Automotive Interior Materials Market Report Scope & Overview:

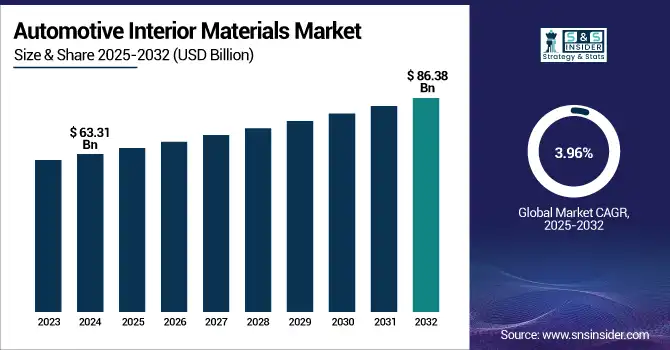

The Automotive Interior Materials Market was valued at USD 63.31 Billion in 2024 and is expected to reach USD 86.38 Billion by 2032, growing at a CAGR of 3.96% from 2025-2032.

Get More Information on Automotive Interior Materials Market - Request Sample Report

The Automotive Interior Materials Market is driven by the increasing adoption of innovative lightweight and sustainable materials in vehicle interiors and design features. Automakers have been redirecting their efforts to improve appearance, comfort, and functionality, and the choice of interior materials has become an important consideration that affects consumer purchasing decisions. Superior plastics, composites, natural fibers, and smart fabrics have made their way into vehicle interiors, providing enhanced durability, design possibilities, and passenger experience. Sustainability is one of the biggest forces driving this market. Driven by environmental consciousness, there is a growing trend of consumers and manufacturers opting for sustainable materials like biodegradable plastics, recycled fibers, and renewable resources to minimize the carbon footprint of a vehicle. This trend is reflected in the design and manufacturing of vehicle interiors.

Another crucial factor for the growth of the market is the demand for lightweight materials. To address this challenge, automakers are working to lower vehicle weight for both fuel efficiency and compliance with strict emission standards. The use of lightweight materials — such as aluminum, carbon fiber, and high-strength plastics — is also becoming more widespread for interior components, such as door panels, seats, and dashboards, improving fuel economy, better vehicle performance, and safety. In addition, the market is also progressing because of the technological innovations in the material science. The world of materials goes beyond traditional textiles, as advances in synthetic materials and dynamic, active textiles, such as intelligent upholstery that senses temperature to adapt to environmental conditions, will create new applications for cars and other vehicle interiors as well. This trend also contributes to the ongoing evolution of the automotive interior materials market, which is adapting to the needs of lightweight, energy-efficient, and sustainable vehicles, such as electric vehicles.

With a shift toward premium and luxury rides, the aversion to leather, wood, and other interior soft-touch materials will only accentuate the need for high-end stuff. With the growing urge of consumers to have a more luxurious and comfortable interior, automotive interior materials are getting trendier, and thus, the market is expected to grow further.

Market Dynamis

Drivers

-

Innovations in smart materials, such as temperature-sensitive fabrics and sensors integrated into upholstery, enhance functionality and comfort.

Smart materials innovations are creating a new approach to manufacturing automotive interior materials, one through a control and comfort point of view. There are some materials such as temperature-sensitive fabrics that can be engineered to naturally respond to changes in the environment, giving passengers a closer fit and more comfort. These materials can change the temperature or texture by environmental factors like heat or pressure in such a way that we are comfortable in any weather conditions. For instance, seats with fabrics that respond to temperature automatically conserve warmth—which can ensure a more comfortable ride, no matter how frigid it is outside.

Also, the integration of sensors into upholstery is one more key development trend in the market. Such sensors also track data such as body temperature, posture, and motion, which enables the system to modify seat positioning, heating, or cooling for optimal comfort. On top of that, smart materials can also assess the health of the driver in luxury cars and adapt the seat and climate control based on individual needs or preferences.

These improvements provide a boost to comfort and convenience but also enhance vehicle performance through increased energy efficiency. The other example is, that temperature-based fabrics can help in reducing dependency on air conditioning or heating systems thereby maintaining normal temperatures as well as reducing energy consumption of automotive interiors. The future of automotive interior materials market is poised to shape up on the back of the growing integration of smart materials with the rise in automotive interior designing focusing on more user-centric and technologically and communicatively advanced interior vehicle spaces.

Restraints

-

The production of innovative materials like smart fabrics and composites requires advanced manufacturing techniques, which can be resource-intensive.

Some advanced materials used in automotive interior materials, such as smart fabrics and composites, involve a complex manufacturing process, rendering them resource-intensifying. Smart fabrics, such as these, have sensors or other features that react to the environment; putting electronics into fabrics in a way that is comfortable and functional will require specialized technologies. Composite materials are often composed of different elements for added strength, lightweight characteristics, and durability, but most are made using specific manufacturing processes that require molding, layering, and curing to produce optimum characteristics and quality. Such processes often require the use of advanced machinery, specialized equipment, and expert knowledge, which means they are more time-consuming and pricier. In addition, carbon fiber and thermoplastic composites need to follow stringent quality control processes to ensure they are produced consistently and meet safety standards, thus, further complicating manufacturing. Additionally, there are costs associated with the requirements of special facilities and trained labor that make these materials resource-intensive to create. In terms of dollars and cents for automakers, this creates added production costs, costs consumers might see reflected in the price of vehicles made with these materials.

These new materials are game changers in aspects of performance, looks, and sustainability, however integrating them into mass production remains challenging and restricts their broad adoption. Due to the high expenses involved and complex fabrication processes, their use is often limited to high-end or luxury classes of vehicles that can support a more lofty budget for this type of innovation, while mass-market vehicles struggle to adopt the materials and processes at an affordable scale.

Segment Analysis

By Application

Based on Application, the Dashboard segment dominates the market owing to its central role in enhancing both aesthetics and functionality in vehicles. Manufacturers are increasingly focusing on environment-friendly and comfortable material integration in dashboards, aligning with evolving consumer preferences. Innovations in thermoplastic polymers and eco-leather have led companies like Faurecia and Toyota Boshoku to introduce advanced dashboard solutions. This dominance reflects the ongoing trend toward integrating digital instrument clusters and infotainment systems, which further drives demand in the Automotive Interior Materials Market.

Based on Application, the Door Panels & Trims segment is growing at the fastest CAGR during the forecast period. This growth is fueled by consumer demand for personalized and lightweight interior components, combined with advancements in sustainable and premium-grade materials. Several OEMs and interior system suppliers are launching composite-based and modular door trim solutions to enhance design flexibility and fuel efficiency. The segment's growth reflects broader trends in vehicle customization and interior optimization within the evolving Automotive Interior Materials Market.

By Product

Based on Product Type, the Plastics (Polymers) segment dominates the market due to its widespread use in dashboards, door panels, trims, and consoles, attributed to its lightweight, durability, and cost-effectiveness. Plastics like ABS, polypropylene, and PVC are extensively utilized for their ease of molding and compatibility with advanced designs. Companies such as Faurecia and Lear Corporation are actively innovating in polymer integration for aesthetic and safety improvements. This segment’s dominance aligns with the auto industry's shift toward lighter materials to boost fuel efficiency and meet emission norms.

Based on Product Type, the Fabric segment is growing at the highest CAGR during the forecast period, primarily driven by the increasing preference for sustainable and comfortable interiors. Fabrics offer breathability, customization, and eco-friendliness, appealing to both automakers and consumers focused on green mobility. Several suppliers are introducing recycled and bio-based textiles, with developments from companies like Grupo Antolin and Adient emphasizing low-VOC, high-durability solutions. The growth in this segment reflects the industry's push for eco-conscious innovations in automotive interior design.

By Vehicle Type

Based on Vehicle Type, the Passenger Vehicles segment dominates the market owing to their high global production volumes and consumer demand for enhanced comfort and aesthetics. Automakers are increasingly focusing on integrating advanced interior materials to improve safety, ergonomics, and design appeal. Leading companies like Toyota Boshoku and Hyundai Mobis are investing in sustainable and premium interior components specifically tailored for passenger cars, reinforcing this segment’s dominance across developed and emerging markets.

Based on Vehicle Type, the Light Commercial Vehicles (LCVs) segment is growing at the highest CAGR during the forecast period. This growth is primarily driven by expanding urban logistics, increased adoption of electric LCVs, and the need for lightweight, durable interior materials. OEMs are developing ergonomic and functional cabin designs for LCVs, targeting e-commerce and delivery segments. Suppliers such as Grupo Antolin and Adient are launching modular interior solutions to cater to this demand, making LCVs a high-growth area in automotive interior innovation.

Regional Analysis

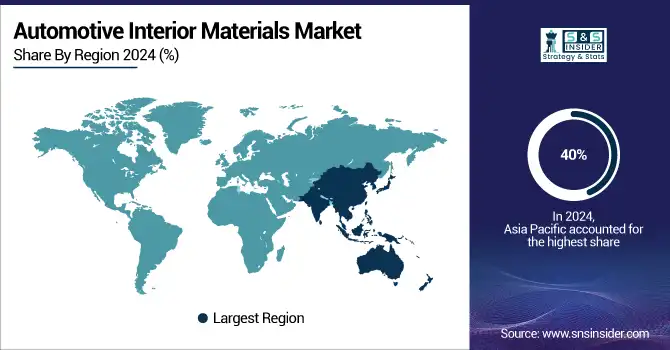

In 2023, the Asia Pacific region dominated the market and accounted for a revenue share of more than 40%. The global automotive interior material market is gaining momentum in the region due to the fast pace of the economy, increasing disposable income, and urbanization, which increases the demand for vehicles with comfortable and aesthetically pleasing interior designs.

The automotive interior materials market in North America has the potential to grow exponentially during the forecast period. It has a large regional presence with OEMs as well as a long-standing automotive industry leadership. The region sees a rising demand for high-quality interior materials that combine both looks and comfort with durability. In addition, the strict safety standards set by the government and the incorporation of innovative technology provide constructive growth in the area of automotive interior materials.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major key players along with their products are

-

Lear Corporation – Seating and Interior Systems

-

Adient – Automotive Seating

-

Faurecia – Cockpit Modules

-

Magna International – Interior Trim Products

-

Toyota Boshoku Corporation – Automotive Seats and Interiors

-

BASF – Polyurethane Foam for Automotive Interiors

-

Dow Chemical – Automotive Interior Materials

-

3M – Automotive Adhesives and Sealants

-

Borgers AG – Interior Trims and Acoustic Solutions

-

Seiren Co. Ltd. – Automotive Interior Fabrics

-

SABIC – Automotive Interior Materials (Polycarbonate)

-

Sumitomo Riko Company – Rubber and Plastic Automotive Parts

-

JCI (Johnson Controls) – Automotive Seating Systems

Recent Developments

-

March 2024: BASF Launched a new range of biodegradable interior materials designed to enhance vehicle sustainability without compromising performance.

-

March 2024: 3M Introduced advanced adhesive solutions for automotive interiors, offering improved durability and temperature resistance.

-

April 2024: Borgers AG Expanded its product portfolio to include eco-friendly acoustic materials for automotive interiors, aligning with industry sustainability goals.

-

April 2024: Seiren Co. Ltd. developed a new line of high-performance automotive fabrics, focusing on durability and aesthetic appeal.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 63.31 Billion |

|

Market Size by 2032 |

USD 86.38 Billion |

|

CAGR |

CAGR of 3.96% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

|

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Lear Corporation, Adient, Faurecia, Magna International, Toyota Boshoku Corporation, BASF, Dow Chemical, 3M, Borgers AG, Seiren Co. Ltd., SABIC, Sumitomo Riko Company, JCI. |

|

Key Drivers |

• Innovations in smart materials, such as temperature-sensitive fabrics and sensors integrated into upholstery, enhance functionality and comfort. |

|

RESTRAINTS |

• The production of innovative materials like smart fabrics and composites requires advanced manufacturing techniques, which can be resource-intensive. |