5G in Aviation Market Report Scope & Overview:

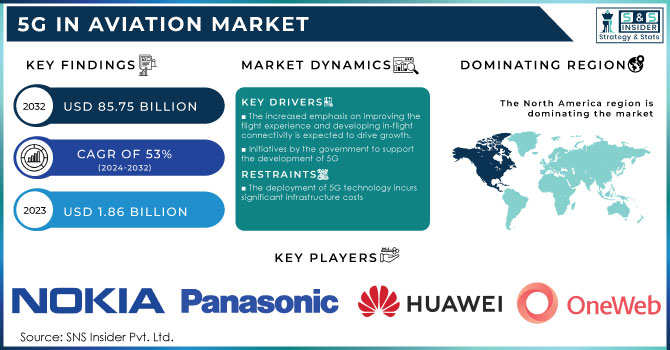

The 5G in Aviation Market was valued at USD 1.86 Billion in 2023 and is expected to reach USD 85.75 Billion by 2032, growing at a CAGR of 53% over the forecast period of 2024-2032.

To get more information on 5G in Aviation Market - Request Free Sample Report

Evolution 5G is a fundamental wireless networking and communication system that connects the aviation infrastructure and technologies that generate and transmit data to end users. Fifth-generation mobile networks are widely looking to promote wireless communication and networking technology by replacing 4G LTE hardware and communication infrastructure. The transition from 4G LTE to 5G connectivity promises to make internet access faster than previous technologies. The primary goal of 5G Technology is to broaden the aviation technological scope of the internet of things, as well as virtual reality and augmented reality concepts. 5G technology has enormous potential for integrating digital technology with a large number of individual users.

5G technology in the aviation industry is still in its early stages. The industry has well articulated the adoption of 5G in the aviation industry and its application due to its properties such as ultra-high reliability and low latency with the technological absorption in digital aviation. The addition of 5G technology improves passenger experience while increasing operational efficiencies. On the other hand, IoT will help the aviation MRO operation anticipate and resolve a number of business issues. Several industry companies have already begun to create 5G infrastructures, allowing IoT for baggage handling, passenger boarding, security check-ins, and other airport-side operations.

MARKET DYNAMICS

KEY DRIVERS

-

The increased emphasis on improving the flight experience and developing in-flight connectivity is expected to drive growth.

-

Initiatives by the government to support the development of 5G

RESTRAINTS

-

The deployment of 5G technology incurs significant infrastructure costs

OPPORTUNITIES

-

Contracts and agreements with key players in the aviation industry

-

Continuous progress in the 5G networ

CHALLENGES

-

Developing 5G Infrastructure Requires Significant Investment

-

Limitations in Technology to Support Consistent High-Speed Connections

IMPACT OF COVID-19

The COVID-19 health crisis has increased transportation complexity, with airports around the world experiencing bottlenecks in operational processes. The deployment of 5G technology in airport and aircraft operations is expected to control pandemic threats while optimising ground operations and reducing congestion. The emergence of the COVID-19 pandemic, which severely impacted the airline industry, exacerbated the situation. Thousands of planes were grounded around the world, and the industry saw a significant drop in revenue. The aviation industry's losses have influenced the adoption of innovative technologies such as 5G in aviation.

The market is divided into three segments: Enhanced Mobile Broadband, Fixed Wireless Access, and Others. For the forecast period, the enhanced mobile broadband segment has the largest market share. eMBB is a 4G network innovation that can also be considered the first phase of 5G services. In-flight entertainment, real-time air traffic alerts, real-time video streaming, games with 3D and 4K resolutions, and high-speed internet access for latent-free cloud access are among the prominent applications involved with eMBB. The growing demand for better flight experiences is driving up the demand for eMBB technology, which is used in in-flight 5G connectivity.

According to end-use, 5G infrastructure for airports is expected to account for the majority of the overall market. As the number of smart connected airports grows, so does the demand for a 5G network to support these smart connected airports. With rising air passenger traffic worldwide, the installation of 5G will aid in the enhancement of such operations in airports by enabling ultra-high-speed connectivity, thereby fueling the growth of aviation 5G globally. eMBB is an evolution of the existing 4G network, as well as the first phase of 5G services. In-flight entertainment, real-time air traffic alerts, real-time video streaming, games with 3D and 4K resolutions, and high-speed internet access for latent-free cloud access are among the prominent applications involved with eMBB. There is an increasing demand for improved flight experiences, which is fueling the demand for eMBB technology used in in-flight 5G connectivity.

The aircraft operations segment is expected to account for the majority of market share in 2022. The provision of 5G services to airlines is included in 5G services for aircraft operations. Airlines build 5G infrastructure to improve Wi-Fi connectivity in their aircraft. They purchase a one-time package of 5G network for their aircraft fleet from telecom industry vendors. International flights will be more likely to adopt 5G networks because they are long-haul flights with a mandatory requirement for Wi-Fi connectivity. The increased demand for a better flight experience and a fast internet connection throughout the flight will drive the growth of the 5G services market in aircraft operations.

KEY MARKET SEGMENTATION

By Product

-

Enhanced Mobile Broadband

By End Use

-

5G Aircraft Infrastructure

-

5G Airport Infrastructure

By Communication Infrastructure

-

Small Cell

-

DAS

By 5G Services

-

Aircraft Operations

-

Airport Operations

By Technology

-

eMBB

-

FWA

-

URLLC/MMTC

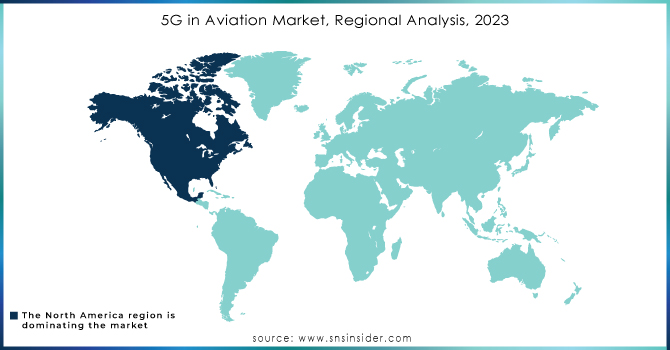

REGIONAL ANALYSIS

The Global 5G In Aviation Market is divided into four regions based on regional analysis: North America, Europe, Asia Pacific, and the Rest of the World. In terms of research and development activities in 5G technology for aviation, network design/deployment, and the presence of key market players, North America has the largest market share. The region has a high demand for air travel, and air passenger traffic is growing rapidly. As passenger traffic grows, so does the demand for good internet connectivity in airports and on aircraft. The region is well known for its rapid adoption of new and advanced technologies, such as the Internet of Things, artificial intelligence (AI), and autonomous/connected aircraft, which will boost the market in this region.

Need any customization research on 5G in Aviation Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Ericsson, Nokia, Cisco Systems, Panasonic Avionics Corporation, Huawei Technologies Co. Ltd., Gogo LLC, Global Eagle Entertainment, ONEWEB, Aeromobile Communications, Smartsky Networks, Inseego Corp, Intelsat and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.86 Billion |

| Market Size by 2032 | US$ 85.75 Billion |

| CAGR | CAGR of 53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Enhanced Mobile Broadband, Fixed Wireless Access) • By End Use (5G Infrastructure for Aircraft and Airport) • By Technology (eMBB, FWA, URLLC/MMTC) • By Communication Infrastructure (Small Cell, DAS) • By 5G Services (Aircraft Operations, Airport Operations) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Ericsson, Nokia, Cisco Systems, Panasonic Avionics Corporation, Huawei Technologies Co. Ltd., Gogo LLC, Global Eagle Entertainment, ONEWEB, Aeromobile Communications, Smartsky Networks, Inseego Corp and Intelsat |

| DRIVERS | • The increased emphasis on improving the flight experience and developing in-flight connectivity is expected to drive growth. • Initiatives by the government to support the development of 5G |

| RESTRAINTS | • The deployment of 5G technology incurs significant infrastructure costs. |