Corn Flour Market Report Scope & Overview:

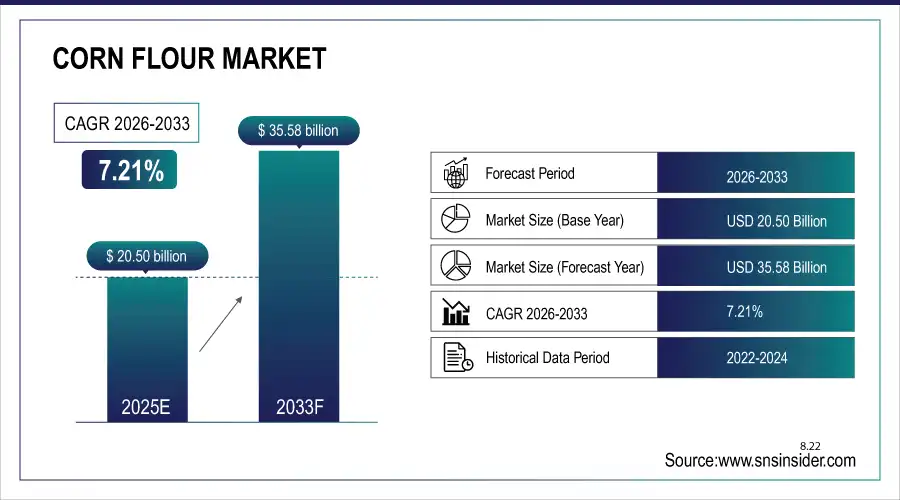

The Corn Flour Market size was valued at USD 20.50 Billion in 2025E and is projected to reach USD 35.58 Billion by 2033, growing at a CAGR of 7.21% during 2026-2033.

The global market includes comprehensive insights into market dynamics, trends, segmental performance, regional analysis, competitive landscape, and key strategic initiatives by leading players. Rising demand for processed and convenience foods, growing health awareness, and innovations in corn-based food ingredients are driving market expansion worldwide. These factors are creating significant growth opportunities across various regions and applications, boosting adoption in bakery, snacks, and industrial food products, and strengthening overall market potential.

Over 55% of households globally consume corn flour at least once a week in various recipes.

Market Size and Forecast:

-

Market Size in 2025: USD 20.50 Billion

-

Market Size by 2033: USD 35.58 Billion

-

CAGR: 7.21% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Corn Flour Market - Request Free Sample Report

Corn Flour Market Trends

-

Consumers are increasingly choosing gluten-free and nutritious food options, driving higher corn flour demand.

-

Corn flour’s natural gluten-free property, high fiber content, and easy digestibility make it appealing to health-focused consumers.

-

Awareness of diabetes and obesity has increased corn flour use in bakery, snacks, and convenience foods.

-

Manufacturers are developing fortified and innovative corn flour products to meet diverse dietary needs.

-

Milling, extrusion, and fortification techniques improve corn flour quality, functionality, and shelf-life.

-

Adoption of automation and precision technologies reduces production costs, ensures consistency, and enables expansion into new applications.

U.S. Corn Flour Market Insights

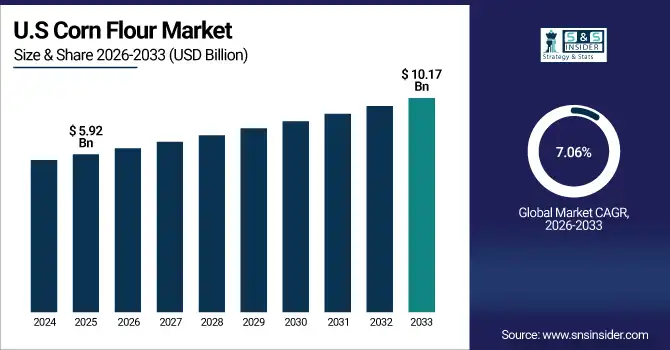

The U.S. Corn Flour Market size was valued at USD 5.92 Billion in 2025E and is projected to reach USD 10.17 Billion by 2033, growing at a CAGR of 7.06% during 2026-2033. The U.S. market growth is driven by rising consumer preference for gluten-free and healthier food alternatives, along with increasing consumption of bakery and snack products. Strong adoption of corn flour in processed foods further supports expansion. Additionally, growing e-commerce and supermarket penetration across the country is enhancing product accessibility, making it easier for consumers to purchase corn flour. These factors collectively fuel demand, strengthen market presence, and drive sustained growth in the U.S. market.

Corn Flour Market Growth Drivers:

-

Rising Consumer Preference for Gluten-Free and Healthier Food Products Enhances Market Growth Globally

Consumers are increasingly shifting toward gluten-free and health-conscious diets, significantly boosting demand for corn flour. Corn flour is widely recognized for its nutritional benefits, including being naturally gluten-free, rich in fiber, and easily digestible, which appeals to health-conscious consumers. Rising awareness about diabetes and obesity has led to higher adoption of corn flour in bakery, snacks, and convenience foods. Manufacturers are focusing on innovative products and fortified options to meet dietary needs, resulting in increasing market penetration and sustained growth across both retail and industrial applications globally.

Over 50% of consumers globally regularly use corn flour in their daily cooking and baking for health and dietary benefits.

Corn Flour Market Restraints:

-

Fluctuations in Raw Material Prices Could Limit Corn Flour Market Growth Globally

Volatility in corn prices due to climate change, supply chain disruptions, or geopolitical factors can increase production costs for corn flour manufacturers. Higher raw material costs may reduce profitability and force companies to adjust pricing, potentially affecting demand. Small-scale manufacturers are particularly vulnerable to cost fluctuations, which can lead to decreased market competitiveness. Price-sensitive consumers may switch to substitutes like wheat or rice flour. These economic and supply chain challenges can restrain growth despite increasing consumer demand for processed and gluten-free products in various regions.

Corn Flour Market Opportunities:

-

Technological Advancements in Processing and Product Development Enhance Market Potential Globally

Innovations in milling, extrusion, and fortification processes are improving corn flour quality, functionality, and shelf-life. Advanced processing techniques allow manufacturers to produce modified starches, pre-cooked flours, and value-added variants, meeting evolving consumer needs. Adoption of automation and precision technology also reduces production costs and ensures consistency. These advancements open new application areas in bakery, snacks, and industrial food products, while increasing global competitiveness. Companies leveraging technological innovations can capitalize on growing demand, expand product portfolios, and strengthen their market presence, enhancing overall growth potential.

Over 30% of consumers globally regularly use corn flour in bakery, snacks, and convenience foods for health and dietary benefits.

Corn Flour Market Segmentation Analysis

-

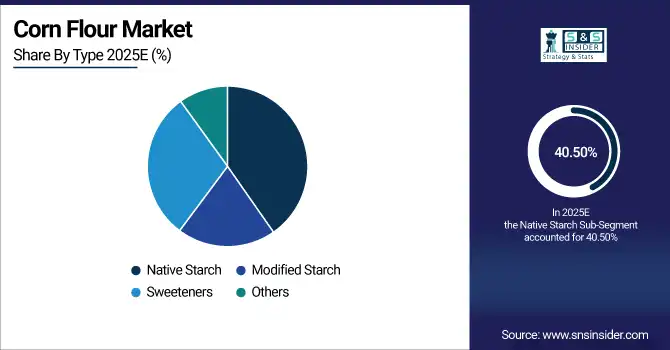

By Type, Native Starch led the Corn Flour Market with a 40.50% share in 2025E, whereas Modified Starch is the fastest-growing segment with a CAGR of 8.37%.

-

By Application, the Bakery & Confectionery sector dominated the market with 35.20% share in 2025E, whereas the Snacks & Convenience Foods segment is expected to grow fastest with a CAGR of 8.50%.

-

By Distribution Channel, Supermarkets/Hypermarkets led the market with 45.10% share in 2025E whereas Online Retail is registering the fastest growth with a CAGR of 9.20%.

-

By End-User, Food and Beverage Industry held 50.20% share in 2025E, whereas Food Service and Restaurants sector is growing the fastest with a CAGR of 8.40%.

By Type, Native Starch Leads Market While Modified Starch Registers Fastest Growth

Native Starch segment dominated the Corn Flour Market with the highest revenue share in 2025E due to its natural composition, versatility in food applications, and consumer preference for minimally processed ingredients. It is widely used in bakery, snacks, and thickening applications, offering consistent texture and taste. Additionally, its cost-effectiveness and widespread availability support higher adoption among manufacturers and households. Ingredion Incorporated is a leading player providing high-quality native starch products that cater to diverse food applications. Modified Starch segment is expected to grow at the fastest CAGR during 2026-2033 due to its functional properties, including improved stability, viscosity control, and suitability for industrial applications, driving rapid demand in processed foods.

By Application, Bakery & Confectionery Dominate While Snacks & Convenience Foods Shows Rapid Growth

Bakery & Confectionery segment dominated the Corn Flour Market with the highest revenue share in 2025E as corn flour enhances texture, shelf-life, and moisture retention in cakes, cookies, and pastries. Its gluten-free properties appeal to health-conscious consumers and specialty bakers. Archer Daniels Midland Company (ADM) is a key supplier of corn flour for bakery applications, providing innovative solutions for texture and consistency. Snacks & Convenience Foods segment is expected to grow at the fastest CAGR during 2026-2033 due to rising consumption of packaged snacks, ready-to-eat meals, and instant foods, where corn flour is a key ingredient for binding, thickening, and providing a smooth texture, boosting adoption in the fast-growing processed food sector.

By Distribution Channel, Supermarkets/Hypermarkets Lead While Online Retail Registers Fastest Growth

Supermarkets/Hypermarkets segment dominated the Corn Flour Market with the highest revenue share in 2025E due to wide product availability, bulk discounts, and convenience for consumers. Supermarkets provide strong brand visibility and marketing support, enhancing consumer trust and repeat purchases. Tate & Lyle PLC supplies corn flour to multiple retail chains, strengthening its presence in supermarket channels. Online Retail segment is expected to grow at the fastest CAGR during 2026-2033, driven by increasing e-commerce adoption, convenient home delivery, and a wider variety of product options. The growth of online platforms allows manufacturers to reach untapped markets and engage directly with consumers, accelerating overall sales growth.

By End-User, Food and Beverage Industry Sector Leads While Food Service and Restaurants Sector Grows Fastest

Food and Beverage Industry segment dominated the Corn Flour Market with the highest revenue share in 2025E as it extensively uses corn flour in bakery, snacks, sauces, and industrial food products. Its functional properties and cost-effectiveness make it a preferred ingredient for large-scale food manufacturers. Roquette Frères is a major supplier catering to industrial food applications with high-quality corn flour. Food Service and Restaurants segment is expected to grow at the fastest CAGR during 2026-2033 due to increasing demand for prepared meals, fast food, and ethnic cuisine, where corn flour is used for thickening, coating, and improving texture, driving adoption in the expanding hospitality and foodservice sector.

Corn Flour Market Regional Analysis:

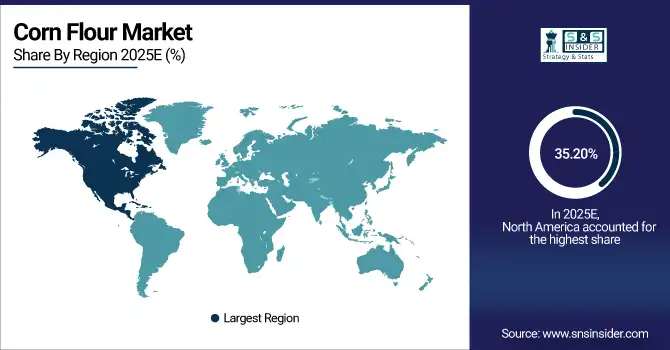

North America Corn Flour Market Insights

North America dominated the Corn Flour Market with the highest revenue share of around 35.20% in 2025E, driven by high consumption of bakery products, snacks, and processed foods. Strong retail infrastructure, widespread supermarket chains, and growing consumer health awareness have further boosted corn flour adoption, making the region a key hub for both industrial and household usage across diverse food applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Corn Flour Market Insights

The U.S. dominates the North America corn flour market due to high consumption of bakery, snacks, and processed foods, widespread supermarket and retail networks, growing health-conscious consumer base, and strong adoption of gluten-free and convenience food products.

Asia-Pacific Corn Flour Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 8.50% from 2026-2033 due to rapid urbanization, rising disposable income, and expansion of the processed food industry. Increasing demand for convenience foods, gluten-free products, and growing consumer awareness of corn flour benefits are fueling market adoption, creating significant opportunities for manufacturers across key APAC countries, especially in bakery and snack applications.

China Corn Flour Market Insights

China leads the Asia Pacific corn flour market due to rapid urbanization, rising disposable income, expanding processed and convenience food industry, increasing bakery and snack consumption, and growing awareness of corn flour’s health benefits, driving widespread adoption across households and industrial food applications.

Europe Corn Flour Market Insights

Europe holds a significant share in the Corn Flour Market, driven by increasing demand for bakery products, snacks, and processed foods across the region. Growing health awareness, preference for gluten-free and organic products, and strong retail and foodservice infrastructure are boosting corn flour adoption. Key manufacturers focus on innovation and fortified variants, supporting market growth and expanding applications in industrial and household segments.

Germany Corn Flour Market Insights

Germany dominates the European corn flour market in 2025, driven by strong demand for gluten-free and functional foods, advanced milling technologies, and urban consumption, while the UK, France, Italy, and Spain also show steady growth.

Latin America (LATAM) and Middle East & Africa (MEA) Corn Flour Market Insights

The Middle East & Africa corn flour market is growing rapidly, led by Saudi Arabia and the UAE, driven by urbanization, changing diets, and demand for processed foods. In Latin America, Brazil and Argentina dominate due to strong agricultural sectors, large corn production, and well-established milling and supply chain infrastructure.

Corn Flour Market Competitive Landscape:

Archer Daniels Midland Company (ADM) is a global leader in agricultural processing and food ingredient solutions, focusing on sustainability and innovation. Its Larodex® Pregelatinized Corn Flour is a pre-cooked flour used in bakery products, batters, and milk replacement formulas, while HarvestEdge™ Specialty Corn Flour caters to gluten-free and keto-friendly applications. Together, these products support ADM’s mission to provide versatile, high-quality corn flour solutions for both industrial and retail food applications globally.

-

In July 2025, ADM introduced regeneratively sourced flours milled with 100% renewable electricity, aligning with sustainability goals and consumer demand for clean-label products.

Cargill is a multinational corporation providing food, agriculture, and industrial products globally. Its MaizeWise® Whole Grain Corn Flour delivers 100% whole grain nutrition for bakery and snack applications, while the Masa Flour product line offers varied granulations for chips, tortillas, and taco shells. These products exemplify Cargill’s commitment to innovation and high-quality ingredients, helping manufacturers create functional, nutritious, and consumer-preferred corn flour-based food products across multiple markets.

-

In August 2025, Cargill announced plans to construct a new corn ethanol plant in Goiás, Brazil, adjacent to an existing sugarcane ethanol plant. This facility aims to expand Cargill’s biofuel production in Brazil, reflecting the company's commitment to sustainable energy solutions.

Ingredion Incorporated is a global ingredient solutions company specializing in starches, sweeteners, and functional food ingredients. Its CORN PRODUCTS®/CASCO® Industrial Corn Starch is ideal for industrial food and non-food applications, while the food-grade unmodified CORN PRODUCTS™/CASCO™ Corn Starch provides versatility in bakery, snack, and processed foods. Ingredion leverages these products to deliver consistent quality, functional performance, and innovation, meeting evolving consumer and manufacturer demands across global corn flour markets.

-

In May 2025, Ingredion launched three new clean label texturizing starches in Europe, the Middle East, and Africa (EMEA), supporting the 'natural' and clean label positioning consumers increasingly seek.

Corn Flour Market Key Players:

Some of the Corn Flour Market Companies are:

-

Cargill, Incorporated

-

Archer Daniels Midland Company (ADM)

-

Tate & Lyle PLC

-

Ingredion Incorporated

-

Associated British Foods plc

-

Roquette Frères

-

Bunge Limited

-

Tereos Group

-

Grain Processing Corporation (Kent Corporation)

-

AGRANA Beteiligungs-AG

-

Global Bio-Chem Technology Group Company Limited

-

Gruma S.A.B. de C.V.

-

General Mills, Inc.

-

Nestlé S.A.

-

Mondelez International, Inc.

-

PepsiCo, Inc.

-

Wilmar International Limited

-

Bühler Group

-

Louis Dreyfus Company (LDC)

-

MGP Ingredients, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 20.50 Billion |

| Market Size by 2033 | USD 35.58 Billion |

| CAGR | CAGR of 7.21% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Native Starch, Modified Starch, Sweeteners and Others) • By Application (Bakery & Confectionery, Snacks & Convenience Foods, Beverages & Soups, Animal Feed, Industrial Applications and Others) • By Distribution Channel (Convenience Stores, Online Retail, Supermarkets/Hypermarkets and Others) • By End-User (Food and Beverage Industry, Food Service and Restaurants, Home Cooking and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Ingredion Incorporated, Associated British Foods plc, Roquette Frères, Bunge Limited, Tereos Group, Grain Processing Corporation (Kent Corporation), AGRANA Beteiligungs-AG, Global Bio-Chem Technology Group Company Limited, Gruma S.A.B. de C.V., General Mills, Inc., Nestlé S.A., Mondelez International, Inc., PepsiCo, Inc., Wilmar International Limited, Bühler Group, Louis Dreyfus Company (LDC), and MGP Ingredients, Inc. |