Colposcope Market Overview:

The Colposcope Market was valued at USD 392.10 million in 2023 and is expected to reach USD 593.35 million by 2032, growing at a CAGR of 4.73% over the forecast period of 2024-2032.

To Get more information on Colposcope Market - Request Free Sample Report

This report emphasizes the prevalence and incidence of cervical cancer and HPV, which continue to propel the need for colposcopy procedures and early detection methods. The research discusses technological innovations and adoption patterns, such as digital imaging integration, AI-driven diagnostics, and hand-held colposcopes that improve accessibility in low-resource settings. In addition, it looks into the changing regulatory environment and compliance patterns, emphasizing strict quality levels and approval processes that impact product development and entry into the market. The report also explores healthcare expenditure on cervical cancer screening across regions, measuring the influence of government programs, commercial investment, private healthcare growth, and out-of-pocket payments in shaping the market.

U.S. Colposcope Market Size & Forecast

The U.S. Colposcope Market was valued at USD 89.47 million in 2023 and is expected to reach USD 122.96 million by 2032, growing at a CAGR of 3.61% over the forecast period of 2024-2032. The colposcope market in the U.S. is expanding as more awareness about HPV-related cancers, broadening screening programs, and technological improvements in robotics-enabled colposcopy for improved accuracy drive demand. Furthermore, innovation and availability of cervical cancer detection are being driven by government-sponsored programs and private funding.

Market Dynamics

Drivers

-

The colposcope market is driven by the rising prevalence of cervical cancer and HPV infections, increasing the demand for early detection and diagnosis.

As per the World Health Organization (WHO), cervical cancer is the fourth most prevalent cancer in women worldwide, with more than 600,000 new cases reported every year. Government programs and awareness campaigns, including the National Cervical Cancer Screening Program in many nations, have boosted screening rates considerably, driving market growth. Technological innovations such as AI-based colposcopes and digital imaging solutions also improve diagnostic accuracy and efficiency, resulting in higher adoption. The increasing demand for non-invasive and portable colposcopes, especially in resource-poor environments, continues to drive demand further. Additionally, rising healthcare spending and access to insurance coverage for cervical cancer screening drive the market further. The integration of colposcopes with electronic health records (EHRs) and telemedicine platforms drives the increasing practice of remote diagnostics. Major players are aggressively introducing new products and broadening their portfolios, including DYSIS Medical's artificial intelligence-based colposcopy solutions. The increasing volume of gynecological procedures and outpatient diagnostic facilities is also a key driver fueling market growth. These drivers together propel the colposcope market, guaranteeing ongoing technological innovation and rising adoption rates.

Restraints

-

The high cost of advanced colposcopes limits affordability, particularly in low-income and developing regions.

Digital colposcopes equipped with AI and imaging capabilities may range from USD 5,000 to USD 20,000, which is out of reach for most healthcare providers. Restricted reimbursement schemes in some nations discourage investment in colposcopic procedures, negatively influencing market growth. The unavailability of skilled professionals with training in the interpretation of colposcopy also influences appropriate diagnosis and patient outcomes. Numerous healthcare centers, especially in remote and rural regions, do not have the proper infrastructure and skilled personnel to conduct colposcopic tests efficiently. Regulatory hurdles are also a barrier, as colposcopes have to pass rigorous approval processes from organizations such as the FDA, CE, and ISO, which slows product launches. Discomfort and fear among patients facing colposcopy procedures also fuel reluctance, which impacts screening levels. The presence of other screening technologies, including HPV DNA testing and liquid-based cytology, constrains the growth prospects of colposcopes further. The propensity for false-negative and false-positive findings in colposcopic procedures also inspires anxieties concerning diagnostic validity. These combine to constrain market development, calling for remedies like economical devices, training courses, and streamlining regulation to improve take-up.

Opportunities

-

The colposcope market presents lucrative opportunities with the growing adoption of AI-driven colposcopy systems for enhanced diagnostic accuracy.

Artificial intelligence-enabled colposcopy can enhance early detection rates by as much as 40%, turning cervical cancer screening into a game-changer. Growing healthcare infrastructure in emerging markets like India, Brazil, and South Africa represents a huge growth opportunity as governments increasingly invest in early detection initiatives. Increasing demand for handheld and portable colposcopes, driven by telemedicine and remote care, is a major opportunity too. The universal migration of healthcare toward digital solutions aids market growth, as colposcopes are becoming part of EHR systems to ensure end-to-end data management. Moreover, collaborations between healthcare organizations and major industry players are fueling innovation, like DYSIS Medical's cooperation with research centers for AI-based screening technology. The market is also aided by rising public-private investments toward enhancing women's healthcare services. The emergence of rental and refurbished colposcopes offers the potential to provide affordable services to cost-sensitive healthcare facilities, enhancing market access. Government support for HPV vaccination and cervical cancer education indirectly enhances the demand for colposcopy services. The enhancement of training courses in colposcopy procedures for healthcare professionals has the potential to increase adoption rates even further, covering the present shortfall in skilled individuals.

Challenges

-

The shortage of trained gynecologists and healthcare providers in many developing countries further limits market expansion.

One of the significant challenges in the colposcope market is limited access to healthcare services in less developed areas, where only 19% of women receive routine cervical screening, as reported by the WHO. Patient anxiety and fear of colposcopy procedures lower screening compliance, especially in conservative societies where gynecological examinations are frowned upon. Moreover, lack of knowledge for cervical cancer and colposcopy results in low attendance at screening programs, impacting market growth. Concerns over data privacy and cloud-based digital colposcopes' related cybersecurity risks are another obstacle as healthcare providers need to follow rigorous guidelines such as HIPAA and GDPR. In addition, diagnostic accuracy variability among colposcope users impacts reliability, with the possibility of misdiagnoses and heightened demand for standardized training and AI assistance. Continued supply chain interruptions and high raw material dependency for producing colposcopes are also a challenge, impacting product availability and price. Competition from other screening technologies, including liquid-based cytology and HPV DNA testing, may also constrain the growth prospects of colposcopes. Conquering such obstacles needs higher awareness, enhanced accessibility, and investment in AI-based and mobile colposcopy systems.

Colposcope Market Segmentation Analysis

By Modality

The optical colposcope segment led the market for colposcopes in 2023, with a maximum revenue share of 53.2%. Optical colposcope dominance is mostly due to cost-effectiveness, simplicity of operation, and intensive adoption by clinics and hospitals. These systems are most widely sought after for periodic cervical cancer checks because they have good image quality and are cheap compared to expensive video colposcopes.

In contrast, the video colposcope segment is likely to experience the highest growth in the forecast period. The growing demand for digital documentation, sharing of real-time images, and interoperability with electronic health records (EHRs) is fueling demand for video colposcopes. The growing adoption of telemedicine and AI-based diagnostics further fuels the adoption of video colposcopes, especially in advanced healthcare environments.

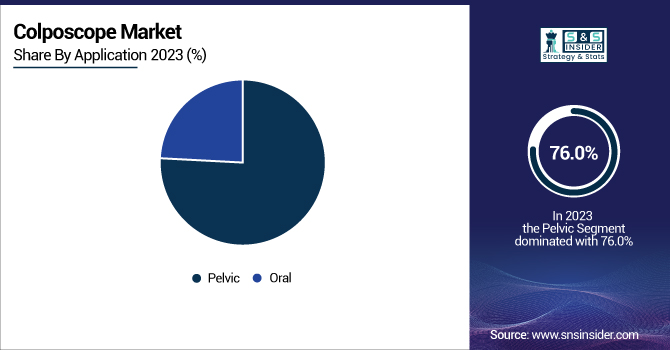

By Application

The pelvic examination segment led the market in 2023 with a revenue share of 76.0%. This is because of the high incidence of cervical cancer and HPV infection, which has resulted in greater cervical screening programs and government campaigns across the globe. The growing awareness regarding early detection and preventive healthcare practices has also driven demand for colposcopy in pelvic examinations.

The oral exam segment is anticipated to increase at a high rate between 2024 and 2032. The growth of non-invasive diagnostic tests of oral cancers and HPV-related oropharyngeal cancers is fueling demand for colposcopes. Moreover, improved non-invasive screening methods and increased adoption in dental and oncology clinics are further driving the segment growth.

By Portability

The stationary colposcope segment dominated the market in 2023, with a revenue share of 58.5%. Stationary colposcope dominance is fueled by its greater magnification power, stability, and superior imaging features, which have it as the top choice in hospitals and specialist gynecology clinics. Integration with digital documentation systems further increases their value in healthcare facilities.

The hand-held colposcope segment is expected to grow at the highest rate over the forecast period. The growing need for portable and low-cost diagnostic tools, especially in low-resource and remote locations, is driving this growth. Handheld colposcopes provide portability, affordability, and simplicity of use, thus being ideal for point-of-care diagnostics and telemedicine.

By End Use

The hospital segment led the colposcope market in 2023, with a revenue share of 22.7%. Hospitals are the main end-users of colposcopes because of their greater patient traffic, sophisticated healthcare setup, and government-sponsored screening programs. Hospital dominance in the market is further promoted by the presence of specialized gynecologists and high-end diagnostic facilities.

While this, the diagnostic center segment will be the fastest-growing segment between 2024 and 2032. Increasing demand for outpatient diagnostic testing, affordable screening services, and speedy access to colposcopy testing is driving diagnostic center growth. Moreover, the development of imaging technology and diagnostic automation is boosting the productivity of colposcopy services within these centers.

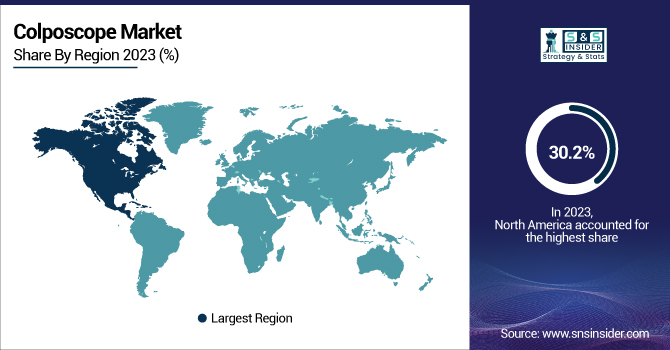

Colposcope Market Regional Insights

In 2023, North America led the colposcopes market, with the highest revenue share of more than 30.2%. The regional market is strengthened by the high rate of cervical cancer screening, well-developed healthcare infrastructure, and the concentration of major industry players. Government programs like the National Breast and Cervical Cancer Early Detection Program (NBCCEDP) in the United States and extensive insurance coverage for cervical screening further drive colposcope adoption. The region also enjoys technological innovation, such as the incorporation of AI-based diagnostic systems and video colposcopes with EHR connectivity, improving the accuracy and efficiency of colposcopy procedures.

The Asia-Pacific region is expected to be the highest-growing market during 2024-2032, driven by growing awareness regarding cervical cancer, rising government healthcare expenditure, and growing access to diagnostic services in emerging economies. China and India are experiencing accelerated adoption of colposcopy across hospitals and diagnostic centers, with driving factors including improving healthcare infrastructure, growing disposable incomes, and expanding demand for cost-effective diagnostic solutions. Besides, different government campaigns for cervical cancer screening programs and the growing involvement of international colposcope producers in the market further fuel the market's growth. The region's affordability-driven uptake of portable and handheld colposcopes also helps ensure that it has a high growth potential.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Colposcope Market and Their Products

-

Karl Kaps GmbH & Co. KG – Kaps VIdeo Colposcope, Kaps SOM Series

-

CooperSurgical, Inc. – Leisegang Colposcope Series

-

DYSIS Medical Inc. – DYSIS Ultra, DYSIS View

-

ATMOS Medizin Technik GmbH & Co. KG – ATMOS iView Colposcope, ATMOS S 41

-

Olympus Corporation – Olympus OCS-500, Olympus OCS-900

-

McKesson Medical-Surgical Inc. – McKesson Video Colposcope

-

Ecleris – Ecleris ColpoScope Series

-

Optomic – OPTOMIC OP-C Series Colposcope

-

Seiler Instrument Inc. – Seiler 935, Seiler 955 Colposcope

-

Symmetry Surgical Inc. – Zeiss Colposcopes (Distributed under Symmetry Surgical)

Recent Developments

In June 2024, Bharat Serums and Vaccines Limited (BSV) partnered with FOGSI’s Public Awareness Committee to introduce India's first colposcopy workshop in Tier 2 cities. The inaugural session, led by Dr. Priya Ganeshkumar at New Ramakrishna Sevasadan Hospital, Siliguri, aimed to enhance awareness and accessibility of colposcopy for early cervical cancer detection among gynecologists.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 392.10 million |

| Market Size by 2032 | USD 593.35 million |

| CAGR | CAGR of 4.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality [Optical, Video] • By Application [Pelvic, Oral] • By Portability [Handheld, Stationary] • By End Use [Hospitals, Diagnostic Centers, Gynecology Clinic, Specialty Clinic, Ambulatory Surgical Center, Academic And Research] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Karl Kaps GmbH & Co. KG, CooperSurgical, Inc., DYSIS Medical Inc., ATMOS Medizin Technik GmbH & Co. KG, Olympus Corporation, McKesson Medical-Surgical Inc., Ecleris, Optomic, Seiler Instrument Inc., Symmetry Surgical Inc. |