Thermal Barrier Coatings Market Report Scope & Overview:

Get E-PDF Sample Report on Thermal Barrier Coatings Market - Request Sample Report

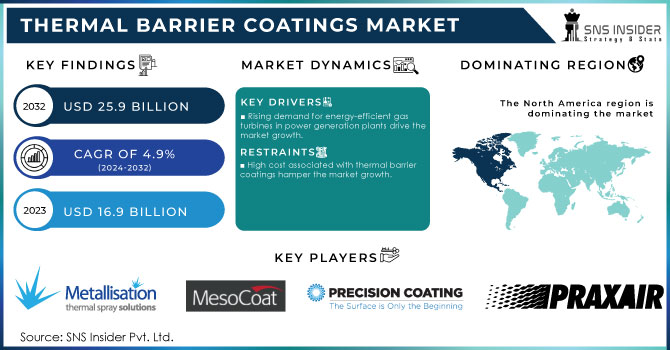

The Thermal Barrier Coatings Market Size was valued at USD 16.9 Billion in 2023 and is expected to reach USD 25.9 Billion by 2032 and grow at a CAGR of 4.9% over the forecast period 2024-2032.

The increasing demand for high-performance materials in industries such as aerospace, automotive, and power generation, the market for thermal barrier coatings is expected to witness significant growth in the coming years. Thermal barrier coatings are primarily used to protect components from the damaging effects of heat. They act as a barrier between the high-temperature environment and the underlying material, preventing heat transfer and reducing thermal stress. This not only improves the lifespan of the components but also enhances their overall performance.

In the aerospace industry, thermal barrier coatings are extensively used in gas turbine engines, where they protect critical components such as turbine blades and vanes from the extreme temperatures generated during operation. The automotive industry is another key market for thermal barrier coatings. With the increasing demand for high-performance vehicles, manufacturers are constantly seeking ways to enhance engine efficiency and reduce emissions. In the power generation industry, thermal barrier coatings are used in gas turbines and boilers to improve efficiency and reduce maintenance costs. By protecting critical components from harsh operating conditions, these coatings enable power plants to operate at higher temperatures, resulting in increased power output and reduced downtime.

Demand in the aerospace industry has also been rising as air traffic is on course to rebound from the pandemic and defense investment increases further-ordering this demand. Based on IATA, international air traffic is forecast to touch 103% of the pre-pandemic activities by 2024, which in turn is driving the aerospace engine market and hence for TBCs with the advent of high operating temperatures and fuel efficiency. Key to the efficient production of energy in the gas turbine industry, which has seen a global rise in installations while world governments push for cleaner forms of power generation, TBCs establish a thermal barrier between the blisteringly hot gases emitted in overtime combustion reactions and the air moving over their surfaces.

In 2023, Praxair Surface Technologies launched an advanced YSZ-based coating aimed at improving thermal protection in both aerospace and power generation sectors. This new solution enhances durability, reducing the frequency of maintenance and downtime for turbine blades.

The research and development in thermal barrier coatings advance the knowledge limits of material performance, with more advanced Yttria-Stabilized Zirconia (YSZ) to provide better thermal protection due to its low thermal conductivity, and high coefficient of thermal expansion. Advanced technologies, such as ceramic matrix composites and nano-structured coatings are enhancing both durability and efficiency by enabling the coating to withstand extremely high temperatures and thermal cycling. They would last longer in extremely high temperatures and heavy wear, energy-saving fuel use that could help these new materials perform critical industry operations in aerospace and energy industries for years to come.

In 2021, Oerlikon launched a nano-structured ceramic TBC, aimed at improving the thermal insulation properties for gas turbines and jet engines. This innovation enhances durability and wear resistance, optimizing fuel efficiency and extending the life cycle of critical components.

Market Dynamics

Drivers

-

Rising demand for energy-efficient gas turbines in power generation plants drive the market growth.

In recent years, there has been a significant surge in the need for energy-efficient solutions within the power generation sector. This demand stems from various factors, including the growing global population, rapid industrialization, and the increasing reliance on electricity for both residential and commercial purposes. As a result, power generation plants are under immense pressure to enhance their operational efficiency and reduce energy consumption. Gas turbines play a pivotal role in power generation, as they efficiently convert fuel into electricity. However, these turbines often operate under extreme conditions, including high temperatures and corrosive environments, which can lead to performance degradation and reduced lifespan. To combat these challenges, thermal barrier coatings have emerged as a vital solution. By effectively reducing heat transfer and improving thermal efficiency, these coatings contribute to the overall energy efficiency of gas turbines. Moreover, thermal barrier coatings also offer additional benefits, such as enhanced corrosion resistance and improved durability. These advantages result in extended maintenance intervals, reduced downtime, and increased operational reliability for power generation plants.

In 2022, GE Power introduced advanced gas turbines featuring enhanced TBC systems designed to withstand higher temperatures, allowing their turbines to achieve increased efficiency and lower emissions. This development supports GE's push towards decarbonization in power generation, as these coatings help boost turbine performance in natural gas power plants.

Restrain

-

High cost associated with thermal barrier coatings hamper the market growth.

A major restraint for the thermal barrier coatings market is their high costs making it nearly impossible for these products to be used on a large scale on industries like aerospace and power generation. The pricing is likely due to the intricate manufacturing, which requires formulating highly advanced materials such as yttria-stabilized zirconia (YSZ) and other ceramic-based compounds. TBCs require specific thermal spraying or plasma spraying procedures for their application, and this calls for expensive equipment and labor to perform this task with precision. Furthermore, substantial investment needs to be made towards the research and development for far more robust and efficient coatings that include nano-structured materials and ceramic matrix composites with this cost normally passed onto end-users.

Opportunities

-

Growing focus on renewable energy sources

With the global focus on renewable energy sources, the demand for thermal barrier coatings is expected to witness substantial growth. As renewable energy technologies continue to evolve and become more prevalent, the need for efficient and reliable systems becomes paramount. Thermal barrier coatings offer a viable solution by improving the performance and longevity of energy systems, ultimately contributing to the sustainability and success of renewable energy initiatives. Furthermore, the adoption of thermal barrier coatings aligns with the broader goals of reducing greenhouse gas emissions and promoting a greener future. By optimizing the efficiency of energy systems, these coatings help minimize energy wastage and enhance the overall sustainability of renewable energy generation. This not only benefits the environment but also presents economic advantages by reducing operational costs and increasing the competitiveness of renewable energy technologies.

Market segmentation

By Product

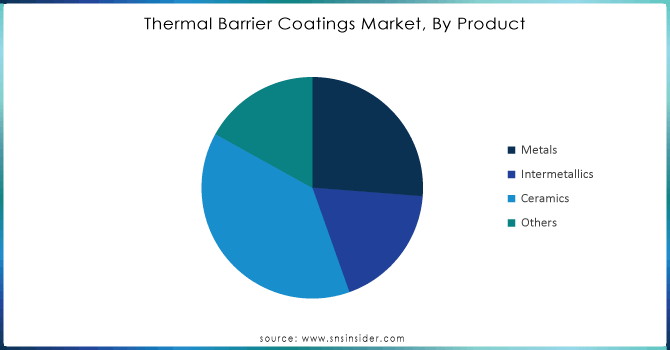

The ceramics product segment dominated the thermal barrier coatings market with a revenue share of about 38.5% in 2023 owing to the exceptional thermal resistance properties it offers, empowering gas turbines to operate at elevated temperatures while achieving heightened efficiencies. Moreover, the automotive and aerospace industries are witnessing a surge in demand for ceramic coatings, particularly in the exhaust systems of automobiles. This burgeoning demand is anticipated to fuel the growth of the market throughout the forecast period.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Technology

HVOF technology segment held the largest market share around 36% in 2023. HVOF has deposition rates of up to 10 times better than conventional methods of thermal spray. It reduces the time required for application of the coating and make less-expensive process. It offers many advantages including improved performance, better efficiency, cost saving, reduced size, packed weight advantage for electromechanical and electrical components operating at higher/lower temperatures or in the corrosive environment so has a life expectancy much wider for components. The industries served include the power, oil gas and water sectors plus mining, engineering chemicals, the petrochemicals industry, aerospace, paper making as well as manufacturing.

By Combination

Ceramic YSZ segment held the largest market share was 38.6% revenue share owner in 2022 and is expected to have the highest CAGR of 5. It is the crystal structure of which is zirconium oxide made stable at room temperature through addition of yttrium oxide. Zirconia and yttria are general denomination of these oxides. The most significant application of this material is TBCs for gas turbines. The growing requirement for gas turbines in main end-user industry hubs like power generation and aerospace will fuel the demand for ceramic YSZ that can also have an impact on the growth of the market across all regions.

By Application

Aerospace application held the largest market share around 32% in 2023. Change in air passenger traffic pattern Trade Agreements with Different Region Helps Negate Decline in Air Traffic Growing purchasing power and awareness among the citizens of India. This has paved the way for advanced, ultra-efficient aero-engine technologies to meet current and anticipated demand in today's busy aviation market.

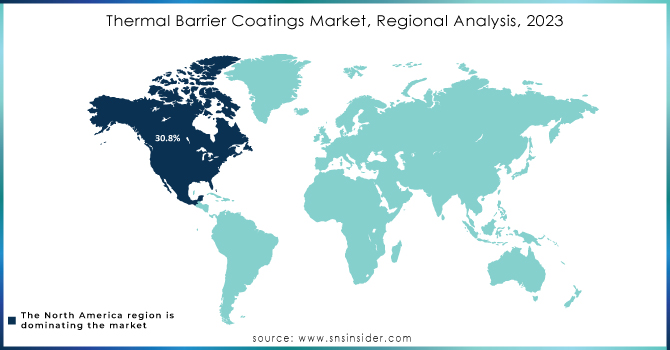

Regional Analysis

North America dominated the Thermal Barrier Coatings Market with the highest revenue share of about 30.8% in 2023. Within North America, the United States emerged as the dominant player in the regional market, a trend that is expected to continue throughout the forecast period. The region is poised for significant growth in the coming years, driven by increasing product demand across various applications, including stationary power plants, aerospace, automotive, and others. Aerospace stands out as one of the key markets for Thermal Barrier Coatings. The United States, in particular, boasts the largest aerospace industry in the nation. According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is projected to reach 8,270 by 2037, driven by a notable increase in air freight. This surge in air traffic can be attributed to factors such as the availability of highly skilled labor, high disposable incomes, and the robust economies of countries within the region. Consequently, the aerospace industry's growth is expected to serve as a significant driver for the Thermal Barrier Coatings Market in North America throughout the forecast period.

Asia Pacific is expected to grow with the highest CAGR of about 5.5% in the Thermal Barrier Coatings Market during the forecast period due to the increasing global demand for power and cleaner alternatives, as well as the expansion of the industrial and automotive sectors in the region. Notably, countries such as India and China are expected to significantly contribute to the market's growth due to the proliferation of power generation projects and the growing requirement for vapor deposition technology.

Key Players

- Praxair Surface Technologies (Praxair TBC Coating)

- MesoCoat Inc.

- ASB Industries Inc.

- Oerlikon Metco (Metco 204NS YSZ)

- Sulzer Ltd. (HVOF Thermal Spray Coatings)

- Flame Spray Technologies (FST) (FS 35 YSZ)

- Cincinnati Thermal Spray Inc.

- General Electric (GE Power) (GE HA Gas Turbines TBC)

- Mitsubishi Power (M701JAC TBC System)

- APS Materials, Inc. (APS Yttria-Stabilized Zirconia Coating)

- TWI Ltd. (Ceramic Matrix Composites Coatings)

- Zircotec Ltd. (Thermal Barrier Ceramic Coating)

- Linde plc (Linde TBC Solution)

- H.C. Starck GmbH (Thermal Spray Powders for TBCs)

- A&A Coatings (YSZ Thermal Barrier Coating)

- Plasma-Tec, Inc. (Plasma-Sprayed Ceramic Coatings)

- Thermion, Inc. (Thermion Ceramic TBC)

- Precision Coating Inc.

- Praxair Surface Technologies

- Metallisation Ltd.

Recent Development:

- In 2023, Chromalloy announced improvements to its proprietary TBC solutions, featuring enhanced oxidation resistance and longevity for high-performance gas turbines, addressing the increasing efficiency and reliability demands in power generation.

-

In 2022: Meggitt launched a new range of TBCs utilizing advanced ceramic materials that provide superior thermal insulation and increased resistance to thermal fatigue, aimed at enhancing the durability of aerospace engines.

-

In March 2020, Praxair Surface Technologies (PST), a U.S.-based company, and Siemens, a prominent German company, signed a new contract. This new contract encompasses a wide array of coating services for all Siemens products. PST will be responsible for coating aerospace and industrial gas turbine components, including casings, vanes, blades, and discs. These components will undergo PST's advanced processes such as slurry, aluminizing, platinum aluminizing, and thermal spray techniques.

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.9 Bn |

| Market Size by 2032 | US$ 25.9 Bn |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Metals, Intermetallics, Ceramics, and Others) • By Technology (Cold Barrier, High-Velocity Oxy-Fuel (HVOF), Plasma Barrier, Electric Arc Barrier, and Flame Barrier) • By Combination (Ceramic YSZ, MCrAlY, Al2O3 (Aluminium oxide), Mullite-based, and Others) • By Application (Stationary Power Plants, Automotive, Aerospace, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Flame Spray Coating Co., MesoCoat Inc., Precision Coating Inc., Praxair Surface Technologies, TWI Ltd., ASB Industries Inc., Thermion, A&A Company, Cincinnati Thermal Spray Inc., Metallisation Ltd. |

| Key Drivers | • Increasing demand for thermal barrier coatings in the aerospace industry • Rising demand for energy-efficient gas turbines in power generation plants drive the market growth. |

| Market Restraints | • High cost associated with thermal barrier coatings |