Robotic Process Automation Market Report Scope & Overview:

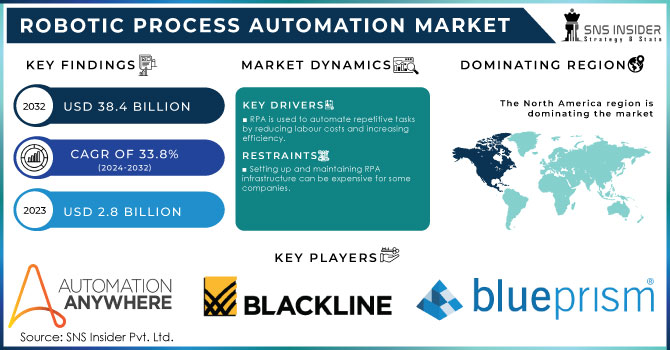

Robotic Process Automation Market Size was valued at USD 2.8 Billion in 2023 and is expected to reach USD 38.4 Billion by 2032, growing at a CAGR of 33.8 % over the forecast period 2024-2032.

Get More Information on Robotic Process Automation Market - Request Sample Report

The global Robotic Process Automation (RPA) market growing with the increasing government initiatives supporting automation and digital transformation in different industry verticals. Government agencies around the world are investing in RPA solutions on a large scale to improve efficiency, and work practices and lower operating costs. U.S. Bureau of Labor Statistics reported a significant rise in the adoption of RPA solutions, with automation-enabled tasks increasing 15% at government offices growing by 15% in 2023. For instance, the European Union has claimed that RPA is used by 30 percent of its public sector workforce in activities such as data entry, document processing, and communications.

According to the U.K. government's Digital Strategy report for 2023, revealed that 25% of repetitive administrative functions in public sectors are now automated, improving the overall efficiency of government operations. These numbers suggest that the market is increasingly moving towards RPA solutions, especially in areas where human labor can be substituted by automated systems, which is fuelling market growth. Market growth is also driven by increasing operational efficiency from enterprises that have become more and more dependent on mobile devices, demand for artificial intelligence (AI) & machine learning (ML), technological innovation, and new technology products. RPA adoption is on the rise in organizations of all sizes as they work towards generating a higher return on investment and offering an uptick in productivity.

Market Dynamics

Drivers

-

RPA is used to automate repetitive tasks by reducing labour costs and increasing efficiency.

-

Businesses across industries are looking to automate tasks for better accuracy, speed, and scalability.

-

Integrating AI and machine learning with RPA creates intelligent bots to handle complex tasks.

AI and machine learning enable Robotic Process Automation (RPA) basically to deliver intelligent bots that can significantly enhance automation capabilities. These advanced bots read data, identify trends, and even make decisions allowing them to handle complex tasks beyond repetition. It enhances accuracy, reduces errors, improves scalability, and thus enables businesses to operate more efficiently and cost-effectively. Intelligent bots can also be used to work 24/7, thus improving productivity and providing superior customer experiences through personalized attention in all contexts delivering better user interactions.

Restraints

-

Setting up and maintaining RPA infrastructure can be expensive for some companies.

-

There are risks of data security breaches while implementing RPA.

-

Automation can reduce jobs in some sectors, necessitating new skills.

The use of Robotic Process Automation (RPA) can greatly result in improved efficiency at the same time it increases data security risks because these bots have access to sensitive pieces of information. Some of these risks involve inadequate security protocols, lack of monitoring, vulnerabilities in third-party tools, and insider threats. These risks can be minimized through strong access controls, data encryption, regular security auditing, and monitoring of bot behavior prevention measures against unauthorized use of bots on an ongoing basis by employees being trained or other related stakeholders training employees on data security, ensuring that third party vendors adhere to high-security standards. Proper management of these measures is essential to protect sensitive data and maintain trust.

Opportunities

-

Cloud deployment reduces upfront costs and makes RPA accessible to a wider range of businesses.

-

RPA can be applied in various sectors beyond traditional back-office operations.

-

Combining RPA with AI and machine learning opens doors for advanced automation capabilities.

-

Mergers and acquisitions can consolidate the market and accelerate innovation in RPA solutions.

Market Segmentation:

By Type

In 2023, the robotic process automation service segment held the largest market share around 64.2%. Consultations, implementation, and training series are part of the services segment. The RPAA service providers have increased the services they offer as a result of increased competition between enterprises. The demand for RPA as a service has been stimulated by continuous improvements in automation services, which allow large-scale and reduced costs.

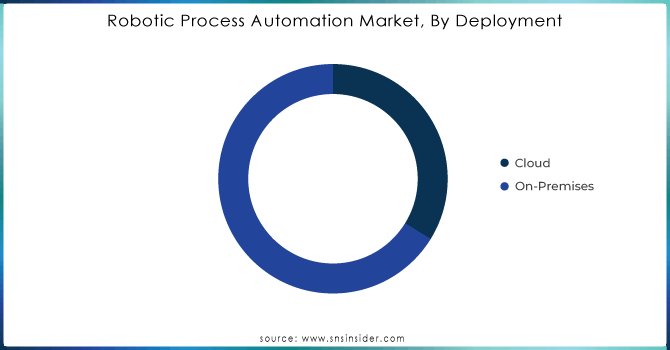

By Deployment

The largest share in 2023 was held by the on-premises segment of the robotic process automation market, which stands at over 72.3%. Businesses can ensure that RPA access policies are in line with internal protocols through on-premise deployment of RPA. In addition, it helps the company to manage the RPA systems of its customers in relation to the requirements. Moreover, the high adoption of on-premise was due to doubts in larger enterprises about the disclosure of information and data within their organization.

Need any customization research on Robotic Process Automation Market - Enquiry Now

By Organization

Large enterprises held a major share of 66% in the robotic process automation market in 2023 which redirected their resources toward value-added and other tasks. RPA is adopted in various businesses for large-scale operations as these require automation to streamline complex workflows while cutting down on unnecessary costs. RPA technology is applied to customer service, back-office processes, and compliance requirements by larger enterprises in sectors such as banking, financial services (BFS), healthcare & telecommunications to improve customer service, back-office operations, and compliance with regulatory requirements.

Government reports from the U.S. Department of Commerce showed that large corporations in the United States implemented RPA in over 70% of their internal operations by the end of 2023, resulting to increase productivity on average by 20%, assisting businesses save billions of dollars every year. European Commission reported a 22% increase in RPA adoption by large enterprises across Europe where, without the help of robots orchestrate repetitive tasks like invoicing, payroll management, and supply chain operations. The ability to handle massive volumes of data and transactions with minimal human intervention makes RPA an essential tool for large organizations, contributing to their dominant position in the market.

By Operations

Rule-based RPA led the market in 2023 which accounted revenue share of over 61% share. Rule-based automation works on predefined instructions and processes the structured data so this form of RPA is fit for industries with standardized procedures like finance, healthcare, retail, etc. This bias towards rule-based systems is especially acute within industries with high volumes of repetitive tasks requiring limited decision-making or human intervention. E.g., Rule-based RPA applications automate payroll systems, data extraction from invoices, and customer service queries.

The 2023 report by the European Union Agency for Cybersecurity (ENISA) also states that approximately 65% of public and private sector bodies using RPA to automate their repetitive operations. Similarly, in the United States, the Bureau of Labor Statistics that 60% of financial services organizations use rule-based RPA to automate front-office and back-office functions. This dominance of market is attributed to its simplicity, efficiency, and ability to be deployed quickly with minimal errors leading to widespread adoption across various industries.

By Application

In 2023, the BFSI segment accounted for around 29.2% of total market revenue and represents one of the most lucrative segments in robotics process automation. Banks and other financial institutions are helping to simplify business processes, such as loans, opening an account, or deposits, through the use of robotic process automation trends in the financial sector. In addition, the efficiency and speed of work are improved by the implementation of RPA.

The healthcare market is projected to grow at the highest CAGR. This is mainly due to factors such as the increasing use of RPA tools in various healthcare processes like admissions and discharge, and clinical data interoperability among others. The increasing digital transformation in IT and telecom industry is projected to boost software requirement over the forecast timeframe. Further, with the increasing complexities in data volume also gives a boost to businesses thereby driving its growth, as well manufacturing and logistic industry are lot more into this.

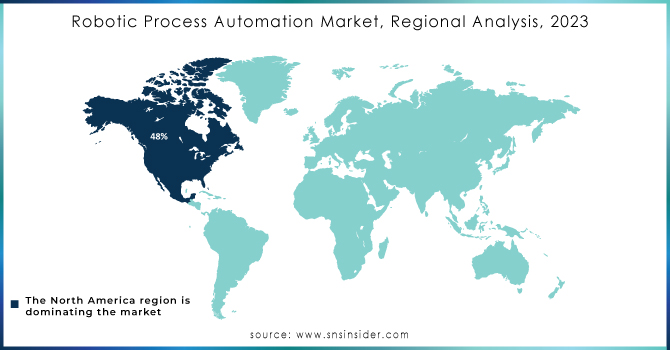

Regional analysis

North America dominated in 2023 with 48% Market Share. The North America region's dominance can be attributed to the adoption of advanced automation technologies, presence of developed countries with a high-level RPA solutions vendors and government initiatives aimed at driving digital transformation. RPA adoption has been primarily driven by the U.S. government, with huge welcome rates in healthcare, banking and public sectors etc., In 2023, over 40% of U.S. companies used RPA to increase the efficiency by automating routine tasks according to U.S. Bureau of Labor Statistics. The US held largest share in RPA, and it will further push the growth of North American market that is driven by large investments on research & development with USD 6 billion spent by US companies during 2023 as stated in data from U.S. Department of Commerce. Canada also saw a 30% increase in RPA adoption in 2023, primarily in the public sector, as per a recent report. North America's technological infrastructure, combined with favourable government policies and a focus on innovation, played a crucial role in its leading position in the global RPA market. The increased adoption of RPA by public bodies and businesses in the region can be attributed to factors that have led to a high penetration rate for RPA across North America.

The Asia Pacific region is projected to grow at the highest CAGR growth rate from 2024 to 2032, which can be attributed to increased adoption of RPA in the IT, pharma, healthcare, telecommunications, manufacturing and retail sectors. Consequently, the market for robotic process automation in the Asia Pacific region is growing.

KEY PLAYERS:

The major players in market are Automation Anywhere, BlackLine Inc., Blue Prism, EdgeVerve Systems Ltd., FPT Software, Uniphore., KOFAX, Inc., WorkFusion, Inc., NICE, NTT Advanced Technology Corp., OnviSource, Inc., Pegasystems, UiPath and others in final Report.

Recent Developments:

-

In October 2023: Rockwell Automation and Microsoft set out to expand their long-term relationship with a view to accelerating industrial automation design and development via generative artificial intelligence. The companies sought to bring together technologies in order to allow the workforce and improve customer manufacturing of Industrial Automation Systems. Both firms recognize that utilizing AI to boost automation across various roles, from control engineers to decision-makers and operators, is a key zone where they intend to help customers streamline.

-

In April 2023: UiPath announced that it had been selected by NTT DOCOMO, Japan's largest telecommunications provider, to enhance its application delivery infrastructure using the UiPath Test Suite. In order to increase the frequency of release from quarterly to biweekly, NTT DOCOMO has used a test suite using AI-driven automation that dramatically reduces testing times for mobile applications. This effective implementation is an example of UiPath's contribution to improving operating efficiency and accelerating digital transformation at a large scale.

-

In 2024, the U.S. government launched a multi-agency-wide Robotic Process Automation (RPA) adoption initiative to automate more than half of repetitive tasks by 2025 via the General Services Administration (GSA). The campaign also aligns with the Biden administration's wider digital transformation goals, and is projected to result in savings of $1 billion per annum as a whole by increasing data processing capabilities.

-

The European Union allocated €500 million out of the Digital Europe Program to amplify RPA employment in medicinal administrations by June 2023. The funding is meant to automate patient data management, billing and supply chains so providers focus on clinical tasks. This initiative is set to accelerate the digital transformation of healthcare across Europe.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.8 Billion |

| Market Size by 2032 | USD 38.4 Billion |

| CAGR | CAGR of 33.8 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Software, Service, Consulting, Implementing, Training) • By Deployment (Cloud, On-premise) • By Organization (Large Enterprises, Small & Medium Enterprises) • By Operations (Rule Based, Knowledge Based) • By Application (BFSI, Pharma & Healthcare, Retail & Consumer Goods, Information Technology (IT) & Telecom, Communication and Media & Education, Manufacturing, Logistics and Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Automation Anywhere, BlackLine Inc., Blue Prism, EdgeVerve Systems Ltd., FPT Software, Uniphore., KOFAX, Inc., WorkFusion, Inc., NICE, NTT Advanced Technology Corp., OnviSource, Inc., Pegasystems, UiPath |

| Key Drivers | • RPA automates repetitive tasks, reducing labor costs and improving efficiency. • Businesses across industries are looking to automate tasks for better accuracy, speed, and scalability. • Integrating AI and machine learning with RPA creates intelligent bots to handle complex tasks. |

| Opportunities | • Cloud deployment reduces upfront costs and makes RPA accessible to a wider range of businesses. • RPA can be applied in various sectors beyond traditional back-office operations. • Combining RPA with AI and machine learning opens doors for advanced automation capabilities. |