Aluminium Market Report Scope & Overview

Get E-PDF Sample Report on Aluminium Market - Request Sample Report

The Aluminium Market Size was valued at USD 195.93 Billion in 2023 and is expected to reach USD 320.22 Billion by 2032, growing at a CAGR of 5.61% over the forecast period of 2024-2032.

The Aluminium market is shaped by key factors that influence its growth and sustainability. Our report will offer a comprehensive supply chain analysis, detailing the stages from raw material sourcing to final product distribution. It will also examine pricing trends, providing insights into past price shifts and future projections influenced by market demand and global factors. As sustainability becomes central, our report will explore sustainability initiatives, focusing on eco-friendly practices in production. Investment trends will also be covered, highlighting shifts in mergers, acquisitions, and new ventures in the Aluminium sector. Lastly, our report will analyze recycling rates, emphasizing the industry's push towards greater recycling efforts to reduce costs and environmental impact.

Market Dynamics

Drivers

-

Increasing Infrastructure Development Activities in Emerging Economies Boosts Aluminium Market Demand

Infrastructure development is booming in emerging economies, particularly in Asia-Pacific, Latin America, and parts of Africa. The rapid urbanization and industrialization in these regions are creating a surge in demand for construction materials, including Aluminium. Governments are heavily investing in building roads, bridges, airports, and residential and commercial properties to cater to their growing populations and economies. Aluminium's lightweight nature and strength make it an ideal material for modern construction projects, offering durability while reducing transportation and installation costs. Furthermore, Aluminium is used in energy-efficient buildings, which are becoming a priority as urbanization accelerates. The construction of railways, airports, and urban transportation systems also requires Aluminium, particularly in structural elements and cladding. As the global demand for infrastructure continues to rise, emerging economies present a significant market for Aluminium products. Additionally, these regions are attracting foreign investments in Aluminium production plants, further boosting market growth. With the infrastructure boom expected to continue, the demand for Aluminium will see substantial growth, particularly in markets like India, China, and Brazil.

Restraints

-

Volatility in Raw Material Prices and Supply Chain Disruptions Impact Aluminium Market Growth

The Aluminium market faces considerable challenges due to the volatility of raw material prices, particularly bauxite and alumina. The prices of these key raw materials fluctuate based on factors such as geopolitical events, changes in mining output, and transportation costs. This price volatility can result in higher production costs for Aluminium manufacturers, squeezing their profit margins. Furthermore, disruptions in the global supply chain, whether caused by trade restrictions, natural disasters, or logistics challenges, can impact the availability of these raw materials. For example, political tensions in key bauxite-producing regions like Guinea or Australia can lead to supply shortages, further driving up material costs. The Aluminium production process is highly energy-intensive, and fluctuations in energy prices can exacerbate these challenges, making it difficult for manufacturers to maintain competitive pricing. The dependency on specific geographic regions for the supply of raw materials also increases the Aluminium market's vulnerability to global disruptions. As a result, manufacturers face risks associated with cost unpredictability, affecting their ability to plan for long-term production and pricing strategies.

Opportunities

-

Growing Demand for Lightweight Materials in the Automotive Industry Creates Opportunities for Aluminium Manufacturers

The automotive industry is increasingly prioritizing the use of lightweight materials to improve fuel efficiency and reduce emissions, creating a significant opportunity for Aluminium manufacturers. As governments around the world implement stricter fuel economy standards and emission regulations, automakers are looking for solutions that help reduce the overall weight of vehicles. Aluminium, with its high strength-to-weight ratio, is an ideal choice for automotive components such as body panels, engine parts, and wheels. The growing popularity of electric vehicles is further driving the demand for Aluminium, as lighter vehicles contribute to improved battery efficiency and longer driving ranges. Additionally, Aluminium is being used in the development of advanced vehicle designs, such as electric car frames, that offer better performance and energy efficiency. This presents an opportunity for Aluminium manufacturers to cater to the automotive sector by developing specialized alloys and components tailored to the industry’s needs. As the trend toward lightweight vehicles continues, Aluminium manufacturers stand to benefit from increased demand and product diversification in the automotive sector.

Challenge

-

High Energy Consumption and Environmental Impact of Primary Aluminium Production

The production of primary Aluminium is highly energy-intensive, with smelting processes consuming vast amounts of electricity, contributing to a significant carbon footprint. As environmental concerns grow, the Aluminium industry is under increasing pressure to adopt more sustainable production methods. The high energy consumption associated with primary Aluminium production results in higher operating costs for manufacturers and adds to the industry's environmental impact. Many countries are implementing stricter emissions regulations, forcing Aluminium producers to reduce their carbon footprint or face penalties. While secondary Aluminium production (recycling) offers a more sustainable option, it still faces challenges related to energy consumption and material quality. The reliance on energy-intensive processes for primary Aluminium production also makes the industry vulnerable to fluctuations in energy prices, which can directly impact profitability. This challenge requires Aluminium manufacturers to invest in cleaner, more energy-efficient technologies, a costly and long-term endeavor, adding complexity to the market's sustainability goals.

Segmental Analysis

By Product Type

In 2023, Primary Aluminium dominated the market with a revenue share of around 54.3%. This is due to its widespread use in industries such as automotive, aerospace, and construction, where high strength and durability are crucial. Primary Aluminium is produced from raw bauxite ore, making it essential in applications requiring high-performance materials. The automotive sector, for instance, continues to rely on Primary Aluminium for manufacturing lightweight vehicle components to meet fuel efficiency and emission regulations. According to the International Aluminium Institute, the production of Primary Aluminium is expected to continue increasing, driven by the ongoing demand for Aluminium in large-scale infrastructure and transportation projects. This trend is further supported by initiatives such as the Aluminium Stewardship Initiative, promoting sustainable production practices for Primary Aluminium, ensuring its continued dominance in the market.

By Form

In 2023, Primary Aluminium dominated the market with a market share of 54.3%. This is due to its widespread use in industries such as automotive, aerospace, and construction, where high strength and durability are crucial. Primary Aluminium is produced from raw bauxite ore, making it essential in applications requiring high-performance materials. The automotive sector, for instance, continues to rely on Primary Aluminium for manufacturing lightweight vehicle components to meet fuel efficiency and emission regulations. According to the International Aluminium Institute, the production of Primary Aluminium is expected to continue increasing, driven by the ongoing demand for Aluminium in large-scale infrastructure and transportation projects. This trend is further supported by initiatives such as the Aluminium Stewardship Initiative, promoting sustainable production practices for Primary Aluminium, ensuring its continued dominance in the market.

By Alloy Type

The Wrought Alloy segment dominated the Aluminium market in 2023 with a market share of around 63.4%. This dominance is largely due to its critical role in high-performance applications such as aerospace, automotive, and construction. Wrought Aluminium alloys, particularly those in the 2xxx, 5xxx, and 6xxx series, are favored for their strength, durability, and lightweight properties. The automotive industry, especially, has adopted Wrought Aluminium for vehicle body parts to reduce weight and enhance fuel efficiency. The Aluminium Association notes that the demand for Wrought Aluminium is expected to increase, especially in sectors focused on lightweighting and energy efficiency. This segment is also driven by innovations in alloying techniques that provide better corrosion resistance, making Wrought Alloys the go-to choice for demanding applications.

By Series

The 3xxx Series – Aluminium-Manganese Alloys dominated the Aluminium market in 2023 with a 39.7% market share. This series is primarily used in applications that require excellent corrosion resistance, including roofing, siding, and manufacturing of beverage cans. The growing demand for sustainable packaging solutions, particularly in the food and beverage industry, has played a significant role in the rise of 3xxx alloys. According to the European Aluminium Association, the 3xxx series is gaining traction due to its balance of strength and formability, making it ideal for the production of thin sheets used in cans and containers. The global push towards reducing environmental impact, alongside increasing demand for recyclable materials, ensures that Aluminium-Manganese alloys remain a leading choice in packaging and other consumer goods.

By End-User

Transportation dominated the Aluminium market in 2023 with a market share of 30.2%. This is mainly due to the rising adoption of Aluminium in the automotive, aerospace, and rail sectors. Aluminium’s lightweight properties are essential for improving fuel efficiency, reducing carbon emissions, and increasing the performance of vehicles. The automotive industry is rapidly shifting toward lightweight materials to meet stringent fuel economy standards and reduce emissions. For instance, global car manufacturers, including Ford and General Motors, have increased the use of Aluminium in their vehicle bodies. Additionally, the aerospace sector continues to prioritize Aluminium for aircraft manufacturing due to its strength-to-weight ratio and resistance to corrosion. As governments enforce stricter environmental regulations, the demand for Aluminium in the transportation industry is expected to remain robust, further solidifying its dominant position in the market.

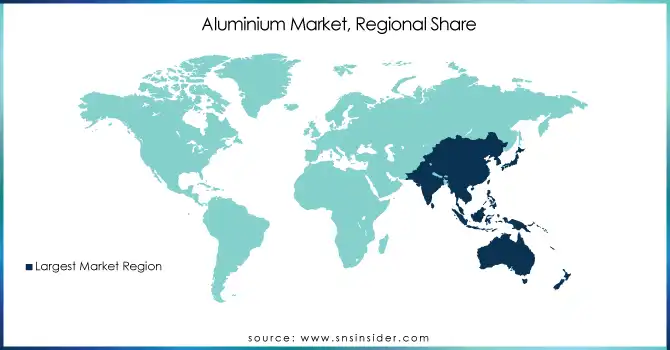

Regional Analysis

In 2023, the Asia Pacific region dominated the Aluminium market with a market share of 48.5%. This dominance is largely attributed to the region's rapid industrialization, high production rates, and massive demand for Aluminium in key sectors such as automotive, construction, and packaging. China, the largest producer and consumer of Aluminium globally, played a crucial role, accounting for more than 50% of the global Aluminium production and consumption. The nation’s commitment to urbanization, infrastructure development, and the thriving automotive industry have significantly contributed to this dominance. Additionally, India, with its growing demand for Aluminium in construction and infrastructure projects, also strengthened the region's market share. According to the International Aluminium Institute, China’s production alone surpassed 40 million metric tons in 2023, and its consumption continues to rise with the booming demand in electric vehicles and renewable energy sectors. Countries like Japan and South Korea also contributed significantly, with major companies like Nippon Light Metal and Korea Aluminium leading the market with their advanced Aluminium products.

On the other hand, Europe emerged as the fastest-growing region in the Aluminium market during the forecast period with a significant growth rate during the forecast period. The region's growth is driven by increasing demand for Aluminium in electric vehicles, aerospace, and renewable energy industries. European governments are pushing for greener technologies, which boosts the use of Aluminium in electric vehicle batteries, solar panels, and energy-efficient building materials. Countries like Germany, Italy, and France are leading this growth, with Germany's automotive industry being one of the largest consumers of Aluminium globally. For example, Audi, Volkswagen, and BMW have increasingly incorporated Aluminium into vehicle production to reduce weight and improve fuel efficiency. Italy's Aluminium sector has also benefited from the growing demand in packaging, particularly for sustainable and recyclable materials. Furthermore, the European Union's emphasis on sustainability and carbon reduction in industrial processes is driving innovation in Aluminium recycling technologies. The EU's focus on reducing emissions has resulted in new regulations that promote the use of Aluminium in green technologies, contributing to the market’s expansion in the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Alcoa Corporation (Aluminium Ingots, Aluminium Billets, Rolled Aluminium Products)

-

China Hongqiao Group Limited (Primary Aluminium, Aluminium Ingots, Aluminium Alloy Products)

-

Constellium SE (Aluminium Rolled Products, Automotive Aluminium Sheets, Aerospace Aluminium Alloys)

-

Ducab Aluminium Company (DAC) (Aluminium Rods, Aluminium Wires, Electrical Conductors)

-

East Hope Group (Primary Aluminium, Aluminium Ingots, Aluminium Alloy Sheets)

-

Gränges AB (Aluminium Foil, Heat Exchanger Materials, Aluminium Rolled Products)

-

Hindalco Industries Ltd. (Aluminium Rolled Products, Aluminium Extrusions, Aluminium Flat-Rolled Coils)

-

Jindal Aluminium (Aluminium Extrusions, Aluminium Profiles, Aluminium Rolled Products)

-

Kaiser Aluminum (Aerospace Aluminium Plates, Aluminium Tubes, Aluminium Billets)

-

Logan Aluminum (Aluminium Coils, Aluminium Beverage Can Sheets, Aluminium Automotive Sheets)

-

Novelis Inc. (Aluminium Auto Sheets, Aluminium Beverage Can Sheets, Aluminium Coated Products)

-

Norsk Hydro ASA (Aluminium Extrusions, Precision Tubing, Primary Aluminium)

-

Press Metal Aluminium Holdings (Primary Aluminium, Aluminium Extrusions, Aluminium Slabs)

-

Qatalum (Qatar Aluminium Manufacturing Co.) (Primary Aluminium, Aluminium Billets, Foundry Alloys)

-

Rio Tinto (Primary Aluminium, Aluminium Sheets, Aluminium Billets)

-

RUSAL (Aluminium Ingots, Aluminium Wire Rods, Primary Aluminium)

-

South32 (Primary Aluminium, Aluminium Slabs, Aluminium Ingots)

-

Trimet Aluminium SE (Aluminium Ingots, Aluminium Wire Rods, Aluminium Casting Alloys)

-

Vedanta Aluminium & Power (Primary Aluminium, Aluminium Billets, Aluminium Rolled Products)

-

Xinfa Group Co. Ltd. (Primary Aluminium, Aluminium Alloy Sheets, Aluminium Foil)

Recent Highlights

-

February 2025: Hindalco announced an investment of Rs 15,000 crore in Madhya Pradesh to expand its aluminium smelting capacity. This project aims to boost the company's aluminium production and enhance its market position in the region.

-

January 2025: Rio Tinto welcomed Australian government support for its aluminium project, aimed at promoting sustainable practices and creating jobs, while contributing to the global effort to reduce carbon footprints.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 195.93 Billion |

| Market Size by 2032 | USD 320.22 Billion |

| CAGR | CAGR of 5.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Primary Aluminium, Secondary (Recycled) Aluminium) •By Form (Plate, Sheet, Extrusions, Castings, Foil, Others) •By Alloy Type (Wrought Alloy, Cast Alloy) •By Series (1xxx Series – Pure Aluminium, 2xxx Series – Aluminium-Copper Alloys, 3xxx Series – Aluminium-Manganese Alloys, 4xxx Series – Aluminium-Silicon Alloys, 5xxx Series – Aluminium-Magnesium Alloys, 6xxx Series – Aluminium-Magnesium-Silicon Alloys, 7xxx Series – Aluminium-Zinc Alloys, 8xxx Series – Miscellaneous Alloys) •By End-User (Transportation, Electrical & Electronics, Consumer Goods, Construction, Packaging, Machinery & Equipment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | China Hongqiao Group Limited, RusAL, Alcoa Corporation, Rio Tinto, Norsk Hydro ASA, Hindalco Industries Ltd., Vedanta Aluminium & Power, Xinfa Group Co. Ltd., South32, Novelis Inc. and other key players |