Geocomposites Market Report Scope & Overview

Get E-PDF Sample Report on Geocomposites Market - Request Sample Report

The Geocomposites Market Size was valued at USD 445.3 million in 2023, and is expected to reach USD 776.0 million by 2032, and grow at a CAGR of 6.4% over the forecast period 2024-2032.

The geocomposites market is driven by an assortment of civil engineering applications, such as construction and environmental projects. Geocomposites are based on the combination of geosynthetic materials such as geomembranes, geonets, and geotextiles that serve mainly in drainage, reinforcement, and containment. This family of products has created growing demand in infrastructure projects involving effective water management systems, erosion control, and soil stabilization. These materials add strength and durability to projects, hence finding their application in small and large-scale construction activities. Industries have recently focused on sustainability, and due to these reasons, geocomposites draw much attention since these improve environmental performance by reducing the use of material and performance in landfills, road construction, and management of water systems. Major companies have continued to develop new geocomposites that are innovative and meet industry needs.

Companies have introduced advanced features with the launch of new, advanced geocomposite products, indicating that the nature of the market is evolving. For example, in August 2023, Afitexinov unveiled a new logo for Draintube Geocomposite- a rebranding step to showcase alignment with sustainability and efficiency goals concerning water drainage applications. Similarly, Griltex introduced the GXP 3 GRID-an advanced underlay for internal waterproofing systems in May 2023. This product illustrates the two major trends of geocomposites: geocomposites are increasingly adopted in more specialized niches of construction applications, and internal water management and structural protection in buildings are the areas where geocomposites show an increasing presence. These developments point to the growing emphasis on improved functionality of the product and deeper market penetration in various applications, further consolidating the position of geocomposites in construction and civil engineering applications.

Novel applications for drainage applications also characterize the increasing usage of geocomposites in building construction. Companies, in October 2023, addressed how drainage geocomposites have been used to prevent the accumulation of water in building projects that could lead to loss of structural stability. Such geocomposites present a sure way of reducing risk related to water intrusion and offer long-term protection in commercial and residential buildings. The demand for such solutions is, therefore, high since several geosynthetic functions may be integrated, such as filtration and drainage combined with barrier protection, into one system. The trend indicates a higher reliance on geocomposites to solve the most complicated construction challenges safely and securely.

Furthermore, other developments in the geocomposites market pertain to the solutions that have been developed to solve particular problems associated with construction, such as the mud pumping problem in rail track construction. In December 2023, further developments were made with the development of a geocomposite to prevent the mud-pumping phenomenon when water and fines begin to weaken the in-situ stability of a rail track. This development represents the continuing drive to develop bespoke geocomposites serving the needs of specific industries and applications, particularly in transportation infrastructure. It further illustrates the developing nature of geocomposites beyond general use in construction towards focused applications in niche segments, hence expanding the materials' market relevance.

In addition, the month of February 2024 saw a tri-planar geocomposites study on ply adhesion values showing the premium performance these products achieved in drain applications. Companies like Geofabrics have advanced their production processes to meet the rise in demand for the class of high-quality geocomposites accordingly. Geofabrics, in August 2023, upgraded its capacity to support the manufacturing of high-performance geocomposites for critical infrastructure projects. These advancements not only mark the technological changes within the market but also the rise in investment toward the production of durable and efficient geocomposite materials capable of serving a variety of industrial applications. As geocomposites continue to be developed for increasingly specialized functions, the place of geocomposites will continue to be cemented within modern infrastructure projects because of their improved performance and sustainability features.

Market Dynamics:

Drivers:

-

Rising demand for geocomposites in infrastructure projects, particularly in drainage and erosion control, boosts market growth.

The versatility and efficiency of geocomposites in solving some of the most common engineering problems increase demand significantly in infrastructure projects involving drainage and erosion control, thus giving a boost to the market. This deals with combining various geosynthetic materials such as geotextiles, geomembranes, and geonets for better solutions regarding water flow and soil stability. In various urban development projects, geocomposites are increasingly put to work to create an effective drainage system to prevent water accumulation and subsequently flooding. In road construction, they are used to reinforce subgrade with reduced erosion by surface runoff. Outstanding examples concern their use in highway construction where they serve as a filter barrier for draining excess water and preserving the structural integrity of the roadbed, decreasing maintenance costs. Applications in coastal engineering include those geocomposites used in seawalls and embankments to prevent erosion by shielding shoreline infrastructure from the ravages of wave action. Applications such as these demonstrate an increasing reliance on geocomposites for sustainable infrastructure solutions, contribution to durability, and performance improvement in vital projects with minimum environmental impacts. Faced with accelerating urbanization and thus the increased demand for infrastructure, the integration of geocomposites in drainage and erosion control systems has gained considerable momentum over recent years, driving substantial growth in the market.

-

Increasing environmental concerns drive the adoption of sustainable construction materials, with geocomposites offering improved soil stabilization and water management.

Environmental concerns are increasingly being considered, thereby driving the adoption of sustainable construction materials; among them, geocomposites will continue to make amends in leading to better soil stabilization and water management. The pressures being put on the construction industry to minimize its impact on the environment have made geocomposites a very strong advantage because they integrate various geosynthetic materials into efficient and eco-friendly systems. For example, in some land reclamation projects, geocomposites ensure soil stability and erosion avoidance to effectively rehabilitate disturbed lands and preserve natural habitats. Water management could be used in the design of a stormwater management system, enabling runoff control and avoidance of flooding to prevent the contamination of water bodies and reduce the need for heavy resource-intensive infrastructure. Besides, geocomposites can provide infiltration and storage for water to feed urban ecosystems and alleviate the heat island effect in the case of green roofs and permeable pavements. These are also two directions that will be pursued in the application of this material to meet global trends in sustainability because of the reduction of using traditional materials that are less friendly to the environment and enhanced environmental protection practices. It offers an increasingly sustainable construction practice that tackles key issues, such as soil erosion, water runoff, and habitat disruption. This, in turn, reflects a commitment by the engaged industry to ecological footprint reduction and fosters environmental stewardship.

Restraint:

-

High initial costs associated with geocomposites can deter adoption, particularly in cost-sensitive projects.

High initial costs can be one of the major deterring factors against the use of geocomposites, especially in projects with a budget constraint where cost is a big issue. Geocomposites comprise various materials into one geosynthetic material that usually requires a higher level of initial investment compared to conventional materials due to advanced manufacturing processes and special performance characteristics. Decision-makers, for instance, might favor cheaper options for small-size construction or regions with limited infrastructure development budgets, when the material costs for geocomposites are higher, though they may yield better performance in the long term and require less maintenance. This financial barrier offsets general adoption, especially in developing areas or public projects that have tight budgets in which immediate cost considerations are strong, versus potential benefits derived from enhanced performance and reduced lifecycle costs.

Opportunity:

-

Growing investments in smart city infrastructure and green construction present vast opportunities for geocomposites in enhancing sustainable building solutions.

Increase in the investment of smart city infrastructure and green construction creates a very potential opportunity for the same to play a vital role in the development of sustainable building solutions. As growing cities move towards smarter and greener designs, there is an ever-increasing demand for innovative materials that will contribute to such sustainability. Geocomposites would be well placed in providing such contributions due to their ability to enhance soil stability, be water-effective, and reduce environmental impact. In such cases, geocomposites may help in devising rainwater harvesting and filtration systems efficiently in smart urban drainage systems, possibly coupled with smart technology for real-time monitoring and management. Geocomposites have a role in green roofs and permeable pavements in green building projects to accommodate infiltration and decrease runoff, all in tune with the principle of sustainable urban growth. These applications represent the potential of geocomposites to help the growing trend of integrating environmental responsibility with state-of-the-art infrastructure and having enormous benefits in smart city and green construction initiatives.

Challenge:

-

Limited awareness of advanced geocomposite applications in certain regions can hinder widespread adoption and market penetration.

The limited awareness of the advanced application of geocomposites in some regions severely influences the wide dissemination and market penetration that these products face. In regions where very little is known about geocomposites, stakeholders may not realize the advantages and modern uses these materials serve, and they would prefer traditional solutions. For instance, a lack of awareness of advanced technologies in geocomposites would lead to the forfeiting of opportunities for better and more viable alternatives in countries with emerging markets or less developed infrastructure. This, in turn, can make people unaware, and further retard the deployment of geocomposites into such critical sectors as erosion, drainage systems, and soil stabilization projects. This will eventually result in slower growth not only in the market but also in those benefits such materials can offer as an aid in improving basic infrastructure and environmental management.

KEY MARKET SEGMENTS

By Product

The Geotextile-Geogrid segment dominated the geocomposites market in 2023, holding an estimated share of about 35%. The increased rates of application within soil reinforcement and stabilization applications, especially within the construction of roads and retaining walls, for which this geotextile-geogrid composite is generally used, count for this. These provide a combination of strengths of geotextiles and geogrids to further enhance load distribution and structural integrity. For example, in the construction of highways, geotextile-geogrid composites are used to enhance the stability of the subgrade to elongate the service life of the pavement. Hence, its effectiveness in mitigating soil deformation and sustaining heavy loads places them among favorites in different infrastructure projects driving sizeable shares in the market.

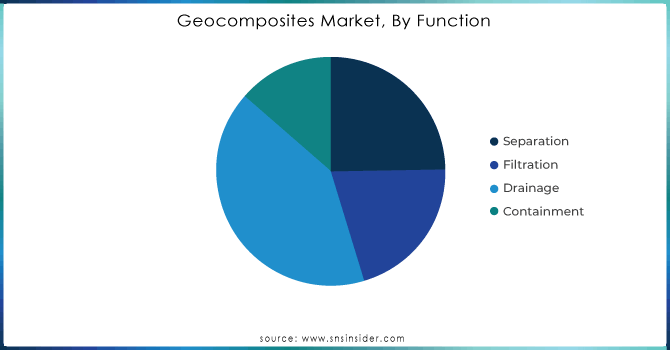

By Function

The Drainage segment dominated the geocomposites market in 2023 and held an approximate market share of 40%. This leading position is due to the highly important function played by the drainage geocomposites in managing water flow and preventing potential issues concerning water accumulation that are extremely crucial for infrastructure stability and longevity. For instance, drainage geocomposites in road and landfill constructions are made to divert the water effectively and manage it so that erosion may be prevented and the construction remains intact. The dominance in market share is brought about by the efficient handling of large volumes of water and the effectiveness in reducing water-related damages in various applications.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

Water & wastewater management dominated the geocomposites market segment, with an estimated share of about 45% in 2023. This leading position of the segment may be credited mainly to the crucial demand for an effective water and wastewater management system, wherein geocomposites are used extensively to provide greater effectiveness in drainage, filtration, and containment. Examples are municipal water treatment plants, which employ geocomposites and ineffective filtration systems handling flow and treating wastewater. Stormwater management systems also make use of them to control runoff and limit the contamination of water bodies. Because of their effectiveness in these applications and due to the growing demand for sustainable and efficient water management solutions, they drive a significant share of the market.

By End-use Vertical

The Construction and Infrastructure segment dominated the geocomposites market, with an estimated share of about 38% in 2023. The segment dominance is driven by the fact that geocomposites have wide uses in different construction and infrastructure applications, including roadways, embankments, and retaining walls, among others, to satisfy certain critical benefits, which also include soil stabilization and erosion control. For example, in highway construction, geocomposites reinforce the subgrade for better distribution of load to improve durability, thus increasing road life. In other infrastructural works, such as bridges and tunnels, they serve an important role in efficient drainage and supporting the soil. Their wide application in these critical areas underpins their leading position in the market.

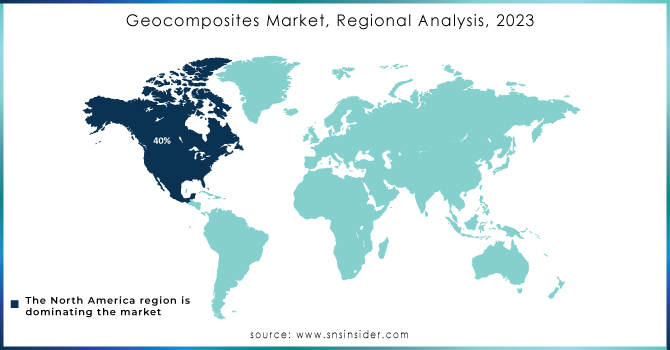

Regional Analysis

In 2023, North America dominated the geocomposites market, with a market share estimated at approximately 40%. This can be attributed to the large infrastructural projects in the region, the huge growth witnessed in its construction sector, and stringent environmental laws. For instance, in North America, there are substantial applications in various construction projects related to roadways, landfills, and different water management systems. Most of the major infrastructure projects, such as the expansion of highways and the development of cities, require these geocomposites to solve complicated engineering problems and meet high levels of environmental requirements. This high demand from diverse large-scale infrastructure projects in North America secures the leading market position of the region.

Key Players

-

ABG Limited (Drainage Geocomposites, Geosynthetic Clay Liners)

-

Atarfil (Geocomposite Drainage Systems, Geosynthetic Clay Liners)

-

BASF (Geocomposite Drainage Systems, Geotextiles)

-

BOSTD Geosynthetics (Geocomposite Drainage, Geotextile Composites)

-

Freudenberg Performance Materials (Geocomposite Drainage Mats, Geotextile Composites)

-

Geomembranes & Geotextiles (Geomembranes, Geotextile Composites)

-

Geosynthetics (Geocomposite Drainage Systems, Geotextile Composites)

-

GSE Environmental (Geocomposite Drainage Systems, Geomembranes)

-

HUESKER (Geocomposite Drainage, Erosion Control Mats)

-

L & M Construction Chemicals (Geocomposite Systems, Geotextile Composites)

-

Leggett & Platt Inc. (Geotextile Composites, Geocomposite Drainage Systems)

-

Propex Global (Geocomposite Drainage, Geotextile Composites)

-

SKAPS Industries (Geocomposite Drainage, Geotextile Composites)

-

Solmax (Geocomposite Drainage Systems, Geotextile Composites)

-

TenCate Geosynthetics (Geocomposite Drainage Systems, Geotextile Composites)

-

Tensar International Corporation (Geocomposite Drainage, Geotextile Composites)

-

TerraFirma (Geocomposite Drainage Systems, Geotextile Composites)

-

Terram Geosynthetics Private Limited (Geocomposite Drainage, Geotextile Composites)

-

Texel Technical Materials (Geocomposite Drainage Systems, Geotextile Composites)

-

Thrace Group (Geocomposite Liners, Geotextile Composites), and other players.

Recent Developments

-

June 2023: GSE Environmental introduced GSE RoaDrain, a man-made drainage layer for roads, featuring high compressive strength and hydraulic conductivity values.

-

April 2023: HUESKER came up with the SoilTain Protect System, a geocomposite comprising a woven filter fabric coupled with a nonwoven cushion layer that acts in contact with geomembranes, protecting them from punctures and abrasions.

-

January 2023: Genap entered into an exclusive partnership with major geosynthetics manufacturer Watershed Geo for the distribution and installation of ClosureTurf, the synthetic end-capping system for landfills.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 445.3 Million |

| Market Size by 2032 | US$ 776.0 Million |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Geotextile-Geonet, Geotextile-Geocore, Geotextile-Geogrid, Geotextile-Geomembrane, Geotextile/Polymer-core- Core Composites, Geocomposite Clay Liners, Others) •By Function (Separation, Filtration, Drainage, Containment) •By Application (Water & wastewater management, Road & highway, Landfill & mining, Soil reinforcement for civil construction, Others) •By End-use Vertical (Construction and Infrastructure, Civil Engineering, Environmental Engineering, Agriculture, Mining, Transportation, Government and Public Sector, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABG Limited, Atarfil, BASF, BOSTD Geosynthetics, Freudenberg Performance Materials, Geomembranes & Geotextiles, Geosynthetics, GSE Environmental, HUESKER, L & M Construction Chemicals, Leggett & Platt Inc., Propex Global, SKAPS Industries, Solmax, TenCate Geosynthetics, Tensar International Corporation, TerraFirma, Terram Geosynthetics Private Limited, Texel Technical Materials, Thrace Group and other players |

| Key Drivers | • Rising demand for geocomposites in infrastructure projects, particularly in drainage and erosion control, boosts market growth • Increasing environmental concerns drive the adoption of sustainable construction materials, with geocomposites offering improved soil stabilization and water management |

| RESTRAINTS | • High initial costs associated with geocomposites can deter adoption, particularly in cost-sensitive projects |