Bicycle Market Report Scope & Overview

The Bicycle Market Size was valued at USD 70 billion in 2023 and is expected to reach USD 150.05 billion by 2031 and grow at a CAGR of 10% over the forecast period 2024-2031. Bicycles offer an eco-friendly and versatile form of transportation, with options like cargo bikes for errands, electric bikes for longer commutes, and mountain bikes for off-road adventures. Their ease of use and safety contribute to their popularity. As people prioritize health and fitness, cycling is increasingly viewed as a way to combat obesity and maintain a healthy lifestyle. This growing interest in cycling fuels market expansion. Additionally, cycling associations like "Go Out and Tour Somewhere" and "Road Soldiers Cycling Club" actively promote cycling by organizing sports tournaments, recreational rides, and rallies, further encouraging people to get on their bikes. This combination of health benefits, environmental friendliness, and engaging community events propels the bicycle market forward.

Get More Information on Bicycle Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Growing environmental concerns push people towards eco-friendly transportation options like bicycles.

-

Rising health consciousness fuels demand for bicycles as a way to combat obesity and stay fit.

The growing focus on health and fitness is a significant driver of the bicycle market. As people become more aware of the dangers of obesity and the importance of an active lifestyle, bicycles are increasingly seen as a convenient and accessible way to stay fit. Cycling offers a low-impact exercise option that can be easily incorporated into daily routines, whether for short commutes or dedicated exercise sessions. This trend towards prioritizing health and wellness is expected to continue driving demand for bicycles in the foreseeable future.

RESTRAINTS:

-

Safety concerns regarding traffic accidents and theft can deter people from cycling.

-

High-quality bicycles can be expensive, limiting affordability for some demographics.

OPPORTUNITIES:

-

Technological improvements in electric bikes can unlock wider adoption for longer distances and those seeking less physical exertion.

-

Development of versatile and user-friendly cargo bikes can attract individuals and businesses seeking eco-friendly alternatives for deliveries and errands.

By developing versatile and user-friendly cargo bikes, manufacturers can attract both individuals and businesses. These innovative bikes can cater to those seeking eco-friendly alternatives for deliveries and errands. It can replace your car trip to the grocery store with a convenient and spacious cargo bike. Businesses, particularly those focused on last-mile deliveries, can leverage cargo bikes to reduce their environmental footprint and navigate congested urban areas efficiently. As cargo bike designs become more user-friendly and offer increased cargo capacity, they have the potential to disrupt short-distance deliveries and transform the way we think about sustainable errands.

CHALLENGES:

-

Premium pricing for high-performance bicycles can be a barrier to entry for budget-conscious consumers.

-

Insufficient dedicated bike lanes and cycling paths can make cycling inconvenient and intimidating for some riders.

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing war in Russia-Ukraine has disrupted the bicycle market, impacting supply chains and potentially raising production costs. While the bicycle industry isn't directly reliant on the warring nations, a significant portion of bicycle components are manufactured in Asia, particularly in countries that source raw materials from Russia and Ukraine. This includes key materials like aluminium, steel, and rubber, which are crucial for frame construction, handlebars, wheels, and tires. The war has disrupted the flow of these materials, leading to potential shortages and price hikes. There is 10-20% increase in raw material costs is possible, impacting production costs for bicycles globally. This could translate to a 5-10% rise in bicycle prices for consumers, potentially dampening demand, especially in regions already facing inflationary pressures. The sanctions imposed on Russia have disrupted traditional shipping routes, causing delays and increasing transportation costs. These combined factors can lead to inventory shortfalls and longer wait times for bicycles.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can shadow the bicycle market, impacting both consumer spending and industry production. When disposable income shrinks, bicycles, particularly higher-end road bikes or e-bikes, may be seen as non-essential purchases. This can lead to a decline in sales, potentially by 10-20% as seen in some markets. The economic downturns can disrupt supply chains and inflate material costs. This can decrease the profit margins for manufacturers and force them to raise prices, further discouraging potential buyers. Moreover, economic uncertainty can lead to a decrease in investments in cycling infrastructure by municipalities. This stagnation in infrastructure development, crucial for creating safe and convenient cycling routes, can hinder the overall growth of the bicycle market.

KEY MARKET SEGMENTS:

By Product

-

Mountain Bikes

-

Hybrid Bikes

-

Road Bikes

-

Cargo Bikes

-

Others

Road Bikes is the dominating sub-segment in the Bicycle Market by product holding above 40% of market share. Road bikes are the most basic bicycles, requiring less maintenance and accessories compared to mountain or electric bikes. Additionally, the growing trend of customizing road bikes for specific purposes like racing or endurance riding is fueling their popularity.

By Design

-

Folding

-

Regular

Regular Bikes is the dominating sub-segment in the Bicycle Market by design holding around 65% of market share. Regular bikes offer a simpler and more affordable option compared to folding bikes. Their lower cost and wider variety cater to a broader range of consumers, particularly casual riders and budget-conscious buyers.

By Technology

-

Electric

-

Conventional

Conventional Bikes is the dominating sub-segment in the Bicycle Market by technology. Conventional bikes are significantly cheaper to purchase and maintain compared to electric bikes. Additionally, for recreational cycling and shorter commutes, conventional bikes offer a sufficient level of exercise and efficiency.

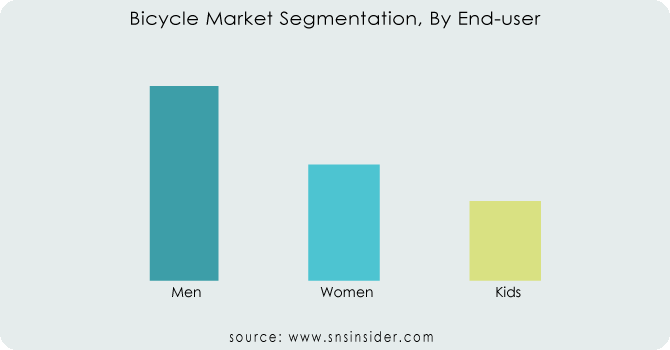

By End-user

-

Men

-

Women

-

Kids

Men is the dominating sub-segment in the Bicycle Market by end-user holding around 55% of market share. Men are often drawn to the technological advancements and performance features offered in high-end bicycles, such as advanced gear systems, lightweight materials, and aerodynamic designs. This focus on advanced technology drives demand for these bikes among the male demographic.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Distribution Channel

-

Online

-

Offline

Offline Retail Stores is the dominating sub-segment in the Bicycle Market by distribution channel. Offline stores allow for test rides, facilitating purchase decisions. Additionally, for complex bikes like electric bikes, in-person assistance with assembly and explanation of features can influence buying choices.

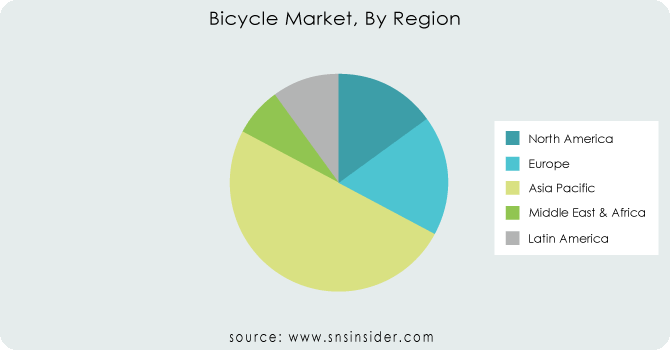

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the bicycle market holding 45% of market share, driven by several factors. Several major bicycle manufacturers are headquartered in this region. This strong local production base fuels affordability and accessibility of bicycles. The growing focus on sustainable transportation in densely populated Asian cities like Tokyo and Beijing is pushing residents towards cycling as a viable alternative.

Europe is the second highest region in this market which boasts a rich cycling culture and well-established cycling infrastructure. This ingrained cycling culture makes bicycles a natural choice for commuting and recreation.

North America is the fastest growing market for bicycles with the growth rate of 8-10%. This growth is fueled by a rising interest in outdoor activities and fitness cycling. The increasing investments in cycling infrastructure in major cities and growing popularity of e-bikes are attracting new riders.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Accell Group; Avon Cycles Ltd.; Cervelo; Dorel Industries Inc.; Atlas Cycles (Haryana) Ltd.; Giant Bicycles; Specialized Bicycle Components, Inc.; Merida Industry Co., Ltd; SCOTT Sports SA; Trek Bicycle Corporation and other key players.

Accell Group-Company Financial Analysis

RECENT DEVELOPMENT

-

In October 2023: Merida launched its Silex gravel bike for better comfort, speed, and handling on any terrain. This new version boasts updated geometry, wider tires, and features designed for bikepacking and multi-surface adventures. Merida offers the Silex in six models, with both carbon fiber and aluminum frames.

-

In October 2022: Cervelo debuts its first mountain bike, the ZHT-5, boasting a lightweight carbon fiber frame for efficiency on rough terrain. Two models are available: the GX with a RockShox SID SL Select RL fork, and the higher-end XX1 featuring the SID SL Ultimate fork.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 70 Billion |

| Market Size by 2031 | US$ 150.05 Billion |

| CAGR | CAGR of 10% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Mountain Bikes, Hybrid Bikes, Road Bikes, Cargo Bikes, Others) • By Design (Folding, Regular) • By Technology (Electric, Conventional) • By End-user (Men, Women, Kids) • By Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Accell Group; Avon Cycles Ltd.; Cervelo; Dorel Industries Inc.; Atlas Cycles (Haryana) Ltd.; Giant Bicycles; Specialized Bicycle Components, Inc.; Merida Industry Co., Ltd; SCOTT Sports SA; Trek Bicycle Corporation |

| Key Drivers | • Bicycles as a handy method of exercise to prevent obesity and other diseases will improve the market. • Dock-less bike-sharing schemes are expected to boost bicycle demand. |

| RESTRAINTS | • Alternatives to commute and physical activities may hinder bicycle uptake. • The greater price of electric vehicles may hinder bicycle uptake. |