Consumer Electronic Sensors Market Report Scope & Overview:

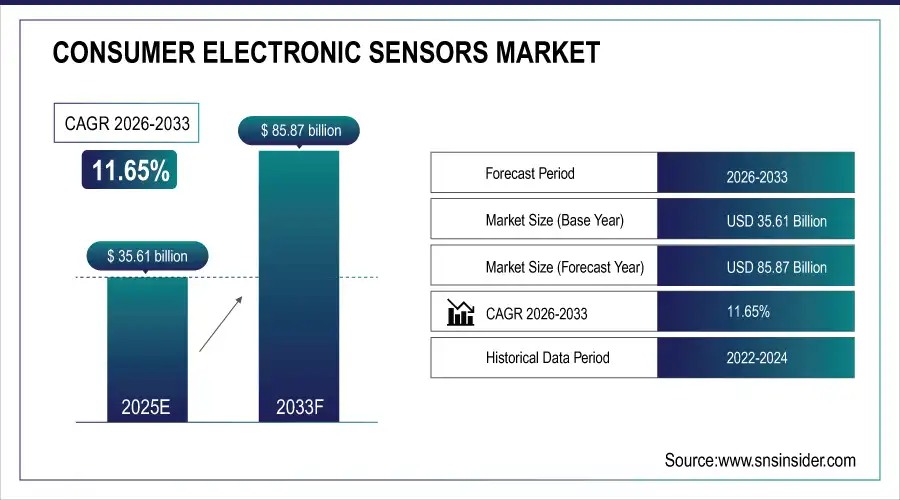

The Consumer Electronic Sensors Market size was valued at USD 35.61 Billion in 2025E and is projected to reach USD 85.87 Billion by 2033, growing at a CAGR of 11.65% during 2026-2033.

The Consumer Electronic Sensors Market analysis highlights the rising demand for advanced sensors in smartphones, wearables, and smart home devices. Increasing adoption of IoT and connected electronics is fueling growth across multiple segments. Miniaturization of sensors and integration with AI are transforming user experience. CMOS and MEMS technologies dominate the market, driving performance improvements. Distribution channels are shifting with faster growth in direct sales alongside distributor dominance. Overall, strong demand from consumer electronics ensures steady expansion of the global market.

By 2025, over 95% of flagship smartphones will integrate 10+ MEMS and CMOS sensors including LiDAR, ambient light, and ultrawideband for enhanced AR, imaging, and contextual awareness capabilities.

Market Size and Forecast:

-

Market Size in 2025E: USD 35.61 Billion

-

Market Size by 2033: USD 85.87 Billion

-

CAGR: 11.65% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Consumer Electronic Sensors Market - Request Free Sample Report

Consumer Electronic Sensors Market Trends

-

Growing adoption of motion and image sensors in smartphones and wearables is driving innovation in user experience and device functionality.

-

Increasing integration of AI and IoT with consumer sensors enables smarter devices, predictive analytics, and enhanced personalization across electronics applications.

-

Rising demand for health monitoring wearables accelerates biosensor adoption, supporting growth in fitness, biomedical, and personalized healthcare technology markets.

-

Miniaturization of MEMS-based sensors boosts compact device design, enabling high-performance sensors in slim smartphones, tablets, and next-generation wearable electronics.

-

Expanding smart home ecosystem increases demand for touch, temperature, and position sensors, fueling growth in consumer appliances and entertainment systems.

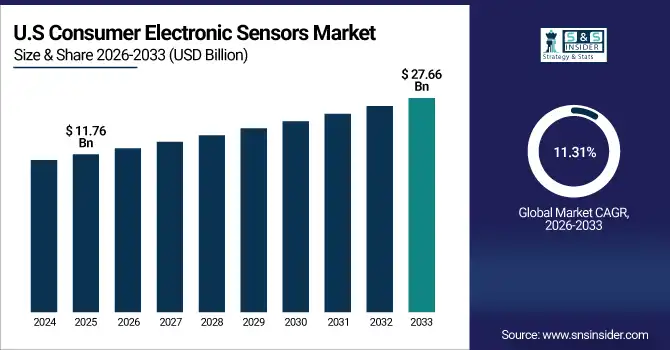

The U.S. Consumer Electronic Sensors Market size was valued at USD 11.76 Billion in 2025E and is projected to reach USD 27.66 Billion by 2033, growing at a CAGR of 11.31% during 2026-2033. Consumer Electronic Sensors Market growth is driven by rising adoption of smart devices, wearables, and connected home technologies, increasing demand for advanced image and motion sensors in smartphones, growing healthcare wearables adoption, strong IoT ecosystem development, and continuous innovations in MEMS and CMOS sensor technologies enhancing consumer electronics performance.

Consumer Electronic Sensors Market Growth Drivers:

-

Rising adoption of smart devices and IoT-enabled electronics fueling demand for advanced consumer electronic sensors

The growing penetration of smartphones, wearables, and connected home appliances is significantly boosting sensor integration. IoT expansion, combined with rising consumer demand for improved functionality, accuracy, and energy efficiency, is driving strong adoption. Image, motion, and biometric sensors are particularly in demand, supporting innovations in consumer electronics while enhancing user experience and device intelligence.

By 2025, over 80% of mid-to-high-tier smartphones globally will include at least three biometric sensors fingerprint, facial recognition, and voice authentication for enhanced security and personalization.

Consumer Electronic Sensors Market Restraints:

-

High manufacturing costs and sensor integration challenges limiting widespread adoption across consumer electronic applications

While consumer demand for advanced features is growing, high production costs of complex sensors remain a barrier. Manufacturers face difficulties in miniaturization, energy efficiency, and ensuring compatibility across multiple platforms. Additionally, supply chain disruptions and dependency on semiconductor availability increase pricing pressures, ultimately slowing down adoption of advanced sensors in lower-cost consumer devices.

Consumer Electronic Sensors Market Opportunities:

-

Growing demand for healthcare wearables and smart home devices creating lucrative opportunities for sensor integration

The increasing popularity of wearable health trackers, smartwatches, and fitness bands is driving sensor innovation. Expanding smart home ecosystems, supported by AI and IoT, present new opportunities for motion, temperature, and biometric sensors. Rising consumer focus on personalization, wellness, and automation will accelerate market growth, making healthcare wearables and home automation key opportunity segments.

By 2025, over 70% of smartwatches sold globally will include advanced biometric sensors for continuous blood pressure, glucose trend, and ECG monitoring, up from 30% in 2022.

Consumer Electronic Sensors Market Segment Analysis

-

By product, image sensors led the market with 38.50% share in 2025, while touch sensors were the fastest-growing segment with a CAGR of 11.20%.

-

By application, communication dominated with 40.10% share in 2025, whereas home appliances showed the fastest growth with a CAGR of 10.50%.

-

By type, smartphones led the market with 42.35% share in 2025, and wearables recorded the fastest growth with a CAGR of 12.20%.

-

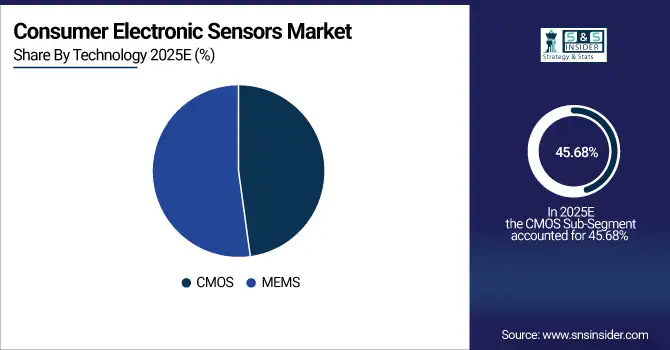

By technology, CMOS held 45.68% share in 2025, while MEMS sensors were the fastest-growing segment with a CAGR of 11.80%.

By Product, Image Leads Market While Touch Registers Fastest Growth

Image sensors lead the consumer electronics sensor market in 2025, holding the highest share due to their extensive use in smartphones, cameras, and laptops for high-quality imaging. Their demand is further boosted by social media, video streaming, and gaming innovations. However, touch sensors are registering the fastest growth, fueled by rising adoption in smartphones, tablets, and smart home devices. Increasing demand for intuitive interfaces and advanced touchscreens across consumer electronics is expected to accelerate touch sensor adoption rapidly.

By Application, Communication Dominate While Home Appliances Shows Rapid Growth

Communication applications dominate the consumer electronic sensors market, driven by the widespread integration of sensors in smartphones, laptops, and tablets to improve connectivity, performance, and user experience. This dominance is supported by increasing demand for 5G-ready devices, IoT, and seamless communication technologies. Meanwhile, home appliances are showing rapid growth, as smart refrigerators, washing machines, and air conditioners adopt motion, temperature, and pressure sensors. Growing consumer preference for smart, energy-efficient appliances with enhanced automation is fueling the demand for sensors in this segment.

By Type, Smartphones Lead While Wearables Registers Fastest Growth

Smartphones lead the consumer electronic sensors market, contributing the largest share due to their reliance on multiple sensors including image, motion, touch, and biometric technologies. With rising global smartphone penetration and demand for advanced camera features, this segment continues to dominate. In contrast, wearables such as smartwatches, health trackers, and AR/VR headsets are the fastest growing. The rising health awareness, increasing fitness trends, and consumer preference for personalized monitoring solutions are fueling rapid growth in the wearable device sensor segment.

By Technology, CMOS Lead While MEMS Grow Fastest

CMOS technology leads the consumer electronic sensors market in 2025, holding a significant share due to its extensive use in image sensors across smartphones, cameras, and laptops. CMOS offers low power consumption, high resolution, and cost efficiency, making it the preferred technology. However, MEMS sensors are growing the fastest, driven by rising applications in wearables, gaming devices, and smart appliances. Their miniaturization, reliability, and versatility make them increasingly crucial in enhancing performance, interactivity, and energy efficiency in consumer electronic devices.

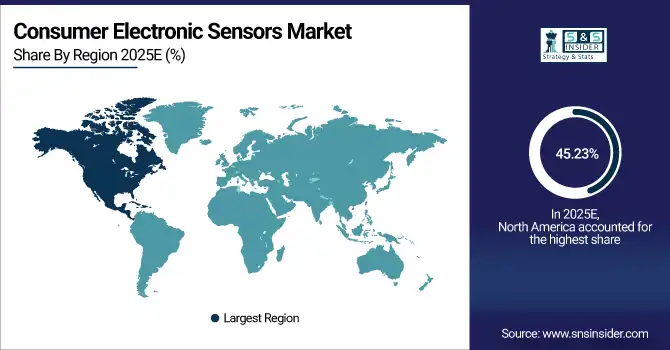

Consumer Electronic Sensors Market Regional Analysis:

North America Consumer Electronic Sensors Market Insights

In 2025 North America dominated the Consumer Electronic Sensors Market and accounted for 45.23% of revenue share, this leadership is due to the strong adoption of advanced consumer electronics. High penetration of smart devices, coupled with demand for premium smartphones and wearables, drives growth. The region emphasizes AI-driven sensors and IoT-based consumer solutions. Investments in R&D by major tech companies strengthen market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Consumer Electronic Sensors Market Insights

The U.S. leads the North American market with robust consumer demand for smartphones, wearables, and smart home devices. A strong ecosystem of semiconductor companies supports sensor development and innovation. Rising adoption of 5G and IoT accelerates integration of image, motion, and biometric sensors.

Asia-pacific Consumer Electronic Sensors Market Insights

Asia-pacific is expected to witness the fastest growth in the Consumer Electronic Sensors Market over 2026-2033, with a projected CAGR of 12.24% due to high production and consumption of smartphones, laptops, and wearables. The region benefits from cost-effective manufacturing and rapid technological advancements. Countries like South Korea, Japan, and India significantly contribute through strong electronics demand. Expanding middle-class income and increasing IoT adoption enhance market growth.

China Consumer Electronic Sensors Market Insights

China is a key contributor within Asia-Pacific, leading global electronics manufacturing and sensor integration. Its large consumer base drives strong demand for smartphones, wearables, and smart appliances. Government initiatives supporting semiconductor and sensor development boost domestic production.

Europe Consumer Electronic Sensors Market Insights

Europe shows steady growth, supported by strong adoption of wearables, entertainment devices, and smart home appliances. Growing consumer demand for energy-efficient products drives sensor adoption. Regional regulations emphasize quality, safety, and sustainability standards for sensors. Germany, France, and the U.K. are major contributors to sensor demand in electronics. Increasing focus on automation and AI further enhances market opportunities in Europe.

Germany Consumer Electronic Sensors Market Insights

Germany is a key market in Europe, benefiting from its advanced electronics and automotive industries. The country emphasizes precision engineering and quality in sensor integration. Smart wearables, consumer appliances, and high-performance devices fuel demand.

Latin America (LATAM) and Middle East & Africa (MEA) Consumer Electronic Sensors Market Insights

The Consumer Electronic Sensors Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing adoption of smartphones, tablets, and wearables. Increasing urbanization and rising disposable incomes support market expansion. Governments are investing in digital infrastructure, boosting demand for connected devices. Consumer preference for affordable electronics drives sensor integration in mid-range products.

Consumer Electronic Sensors Market Competitive Landscape:

Sony Corporation plays a leading role in the consumer electronic sensors market, especially in image sensor technology. Its sensors are widely used in smartphones, cameras, and gaming devices. Sony continues investing in AI-enabled and energy-efficient sensors to enhance user experiences. Strategic partnerships strengthen its global position.

-

In June 2025, Sony Semiconductor Solutions unveiled its advanced LYT-828 CMOS image sensor under the LYTIA lineup, featuring Hybrid Frame-HDR technology for superior imaging and dynamic range. In September 2025, Sony was reported to be developing the IMX09E, a 200-megapixel sensor designed to compete with high-end imaging technologies in smartphones.

Samsung is a dominant force in consumer electronics, driving innovation in image, motion, and biometric sensors. Its sensors are integrated into smartphones, wearables, and home appliances. With continuous R&D investments, Samsung focuses on IoT-driven electronics and 5G-enabled devices, reinforcing its leadership in sensor-driven consumer technologies worldwide.

-

In June 2025, Samsung announced its Bespoke AI home appliances range in India, integrating intuitive AI features, SmartThings connectivity, and advanced sensing technologies for automation. In January 2025, Samsung revealed updates to its SmartThings platform, enabling devices such as TVs, speakers, and refrigerators to act as motion and sound sensors for smarter home control.

Bosch Sensortec specializes in MEMS sensors for consumer electronics, including motion, pressure, and environmental sensors. The company focuses on miniaturization and high-performance solutions for smartphones, wearables, and smart appliances. Bosch leverages advanced sensor fusion technologies to support IoT applications, ensuring strong global demand in the consumer electronics segment.

-

In May 2025, Bosch Sensortec’s BMV080 particulate matter sensor was spotlighted for its ultra-compact, fanless, and maintenance-free design tailored for IoT and indoor air monitoring. In June 2025, at Sensors Converge, the company showcased new developer platforms and environmental sensing solutions, reaffirming its leadership in MEMS innovation for connected devices.

DigiKey is a leading distributor supporting the consumer electronic sensors market by offering a vast portfolio of sensor products. It bridges manufacturers and customers, ensuring global supply chain efficiency. With a focus on accessibility and technical support, DigiKey enables innovation by providing sensors for smartphones, wearables, and connected devices.

-

In April 2025, DigiKey expanded its product offerings by introducing new suppliers and a wide portfolio of sensor components, strengthening its role as a distributor in consumer electronics. In August 2025, DigiKey further enhanced its global portfolio, adding hundreds of thousands of components and emphasizing its commitment to supporting engineers with rapid prototyping solutions.

Consumer Electronic Sensors Market Key Players:

Some of the Consumer Electronic Sensors Market Companies are:

-

Sony Corporation

-

SAMSUNG

-

Bosch Sensortec GmbH

-

DigiKey

-

STMicroelectronics

-

OMNIVISION

-

Analog Devices

-

Panasonic Corporation

-

Knowles Electronics

-

InvenSense

-

TDK Corporation

-

Honeywell International Inc

-

NXP Semiconductors

-

Texas Instruments

-

ROHM Semiconductor

-

Murata Manufacturing

-

Infineon Technologies

-

Renesas Electronics

-

Maxim Integrated

-

ON Semiconductor

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 35.61 Billion |

| Market Size by 2033 | USD 85.87 Billion |

| CAGR | CAGR of 11.65% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Image, Motion, Temperature, Pressure, Touch and Position) • By Application (Communication, Entertainment, Home Appliances, IT and Others) • By Type (Cameras, Laptops, Smartphones, Tablets and Wearables) • By Technology (CMOS and MEMS) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Sony Corporation, SAMSUNG, Bosch Sensortec GmbH, DigiKey, STMicroelectronics, OMNIVISION, Analog Devices, Panasonic Corporation, Knowles Electronics, InvenSense, TDK Corporation, Honeywell International Inc, NXP Semiconductors, Texas Instruments, ROHM Semiconductor, Murata Manufacturing, Infineon Technologies, Renesas Electronics, Maxim Integrated, ON Semiconductor |