Food Emulsifiers Market Report Scope & Overview:

Get More Information on Food Emulsifiers Market - Request Sample Report

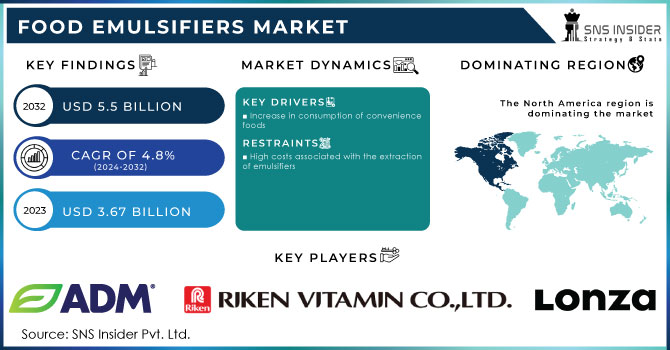

The Food Emulsifiers Market size was USD 3.67 billion in 2023 and is expected to Reach USD 5.5 billion by 2032 and grow at a CAGR of 4.8 % over the forecast period of 2024-2032

Food emulsifiers are synthetic or natural food additives that aid in the stabilization and production of emulsions by decreasing surface tension at the oil-water interface. Food emulsifiers are the most frequently used to improve the taste and texture of food products, particularly baked foods.

By Type, the lecithin segment has dominated the market and is predicted to expand at the fastest CAGR in the forecasting period. Lethcin, a natural phospholipid found in many foods, is commonly utilized in the food industry to stabilize oil-water mixes, improving the texture and appearance of many foods.

Based on application, the bakery products sector accounted for 60% of the market share and is expected to be the largest segment due to several factors including rising demand for bakery products and the potential benefits of emulsifiers in improving product shelf life and texture. Emulsifiers help to stabilize air bubbles created during the baking process, resulting in lighter and more visually pleasing baked items.

MARKET DYNAMICS

KEY DRIVERS

-

Increase in consumption of convenience foods

The demand for food emulsifiers is rising as consumers shift more and more to convenience and processed foods including candy, baked goods, dairy, and sauces. the need for food emulsifiers is rising due to the growing demand for packaged and processed food products. Emulsifiers are essential in the manufacturing of these items because they improve their texture, stability, and shelf life.

RESTRAIN

-

High costs associated with the extraction of emulsifiers

Emulsifiers are typically derived from animal or plant fats, which can be both expensive and difficult to extract in large quantities. This can lead to higher production expenses and result in higher prices for the end consumers. In addition, the extraction process can also be harmful to the environment. For example, the extraction of palm oil, a common source of emulsifiers, has been linked to deforestation and violations of human rights.

OPPORTUNITY

-

Use of food emulsifiers in baked goods

The entire food and beverage industry's macro trend of clean-label products is driving demand for organic ingredients, creating a great opportunity for growth in the food emulsifiers market. The increasing demand for healthy beverages such as protein drinks and juices is one of the expanding categories in the food processing goods market category, which generates market revenue potential for food emulsifiers. Food and beverage manufacturers are investing heavily in research and development to increase the nutritional and multifunctional character of food items with several health benefits, which is driving the worldwide food emulsifier market growth.

-

Innovations in products led to better stability

CHALLENGES

-

Health concerns by consumption of emulsifier

Some of the health risks related to emulsifiers include gastrointestinal issues, obesity, and allergies. Certain emulsifiers, such as polysorbates, may cause allergic reactions in some individuals. Hives, itching, swelling, and trouble breathing are all symptoms of an allergic reaction to emulsifiers. Ingredients in emulsifiers are linked to an increase in cancer risk. Emulsifiers are frequently employed in high-calorie, high-fat processed meals. Obesity has been linked to processed food consumption.

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine war has impacted agriculture commodities which have indirectly impacted the food emulsifier market. Wheat, corn, and other agricultural commodities required to make food emulsifiers have seen significant price increases as a result of the war. However, the 2022 Russia-Ukraine war put unforeseen pressure on the European market and worldwide supply chain, as prices for essential food commodities such as sunflower oil and its derived ingredients surged. While sunflower lecithin currently has a price that is more expensive than soy lecithin, the food ingredient sector is seeing an increase in demand for allergen-free, organic, and non-GMO alternatives.

IMPACT OF ONGOING RECESSION

In 2022, the food emulsifier sector will be impacted by the recession. This war has interrupted raw material channels utilized in food emulsifiers. Food emulsifiers can be found in a wide range of foods, including mayonnaise, ice cream, chocolate, peanut butter, and creamy sauces. Price increases in these goods may result in price increases in emulsifiers. They reached nearly 6% of GDP during the lockdown quarter, and 5.3% in the most recent quarter.

MARKET SEGMENTATION

By Type

-

Lecithin

-

Monoglyceride

-

Diglyceride

-

Derivatives

-

Sorbitan Ester

-

Polyglycerol Ester

-

Other

By Source

-

Plant

-

Animal

By Application

-

Dairy Products

-

Bakery & Confectionery

-

Convenience Foods

-

Meat product

REGIONAL ANALYSIS

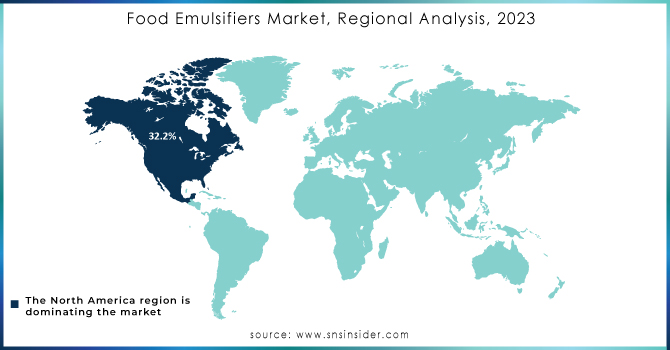

North America had the majority of the market share of 32.2% of the food emulsifiers market in 2022, owing to rising demand for processed foods as well as natural and organic products. Food emulsifiers are used as stabilizing agents and drug carriers in the pharmaceutical and cosmetic industries. This will very certainly increase market growth in this region. Emulsifiers smooth out and prevent separation in salad dressings, ice cream, mayonnaise, and baked products.

Asia-Pacific regional food emulsifier market will have a significant revenue share of 24%, owing to the rising popularity of natural emulsifiers as well as low-fat ingredients. Many emulsifier manufacturers have entered the market, as food emulsifiers are commonly used in the Food & Beverage industries in countries such as China, India, and Japan, where there is a rising demand for processed food items, particularly Ready-to-Eat and low-fat foods.

In 2022, Europe took the lion's share, followed closely by North America and Asia Pacific. It is projected that the economies of Germany, Eastern Europe, and France, will have an impact on the industry's growth during the forecasted period. For dairy and bakery applications, the regional demand for emulsifying agents, such as sorbitan esters and stearoyl lactylates, is anticipated to grow at a consistent CAGR in the next few years. Associations were established to support and promote the use of emulsifiers made for the European food industry, such as the European Food Emulsifier Manufacturers Association.

Need any customization research on Food Emulsifiers Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Food Emulsifiers Market are Archer Daniels Midland Company, Riken Vitamin Co. Ltd, Lonza Group AG, Stepan Co., BASF SE, Ingredion Incorporated, ADM, Corbion NV, Kerry Group, Cargill Inc., and other key players.

RECENT DEVELOPMENTS

In 2023, Dupont introduced a new product line of clean-label emulsifiers.

In 2023, Vantage Food announced the release of its SIMPLY KAKE emulsifier, a patent-pending replacement for traditional baking aids that has been developed to support food makers' efforts to produce products with cleaner labels while producing taller, lighter, and more uniformly baked cakes and sweets.

In 2022, Kerry introduced Puremul, an acacia-based emulsifier that can replace sunflower lecithin and mono- and diglycerides in food and beverage applications. PuremulTM, a novel texture system from Kerry, replaces sunflower lecithin and mono- and diglycerides.

| Report Attributes | Details |

| Market Size in 2022 | USD 3.67 Billion |

| Market Size by 2030 | USD 5.5 Billion |

| CAGR | CAGR of 4.8 % From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lecithin, Monoglyceride, Diglyceride, and Derivatives, Sorbitan Ester, Polyglycerol Ester, and Other Types) • By Source (Plant, Animal) • By Application (Dairy Products, Bakery & Confectionery, Convenience Foods, Meat product) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Archer Daniels Midland Company, Riken Vitamin Co. Ltd, Lonza Group AG, Stepan Co., BASF SE, Ingredion Incorporated, ADM, Corbion NV, Kerry Group, Cargill Inc. |

| Key Drivers | • Increase in consumption of convenience foods |

| Market Challenges | • Health concerns by consumption of emulsifier |