Commercial Vehicle (CV) Active Power Steering Market Report Scope & Overview:

The Commercial Vehicle (CV) Active Power Steering Market Size was valued at USD 5.85 billion in 2023 and is expected to reach USD 14.29 billion by 2031 and grow at a CAGR of 11.8% over the forecast period 2024-2031.

The Commercial Vehicle (CV) Active Power Steering system increases regulated energy to the steering mechanism to reduce the effort required to turn the steered wheels at normal driving speeds. When equipped, the active power steering system in big commercial vehicles lessens the amount of physical effort required by the driver to move the wheel, regardless of whether the vehicle is moving or stationary. In place of the typical and traditional steering gear that would normally be found at the lower end of the steering column, the power steering unit has been installed. It is linked to the hydraulic pump that is located on the generator by two oil lines that go between the two.

Get More Information on Commercial Vehicle (CV) Active Power Steering Market - Request Sample Report

Massive commercial trucks and buses, tipping the scales at up to 80,000 pounds, rely on power steering for maneuverability, especially at low speeds (under 10 mph) and when parked. Without this assistance, turning the wheels would be a tiring struggle. Traditionally, Hydraulic Power Steering (HPS) has been used, offering reliability and affordability. However, HPS can guzzle up to 3% more fuel due to wasted energy. Newer systems like Electric Power Steering (EPS) and Electrohydraulic Power Steering (EHPS) address this issue. By using electric motors, EPS saves fuel (estimates suggest 1-2% improvement) and provides better control at all speeds. Additionally, EPS eliminates bulky hydraulic components, reducing weight and further enhancing fuel efficiency.

MARKET DYNAMICS:

KEY DRIVERS:

-

Manufacturers prefer Electric Power Steering over Hydraulic to boost gas mileage.

-

HPS for commercial trucks allows manual steering during power-steering failure.

-

Eliminating an engine-driven hydraulic pump increases gas mileage by 1 mpg.

-

Less electricity use will boost future market demand.

-

Low-maintenance, faster response.

RESTRAINTS:

-

The high cost of power steering is a deterrent to the market's growth.

-

The power steering system has a sophisticated layout and design.

OPPORTUNITIES:

-

Advanced active power steering is user-friendly & highly compatible with advanced assistance systems.

-

It is anticipated that efforts to improve vehicle safety would have a substantial impact.

-

CV active power steering technology advancements and rapid implementation.

CHALLENGES:

-

The market's growth may be slowed or even halted by changes in the price of raw materials.

-

There will be a problem with fluid leakage that will limit the market growth.

IMPACT OF RUSSIA-UKRAINE WAR

Global supply chains are strained by 10-15%, potentially delaying production. Sanctions on Russia, a previous source of materials, could inflate component prices by 20%. Soaring fuel costs, up 30-40% in some regions, translate to 5-10% higher operational costs for transportation companies. This economic pressure might lead to a 7% decline in demand for new commercial vehicles, impacting CV active power steering sales in the short term.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns can throw a curveball at the CV active power steering market. With businesses transporting less during downturns, freight volumes dip. Transportation companies tighten their belts, prioritizing essential features over advancements like active power steering in new vehicle purchases. This, coupled with a general decline in demand for new commercial vehicles (potentially down 5-7%) due to weakened consumer confidence, puts a damper on CV active power steering sales. Existing fleets might also see replacement delays as companies focus on repairs over new vehicles with advanced features. While the slowdown might create a short-term slump, the market is expected to recover in the long run, driven by the fuel-saving and safety benefits of CV active power steering.

MARKET SEGMENTATION:

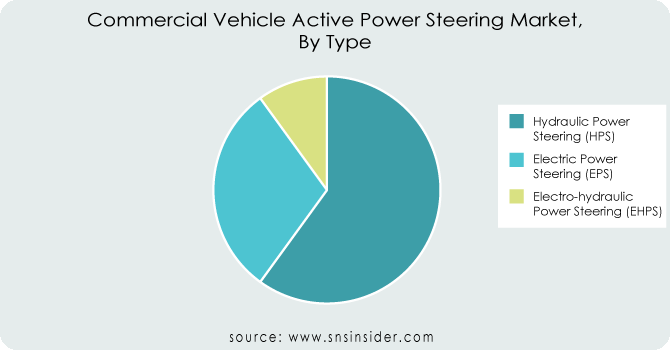

By Type:

-

Hydraulic Power Steering (HPS)

-

Electric Power Steering (EPS)

-

Electro-hydraulic Power Steering (EHPS)

The market has been divided into Hydraulic Power Steering (HPS), Electric Power Steering (EPS), and Electro-hydraulic Power Steering (EHPS) based on the type segment. The market for hydraulic power steering (HPS) is predicted to expand the most during the forecast period. EHPS is a hydraulic power steering system that uses fluid to help in steering. Although EHPS systems are more expensive, they provide better performance and longer endurance than other types of power steering systems.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application:

-

Light Commercial Vehicles (LCV)

-

Medium Commercial Vehicles (MCV)

-

Heavy Commercial Vehicles (HCV)

The market has been divided into Light Commercial Vehicles (LCV), Medium Commercial Vehicles (MCV), and Heavy Commercial Vehicles (HCV) based on the application segment. The market for Heavy Commercial Vehicles (HCV) is predicted to expand the most during the forecast period. These systems make driving more stable and easier to control. They also make steering more accurate and give the driver more control. In addition, they have better-stopping power and can stop the car faster.

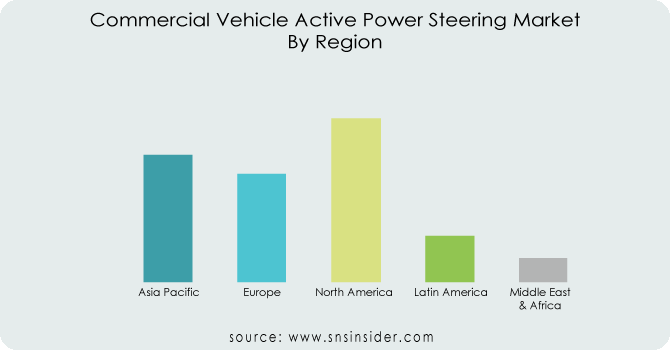

REGIONAL ANALYSIS:

North America currently leads the CV active power steering market due to its strong infrastructure, developed economy, and booming construction and logistics industries. Europe is expected to take the top spot in the future, driven by continuous advancements in the technology and its wider adoption across various applications. Additionally, European manufacturers are developing cost-effective solutions to meet stricter EU emission regulations, which will further propel the market growth in the region. The Asia-Pacific region is also poised for significant growth. The rise of e-commerce is creating new opportunities for CV active power steering systems. Furthermore, recent regulations in India allowing heavier loads for trucks are expected to boost demand in the region.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

ZF Friedrichshafen AG (Germany), Daimler AG (Germany), BMW AG (Germany), AB Volvo (Sweden), Tedrive steering systems GmbH (Germany), Ognibene Power SPA (Italy), Knorr-Bremse (Germany), and Robert Bosch (Germany) are some of the affluent competitors with significant market share in the Commercial Vehicle (CV) Active Power Steering Market.

Recent Developments

-

HL Mando, a South Korean company developing electric vehicles and self-driving systems (part of the HL Group), joined forces with China's Tianrun Industrial Technology Co. in February 2024.

-

Porsche unveiled plans in November 2023 for the next generation Panamera. This sporty luxury sedan promises an unforgettable driving experience, blending comfort and speed.

Daimler AG (Germany)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.85 Billion |

| Market Size by 2031 | US$ 14.29 Billion |

| CAGR | CAGR of 11.8% From 2024 to 2031 |

| Base Yea | 2023 |

| Forecast Period | 2023-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Hydraulic Power Steering (HPS), Electric Power Steering (EPS), Electro-hydraulic Power Steering (EHPS)) • by Application (Light Commercial Vehicles (LCV), Medium Commercial Vehicles (MCV), Heavy Commercial Vehicles (HCV)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ZF Friedrichshafen AG (Germany), Daimler AG (Germany), BMW AG (Germany), AB Volvo (Sweden), Tedrive steering systems GmbH (Germany), Ognibene Power SPA (Italy), Knorr-Bremse (Germany), and Robert Bosch (Germany) |

| Key Drivers | •Manufacturers prefer Electric Power Steering over Hydraulic to boost gas mileage. •HPS for commercial trucks allows manual steering during power-steering failure. |

| RESTRAINTS | •The high cost of power steering is a deterrent to the market's growth. •The power steering system has a sophisticated layout and design. |