Security Inks Market Report Scope & Overview:

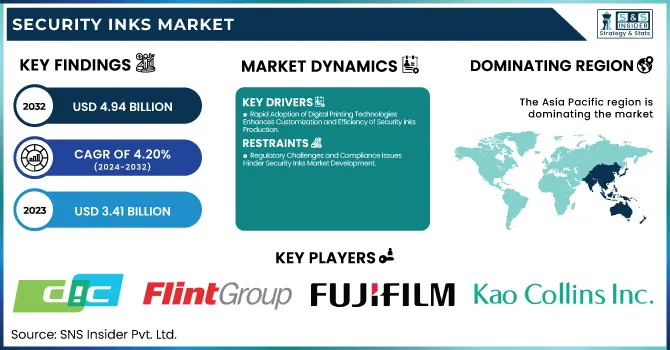

The Security Inks Market Size was valued at USD 3.41 Billion in 2023 and is expected to reach USD 4.94 Billion by 2032, growing at a CAGR of 4.20% over the forecast period of 2024-2032.

To Get more information on Security Inks Market - Request Free Sample Report

The Security Inks market is evolving with advancements in manufacturing techniques that enhance ink quality and security, crucial for meeting stringent industry standards. Our report explores how these innovations are shaping the market. Counterfeiting poses significant risks to sectors like pharmaceuticals, electronics, and luxury goods, and our analysis reveals how security inks are critical in mitigating these threats. With digitalization transforming the industry, digital printing technologies enable more customized and sophisticated security features. Additionally, our report highlights the growing importance of security inks in preventing tampering and ensuring product integrity, offering a protective layer against fraud. These insights provide a comprehensive understanding of the key trends and challenges driving the Security Inks market.

The US Security Inks Market Size was valued at USD 0.52 Billion in 2023 and is expected to reach USD 0.76 Billion by 2032, growing at a CAGR of 4.27% over the forecast period of 2024-2032.

The U.S. Security Inks market is expanding due to increasing concerns over counterfeiting and fraud across various sectors, including currency, identity documents, and packaging. The demand for advanced security features like holographic and color-shifting inks is growing, driven by heightened efforts to protect high-value goods and ensure the authenticity of government-issued documents. U.S. companies, such as SICPA and Sun Chemical, are investing in innovative ink technologies to stay ahead in the market. Furthermore, organizations like the U.S. Department of Homeland Security and the Federal Reserve are pushing for stricter security measures, further fueling market growth.

Security Inks Market Dynamics

Drivers

-

Rapid Adoption of Digital Printing Technologies Enhances Customization and Efficiency of Security Inks Production

The Security Inks market is benefiting from the rapid adoption of digital printing technologies, which are revolutionizing the way inks are produced and applied. Digital printing allows for greater customization and flexibility in creating security features that can be tailored to specific customer needs and requirements. This shift enables manufacturers to produce smaller runs of security inks with unique designs and features without incurring the high costs associated with traditional printing methods. For instance, companies like Fujifilm are leveraging digital inkjet technology to produce high-quality security inks that can incorporate variable data, allowing for on-demand printing of unique codes or patterns. This capability not only enhances security but also improves the overall efficiency of the production process, reducing waste and downtime. As more companies recognize the advantages of digital printing, the demand for versatile security inks that can be easily integrated into various printing systems will continue to grow, driving further innovation and market development.

Restraints

-

Regulatory Challenges and Compliance Issues Hinder Security Inks Market Development

Regulatory challenges and compliance issues present significant restraints to the Security Inks market, as manufacturers must navigate a complex landscape of rules and guidelines that vary by region and application. Different countries have distinct regulations regarding the use of security inks in applications such as currency, identification documents, and packaging, which can complicate the production and distribution processes. For example, compliance with stringent government standards for banknote printing can require extensive testing and certification of security inks, leading to delays and increased costs. Additionally, as regulations evolve to address new counterfeiting methods, manufacturers must continuously adapt their products to meet changing compliance requirements. This need for agility can strain resources and divert attention from innovation and market expansion. Consequently, companies operating in the Security Inks market must invest significantly in regulatory compliance, which can hinder their overall growth and profitability.

Opportunities

-

Emerging Technologies in Security Inks Development Present Opportunities for Innovation and Differentiation

Emerging technologies in the development of security inks present significant opportunities for innovation and differentiation within the market. Advances in materials science, such as the use of nanomaterials and smart inks, are enabling manufacturers to create more sophisticated and effective security features. For instance, inks that change color based on environmental conditions or that can be detected using specialized devices are gaining traction as innovative solutions for anti-counterfeiting measures. Additionally, the integration of digital technologies, such as blockchain and artificial intelligence, into security ink applications offers new avenues for enhanced verification and authentication processes. Companies that embrace these emerging technologies can position themselves as leaders in the market, providing unique products that address the evolving needs of consumers and businesses. As the demand for advanced security solutions continues to grow, the ability to innovate and differentiate through technology will be crucial for success in the Security Inks market.

Challenge

-

Keeping Up with Rapid Technological Advancements in Security Inks Market Poses Challenges for Manufacturers

The rapid pace of technological advancements in the Security Inks market presents challenges for manufacturers striving to keep up with evolving consumer demands and industry standards. As new printing technologies and materials emerge, companies must continually invest in research and development to remain competitive. This need for constant innovation can strain resources, particularly for smaller players in the market that may lack the capital to invest heavily in new technologies. Additionally, the challenge of integrating new advancements into existing production processes can lead to disruptions and inefficiencies. As manufacturers seek to enhance their product offerings and maintain relevance in a fast-changing landscape, the pressure to adapt quickly and effectively to technological shifts will continue to be a significant challenge.

Security Inks Market Segmental Analysis

By Type

In 2023, the Invisible segment dominated the Security Inks market with a market share of 35.4%. Invisible inks are considered one of the most effective tools in combating counterfeiting due to their unique feature of being invisible to the naked eye, yet detectable under specific conditions such as UV light. This characteristic makes them ideal for high-security applications, such as currency, passports, and branded products. In the U.S., the Department of Homeland Security (DHS) and other governmental agencies advocate for the use of invisible inks to enhance the security of official documents and prevent fraudulent activities. For instance, many countries, including the U.S., have integrated invisible inks into banknotes as part of their anti-counterfeit strategies. Additionally, as the complexity of counterfeiting techniques increases, the demand for invisible inks has grown across industries. Security printers and manufacturers continue to invest in this technology, as it provides an effective deterrent to counterfeiters, making the Invisible segment a dominant force in the Security Inks market in 2023.

By Printing Method

In 2023, the Intaglio printing method dominated the Security Inks market with a market share of 39.5%. This method is widely preferred for producing high-quality prints with intricate details that are difficult to replicate. Intaglio printing involves engraving the image or text onto a surface and applying ink, which is then transferred to paper under high pressure, resulting in raised print and fine details. This method is widely used in the production of banknotes, passports, and official government documents due to its ability to incorporate complex security features like microprinting, watermarks, and holograms. The U.S. Federal Reserve, for example, uses intaglio printing to ensure the security of U.S. dollar bills, as it allows for the inclusion of covert security features that are visible only under specific conditions. As counterfeiters continue to evolve their techniques, the need for secure and hard-to-duplicate printing methods has grown, ensuring that intaglio remains the preferred choice in high-security printing applications, reinforcing its dominance in the Security Inks market.

By Application

In 2023, the Security Labels segment dominated the Security Inks market with a market share of 36.2%. Security labels have become an essential component in preventing product counterfeiting and ensuring consumer trust. These labels are used across various industries, including pharmaceuticals, electronics, automotive, and consumer goods. Their primary function is to provide authentication and traceability, ensuring that the products consumers purchase are genuine. In particular, the rise in counterfeit goods, especially in the pharmaceutical sector, has heightened the demand for secure labels that feature advanced technologies such as holograms, color-shifting inks, and QR codes for easy verification. The National Association of Manufacturers in the U.S. has stressed the need for secure labels to protect against counterfeit products that could harm both consumers and brand integrity. Moreover, as global trade expands and more products enter international markets, the need for transparent and secure labeling has surged, which has directly contributed to the growth of the Security Labels segment in the Security Inks market, making it the dominant application in 2023.

Security Inks Market Regional Outlook

In 2023, the Asia Pacific region dominated the Security Inks market with a market share of 40.4%. This dominance can be attributed to several factors, including the rapid economic growth in countries like China and India, where there is a rising demand for secure printing solutions across various industries. For instance, the increasing adoption of anti-counterfeiting measures in the pharmaceutical and consumer goods sectors is propelling the demand for advanced security inks. Additionally, governments in the region are implementing stricter regulations to combat counterfeiting, driving the need for high-security inks in documents and currency. China, as the largest market in the region, has made significant investments in advanced printing technologies, ensuring that its currency and official documents are equipped with the latest security features. India's expanding manufacturing sector, particularly in pharmaceuticals and textiles, is also contributing to the growth of security inks. The overall rise in e-commerce and brand protection efforts across Asia Pacific further solidifies its position as the dominant region in the Security Inks market in 2023.

The North America region emerged as the fastest-growing region in the Security Inks market during the forecast period, with a significant growth rate. This growth can be attributed to increasing government initiatives aimed at enhancing security features in identification documents and currency to combat rising fraud and counterfeiting. The United States is at the forefront of this movement, with the U.S. Department of Homeland Security pushing for more secure printing technologies across various applications, including passports and driver's licenses. Additionally, the presence of key players such as SICPA and Sun Chemical in the U.S. contributes to the region's innovative approach to security inks, driving advancements in product development. Canada is also seeing a surge in demand for secure labeling solutions, particularly in the pharmaceutical and cannabis industries, as regulations tighten around product authenticity. The growing emphasis on brand protection in the retail sector further accelerates the demand for security inks, positioning North America as a rapidly expanding market with significant growth potential in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Chromatic Technologies Inc. (Color-Shift Inks, UV Inks)

-

DIC CORPORATION (SUN CHEMICAL) (SunInnova Inks, SunCure Security Inks)

-

Flint Group (Security Inks for Packaging, UV Offset Inks)

-

FUJIFILM HOLDINGS AMERICA CORPORATION (Security Inks for Documents, UV Security Inks)

-

Gleitsmann Security Inks GmbH (Anti-Counterfeit Inks, UV Security Inks)

-

Ink Tec Inc. (InkTec Security Inks, UV Ink for Documents)

-

Kao Collins Corporation (Kao Collins Security Inks, Functional Inks for Packaging)

-

SICPA HOLDING SA (SICPA Security Inks, UV-Visible Inks)

-

Siegwerk Druckfarben AG & Co. KGaA (Siegwerk Security Inks, UV Inks for Banknotes)

-

Toyo Ink SC Holdings Co. Ltd. (Toyo Security Inks, UV Color-Shifting Inks)

-

Chroma Inks (UV Inks, Anti-Counterfeiting Inks)

-

Chroma Inks USA (Color-Shift Security Inks, UV-Visible Inks)

-

Gans Ink & Supply (Gans UV Inks, Anti-Counterfeit Printing Inks)

-

Guangzhou Mingbo Anti-Forgery Technology Co. Ltd (Invisible Security Inks, UV-Visible Inks)

-

Kao Chimigraf Si. (Security Inks for Packaging, UV Inks)

-

Marabu GmbH & Co. KG (Marabu UV Security Inks, Color-Shift Inks)

-

Naigai Ink Mfg. Co. Ltd (Naigai Security Inks, UV-Visible Inks)

-

Petrel (UV Security Inks, Anti-Counterfeit Inks)

-

Shriram Veritech Solutions Pvt. Ltd. (Anti-Counterfeit Security Inks, Security Printing Inks)

-

T&K Toka Corporation (T&K Security Inks, UV Inks for Documents)

Recent Developments

-

March 2025: Indian researchers developed a new ink that integrates dual security features to combat counterfeiting, offering enhanced detection capabilities for both visible and hidden markers, strengthening security across industries.

-

May 2024: Menlo Security formed a partnership with Google Cloud in May 2024 to improve cybersecurity with advanced isolation technology, providing stronger protection for businesses against digital threats, especially in cloud environments.

-

July 2023: IN Groupe acquired Gleitsmann Security Inks to bolster its security printing capabilities, enhancing its ability to meet growing demand for anti-counterfeiting solutions in banknotes and identity documents.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.41 Billion |

| Market Size by 2032 | USD 4.94 Billion |

| CAGR | CAGR of 4.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Invisible, Biometric, Fluorescent, Thermochromic, Magnetic, Others) •By Printing Method (Offset, Intaglio, Flexographic, Silk Screen, Letterpress, Others) •By Application (Banknotes, Tax Banderoles, Security Labels, Official Identity Documents, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SICPA HOLDING SA, DIC CORPORATION (SUN CHEMICAL), Kao Collins Corporation, Flint Group, FUJIFILM HOLDINGS AMERICA CORPORATION, Gleitsmann Security Inks GmbH, Chromatic Technologies Inc., Ink Tec Inc., Siegwerk Druckfarben AG & Co. KGaA, Toyo Ink Sc Holdings Co. Ltd. and other key players |