Conference Room Solutions Market Report Scope & Overview:

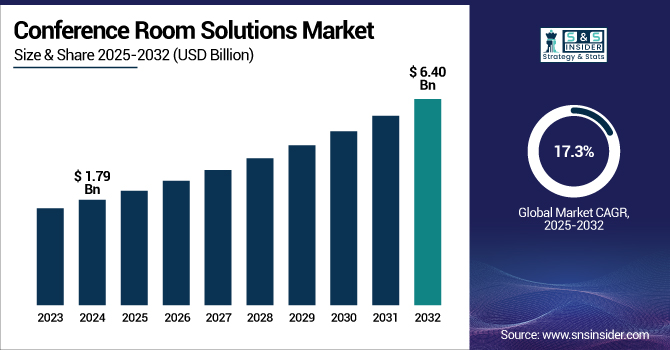

The Conference Room Solutions Market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 6.40 billion by 2032 and grow at a CAGR of 17.3% over the forecast period 2025-2032.

To Get more information on Conference Room Solutions Market - Request Free Sample Report

The Market is expanding fast because of increasing demand for effective collaboration solutions in the face of hybrid and remote work environments. Firms invest in premium AV systems, cloud platforms, and AI-driven real-time transcription, scheduling, and analytics tools. The smart office and digitalization trend are accelerating the adoption of integrated, scalable solutions that enable virtual as much as physical meetings.

As per study, March 2024, conference room solutions space continued to witness growth as businesses adjusted to hybrid work needs. 80% of the staff indicated a liking for hybrid calendars, propelling investment in smart meeting room solutions. solutions such as occupancy sensors, room reservation platforms, and seamless audio-visual equipment became productivity drivers.

The U.S. Conference Room Solutions Market size was USD 0.42 billion in 2024 and is expected to reach USD 1.28 billion by 2032, growing at a CAGR of 14.81% over the forecast period of 2025–2032.

The U.S. leads the market with high usage of advanced technology and strong infrastructure. With more organizations in different industries adopting hybrid and remote working modes, the requirement for effective and hassle-free communication tools has increased. The U.S. hosts giant technology firms such as Microsoft, Zoom, and Cisco, which are spearheading developments in cloud-based conferencing solutions, AI-enabled tools, and high-definition AV systems. Besides, the nation's robust IT environment and emphasis on digital transformation influence the extensive use of integrated conference room solutions industry. This synergy positions the U.S. to stay ahead in the market.

Market Dynamics

Key Drivers:

-

Growing Demand for Advanced Audio-Visual Integration Drives Innovation in Conference Room Solutions

The growing need for smooth integration of audio-visual in meeting rooms is one of the foremost drivers driving the conference room solutions market growth. Companies are increasingly using next-generation technologies to stimulate communication and collaboration during meeting sessions. Technologies such as high-definition video conferencing, wireless, and interactive screens are becoming unavoidable to promote workplace productivity improvement. The integration of AI and ML is also enhancing the functionality of such systems by improving resource utilization, ensuring high-quality video and audio streams, and automating meeting processes. The demand is most pronounced in industries such as technology, education, and business services, where uninterrupted communication is essential to operations. As businesses strive to conduct more productive and engaging meetings, the need for sophisticated conference room systems is on the rise, and businesses are responding by redefining and updating these solutions.

Restraints:

-

High Implementation Costs Hinder Widespread Adoption of Conference Room Solutions

The market has a high level of implementation cost. The cost of setting up a top-notch conference room with equipment such as video conferencing, interactive displays, and integrated AV solutions can be expensive and unattainable for many small to medium-sized companies. Probably the cost of the maintenance is one of the costs that is also charged, and also the cost of upgrading always software and hardware. For other companies, the ROI may not be as clear, particularly for smaller businesses with less capital to spend. These challenges in ensuring that such systems are implemented on a larger scale prevent them from being widely accepted. As technology becomes less expensive over time, however, the market can expect to witness a decline in cost barriers.

Opportunities:

-

Rise in Remote Work Creates Increased Demand for Collaborative Conference Room Solutions

Transitioning to remote and hybrid work setups has opened up a fantastic opportunity for the conference room solutions market trends. As corporations continue to adopt flexible work arrangements, the demand for solutions that enable seamless collaboration among remote and on-site employees has been at an all-time high. Video conferencing solutions, cloud collaboration platforms, and cooperative whiteboards have become necessary in facilitating successful communication and thinking. The market has been experiencing a rapid growth of solutions that connect the in-office and remote participants, making meetings more accessible.

In April 2025, cloud-based solutions led the market with 73%, emphasizing a trend away from on-premise systems. Large enterprises with more than 1,000 employees spent an average of USD 242,000 a year on video conferencing products and services.

Challenges:

-

Ensuring Seamless Integration with Existing IT Infrastructure in Conference Room Solutions

The market is allowing new systems to seamlessly connect to existing IT landscapes. Most organizations have already invested in networks, hardware, and software, and thus have a pre-existing technological infrastructure to which new conference room technologies must be added and made compatible. This will result in increased complexity and longer deployment times, something that no business wants to experience.

Moreover, ensuring that differing platforms and devices interoperate without issues hasn’t been solved yet, particularly in a company where employees use a combination of operating systems and hardware setups. Overcoming these integration challenges is essential for enterprises to be able to deploy and enjoy new conference room technology and features without sacrificing their functionality.

Segments Analysis

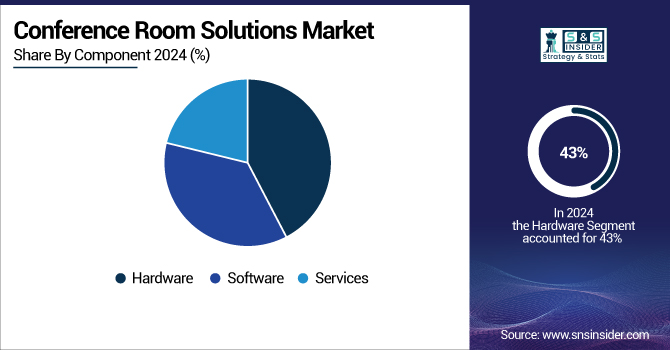

By Component

Hardware was the leading revenue-generating segment in the conference room solutions in 2024, accounting for a 43% share, due to growing installations of smart cameras, displays, and audio solutions. Logitech’s Rally Bar Huddle systems were enhanced, and so too was the meeting-making experience with the introduction of the Room Kit EQX from Cisco. The rise of hybrid meetings led enterprises to invest in solid physical infrastructure in offices around the world.

Software is growing the fastest CAGR of 18.8% in the forecasted period 2025-2032, owing to the rise in demand for AI-based platforms and integrated solutions. In late 2024, Microsoft Teams released Smart Recap, followed by Zoom's AI Companion, further increasing productivity and automation during the meeting process. There is a growing demand for scalable, cloud-based solutions in modern conference rooms, and this surge in smart software innovation reflects that.

By Enterprise Size

Based on size, the Large Enterprises segment held a market share of 55% of the revenue during 2024 due to their enormous IT budgets and requirement for global collaboration. Google scaled up its Meet Series One room kit, and HP Poly solutions gained traction in large multi-nationals. These were companies that invariably had scalable conferencing ecosystems and had established dominion in the conference room solutions market analysis.

The SMES are growing at the fastest pace at 18.03% CAGR with affordable as well as easy-to-deploy conferencing platforms. Startups like Neat released small AI-driven meeting appliances for small groups. Such cloud-based, subscription-based services such as Zoom and Google Meet have become a hit among SMEs, which has turned upper-level conference room equipment into a common presence, driving a robust market expansion.

By Vertical

In 2024 IT and telecom companies dominated with a 33% market share, driven by widespread digital adoption and global workforce collaboration. Firms like Cisco and zoom innovated with secure, scalable conferencing platforms. These companies are also paying to bring ever-improved AV tech and virtual collaboration tools together to support agile workflows, ensuring that their lead in the adoption of the conference room solution is secure.

The BFSI offers a higher CAGR of 18.4% and demonstrates great demand for performing secure and compliant conferencing. This is the segment where the demand right now in this moment is exploding. In 2024, Avaya and Cisco started to provide encrypted video tools to banks. With banks moving more toward digital customer interaction and hybrid teams, we need conference room environments that are secure, reliable, and enable vertical-specific investment.

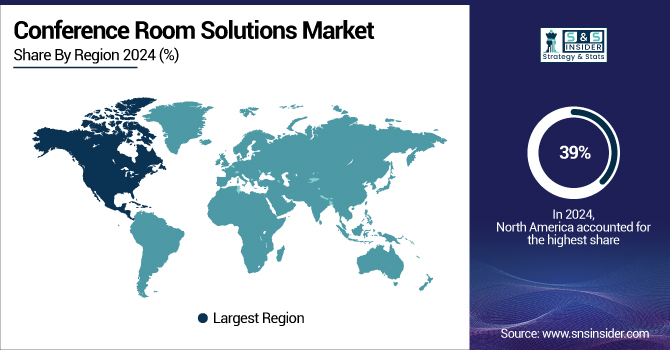

Regional Analysis

In 2024, North America dominated the Conference Room Solutions Market share, estimated to hold over 39% of the global revenue. This leadership is the product of early technology adoption, a swift uptake of hybrid work environments, and strong AV solution provider capabilities.

Shure is introducing its IntelliMix Room Kits in April 2025 to the U.S. market. The kits are equipped with AI-enabled Huddly Cameras and premium audio to solve acoustic challenges and deliver exceptional meeting experiences.

Asia Pacific emerged as the fastest-growing region in 2024, with an estimated CAGR exceeding 21.01%. China and India, for instance, spearheaded this growth as they underwent rapid urbanization, government-led digitalization initiatives, and a surge of tech-savvy enterprises. With its technological advancement and massive investment in digital infrastructure, China rules the Conference Room Solutions market. Increasing implementation of smart cities in the country, the government's strong support for digital transformation, and the rising need for hybrid work solutions fuel the demand for advanced conferencing solutions.

In 2024, Europe established strong momentum in the Conference Room Solutions Market, propelled by rapid digital transformation and permanent hybrid work adoption. In 2024, Germany led the European Conference Room Solutions Market due to its advanced technology infrastructure and strong focus on business digitization. German companies consistently invest in smart workplace solutions, including AI-enabled video conferencing and high-end AV systems, to support hybrid work environments.

In 2024, the Middle East & Africa and Latin America regions showed rising demand for conference room solutions, driven by digital transformation efforts across education, government, and corporate sectors. Countries like the UAE and Brazil began adopting cloud-based video conferencing systems and modern AV setups to improve remote collaboration. Though at an earlier adoption stage, increased infrastructure investments and global business integration are supporting steady market expansion in both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players:

The conference room solutions market companies are Cisco Systems, Microsoft, Zoom Video Communications, Logitech, Poly (formerly Polycom), Crestron Electronics, Google, Barco, Avaya, Huawei, and others.

Recent Trends

• In March 2025, Huawei launched its AI-powered conference room solutions in Beijing to boost collaboration and efficiency in hybrid workplaces. The new solutions incorporated smart voice recognition, real-time translation of languages and auto-meeting summary.

• Microsoft today revealed AI-enhanced Microsoft Teams Rooms in 2024 to better serve collaboration and productivity needs in hybrid workplaces. The new features are designed to make meetings flow more smoothly and facilitate better communication across organizations.

• In November 2024, Zoom officially rebranded as “Zoom Communications Inc.” and emphasized an AI-first product outline. The company unveiled the AI Companion, tailored to tasks like summarizing meetings and drafting emails, in a bid to improve productivity and cut down hours in a typical workweek.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.79 Billion |

| Market Size by 2032 | USD 6.40 Billion |

| CAGR | CAGR of 17.3% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises) • By Vertical (IT and Telecom, BFSI, Healthcare, Retail, Media and Entertainment, Transportation and Logistics, Education, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cisco Systems, Microsoft, Zoom Video Communications, Logitech, Poly (formerly Polycom), Crestron Electronics, Google, Barco, Avaya, Huawei, and Others. |