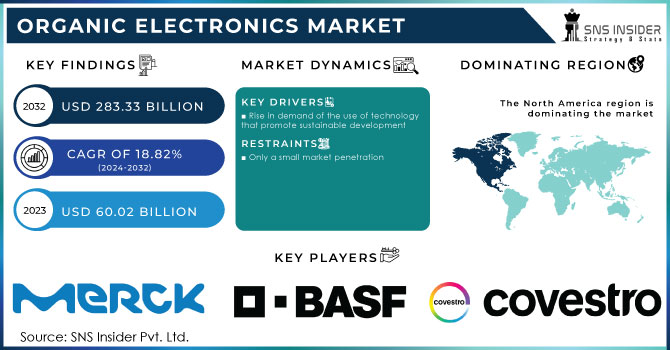

Organic Electronics Market Report Scope & Overview:

The Organic Electronics Market was valued at USD 58.86 billion in 2023 and is expected to reach USD 283.67 billion by 2032, growing at a CAGR of 19.14% over the forecast period 2024-2032. The increasing demand for flexible displays, wearable sensors, and sustainable energy solutions is leading to the rapid adoption of the Organic Electronics Market across industries. Such gains in performance, leading to increased charge carrier mobility, improved quantum efficiency, and enhanced material stability, are fostering innovation in applications ranging from OLEDs and organic photovoltaics (OPVs) to bioelectronics. Recent manufacturing breakthroughs like roll-to-roll printing and inkjet deposition mitigate manufacturing costs on a large scale. These organic batteries and supercapacitors are promising due to their lightweight structure, biodegradability, and better charge-discharge cycles for next-generation portable and flexible energy solutions, thus finding their way into energy storage.

Get PDF Sample Report on Organic Electronics Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Rising Demand for OLEDs and Sustainable Tech Driving Organic Electronics Growth

The major factors fueling the organic electronics market include the wide use of OLED technology in consumer electronics, such as Smartphones, televisions, and wearable devices. Driven by a continuous need for flexible, lightweight, and energy-efficient electronic devices, organic semiconductors have been developed and researched extensively. Improvements in organic photovoltaics (OPVs) and organic thin-film transistors (OTFTs) are also accelerating their use in both energy and display applications. This, coupled with the increasing research and development (R&D) investments by prominent players, and rising government support to implement sustainable and green electronic solutions further propelling the market growth. Meanwhile, the automotive sector is seeing greater penetration of organic electronic elements into smart dashboards, HUDs, and ambient lighting, boosting user experience and energy efficiency.

Restrain:

-

Challenges in Organic Electronics Include Material Instability Environmental Vulnerability and Performance Limitations for Advanced Applications

The relative instability and short lifetime of organic material compared to traditional silicon-based electronics is one of the major problems for the organic electronics market. Organic semiconductors have a higher vulnerability to environmental factors like moisture, oxygen, and UV exposure, which causes degradation over time. This raises reliability issues, especially for long-lifetime applications, such as automotive and aerospace electronics. Moreover, the performance metrics of organic electronic devices, especially the charge carrier mobility and switching frequencies, are yet inferior compared to those of conventional semiconductor technologies, limiting their practical applications in high-speed computing and processing.

Opportunity:

-

Emerging Opportunities in Organic Electronics for Healthcare Wearables Smart Textiles IoT and Sustainable Technologies

Potential openings in the organic electronics marketplace are for rising applications like bioelectronics, smart textiles, and healthcare diagnostics. As organic materials are increasingly being incorporated into printed electronics and wearables, this technology has strong potential for growth. Further development of biodegradable and eco-friendly electronics is in full agreement with international ecological regulatory requirements, driving the interest in organic materials. Moreover, lucrative growth prospects are anticipated to be gained owing to the application of organic electronics in IoT-enabled smart devices and energy-efficient lighting systems. However, as production costs lower and performance rises, the growth will spread into various sectors of the market, including aerospace, defense, and medical devices.

Challenges:

-

Scaling Challenges in Organic Electronics Include Manufacturing Complexity Integration Issues and Material Development Needs

A major hurdle, however, is the complexity of large-scale manufacturing and integration of congregated organic electronic parts. Organic electronics do not utilize conventional silicon-based manufacture, instead requiring specialized techniques to print and coat the materials that need to be of uniform quality and high precision. Until manufacturers work towards a common kit of parts in terms of manufacturing processes for materials, this will continue to hinder widespread adoption. In addition, the existing electronic systems with which organic components need to be integrated are typically hugely incompatible, limiting the seamless integration of organic components into mainstream technology. Even though a lot of progress continues to be made, the existing challenge of further development in material properties and the development of scalable production processes is still one of the most important challenges for organic electronics to be widely commercialized.

Segments Analysis

By Material

In 2023, the market share by semiconductor accounted for 41.6% while the semiconductor segment is anticipated to grow at the fastest CAGR during the forecast period (2024 - 2032). This growth is also due to the rising use of organic semiconductors in OLED, organic photovoltaics, and flexible electronics. They have found demand in applications such as consumer electronic devices, automotive applications, and healthcare beneficiary devices mostly due to their benefits of lightweight, mechanical flexibility, and energy efficiency over traditional alternatives. Also, improvements in organic thin-film transistors (OTFTs) and organic light-emitting diodes (OLEDs) are boosting their performance to target the next-generation electronics. Continued R&D work is anticipated to still enhance the stability of the materials and diversify their applications.

By Application

In 2023, the market share of the display was leading with 47.3%, and it is expected to grow at the fastest CAGR between 2024 and 2032. This growth is primarily driven by the increasing usage of OLED screens across smartphones, televisions, laptops, wearables, and other industrial applications. The quality of the flexible and foldable display technologies continuously improving, which also accelerates adoption, especially in consumer electronics. The growing adoption of energy-efficient and high-contrast display solutions is driving manufacturers to innovate in organic display technology. Further, automotive applications such as organic displays in dashboards and infotainment systems, and, entering application areas such as AR/VR devices driving new growth opportunities for the market.

By End User

In 2023, the market share of Consumer Electronics was 52.8% influenced by increased adoption of OLED displays, wearables, and flexible electronics. Market growth is mainly propelled by the growing demand for high-resolution, lightweight, and energy-efficient display technologies in smartphones, tablets, and smartwatches.

During the forecast period of 2024 to 2032, the growth of the healthcare sector is likely to witness the fastest CAGR, owing to advances in areas such as organic bioelectronics, wearable health monitoring devices, and flexible medical sensors. An increase in the utilization of organic biosensors in electronic skin, implantable medical devices, and real-time patient monitoring is anticipated to fuel demand growth in the sector.

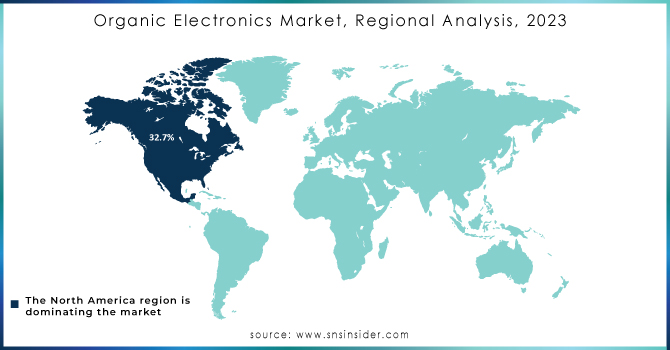

Regional Analysis

Asia Pacific accounted for a share of 34.7% in 2023. China, Japan, and South Korea have carved up the world market in everything from organic semiconductors to flexible displays to fancy-pants consumer electronics. Samsung Display, LG Display, and others lead the way with high-end OLEDs for smartphones, TVs, and wearables. China is also investing massively in organic photovoltaics (OPVs) and printed electronics, which are providing low-cost, rapid deployment solutions. Government support programs for flexible electronics and smart manufacturing are accelerating innovation and large-scale production in the region, adding to market dominance.

North America is anticipated to exhibit the highest CAGR during 2024-2032 owing to the progressions in organic bioelectronics, healthcare applications, and automotive developments. The rising use of organic sensors, electronic skin, and implantable medical devices is propelling growth in the healthcare industry. With organic electronics incorporated into bands, even wearable health-monitoring devices would also be embedded into organic electronics by companies like Apple and Google, putting forth real-time diagnostics. The introduction of organic LED (OLED) displays in vehicle dashboards and infotainment systems by Tesla and General Motors is driving the demand growth in the automotive sector. In addition, heavy R&D investments from institutions such as MIT and Stanford are also developing flexible electronics and organic computing, laying the foundation for continuous growth in the area.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key players

Some of the major players in the Organic Electronics Market are:

-

Merck KGaA (Germany) (Silicon Dielectrics for Flexible OLEDs)

-

BASF SE (Organic Semiconductor Materials)

-

Covestro AG (Polycarbonate Films for Flexible Displays)

-

DuPont (Inks for Printed Electronics)

-

AUO Corporation (OLED Display Panels)

-

Sony Corporation (OLED Televisions)

-

Samsung Display (South Korea) (Flexible AMOLED Displays)

-

LG Display Co., Ltd. (Flexible OLED Displays)

-

Sumitomo Chemical Co., Ltd. (Organic Semiconductor Materials)

-

Universal Display Corporation (Phosphorescent OLED Materials)

-

FlexEnable (Flexible Organic LCD Displays)

-

Nanosys (Quantum Dot Enhancement Film)

-

Plextronics (Conductive Inks for Organic Solar Cells)

-

BOE Technology (Flexible OLED Displays)

-

Royole Corporation (Flexible Displays and Sensors)

Recent Trends

-

In November 2024, Smartkem and AUO joined forces to develop next-generation rollable, transparent microLED displays using OTFT technology, aiming for cost-effective mass production and commercialization.

-

In November 2024, Samsung Display plans to increase production of small and mid-sized organic light-emitting diode (OLED) panels by 10% next year, driven by growing demand for tablets and foldable devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 58.86 Billion |

| Market Size by 2032 | USD 283.67 Billion |

| CAGR | CAGR of 19.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Semiconductor, Conductive, Dielectric, Substrate) • By Application (Display, Lighting, Solar Cells, System Components, Others) • By End User (Consumer Electronics, Healthcare, Automotive, Energy, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck KGaA, BASF SE, Covestro AG, DuPont, AUO Corporation, Sony Corporation, Samsung Display, LG Display Co., Ltd., Sumitomo Chemical Co., Ltd., Universal Display Corporation, FlexEnable, Nanosys, Plextronics, BOE Technology, Royole Corporation. |