Copper Scrap Market Report Scope & Overview:

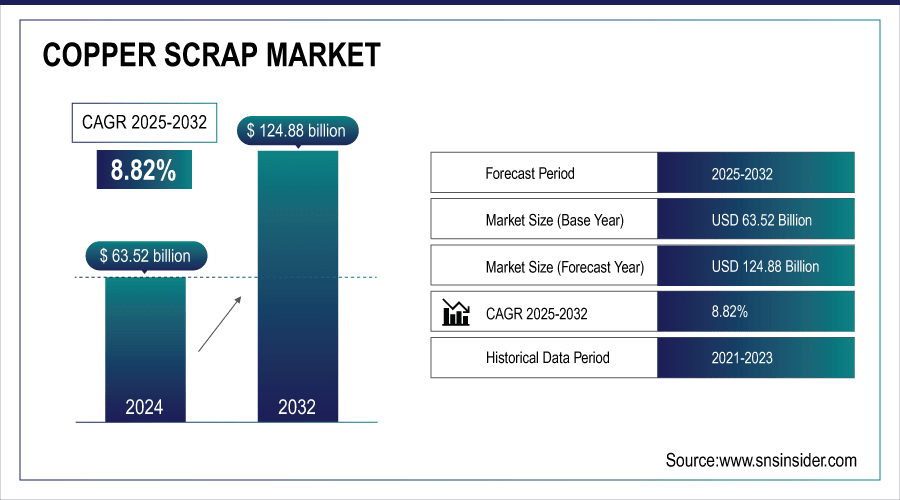

The Copper Scrap Market size was valued at USD 63.52 Billion in 2024 and is projected to reach USD 124.88 Billion by 2032, growing at a CAGR of 8.82% during 2025–2032.

The Copper Scrap Market is seeing strong timing, benefiting from a demand for verified, reusable, environmentally friendly, promoted sources. In the Copper Scrap Market Trends, lubricating oils still dominate the old scrap market by volume because of their availability, while new scrap is quickly becoming an important part of overall supply. The continued strong use of copper across the electrical and electronics sector– driven by the acceleration of electrification, renewable energy projects, and electric vehicles– will ensure that copper maintains it as the largest consumer of this critical metal. Technological innovations in recycling processes, coupled with strict environmental regulations, are driving efficient recovery and recycling of copper. The market in regions with a well-established recycling infrastructure is anticipated to dominate the Copper Scrap Market, adding to the Copper Scrap Market growth as the focus on circular economy is high.

In July 2025, the U.S. announced quotas requiring 25% of high-quality copper scrap to be sold domestically to reduce reliance on imports and support local production. Analysts say the impact on the global copper market will be minimal since much scrap is already consumed domestically. The policy also leaves questions about the definition of “high-quality” scrap and its enforcement timeline, which could start in 2027.

To Get More Information On Copper Scrap Market - Request Free Sample Report

Key Copper Scrap Market Trends

-

There is continued demand from production of new copper, such as for use in electric vehicles (EVs) and renewable energy projects, which will mean more recycled copper integrated into the supply chain.

-

Greater focus by governments on adopting the circular economy and low-carbon manufacturing will drive copper recycling.

-

Shredding, sorting and smelting technologies Giving a “technological edge” to a comprehensive metal recycling to enhance the recovery rates as well as the efficiency.

-

Scalability is constrained by supply chain risks, variations in scrap quality, and obstacles to cross-border trade.

-

Growing use of digitized platforms for scrap tracking increases the value chain transparency and traceability.

Copper Scrap Market Growth Drivers:

-

Copper Scrap Recycling Plays a Vital Role in Sustainability and Energy Efficiency by Cutting Emissions, Saving Resources, and Supporting a Circular Economy

Sustainability and energy efficiency are central to the Global Copper Scrap Market, as the Copper Scrap Industry or Copper Recycling Industry significantly reduces environmental impact compared to primary copper production. The use of copper scrap therefore helps conserve natural resources and reduces dependence on mining, a very resource-intensive and environmentally damaging process, with regeneration of CO₂ e emissions and up to 85% in energy demand. Around 30% of global copper needs are satisfied through recycled copper, clearly demonstrating the crucial role copper plays in supporting circular economy targets. Additionally, copper retains its quality from initial extraction (mining) to recycling, meaning it can be used decades later in applications such as construction or electrical and electronics applications for which it cannot be lost unlike some other metals. Therefore, the copper scrap industry can become a key player in making global decarbonization goals and sustainable production outcomes a reality.

In June 2025, Copper demand is rising sharply, driven by electrification, electric vehicles, and renewable energy projects. Supply constraints from aging mines, environmental regulations, and geopolitical issues are creating a tight market. Despite short-term volatility, long-term prospects remain strong, highlighting opportunities in mining, refining, and recycling to support the global green transition.

Copper Scrap Market Restraints:

-

Quality Variability & Contamination Impacting Efficiency and Profitability in the Copper Scrap Market

Quality variability and contamination remain significant factors in the copper scrap market, as collected scrap often carries coatings, paints, insulation, or alloy impurities that reduce its immediate usability. Because of these impurities, they often need extensive sorting, cleaning or refining to be reused, which adds to operational overhead and costs. The existence of feed contamination directly hits recyclers and downstream manufacturers on profit margins, increasing preprocessing costs of recyclers by 22–38%, according to Industry reports. In addition, variation in scrap quality results in lesser metal recovery rates, thus affecting supply chain reliability. Contamination in recycled copper, even at low levels, can affect product performance and specifications and therefore limits the scope of reusage of copper scrap in high-purity applications such as electronics and energy systems.

Copper Scrap Market Opportunities:

-

Electrification and Green Infrastructure are Fueling Rising Copper Scrap Demand and Recycling Growth

Electrification and green infrastructure expansion are significantly boosting copper scrap demand, as electric vehicles (EVs), renewable energy systems, and smart grids rely heavily on copper for conductivity and efficiency. But an average EV needs approximately 80–90 kg of copper and wind turbines consume around 4.7 tons of copper per megawatt of capacity. Solar photovoltaic systems also require roughly 5.5 tons of copper per megawatt. This growing metal intensity inherently reinforces the recycling ecosystem, where copper scrap is a key secondary resource to accommodate the increasing demand. With the increasing demand for carbon neutrality and sustainable infrastructure from governments, copper scrap recycling is becoming a key driver of cost-effectiveness, resource conservation, and circular economy growth.

Key Copper Scrap Market Segment Analysis

-

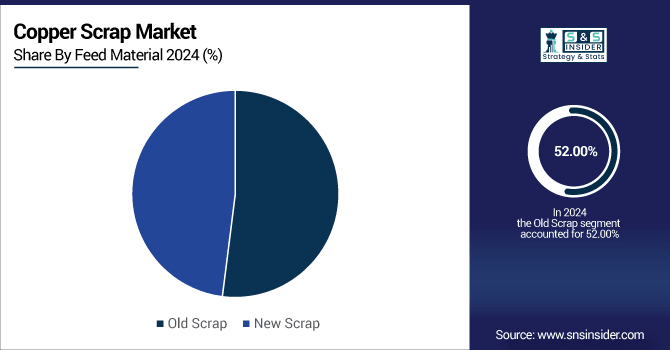

By Feed Material: Old Scrap dominated the market in 2024 with 52%, while New Scrap emerged as the fastest growing category.

-

By Grade: #2 Copper Scrap dominated the market with 34% share in 2024, whereas #1 Copper Scrap was the fastest growing segment.

-

By Application: Brass Mills dominated the market with a 63% share in 2024 and also represented the fastest-growing application segment.

-

By End-use: Electrical & Electronics dominated with 52% share in 2024 and simultaneously was the fastest growing end-use sector.

By Feed Material, Old Scrap Leads While New Scrap Emerges as Fastest-Growing Segment in the 2024 Copper Scrap Market

In 2024, old scrap emerged as the leading feed material segment in the copper scrap market due to its steady availability from recycling and reprocessing activities scrap, specifically from decommissioned infrastructure, end-of-life vehicles, and construction debris, became a widely used material source for industries, making it a profitable input material. Meanwhile, new scrap, which refers to scrap from manufacturing and processing waste, became the top growing category. The increasing adoption of sustainable manufacturing practices and circular economy initiatives have driven higher demand for new scrap, marking its rising significance in supporting greener and efficient supply chains.

By Grade, Dominance of #2 Copper Scrap and Rapid Growth of #1 Copper Scrap in the 2024 Market

The copper scrap market in 2024 was dominated by #2 copper scrap, primarily because of its widespread availability and cost-effectiveness for multiple industrial applications. They represented the relentless driving force behind growth in the market as they pugged a steady high volume of copper scrap. In addition to it, brass mills were the largest positive in origin along with the fastest-growing application segment, owing to robust usage of brass in plumbing, fittings, and decorative applications. Particularly amongst brass mills whose demand for copper scrap has been continuously bolstered by infrastructure expansion and manufacturing there was sound justification for consumption.

By Application, Brass Mills Lead as the Dominant and Fastest-Growing Application Segment in the 2024 Copper Scrap Market

In 2024, brass mills accounted for the dominant application segment in the copper scrap market, fueled by strong demand for brass products across industries such as construction, automotive, and consumer goods. They were the dominant growth factor in the market as they pounded a consistent heavy volume of copper scrap. Apart from it, brass mills were the largest positive-originating as well as the fastest developing segment of the application, due to increasing usage of brass for plumbing, fittings, and decorative applications. Copper scrap consumption was well founded among brass mills that have steadily increased demand due to infrastructure development and manufacturing activities.

By End-use, the Electrical & Electronics Sector Leads Copper Scrap Market Growth in 2024

The electrical and electronics sector dominated the copper scrap market in 2024, owing to copper’s unmatched conductivity, durability, and recyclability, which are essential for power transmission, electronic devices, and smart infrastructure. The dominance of this sector was driven by fast electrification, pipeline of renewable energy projects and the production of electric vehicles (EVs). Additionally, the electrical and electronics segment was the fastest-growing end-use category as industries worldwide headed toward energy efficiency and digital transformation. High-performance cables, wiring and electronic components were the primary drivers cementing the sector as the most significant copper scrap usage area in an ever more technologically driven world.

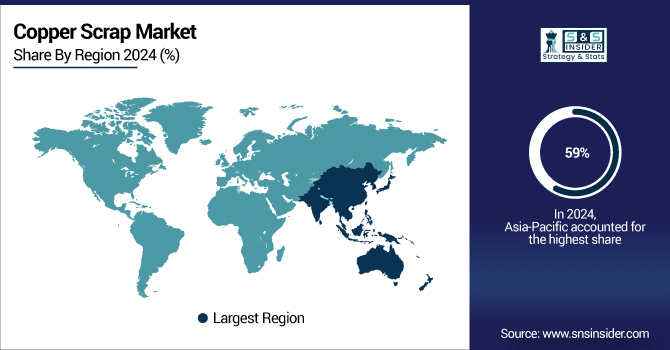

Asia-Pacific Copper Scrap Market Insights

In 2024, Asia-Pacific dominated with 59% share of the Copper Scrap Market, making it the leading region globally. The dominance in demand mostly lived to copper-intensive nations like China, Japan, South Korea and India that comprise key development projects in their construction, power infrastructure, automotive and electronics segments. Regional leadership may also be bolstered by government-backed initiatives promoting recycling energy efficiency and sustainable production. Rising copper scrap consumption supported through growing adoption for electric vehicles, renewable energy projects and green infrastructure Increasing refining capacity coupled with a refined supply chain is another factor which is augmenting the Asia-Pacific copper scrap market, which will cement the region to retain its leading position in copper scrap utilization and recycling by application through a diversity of end use sectors.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Copper Scrap Market Insights

In 2024, North America demonstrated a strong position in the copper scrap market, supported by advanced recycling infrastructure and widespread copper usage across multiple sectors. The U.S. ranks first in the region, supported by strong scrap gathering networks and robust demand for construction, power transmission and industrial applications. Electric vehicle production growth, energy grid modernization, and industrial automation adoption are all expected to drive increased consumption of refined copper. Copper recoveries across the region are also being supported by sustainability initiatives. Meanwhile, Canada keeps moving forward thanks to government-funded recycling programs, and Mexico adds its bit with automotive and manufacturing scrap recovery, as a result delivering sustainable regional copper scrap demand growth.

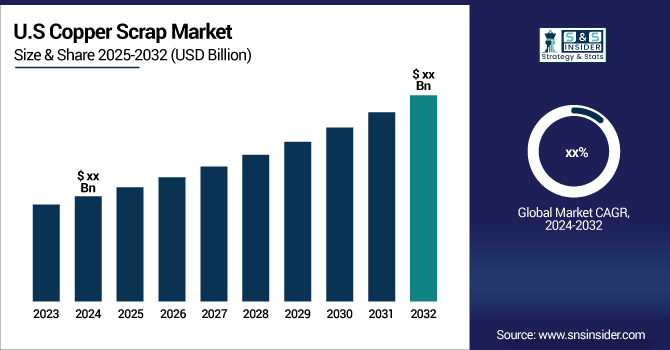

U.S. Copper Scrap Market Insights

In 2024, the U.S. copper scrap market was valued at USD 8.58 billion, making it the largest contributor within North America. The market is projected to expand steadily, reaching USD 17.18 billion by 2032, driven by a healthy CAGR of 9.08% during 2025–2032. With an increase demand from wire rod mills, brass mills and building & construction sectors due to a heightened focus on recycling & sustainability practices of the country the growth is justified. The United States has retained its place as the regional copper scrap giant, which can in parts be attributed to the sizable U.S. industrial base and recycling infrastructure, coupled with international trends to substitute primary copper production with secondary raw materials.

Europe Copper Scrap Market Insights

In 2024, Europe’s copper scrap market was driven by its sustainability-focused approach and regulatory frameworks such as the European Green Deal. Strict recycling regulations and circular economy policies encourage large-scale copper recovery, this is driven by stringent recycling regulations and circular economy policies which favor extensive copper recovery, and steady application demand in the automotive and construction sectors. Germany, Italy, and France, prominent contributors with advanced recycling technologies, rely on energy-efficient production. Further contributing to growth are investments in, for example, wind, solar, and even electric cars, which are essential to both renewable energy and electrifying the economy. The Europe copper scrap recycling industry is part of its overall industrial ecosystem balancing carbon diminution and resource dependency strategies. Although its policies are strong, the growth momentum itself is limited in comparison with the size of the industrial base and fast-growing copper demand within the Asia-Pacific.

Middle East & Africa Copper Scrap Market Insights

In 2024, the Middle East & Africa witnessed growth in copper scrap demand, fueled by infrastructure development, electrical grid expansion, and industrialization. GCC and South Africa Economies Are Emerging as Major Growth Contributors, However, Partnership in Mining and Slow Recycling Is Taking Place Yet there are still barriers to large-scale progress from the region little existing infrastructure to recycle such waste and high reliance on imports. Given shifting government priorities to divert away from oil and gas, there are also opportunities from investing in copper recycling and manufacture. Demand is seen to be supported by growing power networks, urban building site activity, and new producing bases. The region may still be smaller in terms of market size, but its long-term outlook is growing stronger.

Latin America Copper Scrap Market Insights

In 2024, Latin America experienced moderate progress in copper scrap adoption, supported by gradual advancements in its manufacturing and construction industries. Brazil and Chile are emerging as key enablers, with Brazil focusing on sustainability-driven initiatives in the recycling space while Chile aims to reach higher scrap use thanks to its copper endowments. There has been progress in the expansion of recycling efforts across the region, but limited infrastructure and the inconsistent nature of collection systems plague development on a regional scale. The increasing demand from industrial sectors and the rising concern regarding the environment are gradually changing and enhancing the recovery of copper scrap.

Competitive Landscape for Copper Scrap Market:

Glencore, headquartered in Baar, Switzerland, and founded in 1974, is one of the world’s largest diversified natural resource companies. The company works in metals & minerals, energy products and agricultural commodity, with notable contributions to production, trading and marketing. Glencore operates globally managing supply chains and integrated operations to serve industrial and consumer markets. Those include its copper, cobalt, zinc and nickel operations but it is also involved with oil and coal trading.

In December 2024, Glencore partnered with Canadian recycler Cyclic Materials to supply over 10,000 metric tons of recycled copper. The copper will be processed at Glencore’s Horne Smelter and Copper Refinery in Quebec into copper cathodes for new products. This collaboration supports the growing demand for copper in electric vehicles, renewable energy, and AI data centers while promoting sustainable recycling and resource circularity.

Aurubis AG, founded in 1866 and headquartered in Hamburg, Germany, is a leading global copper producer and recycler. It focuses on the reprocessing (or refining) of copper and other non-ferrous metals for electronic, construction, and automotive industries. Aurubis operates the leading integrated copper production network in Europe and is known for its polypropylene and innovative sustainable high-quality copper products.

In April 2025, Aurubis AG, Europe’s largest copper producer, announced an $800 million investment to build a state-of-the-art copper recycling facility in Richmond, Georgia. Set to begin operations in 2025 after four years of construction, the plant will be North America’s first large-scale copper recycling site, processing 180,000 metric tons of scrap annually to produce 70,000 tons of refined copper.

Copper Scrap Market Key Players:

Some of the Copper Scrap Market Companies

-

Ames Copper Group

-

Aurubis AG

-

CMC

-

Glencore

-

Global Metals & Iron Inc.

-

JAIN RESOURCE RECYCLING PVT LTD.

-

KGHM METRACO S.A.

-

OmniSource, LLC.

-

Pascha GmbH

-

Perniagaan Logam Panchavarnam Sdn Bhd

-

S.I.C. Recycling, Inc.

-

Boliden

-

Sims Limited (Sims Metal)

-

Umicore

-

Schnitzer Steel / Radius Recycling

-

Metalico, Inc.

-

Cyclic Materials

-

Kuusakoski Oy

-

European Metal Recycling (EMR)

-

SA Recycling LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 63.52 Billion |

| Market Size by 2032 | USD 124.88 Billion |

| CAGR | CAGR of 8.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Feed Material (Old Scrap, New Scrap) • By Grade (Bare Bright, #1 Copper Scrap, #2 Copper Scrap, Other Grades) • By Application (Wire Rod Mills, Brass Mills, Ingot Makers, Other Applications) • By End-use (Building & Construction, Electrical & Electronics, Industrial Machinery & Equipment, Transport Equipment, Consumer & General Products) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Ames Copper Group, Aurubis AG, CMC, Glencore, Global Metals & Iron Inc., JAIN RESOURCE RECYCLING PVT LTD., KGHM METRACO S.A., OmniSource, LLC., Pascha GmbH, Perniagaan Logam Panchavarnam Sdn Bhd, S.I.C. Recycling, Inc., Boliden, Sims Limited (Sims Metal), Umicore, Schnitzer Steel / Radius Recycling, Metalico, Inc., Cyclic Materials, Kuusakoski Oy, European Metal Recycling (EMR), SA Recycling LLC. |