reduce defects and help maintain quality. These innovations are driving increased quality and making HDPE pipes more attractive than their conventional counterparts, making them suitable for use in important infrastructure projects, while promoting sustainable and cost-effective piping systems.

HDPE Pipes Market Challenges

-

Meeting stringent environmental and quality standards increases production costs and complexity for HDPE pipe manufacturers.

Regulatory compliance and adherence to quality standards are critical challenges for HDPE pipe manufacturers. Strict regulations are implemented by governments and organizations globally to regulate the piping systems to confirm their safety, durability, and environmental of piping systems. Unlike China, where many manufacturers are still struggling to compete with western companies, many compliance standards, including ASTM, ISO, and AWWA, involve hefty testing and certifications that raise production costs. An added layer of complexity comes from environmental regulations which also stress recyclability, emissions, and raw material sourcing and manufacturers must follow suit in its practices. Not meeting these standards can result in product recalls, legal penalties, and loss of market reputation. In addition, the different regulations applicable to different regional areas make it difficult for global manufacturers who must adapt to these constraints and consistently modify their products to make them compliant in a specific region. With sustainability on the agenda, companies will need to research and develop new sustainable products but still adhere to compliance. The biggest hurdle in the HDPE pipes market is the need to balance cost-effectiveness with compliance to regulations.

HDPE Pipes Market Segment Analysis

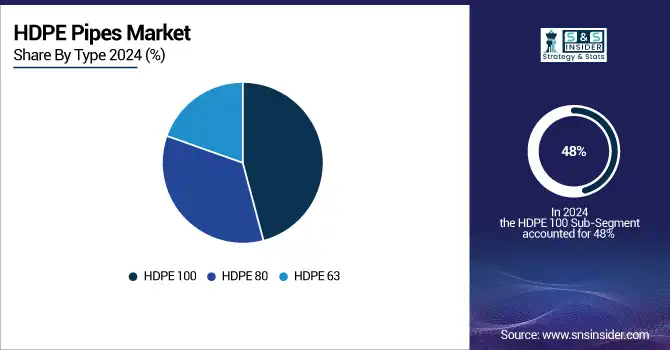

By Type

HDPE 100 segment dominated with a market share of over 48% in 2025, primarily due to its exceptional strength, durability, and resistance to high pressure. This makes it a preferred material for critical applications, such as in water supply, gas distribution and industrial piping, where reliability and longevity are paramount. The dense structure of the material make it highly resistant to corrosion, chemicals and environmental stress cracking, ensuring a long service life with very little maintenance. Moreover, HDPE 100 pipes provide the utmost flexibility and are resistant to impact, which works remarkably for underground installations and terrains. Increasing need for sustainable and cost-efficient piping solution along with infrastructure development and urbanization is anticipated to boost the adoption of HDPE 100 pipes across sectors, reinforcing their dominancy in the market.

By Application

The Sewage System Pipe segment dominated with a market share of over 32% in 2025, resulting from the increasing demand for durable and effective wastewater management systems. Reliability of HDPE pipes and their high durability, corrosion resistance and flexibility make them the perfect choice for sewage and drainage applications. Due to their unbeatable resistance to leakage, chemicals, and corrosion, these pipes are guaranteed to have a long lifespan, thus lowering maintenance costs. Growing urbanized areas and subsequent government upgrades of outdated sewage systems raise demand potential even higher. Furthermore, the increasing emphasis on the adoption of sustainable & cost-efficient piping systems in municipal & industrial sectors is also supporting the profitability of this segment. With the growth of Megacities, new cities and Urbanization around the globe, HDPE sewage pipes are being increasingly adopted as a solution to the city infrastructures ensuring transport of control & efficient sewage management.

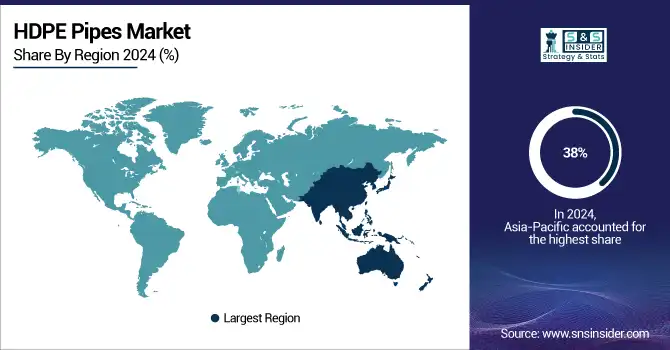

HDPE Pipes Market Regional Analysis

Asia Pacific HDPE Pipes Market Insights

The Asia-Pacific region dominated with a market share of over 38% in 2025, driven by rapid urbanization, robust infrastructure development, and an increasing demand for effective water management systems. China and India lead this trend as increasing government spending on water supply, sewage treatment, and irrigation networks evolves. Growing adoption of HDPE pipes in agriculture, construction and industrial applications also expands the market growth. And therefore, the emphasis on sustainable and cost-effectiveness of piping solutions in the region has been assisting the demand respective market, especially as HDPE pipes are durable, corrosion-resistance, and flexible. The region is predicted to dominate the global HDPE pipes market in the coming years, due to its growing smart city initiatives and rapid pace of industrialization.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe HDPE Pipes Market Insights

Europe's HDPE pipes market is witnessing significant growth due to increasing environmental awareness and stringent government regulations promoting sustainable piping solutions. With an increasing focus on carbon footprint reduction and more advanced water management systems, the demand for HDPE pipes in the wastewater treatment, agriculture, and industrial applications is rising in the region. Moreover, this market growth is bolstered by a movement towards durable, corrosion-resistant, and recyclable materials in construction and infrastructure projects. Countries like Germany, UK and France are at the forefront of adopting HDPE pipes backed by strong investments in smart water management and green buildings. As the world increasingly seeks eco-friendly alternatives and embracing the principles of the circular economy, the Europe HDPE pipes market is expected to expand at a steady and long-term pace.

North America HDPE Pipes Market Insights

The North America HDPE Pipes Market is witnessing steady growth in 2025, driven by infrastructure upgrades, industrial expansion, and increasing adoption of durable, corrosion-resistant piping solutions. Key markets such as the U.S., Canada, and Mexico are experiencing rising demand for water supply, sewage, and gas distribution pipelines. Replacement of aging infrastructure, along with growth in oil & gas and agricultural sectors, is further boosting demand. Moreover, government initiatives promoting sustainable materials and advanced pipe technologies are propelling market growth across the region.

Latin America (LATAM) HDPE Pipes Market Insights

The LATAM HDPE Pipes Market is expanding gradually in 2025, fueled by urbanization, agricultural development, and growing industrial activities in countries like Brazil, Mexico, and Argentina. Local construction and irrigation projects are driving demand for high-performance HDPE pipes. Investments in water management systems and renewable energy infrastructure are further enhancing market penetration. Additionally, government-led initiatives and international collaborations are supporting the adoption of advanced HDPE piping solutions across the region.

Middle East & Africa (MEA) HDPE Pipes Market Insights

The MEA HDPE Pipes Market is gaining momentum in 2025, supported by rapid urbanization, industrial diversification, and expansion of water and energy infrastructure. Countries such as the UAE, Saudi Arabia, South Africa, and Egypt are witnessing higher adoption of HDPE pipes for municipal, industrial, and agricultural applications. Regional focus on sustainability, combined with investments in irrigation systems and oil & gas pipelines, is boosting market growth. Furthermore, government infrastructure programs and private sector projects are enhancing the availability and usage of advanced HDPE piping solutions across the region.

HDPE Pipes Market Competitive Landscape

WL Plastics

WL Plastics is a leading manufacturer of HDPE piping solutions for water, gas, and industrial applications.

-

In December 2024, WL Plastics acquired Charter Plastics’ HDPE extrusion pipe business to expand its product portfolio and enhance its presence in the HDPE market.

Chevron Phillips Chemical Company LLC

Chevron Phillips Chemical Company LLC is a global petrochemical company specializing in polyethylene and other polymer products.

-

In October 2023, Chevron Phillips Chemical Company LLC made a USD 15 billion offer to acquire Nova Chemicals Corp. If completed, the acquisition would position the company as the third-largest polyethylene producer in North America and the leading high-density polyethylene (HDPE) producer in the region.

HDPE Pipes Market Key Players

Some of the major key players in the HDPE Pipes Market

-

Ionomr Innovations Inc. (Canada) – (High-performance HDPE piping solutions)

-

Hyundai (Japan) – (Industrial-grade HDPE pipes)

-

JM EAGLE, INC. (US) – (Water, gas, and sewer HDPE pipes)

-

CHINA LESSO (China) – (Irrigation, water supply, and drainage pipes)

-

Supreme Industries Ltd. (India) – (Agricultural, plumbing, and industrial HDPE pipes)

-

Chevron Phillips Chemical Company LLC (US) – (High-density polyethylene resins for HDPE pipes)

-

AGRU (US) – (HDPE pipes for chemical and industrial applications)

-

Dyka Group (Netherlands) – (Municipal and construction HDPE pipes)

-

Jain Irrigation Systems Ltd. (India) – (Agricultural and irrigation HDPE pipes)

-

Astral Pipes (India) – (Water supply and drainage HDPE pipes)

-

Advanced Drainage Systems (US) – (Stormwater management and drainage pipes)

-

ISCO Industries (UAE) – (Industrial and municipal HDPE piping solutions)

-

Al-Rowad Complex (UAE) – (HDPE pipes for gas and water distribution)

-

Cosmoplast Industrial Company LLC (UAE) – (Infrastructure and construction HDPE pipes)

-

Union Pipes Industry LLC (UAE) – (Large-diameter HDPE pipes for water and gas)

-

Future Pipe Industries (UAE) – (Composite and HDPE piping solutions)

-

PolyFab Plastic Industry LLC (UAE) – (HDPE pipes for plumbing and construction)

-

Pipelife International (Austria) – (Water and gas supply HDPE pipes)

-

Blue Diamond Industries (US) – (Conduit and telecom HDPE pipes)

-

Aliaxis Group (Belgium) – (HDPE pipes for industrial and infrastructure applications)

Suppliers for (high-quality and durable HDPE pipes for water, sewer, and industrial applications) on HDPE Pipes Market

-

JM Eagle

-

Chevron Phillips Chemical

-

Aliaxis

-

Jain Irrigation Systems

-

Pipelife International

-

Nandi

-

National Pipe & Plastics

-

Kubota ChemiX

-

FLO-TEK

-

Olayan

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 22.99 Billion |

| Market Size by 2033 | USD 34.71 Billion |

| CAGR | CAGR of 5.28% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (HDPE 63, HDPE 80, HDPE 100) • By Application (Oil and Gas Pipe, Agricultural Irrigation Pipe, Water Supply Pipe, Sewage System Pipe, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Ionomr Innovations Inc. (Canada), Hyundai (Japan), JM EAGLE, INC. (US), CHINA LESSO (China), Supreme Industries Ltd. (India), Chevron Phillips Chemical Company LLC (US), AGRU (US), Dyka Group (Netherlands), Jain Irrigation Systems Ltd. (India), Astral Pipes (India), Advanced Drainage Systems (US), ISCO Industries (UAE), Al-Rowad Complex (UAE), Cosmoplast Industrial Company LLC (UAE), Union Pipes Industry LLC (UAE), Future Pipe Industries (UAE), PolyFab Plastic Industry LLC (UAE), Pipelife International (Austria), Blue Diamond Industries (US), Aliaxis Group (Belgium). |