Air and Missile Defense Radar (AMDR) Market Report Scope & Overview:

To get more information on Air and Missile Defense Radar (AMDR) Market - Request Free Sample Report

The Air and Missile Defense Radar (AMDR) Market was valued at USD 7.67 billion in 2023 and is projected to grow to USD 13.4 billion by 2032, achieving a CAGR of 6.34 % over the forecast period from 2024 to 2032.

Demand for Air and Missile Defense Radar. In the aftermath of ongoing terrorist activity and incursion, governments around the world must strengthen their defence. As a response, various nations have boosted their efforts in procuring and developing Air and Missile Defense Radar systems, which aid in the detection of oncoming missiles from vast distances, ground control interceptions, and surveillance.

Countries have introduced x-band radar into their naval platforms in recent years to improve long-range detection and tracking of ballistic missiles. Radar technology improvements have greatly aided airborne radar, marine radar, and military radar systems in detecting and tracking unwanted aircraft, ships, and land-based vehicles. Over the projected period, the development of dual-band radar and multi-mission phased array radar is expected to have a positive impact on market growth.

MARKET DYNAMICS

KEY DRIVERS

-

Militaries around the world are replacing legacy systems as a result of technological advancements in warfare.

-

Territorial Conflicts and Geopolitical Uncertainties in the Middle East and Asia-Pacific

RESTRAINTS

-

Performance Impaired as a Result of Growing Cyber Warfare

-

The variables that drive market development are critical.

OPPORTUNITIES

-

Increased Use of Ballistic Missiles and Air and Missile Defense Systems

-

Surprisingly, inventive advancements in short-range air defence frameworks will also fuel the global short-range air defence frameworks market.

CHALLENGES

-

Interruptions caused by electromagnetic jamming and noise

-

Significant costs involved with the expansion of air defence frameworks and global agreements surrounding the movement of weapons are limiting market growth.

IMPACT OF COVID-19

COVID-19 is a one-of-a-kind global public health emergency that has impacted practically every industry, with long-term consequences expected to harm corporate development within the anticipated time range. The ongoing examination increases many of the investigation structure to ensure hidden COVID-19 concerns and anticipated future paths.

The paper provides knowledge insights on COVID-19 while considering changes in consumer behaviour and requests, purchasing patterns, supply chain re-routing, elements of current market effects, and massive government involvement. The new review provides insights, analyses, examination, and a gauge, taking into account the COVID-19 effect.

The competitive landscape of the air and missile defence radar system market provides details and information supplied by firms. The report provides a complete analysis and specific insights into the companies' earnings. Organization description, significant business, air and Missile defence Radar System product presentation, ongoing advances, Air and Missile defence Radar System transactions by region, type, application, and sales channel are all included in the details.

The market is divided into three sections based on range: short range, medium range, and long range. During the projection period, long-range radars will dominate the total market. Increased need for long-range radar systems for surveillance and navigation is pushing the market for long-range AMDR systems.

The market is divided into three categories based on platform: air, naval, and land. The fast use of AMDR systems in land-based platforms is fueling the expansion of the land-based platform segment; land-based AMDR systems are primarily used in homeland security and military applications. In land-based AMDR applications, S-band and X-band radars are often used.

During the forecast period, the naval-based AMDRS segment will increase at a rapid pace. Long-range artillery, ballistic seven stealth missiles, and other naval-based AMDRs are utilised for naval inquiry and detection. These are also used to monitor smuggling, drug trafficking, and terrorism, among other things.

Airborne AMDRs are employed for a variety of purposes, including air surveillance, missile defence, and early warning systems. The market is divided into two categories: ballistic missile defence and conventional. As military businesses throughout the world spend in research & development to improve radar capabilities such as speed, accuracy, and destructive capacities to be utilised for ballistic missiles, the market for the BMD category is predicted to rise at a faster rate than others.

KEY MARKET SEGMENTATION

By Application

-

Ballistic Missile Defense

-

Conventional

By Platform

-

Ground Based

-

Naval

-

Airborne

By Range

-

Short

-

Medium

-

Long & Strategic System

REGIONAL ANALYSIS

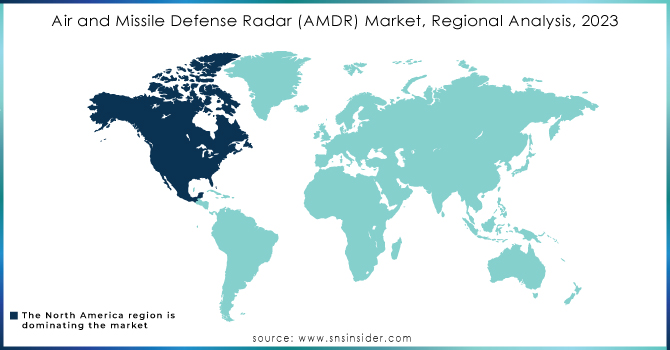

Revenue for air and missile defence radar systems is calculated across the Americas, Asia-Pacific, Europe, the Middle East, and Africa. Argentina, Brazil, Canada, Mexico, and the United States are all part of the Americas region. The Asia-Pacific region was examined, which included Australia, China, India, Indonesia, Japan, Malaysia, the Philippines, South Korea, and Thailand. Europe, the Middle East, and Africa are examined in France, Germany, Italy, the Netherlands, Qatar, Russia, Saudi Arabia, South Africa, Spain, the UAE, and the UK. The Asia-Pacific region was the second-largest market.

Because of the rise in cross-border disputes, nations such as China, India, and South Korea are expanding their investment in radar systems, which is fueling the development of the market around here. North America, Asia-Pacific, Europe, the Middle East and Africa, and Latin America are the market segments. North America is expected to be the largest market throughout the projection period.

The United States, as the world's largest military high roller, is investing in an air and rocket safeguard radar framework with the end objective of monitoring and boundary protection.

Need any customization research on Air and Missile Defense Radar (AMDR) Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Thales, SAAB, Rockwell Collins, Raytheon, Northrop Grumman, Lockheed Martin, Israel Aerospace Industries, Honeywell International, Boeing, BAE Systems, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.67 Billion |

| Market Size by 2032 | US$ 13.4 Billion |

| CAGR | CAGR of 6.34% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Ballistic Missile Defense, Conventional) • By Platform (Ground Based, Naval, Airborne) • By Range (Short, Medium, Long & Strategic System) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thales, SAAB, Rockwell Collins, Raytheon, Northrop Grumman, and Lockheed Martin, Israel Aerospace Industries, Honeywell International, Boeing, BAE Systems, and other players. |

| DRIVERS | • Militaries around the world are replacing legacy systems as a result of technological advancements in warfare. • Territorial Conflicts and Geopolitical Uncertainties in the Middle East and Asia-Pacific |

| RESTRAINTS | • Performance Impaired as a Result of Growing Cyber Warfare • The variables that drive market development are critical. |