MULTI-FUNCTION DISPLAY MARKET KEY INSIGHTS:

To Get More Information on Multi-Function Display Market - Request Sample Report

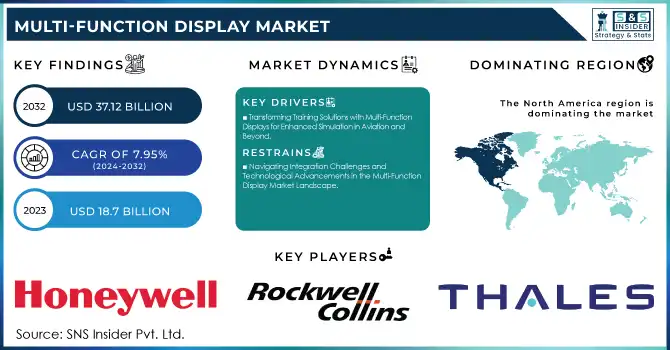

The Multi-Function Display Market Size was valued at USD 18.7 Billion in 2023 and is expected to reach USD 37.12 Billion by 2032 and grow at a CAGR of 7.95% over the forecast period 2024-2032.

The Multi-Function Display market is growing due to the increasing adoption of advanced technology, and increased demand for situational awareness through varied applications during flying operations is driving the growth of the MFD Market. MFDs combine different functionalities in a single display to give the user various types of information redundantly, and in turn, assist them with decision-making efforts by providing a reduced operational time frame. Advancements in display technology, including high-resolution screens, touch functionality, and enhanced user interfaces have greatly improved the ease of use and efficacy of MFDs in mission-critical situations. 90% of new commercial aircraft had MFDs installed, with 70% having 4K touchscreen MFD displays for improved resolution. Helmet-mounted displays saw an increase in military adoption as well with 60% of fighter jets flying with HMDs, while 40% of electric vehicles used MFDs to show important metrics like battery health and navigation. Besides, an increasing trend in digitalization of various sectors including aerospace & defense and automotive among others is also accelerating the demand for MFDs owing to this integrated functionality that holds the potential to improve operational efficiency.

Additionally, the growing focus on safety and efficiency in transportation systems is known to be boosting the uptake of MFDs. MFDs are also used to manage cockpit information and keep an eye on relevant flight data in aviation. In automotive, MFDs enhance driver safety by integrating navigation, communication, and vehicle diagnostics in a single interface.

In 2023, MFDs in commercial early aviation were able to reduce pilot workload by up to 20% for critical phases of flight. MFDs, the multi-function display was found in about 45% of vehicles where navigation, communication, and diagnostics were featured which integrated to improve safety while driving. Modern naval vessels employed MFDs for advanced navigation and system monitoring, with 75% of respondents expressing such familiarity with them, and more than 80% of industry professionals admiring the crucial role of MFDs in standards safe and efficient operation.

MARKET DYNAMICS

KEY DRIVERS:

-

The rising adoption of automation & advanced systems in different industries is one of the major driving factors for the growth of the Multi-Function Display market.

With organizations looking for ways to boost productivity, human error has been their enemy and as a result, automated solutions are on the rise to optimize operational processes. This transformation would not be possible without MFDs performing the important function of providing access to multiple workflows in a single window integrating information from many stores of data. It helps users access and understand important data and assists them in making faster decisions which leads to more efficient working. In 2023, about 85% of commercial planes have resorted to the use of Multi-Function Displays (MFD) for higher automation and lower pilot workload. About 50% of relatively new vehicles incorporated MFDs which provided a 30% enhancement in user perceptions about operational performance. About 70% of new military aircraft and vessels integrated MFD technology into automated systems to improve mission success. A survey also found that 75% of respondents working in the industry view MFDs as vital for minimizing the risk of human error and improving workflow management. Thereby increasing demand for these displays, MFDs are being utilized in industries such as aerospace, automotive, and military to improve workflows and functions of automated systems.

-

Transforming Training Solutions with Multi-Function Displays for Enhanced Simulation in Aviation and Beyond

The need for efficient training programs becomes even more important as industries start adopting advanced technologies. MFDs are being used as part of simulators for pilot training (both civil and military), and operator training on how to use these devices in the cockpit and during operations. These trainers simulate a replica of the operational environments and not only enable representation but also interaction with simulated systems under supervision. This is not only good for having a better experience while learning but also for making sure operators know how to react in the outside world perfectly. Organizations invest in training and development for their workforce to be skilled with advanced technologies.

In 2023, approximately 80% of civil and military aviation flight training programs included Multi-Function Displays in their simulators to better train pilots similar to how they would operate within an actual aircraft. With a particular emphasis on MFD, the aviation sector spent an estimated USD 3 billion on training solutions. In aerospace and defense sectors where effective training was among top priorities, approximately 65% of operators using MFDs showed a 40% increase in knowledge retention while maximizing their operational readiness. The demand for MFDs utilized in training & simulation along with civilian purposes will witness a steady rise, driving the market over the forecasting period.

RESTRAIN:

-

Navigating Integration Challenges and Technological Advancements in the Multi-Function Display Market Landscape

The complexity with which Multi-Function Display has to be integrated into existing platforms is one of the major restraints in this market. Given that MFDs merge many functions within one interface, it can be difficult to make them compatible across various technologies and systems. The complexity involved can result in prolonged deployment cycles which may require specialist skills thereby discouraging adoption of MFD solutions. The rapidity of technological progress poses another challenge that requires constant revisions and improvements to MFDs. This will take continued investment to remain competitive in developing technologies like AI and AR. So, manufacturers should transform their products to align with emerging user needs to stay ahead in an ever-evolving market. Losing market share and customers to competitors providing more sophisticated or user-friendly solutions due to repeating the same product without upgrading.

KEY SEGMENTATION ANALYSIS

BY SYSTEM

In 2023, the Electronic Flight Display dominated the market share at 42% in terms of revenue due to its significant impact on situational awareness and operational efficiency in aviation. EFDs integrate important flying data like altitude, magnitude, navigational information, and system alarms into one interface for pilots to review and decode data expedited. These features help mitigate pilot workload and minimize the probability of human error, becoming a necessary instrument on modern aircraft. Furthermore, the need for digital cockpits and stringent regulations demanding better safety and performance are also retaining EFDs' presence strong in the market.

Heads-up displays are projected to have the fastest growth in CAGRs during 2024–2032 owing to their unique advantages that can enhance pilot visibility and safety. Heads-up displays (HUDs) shine important flight information onto the windshield so that pilots can not only see what they need to know but also what is outside of their cockpit. This is especially useful during the more important parts of a flight like takeoff and landing. Increasing demand for modern-day avionics coupled with an increased focus on improving pilot situational awareness is driving the investments in HUD technology. In addition, HUD systems are expected to be a major growth area in the MFD market due to features like augmented reality integration, and improvements like enhanced display clarity, which will attract more customers over time as they become more active users of HUDs.

BY PLATFORM

The Land segment led the Multi-Function Display market with a share of 52% in 2023. These displays have been highly adopted in land applications as they help in integrating navigation, vehicle diagnostics, as well as, communication systems on a single interface. As a result, operators can make rapid and informed decisions to boost operational efficiency. In addition, the adoption of smart vehicle technologies has accelerated the use of these displays in land applications. Moreover, the increased push for vehicle automation in the land transportation sector has also propelled the demand for MFDs, hence, contributing to the large market share of this segment.

The Airborne segment is expected to register the fastest growth rate between 2024 and 2032 as there have been several advancements in the aviation sector. Currently, the focus is on enhancing the situational awareness and safety of the pilots. The industry is progressively integrating advanced avionics into all its airframes, leading to a high demand for MFDs that are compatible with a broad array of avionics systems. The adoption of unmanned aerial vehicles in the civil and defense platforms is also rapid. Additionally, manufacturers are incorporating advanced systems in new models of aircraft which is a trend that will complement the growth of this segment as there will be a high demand for innovative MFDs that can be installed in such aircraft. Further, safe and efficient navigation, more advanced communication as well as monitoring, and control systems are required in airborne applications.

BY TECHNOLOGY

LED held the largest market share of 38% in terms of revenue for the Multi-Function Display segment due to high demand from various end-use industries such as automotive, aviation, and consumer electronics during the forecast period. LEDs are chosen primarily for their high brightness energy efficiency, and long life that are used in such applications where they need to be visible like the aircraft cockpit or vehicle dashboard. The fact that they can generate bright, clear images irrespective of lighting facilitates a better user experience which in turn is contributing to increased demand. Finally, the maturity of LED technology has resulted in these cost-effective solutions becoming embedded into an increasing variety of devices.

The OLED segment is projected to grow at the fastest CAGR between 2024 and 2032 owing to continuous technological advancements in display technology coupled with a rise in demand for high-quality images. Compared to traditional LED displays, OLEDs have better contrast ratios, better viewing angles, and faster response times which make them attractive for high-quality imaging applications like avionics as well as automotive displays in premium vehicles. With manufacturers focusing more on the user experience while optimizing the visible performance of RGB LEDs, demand for OLED technology will be high. In addition, continuous advancements in the manufacturing process of OLED and declining fabrication costs should continue to attract investors leading to greater accessibility which will drive the growth of the MFD market region segment of OLED.

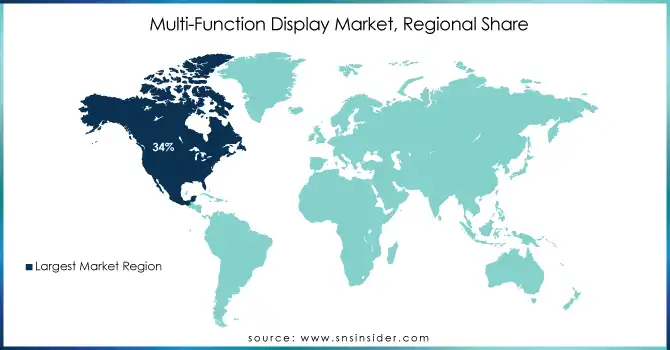

REGIONAL ANALYSIS

North America accounted for the largest share of 34% in the year 2023, primarily due to the highly developed aerospace and defense sectors of surrounding countries such as The United States. Boeing, one of the largest aerospace manufacturers in the world, is an excellent case in point - MFD technology appears throughout its commercial and military aircraft. An example of such modern technology is the multiple-function display systems (MFDs) installed on Boeing's 787 Dreamliner, giving pilots essential flight information to improve situational awareness and operational efficiency. In addition, stringent regulatory standards along with aviation focus on safety and performance are elevating the demand for advanced display technologies.

Asia Pacific region to grow at the fastest CAGR through 2024–2032 owing to rising industrialization and infrastructure development investments. The expansion of MFD technology in certain industries, especially the automobile industry in countries like China and Japan, is one example. Several companies even combined such advanced MFDs in their vehicles, which has resulted in better user interface and driving experience for the end users themselves (Toyota integration for business times). Among regions, the growth in the adoption of smart vehicles and focus on connectivity and automation are expected to be key drivers for the MFD market in the Asia Pacific. Moreover, when governments are spending on upgrading transport systems along with new technologies, the need for novel display solutions will also increase resulting in Asia Pacific being one of the largest growing areas in forecasted years.

Do You Need any Customization Research on Multi-Function Display Market - Inquire Now

Key Players

Some of the major players in the Multi-Function Display Market are:

-

Honeywell International Inc. (Primus Epic, Honeywell 3D Display)

-

Rockwell Collins, Inc. (Pro Line Fusion, PAVES 3)

-

Thales Group (TopFlight, AVANT)

-

Garmin Ltd. (G3000, G5000)

-

Northrop Grumman Corporation (Integrated Avionics System, LYNX)

-

General Dynamics Mission Systems (Advanced Displays, Multi-Function Tactical Display)

-

L3 Technologies, Inc. (Ruggedized Multi-Function Display, L3Harris MFD)

-

Boeing (737 MAX MFD, 787 Dreamliner Display)

-

Elbit Systems (SkyLens, Digital Cockpit)

-

Mitsubishi Electric Corporation (Airborne Multi-Function Display, Avionics System)

-

Panasonic Corporation (Toughpad MFD, Avionics Display System)

-

Fujitsu Limited (Multi-Function Display Unit, MFD for Military Applications)

-

Saab AB (Gripen Multi-Function Display, MFD for Fighter Aircraft)

-

CMC Electronics Inc. (MFD-200, MFD-800)

-

Meggitt PLC (Meggitt MFD, Flight Data Display)

-

Avidyne Corporation (EX600, IFD550)

-

Indra Sistemas, S.A. (MFD for Military Aircraft, AVANT MFD)

-

Aerosonic Corporation (Multi-Function Flight Display, Cockpit Display Systems)

-

Hawker Beechcraft Corporation (MFD for Beechcraft Bonanza, King Air MFD)

-

Sagem (Safran) (MFD for Military Applications, Cockpit Display)

Some of the Raw Material Suppliers for Multi-Function Display Companies:

-

3M Company

-

DuPont de Nemours, Inc.

-

Honeywell Specialty Materials

-

BASF SE

-

Corning Inc.

-

Schott AG

-

Samsung Display Co., Ltd.

-

LG Display Co., Ltd.

-

Nitto Denko Corporation

-

Yazaki Corporation.

RECENT TRENDS

-

In October 2024, Collins Aerospace received FAA TSO approval for its multi-core Multifunction Display, enhancing cockpit processing power by 75%. This advancement significantly improves data handling for military and civil aviation operations.

-

In April 2024, Researchers at Linköping University, Sweden, created a touch-responsive LED display that senses touch, light, fingerprints, and even the user's pulse, this innovation could lead to a new era of interactive screens for devices like phones and tablets.

-

In July 2024, Aspen Avionics and Electronics International are collaborating to add engine monitoring to Aspen's Evolution displays for single-engine aircraft. The upgrade will support four- and six-cylinder engines.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.7 Billion |

| Market Size by 2032 | USD 37.12 Billion |

| CAGR | CAGR of 7.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Electronic Flight Display (EFD), Heads-Up Display (HUD), Helmet-Mounted Display (HMD), Portable and Flexible Multi-Function Display) • By Platform (Land, Airborne, Naval) • By Technology (LED, LCD, OLED, Active-Matrix Liquid Crystal Display) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Rockwell Collins, Inc., Thales Group, Garmin Ltd., Northrop Grumman Corporation, General Dynamics Mission Systems, L3 Technologies, Inc., Boeing, Elbit Systems, Mitsubishi Electric Corporation, Panasonic Corporation, Fujitsu Limited, Saab AB, CMC Electronics Inc., Meggitt PLC, Avidyne Corporation, Indra Sistemas, S.A., Aerosonic Corporation, Hawker Beechcraft Corporation, Sagem (Safran) |

| Key Drivers | • Enhancing Automation Efficiency Through Multi-Function Displays in Aerospace Automotive and Military Industries • Transforming Training Solutions with Multi-Function Displays for Enhanced Simulation in Aviation and Beyond |

| Restraints | • Navigating Integration Challenges and Technological Advancements in the Multi-Function Display Market Landscape |