Conductive Polymers Market Key Insights:

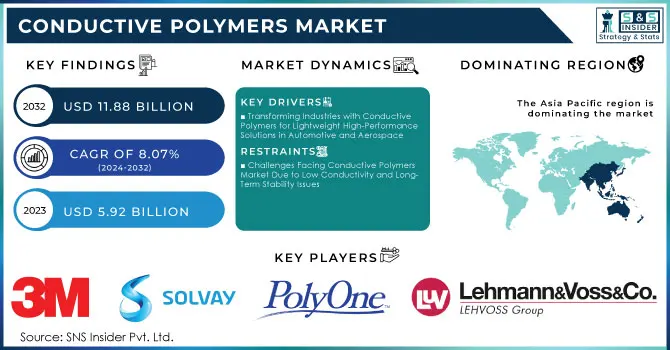

The Conductive Polymers Market Size was valued at USD 5.92 Billion in 2023 and is expected to reach USD 11.88 Billion by 2032 and grow at a CAGR of 8.07% over the forecast period 2024-2032. The conductive polymers market has unique properties including flexibility, lightweight, and high conductivity, which drive their growing demand in various applications. As such, they are being employed extensively in electronic devices including sensors, actuators, and displays that require smaller footprints with improved functionality while enabling more efficient use of power. Since they enhance the performance and efficiency of energy storage devices such as batteries and capacitors, their application in energy storage systems is also on the rise. It has been found that conductive polymers can increase the capacity retention of lithium-ion batteries by more than 90% after a lifetime test of 500 cycles, clearly demonstrating their potential for improving battery cyclability.

Get More Information on Conductive Polymers Market - Request Sample Report

The growth in the market has also been driven by increasing demand for conductive polymers from wearable technology and flexible electronics, which necessitate materials that can adapt to different shapes and surfaces. This is also because of their role in renewable energy like that of solar cells because they provide an inexpensive mechanism to convert and store energy. In addition, breakthroughs in material science, particularly the introduction of nanocomposites have improved conductive polymers relatively even more while also improving their initial functionality which allows these materials to fulfill the growing demands of automotive, aerospace, and healthcare industries. The application of conductive polymers has improved the efficiency of OPV cells in the solar energy area. A few of them have demonstrated efficiencies of over 15%, while the older technologies offer less than 10%. These nanocomposites have further enhanced the performance of these polymers, increasing conductivity to 50%, and thereby paving the way for applications in automotive, aerospace, and healthcare industries.

MARKET DYNAMICS

KEY DRIVERS:

-

Transforming Industries with Conductive Polymers for Lightweight High-Performance Solutions in Automotive and Aerospace

The increasing demand for lightweight and high-performance materials in such industries as automotive, and aerospace is one of the major factors driving the growth of the global conductive polymers market. More and more, as manufacturers push to lighten vehicles and aircraft to reduce fuel consumption and emissions, conductive polymers could be used in place of conventional metal parts. It offers the conductivity required for electronic systems and helps in weight reduction these two key attributes are essential in EV design, and next-gen aerospace technologies. The aerospace industry is targeting a weight reduction of 20% in aircraft, as achieving just a 1% decrease can result in a 4% improvement in fuel efficiency. Conductive polymers are increasingly being considered as alternatives to traditional metals in various components, helping to meet these weight reduction goals Conductive polymers are gaining momentum in a range of applications such as sensors, circuit boards, and touchscreens in the automotive industry where next-generation smart and sustainable vehicles require new functionality. In addition, the proliferation of electric vehicles, which requires modern energy storage technologies, has increasingly promoted the development of conductive polymers for improving battery performance and efficiency.

-

Driving Sustainability with Conductive Polymers as Eco-Friendly Alternatives for a Greener Future

The other major factor is the growing focus on environmental sustainability, resulting in a movement towards green materials. Conductive polymers can be environmentally friendly replacements for conventional materials (e.g., metals and most petroleum-based plastics), especially those derived from renewable resources. With governments and industries worldwide increasingly incentivizing commitment to carbon footprint reduction and more general economic sustainability, conductive polymers are rapidly being recognized as high-performance alternatives for numerous applications that are far less damaging to our planet. Conducive polymers sourced from sustainable resources are rapidly gaining traction as the production of bio-based plastics is expected to touch 6.4 million metric tons in 2024. More importantly, a shift towards greener options such as conductive polymers would help companies scale down their carbon footprint drastically. Studies indicate that substituting traditional petroleum-based plastics with bio-based alternatives can reduce greenhouse gas emissions by as much as 30 %to 50 % throughout the product's lifecycle. Their bio-based and recyclable composition aligns with global sustainability objectives, making them the materials of choice for companies wishing to comply with rigorous environmental policies without compromising product performance.

RESTRAIN:

-

Challenges Facing Conductive Polymers Market Due to Low Conductivity and Long-Term Stability Issues.

The main restraint for the conductive polymers market is their significantly low conductivity compared to traditional metals. This has inhibited their use in high-performance programs such as large-scale electronics and electric grids. For example, in the industry, touchscreens and displays use indium tin oxide (ITO) because it has higher conductivity than other conductive coatings with respect highest price. The reduced efficiency of conductive polymers in these critical applications has limited their application. On the other extreme, conductive polymers may not be suitable for long-term harsh environments because they continually break down over time. In the latter case, they suffer from both oxidation and mechanical wear which means that their long-term stability in applications is very poor. In the automotive sector, for example, conductive polymers can have an accelerated decay rate (compared to metal alternatives) when used in sensors and circuits leading eventually to system failures of a vehicle. This lack of reliability is a huge problem in industries where material longevity and performance versatility are essential.

KEY MARKET SEGMENTS

BY PRODUCT

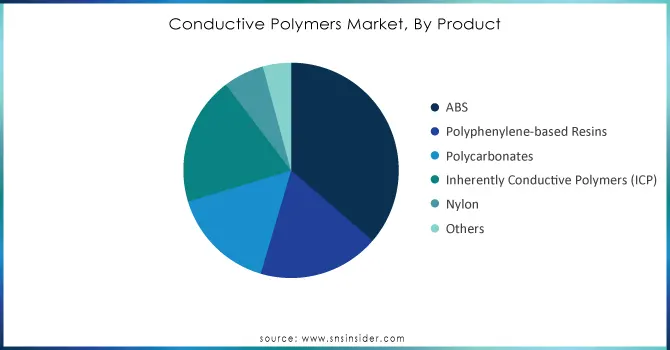

ABS dominated the market with 36.3% of demand share in 2023 which can be mainly attributed to its versatile nature and cost-effectiveness alongside durability which bodes well for long-term investments across applications implementations depending on end-user cases such as household goods, consumer electronics, etc. It is extensively used in auto, electrical, and consumer lines of businesses for its Strength & Ductility Impact Resistance Process Ability. The combination of mechanical toughness and heat resistance is why ABS remains a popular thermoplastic in the market, used for applications such as car dashboards, electrical housings, and plastic blocks. Segments of this kind of use have crystallized ABS's position in the market as one best materials available.

Inherently conductive polymers (ICPs) are likely to be the fastest expanding category through 2024–2032, as they possess the rare property of electrical conductivity along with polymer-specific properties including flexibility and lightness. An increase in the usage of ICPs for advanced applications such as organic electronics, sensors, and energy storage systems. The increasing requirement for portable and high-speed electronic devices along with the adoption of smart materials in medical and wearable electronics sectors are propelling market growth rapidly.

Need Any Customization Research On Conductive Polymers Market - Inquiry Now

BY APPLICATION

The actuators and sensors segment dominated 28.3% of the share in 2023. Conductive polymers extend the material palette to a range of flexible, lightweight, and electrically conducting materials that are desirable for actuators or sensors. These devices are key to operations in industries from automotive and aerospace to home appliances, where they deliver motion control capabilities with the ability of system measurement. This automation is in part driven by the automotive sector which has an increased focus on autonomous vehicles and advanced safety features, all demanding high-performance sensors and actuators using materials such as conductive polymers.

The solar energy segment is expected to register an impressive CAGR over the forecast period (2024-2032), upheld by a growing global emphasis on renewable energy. Solar panel manufacturers have been using conductive polymers in solar panels to improve energy conversion efficiency and lower production costs. Due to their lightweight and flexibility, these materials are well suited for new solar technologies including Organic Photovoltaic cells which allow flexible solar panels that can be used in unsecured areas and also give the ability to be portable. This increasing demand for sustainable energy solutions along with advancements in conductive polymer-based solar cell technology are the significant factors boosting this segment

REGIONAL ANALYSIS

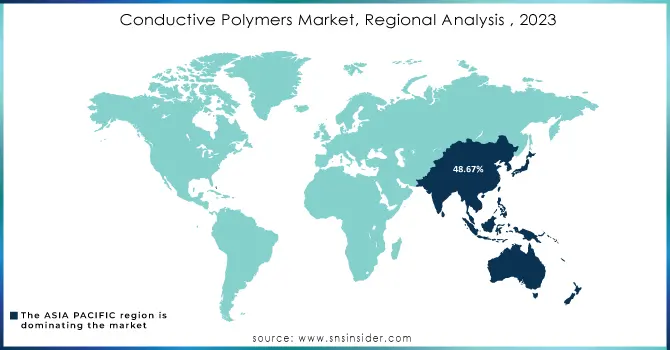

The Asia Pacific was the largest market region for conductive polymers accounting for 48.6% of global revenue in 2023, and remains the main driver of growth, growing faster than any other region during 2024-2032. Their leadership is based upon the flourishing industries of electronics and automotive in countries including China, Japan, and South Korea. Subsequent Growing Industries: Given vast applications in the manufacturing domain, i.e., the need for very lightweight materials and the significant role played by APAC as a global hub for electronics production surplus demand has been realized. Additionally, the widespread applications of conductive polymers in smartphones and laptops get further solidified with electronic automotive components adopted on a large scale throughout the Asia Pacific. Rising investments in renewable energy projects such as conductive polymers-based solar panel installations are fueling the growth of this market. The aggressive expansion of renewable energy in China, together with the escalating focus on infrastructure and electric vehicles (EV) manufacturing in India should continue to drive demand for conductive polymers worldwide supporting growth across major regions.

Key Players

Some of the major players in the Conductive Polymers Market are:

-

3M (VHB Tapes, Scotch-Weld Adhesives)

-

Solvay (Solef PVDF, Hyflon PFA)

-

SABIC (Noryl Resin, Lexan Polycarbonate)

-

PolyOne Corporation (OnForce LFT, Gravi-Tech)

-

Lehmann & Voss & Co. (LUVOCOM, LUVOBATCH)

-

Advanced Polymer Materials Inc. (Conductive Polymer Coatings, Adhesive Systems)

-

Agfa-Gevaert Group (Orgacon, Electroconductive Inks)

-

Celanese Corporation (Fortron PPS, Celstran CFR-TP)

-

Eeonyx (EeonTex, Conductive Coatings)

-

Heraeus Holding (Clevios PEDOT, Silver Nanowires)

-

Hyperion Catalysis International (Graphite Nanofibers, Carbon Nanotubes)

-

KEMET Corporation (Polymer Tantalum Capacitors, Polymer Aluminum Capacitors)

-

Parker Hannifin Corp. (Chomerics Conductive Elastomers, Therm-A-Gap)

-

Premix Group (PRE-ELEC Compounds, Conductive Masterbatches)

-

RTP Company (PermaStat, Conductive Compounds)

-

The Lubrizol Corporation (Estane TPU, Electro-Rheological Fluids)

-

Henkel AG & Co. KGaA (LOCTITE Conductive Adhesives, Bergquist Gap Filler)

-

Toray Industries (Torayca Carbon Fiber, Polyphenylene Sulfide)

-

BASF (Ultradur High Speed, Ultramid)

-

DSM Engineering Materials (Arnitel, Stanyl)

Some of the Raw Material Suppliers for Conductive Polymers Companies:

-

Borealis

-

LyondellBasell

-

DuPont

-

Asahi Kasei

-

LG Chem

-

Sinopec

-

Braskem

-

INEOS

-

Sumitomo Chemical

-

ExxonMobil Chemical

RECENT TRENDS

-

In February 2024, Panasonic Industry Announces Commercial Production of the Industry's First High Capacitance Type Conductive Polymer Hybrid Aluminum Electrolytic Capacitors for Automotive Guaranteed to Operate at 135°C.

-

In January 2024, N-ink wins €1M from Voima Ventures Science Challenge for its IoT-transforming conductive polymers.

-

In March 2024, Toray Industries created a high-performance ion-conductive polymer membrane that boosts battery efficiency by 10 times, helping improve the safety and lifespan of lithium-ion and lithium-metal batteries for electric vehicles and drones.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.92 Billion |

| Market Size by 2032 | USD 11.88 Billion |

| CAGR | CAGR of 8.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (ABS, Polyphenylene-based Resins, Polycarbonates, Inherently Conductive Polymers (ICP), Nylon, Others) • By Application (Actuators & Sensors, Anti-static Packaging, Batteries, Capacitors, Solar Energy, Others) • By Type (Electrically Conductive, Thermally Conductive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Solvay, SABIC, PolyOne Corporation, Lehmann & Voss & Co., Advanced Polymer Materials Inc., Agfa-Gevaert Group, Celanese Corporation, Eeonyx, Heraeus Holding, Hyperion Catalysis International, KEMET Corporation, Parker Hannifin Corp., Premix Group, RTP Company, The Lubrizol Corporation, Henkel AG & Co. KGaA, Toray Industries, BASF, DSM Engineering Materials |

| Key Drivers | • Transforming Industries with Conductive Polymers for Lightweight High-Performance Solutions in Automotive and Aerospace • Driving Sustainability with Conductive Polymers as Eco-Friendly Alternatives for a Greener Future |

| RESTRAINTS | • Challenges Facing Conductive Polymers Market Due to Low Conductivity and Long-Term Stability Issues |