Commercial Radars Market Report Scope & Overview:

Get More Information on Commercial Radars Market - Request Sample Report

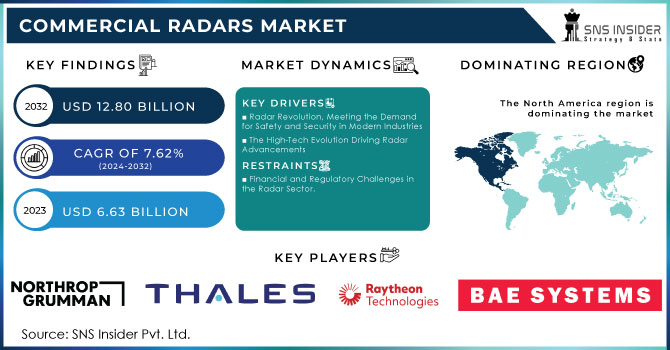

The Commercial Radars Market Size was valued at USD 6.63 Billion in 2023 and is expected to reach USD 12.80 Billion by 2032 and grow at a CAGR of 7.62% over the forecast period 2024-2032.

The commercial radars market has been growing due to factors such as increased demand for monitoring weather systems, the widespread adoption of ADAS in vehicles and air and marine transportation, and growing security measures in several industrial sectors are all contributing to the growth of a market for commercial radars. Commercial radars are a volatile market involving highly diverse applications ranging from aviation, marine, weather monitoring, automobile, and security.

Advanced driver-assistance systems hold great promise as accident prevention technology. By 2023, forward collision prevention, lane-keeping assistance, and other features in ADAS are estimated to prevent or mitigate up to 62% of all crashes, thereby avoiding around 3.59 million accidents every year. For instance, forward collision prevention could address some 1.7 million accidents, while lane-keeping assistance has an impact on about 1.12 million crashes. Additionally, it is estimated that ADAS technologies will likely avoid up to around 20,841 fatalities annually. Lane-keeping assist alone is among the largest contributors, saving more than 14,000 lives.

Modern technological development continues to alter the commercial radar environment. Moreover, the growing integration of AI and ML functionality allows for enhanced data analysis and, consequently, more effective decision-making leading the market to an even further miniaturization of systems for drones and unmanned vehicles as well as applications based on phased array systems for even more precise and flexible operation. Integrating 5G technology in commercial radar systems takes performance, efficiency, and capabilities to a completely new level. Continuous real-time data are provided by radars, and for border security, it becomes necessary. DHS U.S. Customs and Border Protection utilizes Border Surveillance Systems to strengthen situational awareness along the U.S. border. The BSS integrates different commercial technologies, including mobile and fixed video surveillance systems, thermal imaging, ground sensors, radar, and radio frequency sensors, to enhance surveillance across the border.

Commercial Radars Market Dynamics

KEY DRIVERS:

-

Radar Revolution, Meeting the Demand for Safety and Security in Modern Industries

Increased safety and security awareness in the industries is a major factor driving the commercial radar market. The increasing instances of accidents and threats have compelled organizations to spend heavily on radar systems for enhanced surveillance and safety measures. The Thales Group had just released a new generation of the Ground Master 400 Alpha, an advanced technological medium to enhance the capabilities of air and ground surveillance. This follows the emerging industry trend of integration, leveraging advanced technologies to bolster security and safety processes. Meanwhile, the industry has allocated massive expenditures and investments in its infrastructure in aviation, developing its radar capacity as the rising volumes of air traffic take flight with needs in the same growing exponentially.

-

The High-Tech Evolution Driving Radar Advancements

Technological advancements are key drivers for the commercial radars market. Discoveries in radar technology terms of the infusion of artificial intelligence and machine learning improve detection capability and raise the operational efficiency of the radar.

Software-defined radar and quantum radar systems are revolutionary innovations that change the game for how radar systems operate. They make it possible for radar systems to better adapt and work effectively under various environments. Not only does it enhance functionality existing in current radar systems, but it also makes possible new forms of exploitation of them across different sectors such as automotive and maritime navigation.

RESTRAIN:

-

Financial and Regulatory Challenges in the Radar Sector.

Currently, there are several restrains that face the commercial radars market mainly by the cost of huge development and implementation costs that may hamper mass applications in different industrial fields. In avionics and defense, the main regulatory challenges include stiff compliance requirements. Technological advancement is also so rapid that markets must continually invest their resources in research and development further stresses their financial resources. It deals with issues of cybersecurity and data privacy that increasingly pose serious concerns, which may discourage investment in radar technologies. On the whole, these are factors capable of slowing down market growth despite the growing demand for safety and security solutions.

Commercial Radars Market Segmentation Overview

BY COMPONENT

In 2023, the highest revenue share of the antenna segment accounted for 21.4%. An antenna is the most critical component in a commercial radar as it enables the required transmission and reception of electromagnetic waves, thus it allows the radar system to detect and locate objects. In May 2024 General Atomics modernizes the EagleEye multi-mode radar by adding an AESA antenna and related software. The drop-in antenna will increase the radar range well beyond 50 miles to at least 120 kilometers, or more than double that of the current system.

Signal & data processors are expected to grow at 8.67% CAGR during the forecast period. The signal and data processors are important for processing the radar signal to obtain usable information about targets.

BY PLATFORM

The land platform held the highest revenue share of 35.76% in 2023. Ground-based radar systems are critical for border security and defense application tracking and monitoring. Such radars help in tracking threats or intrusions and unauthorized activities thereby increasing the security mechanisms. Radars operated in vehicle or transport environments can be used to warn against collisions by detecting nearby objects or obstacles in real-time. Sensor solutions provider HENSOLDT showcased its latest technological developments at the Africa Aerospace and Defence (AAD) Expo from 18 to 22 September 2024 as a further step towards leadership in spectrum dominance, optronics, and radar technologies.

The naval platform is anticipated to witness the highest CAGR of 8.13% during the entire forecast period. Maritime commercial radar systems are often associated with compact dimensions, easy installation procedures, cordial user interfaces, and low prices.

BY FREQUENCY

In 2023, the market's highest revenue share was the S frequency segment with 30.75%. The radars of the S-band are recognized for their coverage over long distances and important atmospheric conditions; thus, they are highly used in applications where extended-range detection is critical. In addition, this frequency offers high-resolution imaging that involves high-definition target identification and tracking in a commercial platform.

The X frequency segment is likely to be the fastest-growing segment with 8.19% CAGR during the forecast period. X-band radar systems operating in a frequency of 8-12 GHz have identified even minute-sized particles due to the shorter wavelength.

BY DIMENSION

The 2D segment had the highest revenue with 48.89% of the total market share in the year 2023. The azimuth angle detection feature allows a 2D radar system to detect the angle or orientation of a target object horizontally from the radar unit. This information is crucial in tracking moving targets and doing effective surveillance.

The 3D segment is expected to grow fastest at 9.11% CAGR over the forecast period. The growth in 3D commercial radars has arisen due to growing demand from various sectors such as aviation, maritime, and defense for surveillance and security systems.

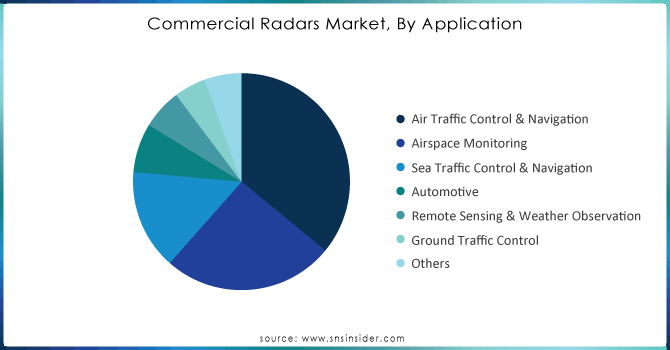

BY APPLICATION

Air Traffic Control & Navigation dominated the market share with 35.96% of the total market share in 2023. Applications for Commercial Radar, Air Traffic Control, and Navigation Apply Surveillance Systems & Technologies to Safeguard the Safe & Efficient Movement of Aircraft.

Airspace monitoring is expected to lead during the forecast period at 8.26%. Commercial radars in airspace monitoring and surveillance are essential for airports for perimeter security, weather monitoring, aircraft collision warning, navigation, and more. This has been raised by the increased demand for air travel that increases air traffic, thereby creating a necessity for strong radar systems in airports globally.

Need any customization research on Commercial Radars Market - Enquiry Now

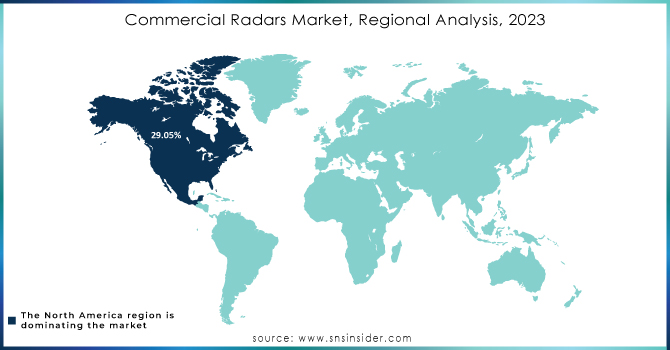

Commercial Radars Market Regional Analysis

In 2023, North America dominated the market with a market share of 29.05%. This market has been booming mainly due to increased demand for air travel, increased security concerns, and the necessity to monitor and predict the weather.

Asia Pacific is projected to grow at the highest CAGR of 8.02% during the forecast period. The rate of road accidents is increasing, and in the region, 2 of the world's most populated countries are found, which has surged automotive safety systems that primarily consist of radars.

Key Players

Some of the major players in the Commercial Radars Market are:

-

Northrop Grumman Corporation (AN/APG-83 AESA Radar, AN/TPS-80 G/ATOR)

-

Thales Group (Ground Master 400, Air Master 100)

-

Raytheon Technologies Corporation (AN/APG-79 AESA Radar, AN/TPY-2 Radar)

-

Lockheed Martin Corporation (AN/APG-83, Radar System for C-130J)

-

BAE Systems (Siren Radar, Dismounted Soldier Radar)

-

Honeywell International Inc. (SmartView Radar, IntuVue 3D Weather Radar)

-

Leonardo S.p.A. (Gabbiano TS, Seaspray Radar)

-

Airbus S.A.S. (ASR-9000, ANS-600 Radar)

-

General Dynamics Corporation (GDC4S RSM, ISR Solutions)

-

L3Harris Technologies, Inc. (FALCON III Radio, Radar Surveillance Solutions)

-

Saab AB (ERIEYE AEW&C, Sea Giraffe)

-

Raytheon Technologies (APG-68, APY-10)

-

Elbit Systems Ltd. (C-Guard, ELM-2022)

-

Indra Sistemas S.A. (Lanza 3D Radar, Tetra radar)

-

Mitsubishi Electric Corporation (J/FPS-3, J/FPS-5)

-

Kongsberg Gruppen (HUGIN AUV, Sea Protector)

-

Rockwell Collins (now part of Collins Aerospace) (Pro Line Fusion, Radar Data Link)

-

Zodiac Aerospace (now part of Safran) (Zodiac Radar, Elan Flight Systems)

-

Echodyne (Echodyne MESA, Radars for UAS)

-

Sierra Nevada Corporation (Sierra Nevada Airborne Radar, M-ATV Radar)

RECENT TRENDS

-

In March 2024, UAE-based EDGE Group and the Spanish defense contractor will provide military radars for "untapped and fragmented" markets outside Europe and NATO.

-

September 2024, The Cabinet Committee on Security approved deals worth about Rs 13,000 crore to buy new high-power radars and close-in weapon systems from Indian manufacturer Larsen and Toubro to upgrade the capability of the Indian Air Force in keeping a sharp eye on air activity in China and Pakistan and protect its critical assets.

-

In Feb 2024, Mercury Systems, Inc. announced a significant three-year subcontract worth as much as $96 million with Raytheon for high-performance signal processing sub-systems for the US Army's Lower Tier Air and Missile Defense Sensor, or LTAMDS. The hardware provided under the subcontract will power nine LTAMDS radar systems, supporting the US Army as well as Poland - and represents Poland as the first foreign customer in the LTAMDS program.