Hearing Aids Market Report Scope & Overview:

Get More Information on Hearing Aids Market - Request Sample Report

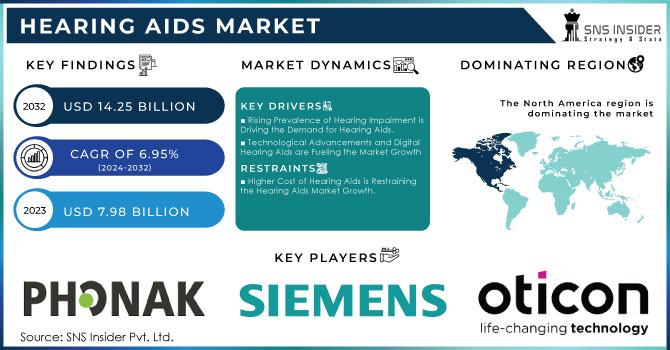

The Hearing Aids Market Size was valued at USD 7.98 Billion in 2023, and is expected to reach USD 14.25 Billion by 2032, and grow at a CAGR of 6.95%.

The hearing aid market is experiencing notable growth due to the increasing aging population and a surge in hearing impairment cases globally. According to the World Health Organization (WHO), over 1.5 billion people currently live with some degree of hearing loss, and this number is projected to exceed 2.5 billion by 2050. Aging is a significant factor, as hearing impairment becomes more common among the elderly. In the United States, the National Institute on Deafness and Other Communication Disorders (NIDCD) reports that 15% of adults have hearing difficulties, with the highest prevalence among individuals aged 75 and older. As global populations age, especially in developed countries, the demand for hearing aids is expected to rise substantially.

Governments are playing a crucial role in addressing this growing issue by making hearing aids more accessible. In 2022, the U.S. Food and Drug Administration (FDA) implemented a landmark ruling allowing the sale of over-the-counter (OTC) hearing aids. This regulation enables individuals with mild to moderate hearing loss to purchase hearing aids without a prescription, reducing costs and increasing access. The initiative is particularly beneficial for older adults who previously faced financial and procedural barriers in obtaining hearing aids. With the price of hearing aids often being a significant concern, this ruling has improved affordability and fostered greater competition in the market, pushing manufacturers to innovate and reduce prices. Similarly, in Europe, several countries are enhancing hearing health programs to support the aging population. Germany, for example, offers reimbursement for hearing aids through statutory health insurance, making these devices more affordable for the elderly. These government initiatives are crucial in driving market growth by ensuring that older adults can access hearing aids with ease.

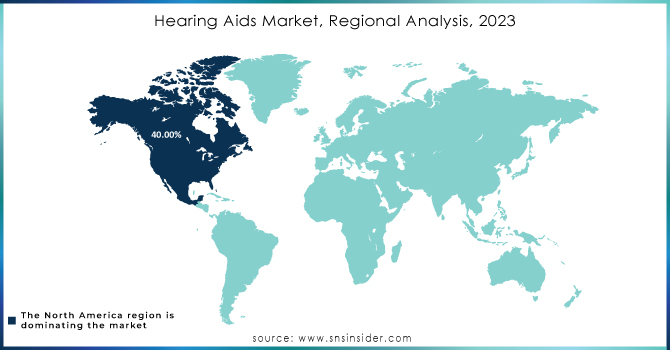

Technological advancements are also playing a significant role in the hearing aid market. Digital hearing aids, which dominate the market, offer superior sound processing, noise cancellation, and Bluetooth connectivity, allowing users to integrate them with smartphones and other devices. In 2023, digital hearing aids accounted for approximately 85% of the market share, largely due to their ability to provide a customized listening experience. The U.S. Centers for Disease Control and Prevention (CDC) notes that the majority of hearing aids issued today are digital, as they provide better sound quality and can be adapted to various listening environments. These advancements make hearing aids more user-friendly and appealing, particularly to the tech-savvy older population. North America, particularly the United States, dominated the hearing aids market in 2023, holding around 40% of the global market share. This is largely due to the region's advanced healthcare infrastructure, high adoption of new technologies, and favorable government policies like the FDA’s OTC ruling. According to the Centers for Medicare & Medicaid Services (CMS), hearing aid usage in the U.S. increased by 15% in 2023, as more individuals took advantage of the newly available OTC hearing aids. Additionally, the growing awareness of hearing health among older adults is contributing to the high market share in North America.

MARKET DYNAMICS:

Key Drivers:

-

Rising Prevalence of Hearing Impairment is Driving the Demand for Hearing Aids.

-

Technological Advancements and Digital Hearing Aids are Fueling the Market Growth

Restraints:

-

Higher Cost of Hearing Aids is Restraining the Hearing Aids Market Growth.

-

Social Stigma Surrounding Hearing Loss and the Use of Hearing Aids is a Significant Barrier to Market Growth.

Opportunity:

-

The Introduction of Over-The-Counter Hearing Aids in Markets Offers a Significant Growth Opportunity.

-

Government Initiatives Aimed at Improving Access to Healthcare and Increasing Awareness About Hearing Loss Potentially Expanding the Market for Hearing Aid Devices.

KEY MARKET SEGMENTATION:

By Product Type

In 2023, the Behind-the-Ear (BTE) hearing aids segment accounted for the largest market share, holding approximately 35% of the total product market. BTE hearing aids are widely preferred due to their versatility, ease of use, and adaptability to different levels of hearing loss. According to the National Health and Nutrition Examination Survey (NHANES) conducted in the U.S., BTE hearing aids are most frequently prescribed, particularly for older adults, due to their ease of handling and maintenance. These devices also support advanced features such as Bluetooth connectivity and noise cancellation, making them highly suitable for daily use in diverse environments. Furthermore, BTE hearing aids can house larger batteries, providing longer-lasting performance, which is particularly beneficial for elderly users who may have difficulty frequently changing batteries. Given these benefits, the BTE segment’s substantial market share is expected to persist as technological enhancements and consumer preferences continue to align with these product features.

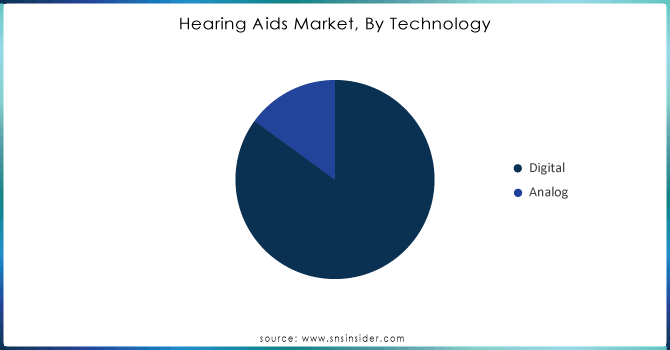

By Technology

Digital Hearing Aids held a commanding 85% of the market share in 2023. These devices are equipped with advanced sound processing technology that can be fine-tuned to the user’s specific needs, providing superior sound quality and minimizing background noise. Digital hearing aids are widely recognized for their ability to enhance the clarity of speech in various listening environments, making them a popular choice among both patients and healthcare providers. According to the U.S. Centers for Disease Control and Prevention (CDC), nearly 90% of newly issued hearing aids in the U.S. are digital, reflecting the growing demand for customized hearing solutions. Moreover, government health agencies have endorsed the adoption of digital hearing aids due to their efficacy in improving the quality of life for individuals with hearing loss. The transition from analog to digital technology has been accelerated by advancements in artificial intelligence and machine learning, allowing digital devices to offer real-time adjustments, and making them indispensable in the current market.

Need any customization research on Hearing Aids Market - Enquiry Now

REGIONAL ANALYSIS:

North America held the largest market share in 2023, accounting for 40% of the market. This leadership is attributed to the region's advanced healthcare infrastructure, high adoption rates of cutting-edge technologies, and favorable government policies. The U.S. has been at the forefront, particularly after the FDA’s approval of OTC hearing aids in 2022, which significantly lowered the cost of entry for consumers. Additionally, federal programs like Medicare and Medicaid have increased access to hearing aids for older adults, driving demand. According to the Centers for Medicare & Medicaid Services (CMS), the number of hearing aid users in the U.S. surged by 15% in 2023. This high penetration rate is further supported by rising awareness about hearing health, particularly among the aging population. North America’s leadership is also reinforced by strong consumer spending power and a steady influx of technological innovations in the region, ensuring its continued dominance in the global hearing aids market.

KEY PLAYERS:

The players operating in the hearing aids market are the following:

-

Phonak: Phonak Audeo Marvel

-

Siemens (now part of Signia): Signia Silk

-

ReSound: ReSound LiNX Quattro

-

Oticon: Oticon Opn S

-

Widex: Widex Moment

-

Starkey: Starkey Livio AI

-

Beltone: Beltone TrueHear

-

Audina: Audina Sensa

-

Unitron: Unitron Discover

-

Phonak Audeo Marvel: Phonak Audeo Marvel

-

Sivantos (formerly Siemens): Signia Pure Charge&Go

-

Hansaton: Hansaton Spirit

-

Etymotic Research: Etymotic ER-2

-

Eargo: Eargo 6

-

Lyric: Lyric Invisible Hearing Aid

-

Zounds: Zounds Clarity

-

Miracle-Ear: Miracle-Ear Ignite

-

Advanced Bionics: Advanced Bionics Neptune

-

Med-El: Med-El SONNET

-

Otofon: Otofon Elite

RECENT DEVELOPMENTS

-

In Jan 2023, Sonova introduced its Conversation Clear Plus earbuds, as an intended launch to expand its products in the hearing solutions segment.

-

In Oct 2023, Starkey Laboratories Inc., introduced its OTC hearing aid called the Start Hearing One, as part of its strategic plans to expand its product offerings in the U.S. Market.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 7.98 Billion |

|

Market Size by 2032 |

US$ 14.25 Billion |

|

CAGR |

CAGR of 6.95% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Product Type (In-the-Ear Hearing Aids, Receiver-in-the-Ear Hearing Aids, Behind-the-Ear Hearing Aids, Canal Hearing Aids) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Audicus, Audina Hearing Instruments, Inc., Eargo, Inc., GN Store Nord A/S, Horentek Hearing Diagnostics, MDHearing, SeboTek Hearing Systems, LLC, Sonova, Starkey Laboratories, Inc., Vision, Inc. & other players |

|

Key Drivers |

•Rising Prevalence of Hearing Impairment is Driving the Demand for Hearing Aids. |

|

RESTRAINTS |

•Higher Cost of Hearing Aids is Restraining the Hearing Aids Market Growth. |