Cold Gas Spray Coating Market Report Scope & Overview:

Get E-PDF Sample Report on Cold Gas Spray Coating Market - Request Sample Report

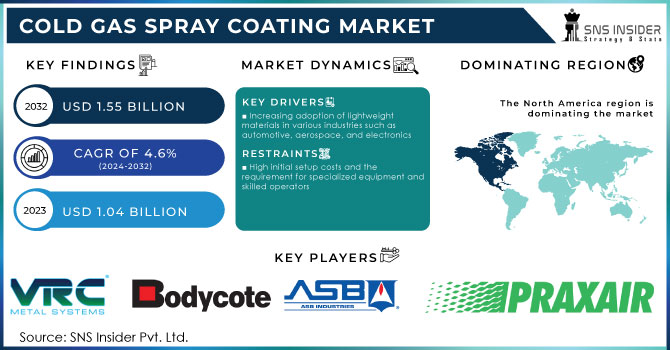

The Cold Gas Spray Coating Market size was valued at USD 1.04 Billion in 2023. It is expected to grow to USD 1.55 Billion by 2032 and grow at a CAGR of 4.6% over the forecast period of 2024-2032.

The cold gas spray coating market is a rapidly growing industry that involves the application of coatings using a unique process known as cold gas spraying. This innovative technique utilizes high-pressure gas to propel fine particles onto a substrate, resulting in a highly efficient and durable coating. The growth of the cold gas spray coating market is owing to its wide range of applications across various industries.

Moreover, The U.S. Department of Energy (DOE), in its 2023 report, highlighted the use of cold gas spray technology for repairing and restoring turbine blades in power generation. The DOE reported that cold spray technology reduces maintenance costs by up to 40% while extending the lifespan of components by more than 30%, making it a viable solution for energy infrastructure.

From aerospace and automotive to oil and gas, this technology has proven its versatility and effectiveness. Cold gas spray coatings are utilized for corrosion protection, wear resistance, thermal barrier coatings, and even repair and restoration purposes. Additionally, the ability of cold gas spray coatings to extend the lifespan of components and reduce maintenance costs has further fueled their adoption across industries.

In 2023, VRC Metal Systems launched a new portable cold spray system, designed for rapid deployment and use in both field and workshop settings. This innovation enables real-time component repairs in industries such as aerospace and defense, reducing downtime and maintenance costs.

The inclusion of cold gas spray coating in additive manufacturing is playing an increasing role in the development of the industry. It has also boosted the demand for repairing metal parts in the healthcare, energy, electronics, and other related sectors, as well as adding material layers. Unlike other methods, this approach facilitates the accurate deposition of metal textures without the need for excessively high temperatures.

Thus, as early as 2023, the U.S. Department of Energy already anticipated the use of cold gas spray in 3D printing would decrease production costs by 30% while also expanding the reliability and effectiveness of metal part technology. Thus, the ongoing trends and the new techniques demonstrate the development and improvements to the traditional NL coating in various interest industries.

Cold Gas Spray Coating Market Dynamics

Drivers

-

Increasing adoption of lightweight materials in various industries such as automotive, aerospace, and electronics

-

The ability of cold gas spray coating to provide superior corrosion resistance and thermal protection

The ability of the cold gas spray coating to deliver better corrosion resistance, and thermal protection makes the technology one of the drivers of adoption in many industries. With regular use, this technology allows for the creation of dense, well-adhered coatings capable of effectively shielding the industry components from the environment, thus extending the lifespan of components and reducing maintenance costs. For instance, in 2022, the U.S. Department of Defense reported that the use of cold gas spray coatings in military vehicles delivers a 25% reduction in rust failures at currently 35% operational readiness. Also, in 2023, Impact Innovations released a new line of cold gas spray systems exclusively for application to elements of drilling equipment in the oil and gas industry. This development demonstrates the growing demand for protective equipment that can work in extreme conditions as it improves performance and safety overall.

Restraint

-

High initial setup costs and the requirement for specialized equipment and skilled operators

The introduction of cold gas spray coating into a production process often requires high initial setup costs and essential equipment, limiting its widespread adoption. The relevant investment is often significant, and companies have to purchase advanced cold spray systems. Such a financial arrangement creates difficulties for manufacturers on a smaller scale, as they may not always be prepared to take up the expense. Moreover, critical maintenance of necessary equipment and its operation requires skilled personnel, influencing operational costs in a similar manner. The combination of large expenditure and reliance on specialized knowledge and experience may considerably limit the market’s growth. Cold gas spray technology can currently be successfully implemented only in conditions when companies can afford the costs associated with the utilization of this system. Therefore, the market’s development may be restricted in regions or sectors where participants do not possess adequate resources to use the approach to its fullest extent.

Opportunities

-

Expanding market for natural and organic Cold Gas Spray Coating due to the rising preference for sustainable and eco-friendly products

-

Increasing demand for Cold Gas Spray Coating in emerging economies with a growing middle-class population

Cold Gas Spray Coating Market Segmentation

By Technology

The high-pressure segment held the largest market share around 64% in 2023. High-pressure cold gas spray systems are characterized by the acceleration of particles to higher velocities, which results in better bonding between the coating and the substrate. The high-pressure process can be used for a wider range of materials, meaning that harder metals and alloys can be used, too. It can be applied to a variety of industries, such as aerospace, automotive, oil, and gas, which have high demands. Moreover, with high-pressure systems, a thicker coating and better coverage can be achieved, which is especially beneficial for some types of components exposed to severe environmental conditions.

By End-Use

The transportation end-use segment dominated the cold gas spray coatings market with the highest revenue share of about 45.5% in 2023. One of the key drivers behind this segment growth is the increasing demand for lightweight materials in industries such as aerospace and automotive. Cold gas spray coatings provide an ideal solution by offering lightweight yet robust coatings that enhance fuel efficiency and reduce emissions. Cold gas spray coating technology has emerged as a highly feasible and economically viable solution for the restoration and repair of IDG housings. These IDGs are extensively employed in commercial aircraft, such as the widely recognized Boeing 747, 737NG, and 777, as well as the Airbus A330, A320, and A340. This innovative technique has proven to be exceptionally effective in addressing the challenges posed by complexly designed components made from magnesium or aluminum alloys.

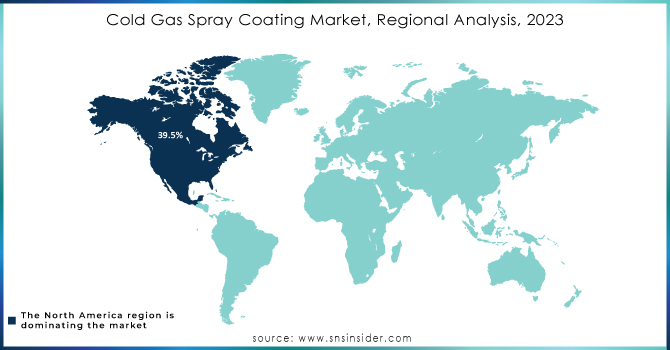

Cold Gas Spray Coating Market Regional Analysis

North America dominated the Cold Gas Spray Coating Market with the highest revenue share of about 39.5% in 2023. This growth is attributed to the region's favorable government regulations, which encourage the adoption of lightweight and high-performance components in the automotive sector as a viable alternative to alloys and metals. As a result, the demand for cold gas spray coatings is expected to witness significant growth in the region throughout the forecast period. Within North America, the United States stands out as the dominant country in this market. The country's market dominance is due to the increasing utilization of cold gas spray coating in the thriving aerospace and defense sector. This sector's reliance on advanced coatings has propelled the United States market forward, creating lucrative opportunities for industry players. Furthermore, the aerospace sector's growing demand for high-performance coatings is expected to further increase revenues in the United States.

Asia Pacific is expected to grow with the highest CAGR of about 4.7% in the Cold Gas Spray Coating Market during the forecast period. China is expected to dominate the global market during this time. This is owing to the rapid expansion of the automotive and electronic sectors, as well as the increasing adoption of cold gas spray coating within these industries. China has emerged as the leading automotive manufacturer worldwide in recent years, and this trend is projected to continue until 2033. For example, according to the International Organization of Motor Vehicle Manufacturers (OICA), China's overall vehicle production reached approximately 27.5 million in 2022. The increasing production and sales of vehicles are expected to drive the demand for cold gas spray coating. This is due to the growing utilization of cold gas spray coating technology for coating and repairing automotive parts and components. Japanese automakers are increasingly incorporating cold gas spray coating to create lightweight and high-performance components, which is expected to further boost the market during the assessment period. Additionally, cold spray coatings are being applied to electronic components and products such as PCBs, transformers, and others. Consequently, the South Korean market is expected to experience growth due to the increasing production and sales of electronic devices, driven by the rapid penetration of digitalization and industrialization.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

VRC Metal Systems (VRC-500)

-

Plasma Giken Co. Ltd. (Plasma Giken Cold Spray System)

-

Bodycote (Bodycote Thermal Spray Coatings)

-

ASB Industries (ASB Cold Spray Technology)

-

Curtiss-Wright Surface Technologies (Surface Technology Cold Spray)

-

Praxair S.T. Technology (Praxair Cold Spray Solutions)

-

Fujimi Inc. (Fujimi Cold Gas Spray Powder)

-

Polymet Corporation (Polymet Cold Spray Coatings)

-

Flame Spray Technologies (Flame Spray Cold Gas Spray Equipment)

-

Oerlikon Metco (Metco 3D Cold Spray)

-

Impact Innovations (Impact Cold Spray Systems)

-

H. W. Schneider GmbH (Schneider Cold Spray Equipment)

-

TWI Ltd. (TWI Cold Spray Technology)

-

Kermetico Inc. (Kermetico Cold Spray Systems)

-

Thermal Spray Technologies (TST Cold Gas Spray Systems)

-

Eisenmann (Eisenmann Cold Spray Coating)

-

Arc Spray (Arc Spray Cold Gas Spray Solutions)

-

Dynametal (Dynametal Cold Spray Technology)

-

Aermet (Aermet Cold Spray Coatings)

-

GTV Verschleißschutz GmbH (GTV Cold Spray Technol

Recent Development:

-

In March 2023, Oerlikon, a global leader in polymer processing, surface engineering, and additive manufacturing, successfully completed the acquisition of Riri. This strategic move will greatly enhance the company's product offerings, particularly in the field of coatings.

-

In July 2022, VRC Metal Systems introduced the C.A.M.P Site cold spray system.

-

In January 2021, Hannecard and ASB Industries joined forces to form Hannecard Roller Coatings, Inc. This collaboration brings together the expertise, technology, and research and development capabilities of both companies, enabling them to expand their portfolios and provide enhanced services to their customers.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.04 Billion |

| Market Size by 2032 | USD 1.55 Billion |

| CAGR | CAGR of 4.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Low Pressure and High Pressure) • By End-use (Transportation, Oil & Gas, Medical, Electrical & Electronics, Utility, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

VRC Metal Systems,Plasma Giken Co. Ltd.,Bodycote,ASB Industries,Curtiss-Wright Surface Technologies,Praxair S.T. Technology,Fujimi Inc.,Polymet Corporation,Flame Spray Technologies,Oerlikon Metco,Impact Innovations,H. W. Schneider GmbH,TWI Ltd.,Kermetico Inc.,Thermal Spray Technologies,Eisenmann,Arc Spray,Dynametal,Aermet,GTV Verschleißschutz GmbH |

| Key Drivers | • Increasing adoption of lightweight materials in various industries such as automotive, aerospace, and electronics • The ability of cold gas spray coating to provide superior corrosion resistance and thermal protection |

| Market Restraints | • High initial setup costs and the requirement for specialized equipment and skilled operators |