Contract Manufacturing and Design Services Market Size & Trends:

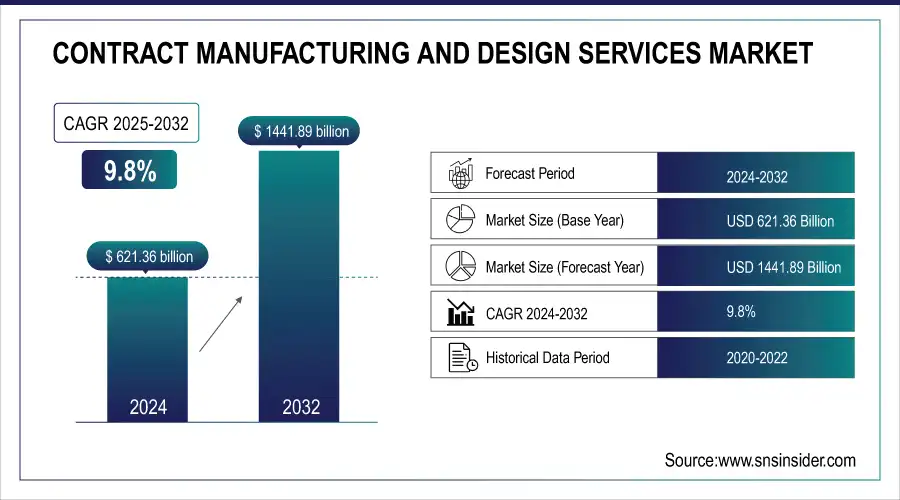

The Contract Manufacturing and Design Services Market was valued at USD 621.36 billion in 2024 and is expected to reach USD 1441.89 billion by 2032, growing at a CAGR of 9.8% from 2025-2032.

The Contract Manufacturing and Design Services Market is growing due to rising product complexity, technological advancements, and the increasing need for cost-efficient, scalable production solutions. Growth is fueled by the biopharmaceutical sector, driven by biologics, cell, and gene therapies requiring specialized handling and cold chain management. Personalized medicine, miniaturization in electronics and medical devices, and adoption of digital workflows enhance production efficiency. Additionally, outsourcing trends, precision manufacturing, and global supply chain optimization further contribute to market expansion.

Market Size and Forecast

-

Market Size in 2024: USD 621.36 Billion

-

Market Size by 2032: USD 1441.89 Billion

-

CAGR: 9.8% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get E-PDF Sample Report on Contract Manufacturing and Design Services Market - Request Sample Report

Contract Manufacturing and Design Services Market Trends

-

Rising demand for cost-efficient and scalable production solutions is driving the contract manufacturing and design services market.

-

Growing adoption across pharmaceuticals, electronics, automotive, and consumer goods is boosting market growth.

-

Expansion of outsourcing strategies to focus on core competencies is fueling service demand.

-

Advancements in precision manufacturing, CAD/CAM, and prototyping technologies are enhancing product quality and development speed.

-

Increasing focus on regulatory compliance, quality assurance, and time-to-market reduction is shaping market trends.

-

Collaboration between original equipment manufacturers (OEMs) and contract service providers is accelerating innovation and operational efficiency.

-

Globalization and supply chain optimization are further expanding market opportunities.

Contract Manufacturing and Design Services Market Growth Drivers:

The Contract Manufacturing Industry is Being Transformed by Technological Innovations like IoT, AI, and Industry 4.0.

The CMDS market is experiencing a major change due to the incorporation of advanced technologies such as IoT, AI, and Industry 4.0 solutions. These advancements are fundamentally transforming the manufacturing of products, resulting in higher production abilities, better quality control, and improved supply chain efficiency in the CMDS sector. IoT enables immediate monitoring and data gathering by linking machines, sensors, and systems via the internet. This enables subcontracted producers to enhance manufacturing procedures, anticipate maintenance requirements, and reduce periods of inactivity. Picture being able to predict equipment malfunctions before they occur, guaranteeing more efficient operations - that is the strength of IoT-powered predictive maintenance in CMDS.AI is a significant innovation, providing enhanced analytics and automation features.

NIST highlights the significance of Industry 4.0 technologies for updating manufacturing processes and remaining competitive in the global market, a critical aspect for CMDS firms to keep in mind. The U.S. Department of Commerce recently announced a five-year competition with a USD 70 million prize to create a new Manufacturing. This collaboration between the government and private sector emphasizes using AI to improve manufacturing in the CMDS market, supporting a trained workforce, and building strong supply chains.

Outsourcing can provide a competitive edge through innovation in core competencies.

Companies can shift their focus to areas like research and development, marketing, and sales by outsourcing manufacturing and design to specialized partners. This change in strategy frees up important Services, allowing for significant investments in innovation. Pharmaceutical companies have the ability to speed up the creation of life-saving medications by outsourcing production to contract manufacturers, allowing them to focus more Services and expertise on drug discovery and clinical trials. This method speeds up the release of new products and encourages innovation, placing companies at the forefront of their industries.

Contract Manufacturing and Design Services Market Restraints:

Restrictions in the Contract Manufacturing and Design Services Sector

Despite the growth potential, the Contract Manufacturing and Design Services (CMDS) market is confronted with several challenges. Supply chain instability, frequently caused by political conflicts, environmental catastrophes, or worldwide health crises such as COVID-19, presents a substantial danger. These interruptions result in shortages of components, higher costs, and production delays. In addition, it is challenging to uphold uniform quality standards in various regions with different regulatory requirements and manufacturing capacities. Protecting intellectual property is also a crucial issue to consider during outsourcing. Although the Indian market shows potential, it also brings distinctive obstacles. Careful pricing strategies are required due to the price sensitivity of both Indian consumers and businesses. India's infrastructure, despite making substantial progress, encounters obstacles in roads, railways, seaports, and airports, which affect the efficiency of logistics and supply chains.

Contract Manufacturing and Design Services Market Segment Analysis

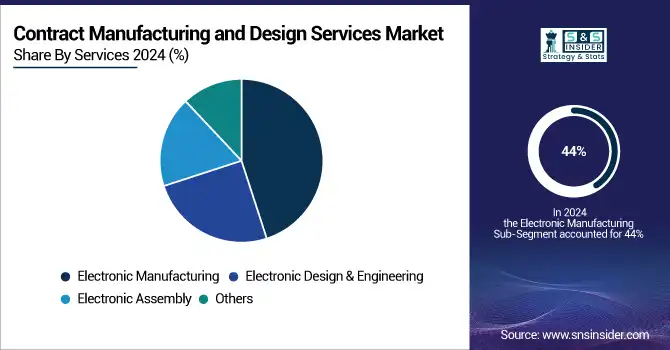

By Services, Electronic Manufacturing Services segment dominated in 2024 with strong demand for high-density circuit boards and advanced gadget components.

Based on Services, Electronic Manufacturing dominated the contract manufacturing and Design Services Market with 44% of share in 2023. The demand for advanced circuit boards has been driven by the rising complexity and shrinking size of electronic gadgets like smartphones and tablets. This has stimulated the expansion of EMS providers with the ability to manage high-density interconnect (HDI) board production. Corporations such as Jabil Inc. focus on providing an extensive array of electronic manufacturing services, with a strong emphasis on innovation and efficiency in order to cater to the changing requirements of the sector.

By End-use, IT & Telecom segment led in 2024, driven by reliance on contract manufacturing for complex electronics, networking equipment, and consumer devices.

Based on End Use, IT & Telecom dominated the Contract Manufacturing and Design Services market with 30% of share in 2023. This shows the importance of contract manufacturing and design services in supporting the IT and telecommunications sectors, known for fast technological progress and rising need for advanced electronic parts. The IT & Telecom industry includes a variety of items and services like telecom devices, networking equipment, consumer electronics, and enterprise IT solutions. This industry heavily depends on subcontracted manufacturers to make intricate electronic parts and systems that need precision, advanced technology, and scalability. Foxconn Technology Group offers a wide range of services to major IT and telecom companies, making it one of the biggest contract manufacturers worldwide. Its functions involve putting together smartphones, tablets, and networking gear for top brands like Apple and Sony. Foxconn, or Hon Hai Precision Industry Co., Ltd., is a global electronics manufacturing company based in Tucheng, New Taipei, Taiwan.

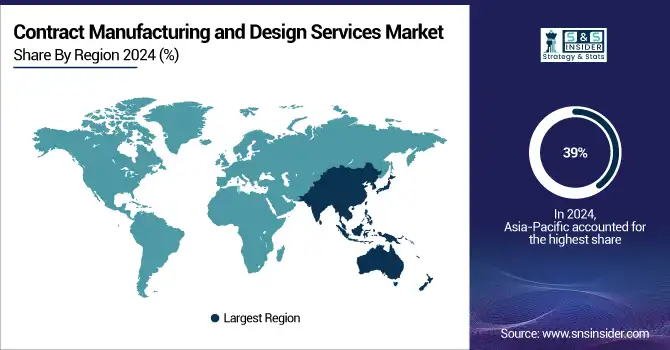

Contract Manufacturing and Design Services Market Regional Analysis

Asia Pacific Contract Manufacturing and Design Services Market Insights

The Asia-Pacific region is projected to see the highest growth in the Contract Manufacturing and Design Services market in 2024, holding a 39% market share. This increase is mainly fueled by the rise in outsourcing in the area, driven by the presence of cheap labor and plentiful raw materials. China, India, and Vietnam are emerging as important centers for contract manufacturing because of their cost benefits and large production capacities. Major corporations like Flex Ltd. and Jabil Inc. have set up substantial business activities in the Asia-Pacific area in order to take advantage of these benefits. An example is Flex Ltd., which runs various production plants in China and India, specializing in electronics and automotive parts. Many global companies have been drawn to the region due to its advantageous environment for outsourcing and cost-efficient production options.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

North America Contract Manufacturing and Design Services Market Insights

In 2024, North America holds a 26% market share and is primarily controlled by the healthcare and automotive sectors, which play a major role in driving the contract manufacturing industry in the region. The healthcare sector benefits greatly from the high-mix-low-volume characteristics of its production, which enables electronic contract manufacturing and design service providers to attain increased gross profit margins. Celestica Inc. and Plexus Corp. are key players in North America, meeting the market need for cutting-edge and convenient diagnostic products. These companies assist various R&D centers and medical institutes like the Mayo Clinic and the Cleveland Clinic by offering advanced manufacturing services for innovative healthcare solutions. The concentration on high-margin, technologically advanced products and the existence of multiple R&D facilities are anticipated to fuel substantial growth in the North American market during the forecast period.

Europe Contract Manufacturing and Design Services Market Insights

Europe holds a significant share in the Contract Manufacturing and Design Services Market due to its advanced manufacturing infrastructure, strong presence of electronics, automotive, and pharmaceutical industries, and focus on innovation-driven production. Increasing adoption of Industry 4.0 technologies, rising demand for outsourced manufacturing, and supportive regulatory frameworks further drive growth. Leading European players emphasize quality, precision, and sustainability, making the region a key contributor to global market expansion.

Middle East & Africa and Latin America Contract Manufacturing and Design Services Market Insights

The Middle East & Africa and Latin America are emerging markets in the Contract Manufacturing and Design Services sector, driven by growing industrialization, rising electronics and pharmaceutical demand, and increasing foreign investments. Companies are leveraging cost advantages and strategic locations to serve regional and global clients. Expanding infrastructure, government incentives, and partnerships with global manufacturers are fostering market growth, positioning these regions as attractive destinations for outsourced design and manufacturing solutions.

Contract Manufacturing and Design Services Market Competitive Landscape:

Benchmark Electronics

Benchmark Electronics is a global provider of integrated electronics manufacturing, precision technology solutions, and engineering services. The company serves diverse industries including aerospace, defense, medical, and industrial sectors. With a focus on advanced manufacturing capabilities, Benchmark emphasizes quality, reliability, and technological innovation to support complex, high-performance products. Its facilities worldwide integrate automation, precision engineering, and service excellence to meet evolving client needs in a rapidly growing electronics market.

-

2025: Broke ground on a new 250,000 sq. ft. facility in Penang, Malaysia, enhancing precision technology capabilities and service offerings.

Flextronics (Flex Ltd.)

Flex is a global leader in electronics manufacturing and supply chain solutions, providing end-to-end services for industries including healthcare, automotive, industrial, and consumer electronics. The company integrates engineering, design, and production capabilities with advanced digital technologies to improve operational efficiency, reduce costs, and enhance innovation. Flex emphasizes smart manufacturing, data-driven processes, and AI-driven solutions to streamline contract management and improve global production performance.

-

2025: Adopted Luminance's AI technology to optimize contract management and review processes, enhancing efficiency in global operations.

Hon Hai Precision Industry

Hon Hai Precision Industry, also known as Foxconn, is a global leader in electronics manufacturing, specializing in complex assembly and design solutions for consumer electronics, automotive, and industrial clients. The company emphasizes innovation, smart manufacturing, and integration of advanced technologies to support large-scale production and prototyping. Foxconn invests in automotive electronics and EV solutions, reflecting a strategic expansion into high-growth technology markets.

-

2024: Unveiled two new reference electric vehicles at Hon Hai Tech Day, showcasing capabilities in automotive design and manufacturing.

Pegatron Corporation

Pegatron is a multinational electronics manufacturer specializing in computing, communication, and consumer electronics. The company focuses on smart manufacturing, AI integration, and 5G-enabled production facilities to improve efficiency and quality. Pegatron emphasizes technological innovation, automation, and global scalability to meet diverse client requirements while supporting high-volume and complex production needs.

-

2025: Inaugurated a smart manufacturing facility in Batam, Indonesia, integrating AI, automation, and 5G technologies to enhance production capabilities.

Contract Manufacturing and Design Services Companies are:

-

Benchmark Electronics Inc.

-

Compal Electronics Inc.

-

Creating Technologies

-

Hon Hai Precision Industry Co. Ltd.

-

Jabil Circuit Inc.

-

Sanmina Corporation

-

Pegatron Corporation

-

Kimball Electronics

-

Universal Scientific Industrial Co., Ltd. (USI)

-

BYD Electronics

-

Shenzhen Kaifa Technology Co., Ltd.

-

SMTC Corporation

-

Lonza Group Ltd.

-

Catalent Inc.

-

WuXi Biologics

-

Plexus Corporation

-

Fabrinet

-

Venture Corporation Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 621.36 Billion |

| Market Size by 2032 | USD 1441.89 Billion |

| CAGR | CAGR of 9.8% from 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Electronic Design & Engineering, Electronic Assembly, Electronic Manufacturing, Others) • By End-use (Healthcare, Automotive, Industrial, Aerospace & Defense, IT & Telecom, Power & Energy, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Benchmark Electronics Inc., Celestica Inc., Compal Electronics Inc., Creating Technologies, Flextronics International Ltd., Hon Hai Precision Industry Co. Ltd., Jabil Circuit Inc., Sanmina Corporation, Pegatron Corporation, Kimball Electronics, Universal Scientific Industrial Co., Ltd. (USI), BYD Electronics, Shenzhen Kaifa Technology Co., Ltd., SMTC Corporation, Lonza Group Ltd., Catalent Inc., WuXi Biologics, Plexus Corporation, Fabrinet, Venture Corporation Limited. |